Revenue

$318.66M

2023

Valuation

$12.30B

2023

Growth Rate (y/y)

48%

2023

Funding

$1.50B

2023

Revenue

Sacra estimates that Brex hit $319M in net annualized revenue in 2023, a 48% increase from 2022 when they hit $215M and grew 12%.

Their acceleration was driven primarily by the 302% year-over-year growth of revenue from deposits, which grew from $26M annualized in 2022 to roughly $105M annualized in 2023. Brex's business checking product was one of the biggest beneficiaries of the shutdown of Silicon Valley Bank shutdown, which drove their total assets from $4B to $7B.

Brex makes most of its revenue from interchange fees when its customers use cards for transactions. Other sources of revenue include seat-based fees from Brex’s financial management SaaS, fees from bank partners where Brex parks its customers’ cash, and transaction revenue from Brex's bill pay product.

Business Model

Unlike Amex, which charged $300-600/year for a corporate card, Brex gave away cards for free and monetized transaction volume at a roughly 2.7% interchange rate.

Brex’s free card served as a wedge to get into early stage companies like its fellow Y Combinator batchmates, and then its interchange model allowed it to index on the upside of those companies as they grew similar to YC’s venture model.

Brex based their credit limits on how much cash startups had in their accounts, giving startups 10x-20x higher credit limits, and waived off the monthly fee, making money through interchange fees, much like consumer neobanks like Chime and Dave.

Brex collects roughly 2.8% on the transaction volume that goes through their platform as gross revenue—after the interchange is split, they end up with about 55% gross margins. Compare that to a purely expense management product like Divvy (now part of Bill.com) with about 80% gross margins, or AmEx at ~65%.

Last year, Brex launched financial and software products complementing its corporate cards to eat into more of a startup’s financial stack, such as expense management, bill payment, and cash management, where they can make money through a SaaS-style subscription fee, reducing their reliance on interchange fees.

Product

Brex found initial traction by indexing on the core problem facing all startups/SMBs: unlike established companies, they struggled to get corporate cards from traditional card companies like AmEx and furnished personal guarantees by founders for cards with low credit limits, even though they might have $100K or $1M in their bank account. On top of that, getting a card involved excessive manual paperwork, a long waiting time, and high monthly charges.

Gradually, Brex layered on more and more features—banking, expense management, venture debt, travel management, financial modeling, and others—en route to building a Silicon Valley Bank-like suite of financial products for startup businesses, all built on top of their (mostly) proprietary infrastructure payments base.

Brex’s key products include:

Corporate cards: Brex’s core product with high credit limits for startups without any monthly or set-up fee.

Brex Cash: A cash management account where companies can hold their funds to earn interest and make ACH/wire payments. Brex parks the funds with its partner FDIC-insured banks.

Venture debt: Provides loans to startups at a 6% to 10% interest rate.

Brex Empower: Spend management software, tightly coupled with corporate cards, through which companies can build rule-based spending workflows, reimburse employee expenses, and review purchases.

Bill pay: Payment software for non-payroll, non-employee spend where companies can process invoices and pay their vendors digitally instead of manually processing invoices.

