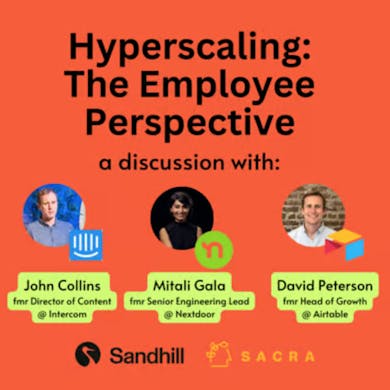

The hyperscaler employee experience

Jan-Erik Asplund

Jan-Erik Asplund

Being an early employee at a rapidly-growing startup affords opportunities for huge career and financial growth:

- John Collins joined Intercom as its first content hire in 2010, building an organic growth machine that helped Intercom get from <$1M ARR to $200M ARR before joining Ramp.

- Mitali Gala joined Nextdoor in 2013, shipping their first Android app and running software teams as they scaled from a few hundred neighborhoods to 90% of the United States

- David Peterson joined Airtable as employee #16 in 2017, building their first growth team and leading partnerships as they scaled from $5M ARR to $156M ARR.

To learn more about the early employee experience at rapidly-growing startups, we teamed up with Sandhill Markets for a panel conversation featuring former Airtable head of growth David Peterson, senior engineering manager at Coinbase Mitali Gala, and former head of content at Intercom and Ramp John Collins.

Transcript below.

Adam: Our guests today, begin with John Collins, from Ramp and Intercom. He was at Intercom longer than at Ramp—Walter actually introduced him to Ramp—which is a fun story I just heard. He was the Director of Growth at Intercom and really focused on the content side. Before that, he was a journalist for 14 years in Ireland where Intercom is famously from. And Des, the co-founder, who might’ve seen on Sacra, they have similar accents, so you'll know. I'm super excited to hear about John’s decision, which is a part of the questions that we'll be asking, about switching careers. He’d been doing journalism for a long time, then there's a really great opportunity to join a hyper growth company—or a company that he thought has the ability to be that—and I think he will have really good insight there.

The next of our fabulous guests here is Mitali Gala, who was an early employee at Nextdoor. She's at Coinbase now, which she can talk about. During 2020 at Coinbase, I think there was definitely some hypergrowth in the last four years there as well. So she can speak to that. But she has a very different experience from John, on the content side, and works on the engineering side, where she built Nextdoor’s Android app from scratch. I’m very excited to hear what she has to say about that, as someone who was in the weeds on the engineering side of a company that was growing very, very quickly. I know that that's something that presents different challenges than maybe on the marketing side.

And then last, but definitely not least, David Peterson, who was an early employee at Airtable and is now on the VC side. I'm very interested to hear his perspective on the operator to investor crossover. Before Airtable, David had been involved at different startups including Comstack, which had raised a bunch of money. So without further ado, we can all get into it. So I gave a little bit of background on each of you, but the overall structure of what we'll talk about is that decision to join, and about then the actual act of being a part of that hyper growth company, and then the decision to leave. There's a nice, clean three-point plan for the event here.

But to start, and before we get into that decision to join, I'd love to hear more generally from each of you about your background and what you're up to—what you've been up to and what you're up to now. David, if your game to kick us off, we can get it going.

David: Right now, as you mentioned, I'm a partner at a small venture fund. I'm one of two partners and it's a partner-only firm, it's just the two of us. We do really early stage investing across the UK, Europe, and Israel, in the B2B space exclusively. A lot of more deeply technical stuff. It’s called Angular Ventures, and that's what I do now. I still feel kind of uncomfortable, honestly, talking about myself as a venture investor. I was at a dinner a few weeks ago with a bunch of investors and founders and I was introducing myself, and every time I would introduce myself to somebody, I was always wincing whenever I had to say that I was on this side now. So I'm still very uncomfortable.

Adam:

‘I'm one of you still. I'm a cool VC. Not a normal VC, I'm a cool VC.’

David:

Which is now that you say it even worse, right? That's almost worse. I should just own it. Anyway, that's what I do now. But my background was really as an early stage person for a long time. I worked at a few different startups, always early, always in growth and go-to market roles. I wore lots of hats on that side and then bootstrapped a company of my own and sold that a while back too.

Adam:

Very cool. We'll get into that, I'm interested in that transition, but we'll save it for the end. John, can you give us a similar rundown?

John:

You kind of touched on it there, I worked as a journalist, actually, for the first part of my career. Mostly writing about tech and business, although I had a brief stint as a health editor and news editor as well. I did broad journalism, and I actually did a stint in the original dot com go around. I worked for a pretty successful web agency that was trying to transition into product, which of course they did perfectly towards the end of 1999. That was a pretty brief decision in the web world. But then I went back into the world of software and the web about a decade ago now, in 2014. Currently, the last almost two years, I'm doing consulting and advising on content and comms and broadly mentoring marketing teams. I do a bit of angel investing and back to a bit of writing where I started off, so back to doing that as well.

