Revenue

$343.00M

2024

Valuation

$1.30B

2024

Funding

$240.80M

2024

Growth Rate (y/y)

25%

2024

Revenue

Click here for our full Intercom dataset.

Sacra estimates Intercom hit $343M in revenue in 2024, up 25% year-over-year. This marks a significant reacceleration from just 10% growth in 2023, when the company faced headwinds from shrinking customer service teams and software budget cuts.

Intercom's revenue growth stems from keeping their per-seat pricing model in place while layering on new AI-driven features with usage-based pricing, like their AI agent Fin (99 cents per resolved support ticket). Fin alone is approaching $100M in ARR, with 7,000+ businesses using it—making it a material and fast-growing revenue line within the overall business.

The company primarily targets mid-market and SMB companies. Intercom focuses on B2B customers over B2C, as B2B clients typically have higher-value interactions but lower volume.

Intercom was cash-flow positive as of late 2023 with $129M in cash reserves. Gross margins were likely around 80% pre-AI, though the introduction of AI features with external API costs (Claude) may create margin pressure. To sustain AI investment, Intercom announced a new R&D hub in Berlin set to open January 2026, with plans to hire 100 engineers, AI researchers, and product staff over the following year.

Valuation & Funding

Intercom has raised $240.8M from notable investors such as Kleiner Perkins, Social Capital, Bessemer Venture Partners, and ICONIQ Capital. It was last valued at $1.3B, pegging its present-day valuation/revenue multiple at about 4.3x.

Publicly listed customer service companies have higher multiples, in the range of 6x to 8x. For instance, leading service-first CRM company, Zendesk, has a market cap of $9.1B and a multiple of 6.63x. Freshworks, which delivers help desk support with automation, has a market cap of $3.7B with a multiple of 6.56x.