Competition

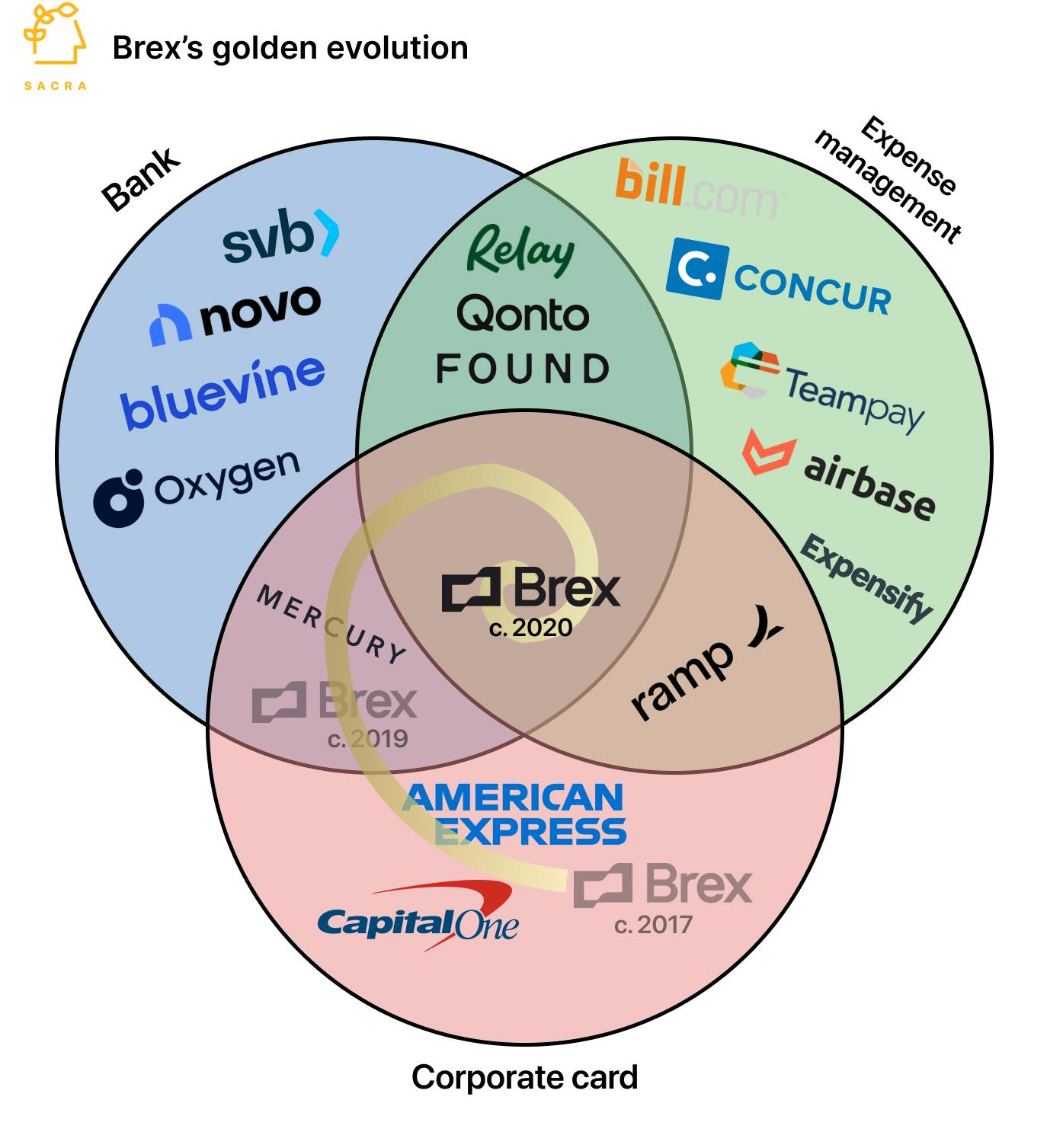

Brex sits at the center of the venn diagram of neobanks, companies offering corporate cards, and expense management companies—their biggest competitors among startups are the other 'overlappers' that are stitching together several functionalities into one integrated product.

The launch of Ramp in 2020 changed the economics of the “startup credit card” by replacing rewards with cash back and bundling in expense management SaaS, which created switching costs and incentivized teams to have only 1 credit card company—forcing Brex to launch its own expense management product to catch up.

By using only Ramp cards across the team, companies could manage all their expenses in one place rather than stitching together their spend across multiple cards.

Mercury jumped in front of Brex in the financial stack with their linked bank account and debit card—now they have their own Mercury IO credit card (via Lithic), which has the advantage of consolidating a startup’s finances in one interface.

Companies need a bank account from day 1, which makes Mercury a priority over a Ramp or Brex for newly-founded startups.

In parallel, incumbents in the spend management category are broadening their product suites. For instance, Bill.com acquired Divvy in May 2021, Airbase launched a standalone bill pay product in June 2021, and Rho added expense management software in August 2022.

Brex is threatened by a growing number of vertical SaaS with cards and expense management focused on industries with high spend irrespective of revenue ala Parker and Juni (ecommerce), Convoy (trucking) and Flexbase (construction) as well as Deel-esque, ‘global-first’ card companies like Jeeves, Moss, YouTrip, Payhawk. Vertical SaaS companies can take ~1.75% on each transaction completed on their platform by issuing virtual or physical credit cards to their customers.

TAM Expansion

Brex is expanding horizontally by eating into more of its customers’ financial stack through software and moving up the stack from startups to sell into enterprises.

Financial management suite

Like Rippling, Brex’s underlying infrastructure allows them to build a compound startup with the pricing advantage of bundling across many SKUs and the integrated UX of all-in-one software. Brex already combines Bill.com ($8B) with bill pay and expense management, Navan ($9.2B) with travel, Pipe ($2B) with debt, and Mercury ($1.6B) with banking—they have the opportunity to expand even further, from loans to accounting to payroll to other services like vendor payments.

The US B2B payments market at $25T is thrice the size of the B2C payments market, but credit card adoption is very low, accounting for only 4% of payments. With its card-led spend management software, Brex has the opportunity to sell more software to its existing customers, capturing more of their business spend on its platform.

Enterprise customers

In 2022, Brex both made the decision to stop serving SMBs/startups and also launched Brex Empower—an enterprise product suite for large companies to streamline reporting, budgeting, and delegating spend.

It already has late-stage startups like Doordash, Classpass, and Scale as its customers and is looking to move to larger Fortune 1000 companies to sell into.

Risks

Pivot in sales motion

As Brex pivots to sell to enterprises, there is a considerable change in the sales motion with longer sales cycles, stricter compliance norms, and higher customer support expectations. Brex’s existing sales and customer support operations fine-tuned for startups may not work for enterprises.

Reliance on interchange fee

Since making the decision to stop working with SMBs, Brex has become even more indexed on revenue from venture-backed startups spending money on their corporate cards—which could be a problem in an uncertain economic environment where both venture fundraising and startup spending are down.

Funding Rounds

|

|

||||||||||||

|

||||||||||||

|

|

||||||||||||

|

||||||||||||

|

|

||||||||||||

|

||||||||||||

|

|

||||||||||||

|

||||||||||||

|

|

||||||||||||

|

||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.