Adam:

Nice. Full circle. Well, with writing, you can write about a lot of different stuff, but maybe that’s the interesting through line.I'm excited to hear that decision, which is different, and everyone here has different paths into it. Mitali, you're our only engineer, so you're representing the workhorses in the gang.

Mitali:

And turns out I didn't even start as a computer engineer back in the day. I actually started my journey as an electrical engineer, ended up really disliking it, got into robotics, and that was my first time being like ‘oh, software. That's kind of cool.’ So I changed majors in grad school, which was both the best and the worst of decisions. It was the best decision because I absolutely loved it. It was the worst decision because I celebrated anytime I got four hours of sleep. I was trying to keep up with grad school courses while not having an underground foundation, so that was fun. I got into Android development because that was the most accessible place to wet my feet in all of that, and I actually fell in love with that.

I broadened my horizons out of mobile, did more web, and did some backend. I’ve always gravitated towards startups, because I think some people call it chaos—I call it exciting and I call it being able to pick and choose what you really want to do and excel at it and then knock it out of the park. That was always exciting. Adam, you alluded to this to some extent, that Coinbase has gone through some hypergrowth in the last couple of years. While Coinbase overall is a fairly big company, I immediately gravitated to Coinbase Institutional, which is the team behind the ETFs and whatnot, if anyone has been keeping a track on that. It’s very much a startup within a bigger ecosystem, probably more so than some of the other startups I've been at. So I’m happy to talk about all of that.

Adam:

It's an awesome group with some varied experience and some throughlines that I'm excited to get into. One of the first things that comes up is the decision to join a company, the company that you decide to join, and whether or not you had a bunch of choices. Some people talk about the decision and it’s just that they were just looking for a job, they got one, and it worked out and that's awesome. Then there's other ways to approach it that look almost like a venture capital process, where you're thinking about your equity and stuff like that.

I'm interested to hear each of your perspectives and how you chose the role that you ended up in. More importantly, how you thought about it and were you thinking of it as a job or a job at a hyper growth company? David, I know that are now on the VC side of things. What was your process like of choosing to go over to Airtable?

David:

It's interesting you lay it out that way because there are two processes here. I knew about Airtable and I was a very early user of Airtable. I actually said this in my interview with them. I told them I was an early user, and Emmett the CTO at the time was like, ‘How early do you think you were?’ And I was like, ‘First thousand, I think.’ And he pulled it up, he just went in and he was like, ‘What's your user ID? What number were you?’ And I was in the six hundreds, so it was pretty good. I was really scared about that when he actually pulled that up, if I was going to be like ten thousandth. That would've been embarrassing.

I was obsessed with Airtable really early, and the reason was because, as I mentioned before, I bootstrapped a company. The V1 of the product that we bootstrapped, I put together an MVP over a weekend, basically to convince myself that it was worth spending any time on. And I was like, ‘look, I'm going to build it this weekend and I want to see if I can make any money by the end of the day on Monday. That's my goal.’ So I hacked this thing together with Airtable and Zapier. This was 2015 or something like that, so this was No-code before, No-code was even like a category. And we ended up getting to six figures of revenue with Airtable and Zapier before we wrote a line of code. Itt worked really well and I was totally sold on these tools.

I was going into my job search process with that context, kind of knowing that Airtable was this product that I loved, and I felt like I understood it. I felt like I had seen the future with Airtable. That being said, I still took a super long approach and I did have this VC-like process. This is what I recommend people do all the time, to be honest, because I think it can be a useful process. You just come up with your list of VCs that you think are reasonable pickers and you look at their portfolios, go into Crunchbase, and put all of that into a big spreadsheet. Then you look at all of those companies and just pick off the ones where you look at their landing page and something stirs in your heart and you're like, ‘here's something interesting here.’ Then, dig into those. That, at least, is a decent way to come up with a list.

Now I did that whole thing and then I still came back to Airtable and I was like, ‘I don't know, there's something about Airtable.’ So maybe don't take my advice, maybe just do what I did, not what I said. But that's how I ended up at Airtable—I found it early and I fell in love with it. When I went and interviewed, there was no job, I wasn't applying to a job. I just lucked into an intro to Howie, and then we courted each other for six months. Then, finally, I convinced him to let me join, basically. Iit was a super generic, vague role. It was the first growth job, and it was like, ‘you're just going to grow stuff and if you don't grow stuff…’ It was just so generic. It was like ‘you don't get to be the head of anything, or the director of anything. You’re just... go do some work.’ Which was great.

Adam:

Make us grow, if we’re not growing it’s on you, David. Were in the startup space before, or is that all post the early bootstrapped company?

David:

Yeah. I had worked at a startup, bootstrapped my own company, and then I went and got an MBA. While I was at business school I actually worked at Founder Collective, if you know that fund, an early stage seed fund on the east coast. I basically didn't go to class and only hung out with Founder Collective because that was way more interesting. They were the ones who got me the intro to Howie because they had seed invested in Airtable. And by the way, they were very much like, ‘look at the portfolio, we'll introduce you to anybody.’ And I was like, ‘I only want an introduction to Airtable.’ And they were like, ‘Really?’