Product

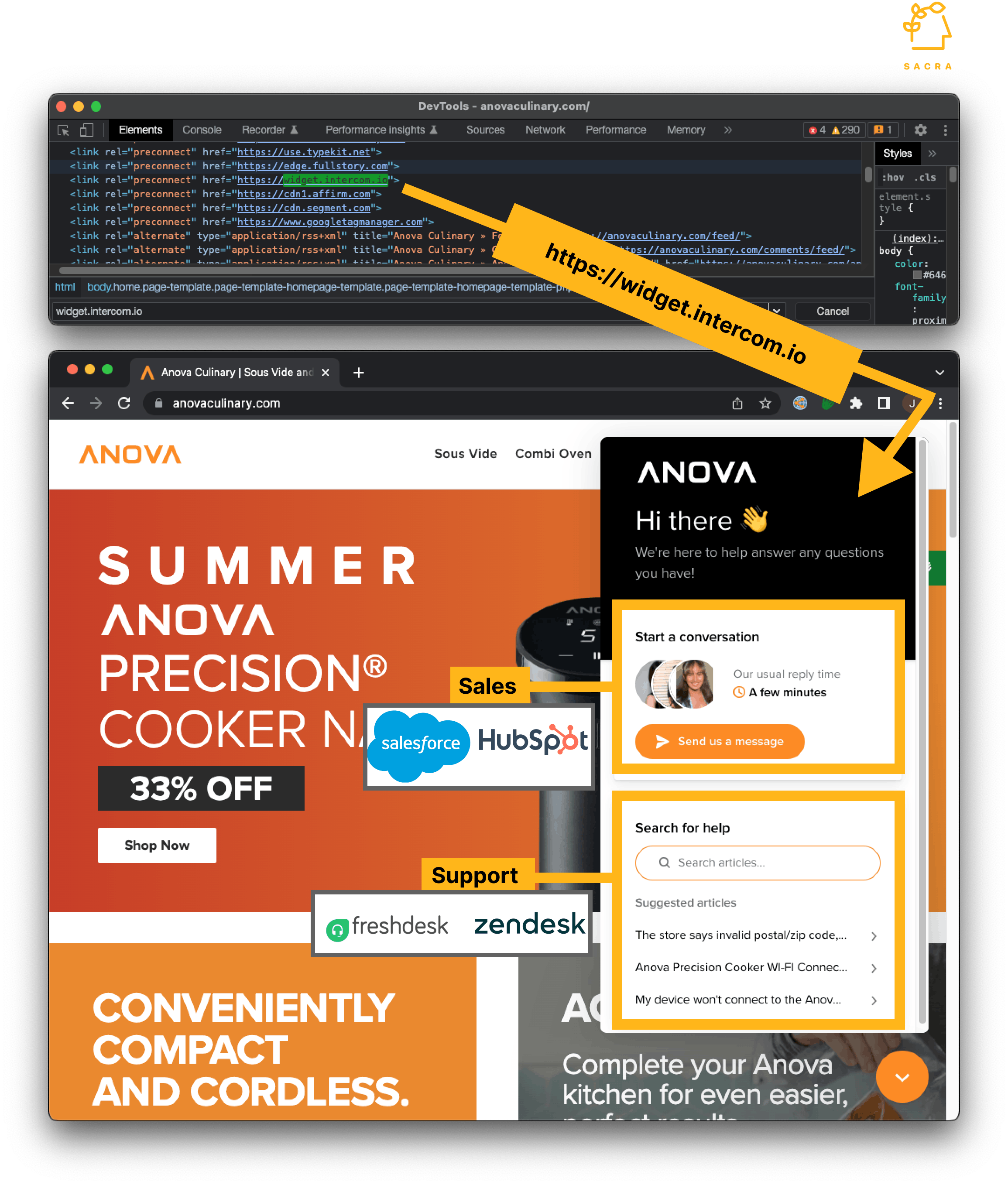

Intercom at its core is a CRM with messaging and support applications built on top. Users insert a JavaScript snippet into their site that tracks visitors and activities. They can then interact with them via targeted content, behavior-driven messages, and conversational support.

Today, Intercom offers a variety of adjacent services on top to help teams engage with their customers in other ways and better help them:

- Surveys: Gather feedback and use it to configure the Messenger experience

- Product Tours: Assist clients by having them go through interactive, multi-step tours

- Bots: Build bots that automatically address a variety of issues

- Switch: Reduce hold times for clients and transfer phone conversations to Messenger

All of these separate features help SMBs boost customer acquisition and decrease churn.

The unique advantage of Intercom’s approach is that it’s integrated in three important ways: integrated across the company, making it easier for different departments to collaborate with each other; integrated directly into the product, so that businesses can engage in live interactions with clients; and integrated with the data, meaning all information is stored in one place, which minimizes disorganization.

One piece of evidence that points to Intercom’s integration capability is that 93% of its customers use more than one tool: the average is 2.5 products per paying customer. However, there have been some complaints about the lack of certain features, notably consolidated reports, indicating that the roadmap is still being paved.

Business Model

Intercom is a customer service platform that combines AI-powered automation with human support. The company operates on a hybrid pricing model: a traditional SaaS per-seat subscription with an added usage-based component for AI interactions.

Intercom has completed a multi-year pivot to become fully AI-native, launching proprietary customer experience models and scaling its AI team from fewer than 10 to 50+ researchers, with over $100M committed to AI development and go-to-market for Fin.ai. The company reports strong positive gross margins on its outcome-based AI pricing, with Fin now resolving over a million support tickets per week—equivalent to the output of more than 6,500 human agents. Fin 2 averages a 66% resolution rate across 6,000+ customers, with more than 20% of customers exceeding 80% resolution rates.

The core subscription offers tiered pricing billed annually: Essential at $29/seat/month, Advanced at $85/seat/month, and Expert at $132/seat/month. All plans include access to the Fin AI agent at $0.99 per successfully resolved ticket, and AI Copilot Assist at $29/seat/month. Intercom also offers a standalone Fin for Platforms SKU—designed for customers already running Zendesk or Salesforce—starting at $49 for 50 resolutions plus $0.99 per additional resolution, with unlimited teammates and no additional seat costs. This lets existing helpdesk customers plug Fin into their current workflows without switching platforms entirely.

Additional products include product tours ($199/mo), WhatsApp messaging support ($9/mo per seat), and surveys ($49/mo), and give Intercom a way to drive additional incremental revenue from customers.

Key to Intercom's early growth was their ability to drive and convert cheap top-of-funnel traffic from SMBs and startups, which they did in two big ways:

- Content marketing: Intercom's main distribution channel from $1M to $50M ARR was their blog, where Intercom wrote multiple posts per week targeting medium-to-high volume SEO keywords to bring in folks searching for information on support, pricing, user engagement, and other common SaaS topics

- Referral: Early on, Intercom inserted "We run on Intercom" links inside each of their customers' chatbots, driving visitors back to their site to learn more about the tool. Each link also sent those visitors to a landing page personalized for traffic from that website in a technique known as "dynamic keyword insertion".

Competition

Intercom operates in the customer service software market, competing with both established players and newer AI-first entrants. The competitive landscape has evolved significantly with the rise of AI-powered solutions that are reshaping traditional support models.

Help desk incumbents

Zendesk stands as the dominant player with approximately 170,000 customers representing 30% of the global customer service market. Unlike Intercom's all-in-one approach, Zendesk has been slower to adopt AI following its $10.2B private equity acquisition in 2022. This acquisition has reportedly led to a focus on cost-cutting rather than innovation. Intercom has moved to exploit this gap directly, positioning Fin as an AI layer on top of Zendesk rather than just a replacement: the standalone Fin for Zendesk SKU lets Zendesk customers plug Fin into their existing ticketing workflow without switching platforms.

Help Scout offers a different pricing approach, having moved further from per-seat models to usage-based pricing calculated on "contacts helped" monthly. Their AI features like Drafts are priced at 50 cents per AI-assisted conversation, billed in 100-conversation increments.