Adam:

You have to send this to them. You're going to have to send this panel to them, it’s like a love letter. Well, that’s awesome. John, that’s super different from your experience. Tell us a little bit about yours. David, that sounds like you were in the startup space and well-informed, you were trying to pick one, but then ultimately ended up going with your heart on what you really resonated with rather than like, ‘oh, they're making so much money, I have to work here.’ It was like, ‘I'm using this tool.’ Whereas John, you were switching from a full-on separate career. I'm interested to hear how that happened. How did Des charm you? Oh, maybe I lost him. Let's see. All good. He'll come back. Mitali, I'll segue here. It’s different on the engineering side, I would imagine. You were in your Master’s program, and then did you go straight from that to Nextdoor or was there something in between?

Mitali:

No, no. I went straight from my Master’s program to Nextdoor as an intern. Actually, I was hearing David talk and there were just so many like, ‘oh my God, me too’ moments. Interestingly, you called out, ‘how did you pick a company and why did you decide to be at a startup?’ My first question to myself was, ‘do I go to this established company that will give me a really good look on my resume and this, that and the other?’ My whole thing was I have a very short amount of time to gain as much knowledge as I possibly can, and the places that will let me do that, at a speed where I'm not going to be boxed in, are going to be startups. So it was like a hypergrowth into my learning more than anything else, if you will. But that was where it started.

I looked up all of the VCs that I really, really liked and shortlisted a bunch of companies there that struck a chord, similar to what David called out. None of them had an opening or a job page. I remember my introduction to Nextdoor was that I actually emailed a bunch of people in their C-suite and their VP list. The VP of finance reached out and it was like, ‘we don't actually have an internship program.’ I sent them a bulleted list that was like ‘here is why you should have an internship program—this is cheaper than a normal hire.’ And that was my internship! So it was a fun experience.

Since then, it's always been those same variables that I've self-selected into, which is the first filtered list is VCs that I really like and companies that are in the right space. And you go like,’oh, there's something there.’ Then the second filtering list is people at the company. Even if they haven't figured it out, smart people will figure it out, so if you're optimizing for that, it's hard to go wrong. If not, you'll get a fantastic experience at the end of it, so regret minimization is great in both of those aspects. That was how I got into my first role, and then David and I intersected at Airtable, and then I went to Front, all for the same reasons.

Adam:

It's super interesting to hear this. Zach Hargett—I don't know any of you know him—he recently put out, like, this Michelin Guide for startups that did that process but made a cool webpage out of it. He basically went out to a bunch of VCs that he really respected, and that are well respected generally, and asked them what their favorite companies were. Like, ‘where would you work, where would you send someone? Who are you most impressed by?’ And I think it's cool to see, and for friends who are looking, for that playbook to become more widely used, and maybe it always had been, I don't know.

I had a similar experience one time, but I didn't get the job and I was maybe too young. I was a freshman in college and I reached out to artsy.net, they actually ended up doing really well. There were like five people and they were like, ‘we don't have enough room in the office for an intern and we don't know what you do.’ I was like, ‘honestly, you don't have to pay me. Just let me hang out.’ He didn't let me. I went back—I'll have to find the emails—but I emailed him every year for three years and it didn't work. But when it does work, it worked great for David and Mitali. John, I'm interested again to hear because it sounds like Mitali and David were kind of similar. John, you had a super different experience it sounds like?

John:

Totally. I worked in media for about 15 years. I suppose if you want an analogy, remember season five of The Wire, in the newsroom? It's probably a lot less glamorous, but very similar in that you had an industry that was trying to do more and more with less and less, and that was really struggling with the transition to the internet. I'd always covered tech and was really interested in tech and using it in the job. So I just said, ‘enough is enough.’ I reached a breaking point anndI really began to think about what kind of transferable skills I had that I could bring to something else and drew up a shortlist, which was approximately three companies.

Also, I had youngish kids at the time, so I wanted to stay in Ireland, which was a bit of a limiting function. But Intercom was at the top of that list. The other thing of course, the advantage, as a journalist who covered tech, was I had contacts. I had exposure and I knew Owen, the CEO of Intercom. I literally emailed Owen, and probably the last time I'd met Owen before I reached out and said, ‘I'd be interested in working for you’ was we'd hung out in San Francisco when I'd been there on a reporting assignment. So, definitely use what you have! I definitely did in that instance.

I would say, the move to Ramp was something quite different, as in, the way I assessed it. It was seven years later, I'd proven what I could bring to a startup, and I'd help grow the content and brand at Intercom. It was a much more methodical process. I had three pillars, people, product, profit. Do I like the people and can I learn from the people? Have they got a good product? Because I didn't want to be trying to shill something that I just didn't believe in, like David and Airtable. Does that homepage resonate with me and get me excited? The final thing is profit, does this thing look profitable? Stripe were literally about to put $100 million into Ramp when I joined. Being a good Irish man, I do whatever John and Patrick do at Stripe.

Adam:

That's great. To regurgitate and summarize a little bit, it's interesting to hear how it ends up looking a lot like VC processes from a picking perspective. That's something I want to talk about later, but you end up where you're so concentrated. It's not like VC where you can put a bunch of checks into a bunch of companies, even if you're a concentrated VC, you have 10 people in their portfolio or whatever, compared to you're going to live and breathe it. The thing that Mitali also mentioned that is interesting for people listening is that if you work with smart people, you can't really go too wrong. Even if it doesn't work out, even if the product that you loved was too niche, at least you loved it, and the people that we work with loved it, and they're smart and good things will happen from there.

I've convinced a number of friends over the years to join startups, and I've preached similar risk mitigation by way of, ‘even if you don't get rich off of the equity, you're going to get so much smarter and you're going to work with such more active people and work on things you really care about.’ I think maybe we're all biased, but it seems like the right thing for most people to do. If you want to put that sort of energy out there.

The next phase of it, where you all went through this decision, you made the jump into these startups. Obviously, it worked out and there's the version that it doesn't work out, but I think that's what I'm arguing for where there's still a lot of benefit there. But once you joined, I'm interested to hear the stories about what it was like and things that jump out. Maybe we can do your favorite part and your least favorite part of working at what is described in here as these hyperscaling, growing really fast companies. Mitali used the word chaos, but you said exciting, maybe it's a personality thing that you have to have. David, when you think about your time at Airtable, what do you think about the best part of it and the worst part of it, from an experience perspective?

David:

It's tough because I'm so nostalgic for, actually, what were, in reality, probably the most painful times. But I feel such nostalgia.

Adam:

The trenches, those were the days! At the time you’re like ‘I hate it here, I should've worked in private equity.’

David: Yes, exactly. I remember we had a very, very small office and we were hiring a handful of people. But it was so small that it just so happened, a new person started one week and the only reason we had a desk for them is because somebody else had just gone out on vacation. And we were like, ‘oh, thank God. We didn't plan.’ And that office, I remember the kitchen was like we couldn’t keep it clean and the building was infested with fruit flies. So we had one of those tennis racket looking things that you wave in the air to kill flies. It was the job of the first person who got into the office to take that and go into the kitchen and just go to town.

Adam:

I can't tell if that’s your favorite part or your least favorite part, which is the best part of the story.

David:

That's exactly it. I'm not sure either. But all of that stuff, I actually like. I love that stuff. You go to work for a startup for exactly that, you're trying to build this together, and it's going to be a small office, and whatever, all of that is part of it. When I think back about what was hard, and what you have to be prepared for, is that if you're joining a pre-product market fit or very early in the journey startup, there's so much uncertainty. By definition, you don't know what's going to work. That means that you can't approach the job by saying, ‘okay, I'm going to own this thing and this is my thing.

Because it might not work, rather than owning a thing you're owning the outcome. You're owning, like, ‘we eventually are going to grow. We eventually are, and I need to own figuring out how to get us there, but that doesn't mean that I'm for sure going to do this one thing and become really good at this one thing.’ That's an uncomfortable place to be. But at least for me, that was exactly the type of personality and approach that I needed to have in the early days. We tried 20 things for every one thing that worked at Airtable, and you need to be able to be that flexible.

Adam:

The stress is an interesting part, where it's the not-knowing what you have to do to win, or to do well, to win. Mitali, was that a similar experience on the engineering side of things? I'm interested to hear, specifically, with a company like Nextdoor, where you're growing and you're growing fast and you're seeing user count. But then there's also things that break and you're shipping stuff, I would assume relatively quickly. What was the experience there? From someone who also experienced the transition from education, and just learning about coding, and then you're live in product and something breaks—that's a different feeling, I’m sure, than a test or whatever.

Mitali:

I think it was a couple different things. One of them is, especially for a company like Nextdoor, both Airtable and Front were different in that we were making money from jump because we're selling contracts. But at Nextdoor for the longest time, it was just like you have users, there was no monetization strategy. It's a complete shot in the dark whether this will actually monetize at the end of the day? Will all of these user counts and DAU and engagement counts actually materialize into something? So it's a very long stretch of time to hold onto your nerves and be like, ‘it will all work out. We're going in the right direction.’ That also means, from an engineering perspective, it’s the definition of a double-edged sword, if you will. The greatest strength is that there's just so much happening that you can insert yourself into anything and learn a ton about it.

But my best and worst memories were the site would go down for any number of reasons, and we're all in this war room that no one is leaving until it's back up. We're getting deliveries of everything to us, and everybody's peeled at all of the dashboards trying to get everything up. Because you can't lose user trust, and you can't fail them when they're trying to do something of importance. So those were probably my best and worst memories, you'd learn a shit ton out of that. Then, the second one I will call out is at a startup, you're learning so many new things about your business that what was relevant yesterday may not even be relevant today. I've had multiple times where the job that I signed up for and the role that I signed up for actually became obsolete. I was the one calling it out, to some extent, like, ‘actually, this doesn't make sense.’