Both competitors offer AI solutions that parallel Intercom's, but with different implementation approaches and pricing structures. Zendesk's "Automated Resolutions" start at $1 for committed volumes and $2 for pay-as-you-go, while Help Scout charges for AI drafts at 50 cents per conversation.

First-generation chatbot providers

Drift represents the earlier generation of chatbots, functioning essentially as phone trees in messenger format. These solutions rely on fully scripted paths and conditional logic rather than true AI understanding.

These providers were most effective in consumer applications with limited product surface areas and high support request volumes. Their chatbots typically addressed scenarios where 87% of requests related to just 16 common issues.

First-generation solutions could achieve resolution rates up to 50%, but required significant manual programming effort, making their economics challenging for many customers.

AI-first entrants

Newer competitors like Decagon are entering the market with AI-first approaches and potentially simpler pricing models. These entrants pose a threat to established players like Intercom whose pricing combines seat-based and usage-based components.

The AI-first challengers benefit from not having to manage the transition from traditional seat-based pricing to consumption-based models. They can design their pricing structures from scratch to align with AI-driven support economics. Intercom's competitive response has been to publish concrete resolution rate benchmarks—Fin 2 averaged 66% resolution across 6,000+ customers—giving it a performance proof point that pure-play AI entrants without comparable scale data cannot yet match.

TAM Expansion

Intercom has tailwinds from the AI revolution in customer service and has the opportunity to grow and expand into adjacent markets like proactive customer engagement, enterprise-level service automation, and becoming the central nervous system for customer data.

AI-powered customer service transformation

The customer service market is undergoing a fundamental shift as AI capabilities mature. Intercom's Fin AI agent, which charges $0.99 per resolved ticket, represents a transition from traditional seat-based pricing to outcome-based models. This shift allows Intercom to capture value from productivity gains rather than headcount.

Customer service teams are shrinking industry-wide, with the "Business Support Service" category employing only 700,000 people in the US compared to 860,000 pre-pandemic. Intercom's AI solutions directly address this trend by enabling smaller teams to handle larger volumes.

The company's ability to achieve 25% YoY growth in 2024 (reaching $343M) after slowing to 10% in 2023 demonstrates market validation of this approach. By charging for resolutions rather than seats, Intercom has found a way to monetize efficiency gains that previously would have reduced their revenue.

Platform expansion: Fin as a cross-stack AI layer

Intercom has expanded Fin's addressable market from "companies willing to switch CX platforms" to "any company running customer support at scale" by making Fin available as a standalone agent for customers already running Zendesk or Salesforce—without requiring a full switch to Intercom's platform. The same SKU is available via API ("Fin over API") for any custom stack, meaning Intercom can monetize the installed base of every major helpdesk, not just its own. Fin Voice—now supporting 28 languages with ~30–40% latency improvements since its launch in March 2025—extends this cross-platform reach into phone-based support channels through integrations like Aircall, opening a channel that pure-platform competitors cannot address without comparable voice infrastructure.

Proactive engagement platform

Intercom is evolving beyond reactive support to proactive customer engagement. Their AI can infer important steps customers haven't taken in applications and proactively offer assistance before issues arise.

This capability positions Intercom to expand into customer success and retention tools, a market adjacent to pure customer service. By identifying at-risk customers and engagement opportunities through AI analysis of behavior patterns, Intercom could develop revenue streams tied to retention metrics and customer lifetime value improvements.

The proactive approach also opens opportunities in product-led growth, where Intercom could help companies identify expansion opportunities within their existing customer base.

Enterprise data integration and orchestration

Intercom's vision includes becoming the central nervous system for customer data, connecting AI and human-driven service with customer information across systems. This positions them to expand into enterprise data orchestration.

While currently skewing toward mid-market and SMB companies, Intercom has enterprise customers like Amazon and aims to serve "both ends of the market." Their deep integration with customer data enables them to potentially offer enterprise-grade analytics and insights beyond support interactions.

The company's investment of $100M in AI features signals their commitment to building an integrated platform where customer data, AI, and human agents work seamlessly together. This integration capability could allow Intercom to expand into broader customer experience management, competing with platforms like Salesforce Service Cloud.

Risks

Cannibalization of seat-based revenue model: Intercom's shift to outcome-based pricing with its AI agent Fin ($0.99 per resolution) could accelerate the shrinking of customer service teams—the very teams that drive Intercom's traditional per-seat revenue. While this pivot acknowledges market realities, it creates tension between promoting AI efficiency and maintaining seat licenses.

API cost margin pressure: Intercom's AI-driven features rely on external LLM APIs like Claude, creating significant cost pressure on gross margins. With Fin priced at $0.99 per resolution and potentially high token consumption per conversation, Intercom faces a delicate balance between competitive pricing and profitability, especially if resolution rates decline or API costs increase.

Pricing complexity alienating customers: Despite efforts to clean up pricing, Intercom's blended model of seat-based fees, AI copilot charges, and per-resolution costs remains complicated. This complexity creates an opening for AI-first competitors with simpler, more transparent pricing models to disrupt Intercom's market position, particularly as customers scrutinize SaaS spending.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.