Part of it is treating yourself as a business and having an ownership mentality, like ‘hey, I actually want the company to succeed and my equity to succeed more than I want my role to succeed. I can go learn this ancillary thing that there's more of a need in the current world and where we need to go.’ Being able to thrive in that and make those decisions, if you enjoy it and if you can do it, that sets you apart for sure. That's probably my favorite part, that you're way more in charge of your own destiny.

Adam:

I really like that the answer of ‘what's your favorite part’ and ‘what's your least favorite part’ about the experience turned into one memory for everybody. They're actually the same thing. Maybe there's a lesson in there, you have to be able to look at that. John, what stage was Intercom at when you joined?

John:

Just completed Series B. We had 60 people between offices in Dublin and San Francisco. Still pretty small, but small enough that they had proper offices and I didn't have to swat fruit flies anymore.

Adam:

Nice. Good.

David:

You really missed out.

Adam:

That was the best part, John. You should go back and start over. So, Series B, and there was a career transition aspect to it, but at the same time you’re still writing. How much was new and how much was not new? What were the things that were the most different from your career outside of tech, and then now, in this business that was growing and doing well?

John:

The biggest transition was the time horizons,and I suppose, the ability to use those time horizons to do creative things and weird, wacky things that you never get the chance to do in traditional media. You're just on that treadmill of deadlines and the news cycle when you're in a news organization. Then, suddenly, you're thinking in sprints and quarters. You're actually able to go, ‘okay, you know what? We're going to publish a book.’ Or, ‘this blog is working, let's think about doing a podcast.’ Which, in 2015, actually a brand doing a podcast was a little bit out there and edgy, not like today where every startup seems to have a podcast. But I'd collaborate with people and do world tours. There was great freedom there to try these things. But it was darn scary, because there were big budgets, but also big responsibilities. Like Mitali said, I think that just feeling that collective responsibility of ‘we want this to work for everyone.’

Adam:

One of the things that I think you all experienced in different ways was a headcount growth that seems crazy, and that I've never been a part of. I've only ever been on super small teams and I've felt the uncertainty, but it never worked out. Which is also something that can happen. But I don't regret anything and I would still support people doing it. Anyway, the headcount growth has always seemed like something really crazy to me, where suddenly there's people around that weren't there a month ago. You hear about these companies and teams that grow from 20 to a hundred people over the course of a year, and it's like, culturally, I'm interested to hear a little bit about what that's like. I'm interested to hear about how roles change within that?

Because within a traditional career path, you probably do each job or each role for a year, Mitali touched on it. But whereas in the startup situation where things are growing really quickly, there's a lot of new people coming in that need to do new things, and what you were doing may or may not be relevant. David, maybe give me a little bit of context, on what headcount growth was like when you were at Airtable, and how that was a part of your experience?

David:

When I joined, I think I was 15, and when I left we were like 750 or 800.

Adam:

Those aren't even real numbers to me. I hear those numbers, I'm like, ‘750, where are they even... where is everyone?’

David:

It was wild, but it was a slow ramp, is the thing. I actually remember three distinct eras, and Mitali was there for part of these eras too, so I'm curious for her thoughts on this. We used to use Quip, not Google Docs. Nobody in the world uses that—other than Facebook, because they didn't want to use Google Docs basically—but anyway, we used to use Quip, and every doc was default public to the rest of the company. I remember when I first started there, something I would do at the end of every day is I would read every doc. Because I would be like, ‘I want to stay up to date on what everybody's working on.’ So I'd just read everything, and there were only 15 of us, so you could totally do that.

It made a lot of sense, because everything was so cross-functional all the time. Everything was interrelated, so that was one era, where you literally were in the flow of the business by default. Then there was this other era where I couldn't do that anymore. But every single person who joined I met, we grabbed coffee, and we went for a walk around Yerba Buena, and I for sure knew every single person. Then, there was a moment where it was like, ‘there's 30 people who joined last week and I don't know anybody.’ It just gets away from you. The thing that changes during that era, too, is that everything silos down. That's the part that I'm least nostalgic for, when I think about the time. It’s a time where it used to be that you were plugged into everything and you were making connections and trying to help the company by synthesizing and figuring out solutions.

To Mitali's point, I think that's absolutely right. The best advice to any early stage employee is, ‘it's not about you, it's about the company. And if you put the company first, you're going to end up succeeding. You need to be looking for ways to get yourself out of the job and all that stuff.’ But what happens as you grow is everything silos down. There's a bunch more bureaucracy. Now there's a meeting about the meeting to get everybody on page for the meeting. All of that stuff… it happens as the headcount goes up.

Adam:

Mitali, when you were at Airtable, what phase that David mentioned would you put yourself in? Did you get coffee with David or were you post- him taking coffee walks?

David:

We definitely got coffee.

Mitali:

We definitely got coffee. I was engineer 12 I think at Airtable, but I left before David, so I actually missed Airtable's hyper, hyper growth. I did see the beginning of it where there's the whole ‘two pizza team’ concept. Engineering, when I started, was very much a two pizza team and you could hold all of the context in your head. We had one singular standup that everybody participated in and it was great. Then, that started to become team stand ups at some point in time, and we had multiple flavors of pizzas, if you will, in trying to keep two pizza teams. But no, I have a slightly different take on this, which is I do really like the idea of having all of the context and it's a very, very, very awesome superpower and I love it.

Then, I also like the growth phase where now, instead of me having to do everything, I can be the ideas person, and then there are other people who can go do the things. It's rewarding in a very different way. And yes, it does mean that, from a trade-off perspective, I know way less of what is going on. But then I end up feeling like I'm being rewarded by a lot of the things that I was thinking of actually seeing the daylight faster than they would if it was just a small group of people. So, I like both sides of it. They each definitely come with challenges. We definitely break a lot more stuff when we're too many people not talking to each other, which is always the case.

Adam:

You mentioned too, and to bring the Coinbase context into it as well, and regarding the two pizza thing, big orgs try to do both. That's probably the best thing, where it's like you have to grow in order to support what you're doing. But then, there's definitely a diminishing return on how much stuff gets done.

Mitali:

At Coinbase, we've actually been fairly public about this as well. In 2020, we got a little too in our heads about hypergrowth and grew unsustainably, really. It got to a point where more than 50% of our capacity was just going towards recruiting, interviewing and onboarding people. That was detrimental to what we actually wanted to do, and unsustainable, and overall created a whole bunch of different problems. We learned the hard way that it’s better to still be very measured in the hyper growth phase and not get too ahead of ourselves and try to hit numbers just for the sake of it.

Adam:

John, at Intercom, was there a marketing team before or were you the guy, did they bring you in to do it?

John:

I was marketing hire number two. Matt Hodges came in as the head of marketing. Marketing grew pretty much in lockstep with the rest of the company. Similarly to David, I started a little later than him, but it was 60 people that grew to about 850. We're European, so we take two weeks off for holidays, but that was kind of dangerous because you'd come back—I remember after one vacation, I think I took a little bit longer than two weeks—but I came back and the first three people I met when I walked in the door at the office, I was like, ‘who the hell are these people? I know everyone works here who are these interlopers?’ But at Intercom, and actually at Ramp as well, there was a big focus on values and what are the values that we believe in?

That really helped inform hiring. I know some people rubbish this, but it just meant that you weren't hiring people who were square pegs in round holes, and that they then in terms would start to hire and build their own teams. Within three or four quarters—because invariably people come in, particularly once you're in that hyper growth phase—they come in and they want to start building their own teams, if you've hired badly and then suddenly you've got a whole team that's pretty misaligned with the rest of the company. That was a big thing, both at Intercom and Ramp, to try and make sure that we went through that rapid hiring and didn't make too many missteps.

Adam:

With the lesson being the domino effect if there's a break in the chain. You hire one person and they're going to hire other people, and if you screw up that one, you're going to screw up the next 10 people they hire pretty quickly. That's super interesting. One thing that it doesn't sound like any of you experienced, but I'm interested to get your take on it, because all these stories are very—or just the way I'm picturing it in my head—they’re very in-person. There’s the fly swatter, the two pizzas, the showing up after vacation and walking into the building and not knowing who the people are.

What are your takes on remote hyper growth and can you picture it? David, I know on the investor side, I'm sure that you get asked this—or maybe you’re on the deep tech side, so remote is not as much of a thing—but what do you think about it? Can you picture it happening remotely? What does that even mean, is it more people getting added to the Slack really quickly?

David:

I'm really curious, Mitali, for your take, since you've been at Coinbase during a remote era. But my last year and a half at Airtable was all remote because of COVID, and during that year and a half, we grew from 250-300 people to 750 people, which was just completely insane. My reflection on that is it was really, really hard and I never met any of those people. It's almost unfair because it was also the first year of the pandemic and I don't think anybody really knew how to do it at that point. I didn't have a great experience with it.

Adam:

Mitali you've done both, right?

Mitali:

I’ve done both and I've done both at very different companies. At Front, I was there before and after the pandemic, so before and after remote. Front has built an identity around being very familial, it prides itself on being the happy place to work and whatnot. It is very much that, and at a company where that is so much part of the culture, that becomes way more difficult to try and do remotely. Because so much of it is the interpersonal relationships and feeling connected, and the body language that you're able to pick up on because you're right there with each other.

Then, there are companies like Coinbase, where because they're so mission-driven, they end up automatically getting specific types of people excited, who all embody that similar culture from just being the kinds of people that they are. That's way easier to embody in a remote-first and a remote-only, in some cases, environment. Because, you're not really having to inculcate the experience and the culture of the company onto the individuals. It's the individuals that are automatically like that—it's a magnet for that group of individuals that feel and think and do and operate very similarly. Which is, again, this very entrepreneurial ownership-mindset kind of individual. I don't know if I would put money on remote-first working for every sort of company. But there's definitely a subsection of companies that absolutely thrive and then can take advantage of a more global workforce as a result of it.

Adam:

That's an easy way to put it—if you would all want to work on the mission just as an individual anyway, then you don't necessarily need the familial, ‘well, I work for the person next to me.’ You're working for the mission. So you can do it at home or do it wherever. John, have you done both? Have you done in-person and remote?

John:

Pretty much. I'm one of those crazy people who changed jobs during the pandemic. I would definitely say that a bunch of stuff that happened during the pandemic probably drove that decision that it's time to move on. But it's quite interesting with Ramp—I think the day they publicly launched was their last day in the office. They suddenly became this fully remote company that they had no intention of being. I haven’t spoken to the co-founders, Eric Glyman and Karim Atiyeh, specifically about this, but I think their style was to hire great individual leaders and almost be like, ‘let John run content and comms as his own individual cell.’ It was a little bit like that. It was quite different. Obviously, there was top-down management, but there was a lot more latitude there of ‘let's just get great people in seats here and figure it out."

Now, they're trying to move much more back to an office-based culture. Obviously, they've got some great talent that they weren't able to access, they wouldn't have been able to access otherwise. It's tough to unwind, in that regard, but they were pretty successful with it the way they approached it. It was down to almost each team level how the nuts and bolts of it worked, making it work remote. It wasn't suddenly that they had to spend a bunch of time writing a handbook about remote culture and doing all these crazy things.

At Intercom there was a bunch of stuff just tried Because it was like ‘oh my God, everyone's remote. How do we keep our culture?’ Very well-intentioned, but we all did enough bad Zoom calls and stilted Zoom calls with friends just trying to keep a social life. But when you were trying to do it at work as well, it was all pretty draining.

Adam:

And as with a lot of stuff in this, the answer is probably somewhere in the middle and it depends on the company. Whether you're hyper growth in person or remote, the node and the decision tree of when you hire one person, and they're going to turn into two people, and those two people are going to turn into four people, each individual, whether you're remote or in person, becomes even more important as a part of the foundation that can have a team fall apart as you get bigger. We're coming up into the last period here, and each of you mentioned it, you mentioned some COVID job changes, and the last part of the story is the decision to leave. The decision to leave, I'm really interested to hear about it.

Within whatever startups, there's lots of different reasons. For all of you, it sounds like it wasn't negative, and I don't think that that's as common. I feel like I hear a lot of ‘it's time to move on or time for a change.’ I'm interested to hear how you made that decision and we can go around the room. I’m interested to hear how you made the decision, both logistically, but also more so, knowing it was time, that’s one of the things I'm most interested in.

David:

For me, it was pretty clear that Airtable had gotten on the pre-IPO track, and that looks and feels like a very particular thing. It's like, you’re bringing in certain types of leaders who have done this before because they need to do it again. And those generals bring all their lieutenants, and that's great, maximize my shareholding, please. Go, do it. But I just longed for the earlier days. I was like ‘I want to go build more. I want to go do more stuff.’ Your world gets smaller and smaller and smaller as a company grows. One of the things that’s so amazing in the early days of a startup is you're experimenting with so many different things. We would run some random experiment and I would do it with 5% of my time just to be like ‘let's see.’

I would do it, figure it out over the weekend, and just launch it, and we'd learn and then we'd keep on moving. Once you're an 800 person company, that idea needs to have a person who's the DRI, and there's going to be all these meetings, and it just takes forever. It's just like that. All of that stuff got so frustrating. I knew I wanted to do early stage stuff, and so I left for that reason. I actually had no idea what I was going to do. I left, and when I lived in San Francisco, I had gotten super into sourdough baking. This was before the pandemic, by the way, before it was cool. I want it very clear. I went to a week-long San Francisco Baking Institute course in 2017, years before the pandemic.

Mitali:

We need receipts, David.

David:

We made a thousand baguettes. I love doing that stuff on the side. So actually, I left Airtable and I went and worked at a bakery in our neighborhood and I did all this other stuff. I was like, ‘I just need to go figure out how to do early stuff again.’ I met with a bunch of companies to think about maybe I could do the early stage ride again. And the reality is I just didn't find that many companies that I was as excited about. Now, we're back to the beginning of the conversation and we're playing the game again—can you find a company that really speaks to you in some way? I just couldn't find that. That's partially because I had loved the Airtable product so much and the Airtable opportunity was so interesting that it was hard to find one that really compared.

I ended up getting convinced, over time, that venture could be interesting. I felt like I had a somewhat unique point of view. Certainly, I'm based in London, so I'm on this side of the Atlantic which is unique. That's why I ended up making the leap. And by the way, the version of venture I'm doing is super early stage, so I get to think about a lot of the same problems. And, it's me and my partner starting it, so, it's entrepreneurial in a very different way. But it's still entrepreneurial, where you're still dealing with all of that stuff. I'm still putting my desk together and finding the office space and that is all incredibly fulfilling for me.

Adam:

Mitali, you moved around a little bit, because you were at Nextdoor and then you did a little time at Airtable and then Front. I’m interested to hear how you made those decisions or some themes? Because I'm sure, it was logistically different for each one, but how did you think about when it was time to move on?

Mitali:

The reality is, that as I was learning more about the companies, I was also learning more about myself. I was getting a lot more confident in A, what I wanted to do, and B, what I was good at. Then it was one of those things where I was trying to build a 2D matrix—and at some points, a 3D matrix, or I don't know, matrices—of trying to line things up in a way that I was putting myself in a position where A, I can succeed and B, I felt rewarded doing it, etc. In some cases, Nextdoor to Airtable was one of those decisions where I'd been there for four and a half years and I needed to get myself different perspectives. Both in terms of not being in a very user-focused/DAU-focused market, and making a jump to trying to understand finances and business as an equal partner to making product decisions, as opposed to just user metrics.

That's why something like Airtable was super, super exciting versus, in some cases, it was wanting to prioritize autonomy of decision, which is something that I knew I would get much, much more of at Coinbase, as an example. It's things of that nature, where it was just a maturity thing like ‘ah, this is what I really, really am craving.’ It took me a while to get there, it was trial and error.

Adam:

That sounds a little bit different from what David was talking about. Where in David's story, it sounds like there was this definitive phase change where it was like, ‘okay, I think I did what I came here to do and now it has the reins a little bit.’ Whereas for you, it sounds like it was more of an internal process, where you discovered something. It was less that the company had changed in a significant way.

Mitali:

Absolutely. This goes back to what I was saying earlier, too. I find excitement in both versions, if you will—the zero to one is exciting for its own reasons, and then the one to 100 is exciting for entirely different reasons. Maybe I have too much of a rose-colored glasses perspective on all of that where I'm like ‘this is so exciting.’ I've always been able to convince myself of the excitement there, and the opportunity there, and things of that nature. But I've definitely learned a lot more about where my personal propensities lie. This goes back to my regret minimization framework that I’m very, very married to: Time is the most valuable thing I have. If it's not doing exactly the things that I need it to be doing, then it's not worth it.

Adam:

I love the engineering approach to these career decisions. John, as the writer, what were your decisions like, as maybe more of a romantic on the arts side?

John:

Probably a bit more like David, to be honest. The company had got to a certain size and a certain stage and bringing in people who had IPO experience, that kind of stuff. On that note, I remember during the pandemic I was on the marketing senior leadership team and there was a bunch of stuff that was breaking because we were remote, and I was the one fixing the processes. I was like, ‘If I'm the person who's worried about process and fixing it, there's something really wrong here.’ That was a small, personal moment where I was like, ‘hmm, maybe there's other things I can do.’

But it was also timing. I'd done seven years, and I felt like I contributed a hell of a lot—that's forever in startup terms. I felt like, I've probably only got one more startup in me, I'd had a long enough career in journalism before that. Because it's tough, particularly with kids and family and travel, which, because I'm based in Ireland, it's always going to be on the cards if I'm doing startups. All of that combined, I was just like ‘okay, let's start a search.’ Of course, these things always take longer than you expect. But it wasn't like I was desperately unhappy. Intercom was still a great place to work and I was still being well compensated, had a great team, and liked doing it. But I definitely was ready and just knew it was time for something new.

Adam:

You're right, seven years in startup time is a lot of years. But you made the decision to jump back into it, and you mentioned you got introduced to Rmp actually by Walter, which is funny. But a much shorter stint at Ramp?

John:

Yeah, and I think a big part of that was probably being remote. I really enjoyed it, I felt like put a bunch of stuff in place there on the PR side. Ramp was hugely successful, and it really helped grow the profit of all the company. Working with Eric Glyman, on the content side, we got a lot of foundational stuff in, a bunch of stuff around SEO, etc. But it was definitely hard. I was the only remote person in Europe as well, that was the other thing. The team was remote, but mostly in the US, so time zones were a hassle. Then, I had some personal stuff on top of that. I just went, ‘hey, we’re coming out of the pandemic.’ It was a good time to just take some time off and take stock. I was lucky, I had a really good deputy both on the content side and on the comms side, that I felt like, ‘okay, I'm not dropping the ball.’

Adam:

You weren’t leaving anybody out, they're ready. They're in a good spot. Well, I know we're out of time, so I'll wrap up relatively quickly and we won't get to the liquidity questions, maybe that's a separate panel. But it's interesting to hear the personal aspects here. That's probably the real answer for everyone. Everyone has different reasons for wanting to move on or whether it's your personal experience within a company, your personal experience just working in general, or stuff in life that happens.

I won't keep everyone for too much longer, just long enough to wrap up and to thank everybody. I hope that you enjoyed it as much as I did. I'm sure that the people watching did, and I think that these types of talks and panels are super illuminating. Most people aren't founders, which is totally cool. The founders are only successful with people like yourselves, who decide to jump in and put the company first. And again, I talked about it at the beginning, but I think it’s under-discussed in terms of the decision to go for it with a start up, the ability to put the company first, how you can mitigate risk, and how it can be a success, even though it's really high risk. You all have successful stories, maybe I should have pulled someone in who spent four years that didn't work out. Maybe that'll be a different panel. But I really, really appreciate it. And again, I think it's super valuable for people. So thank you for joining.