Ramp passes Brex

Jan-Erik Asplund

Jan-Erik Asplund

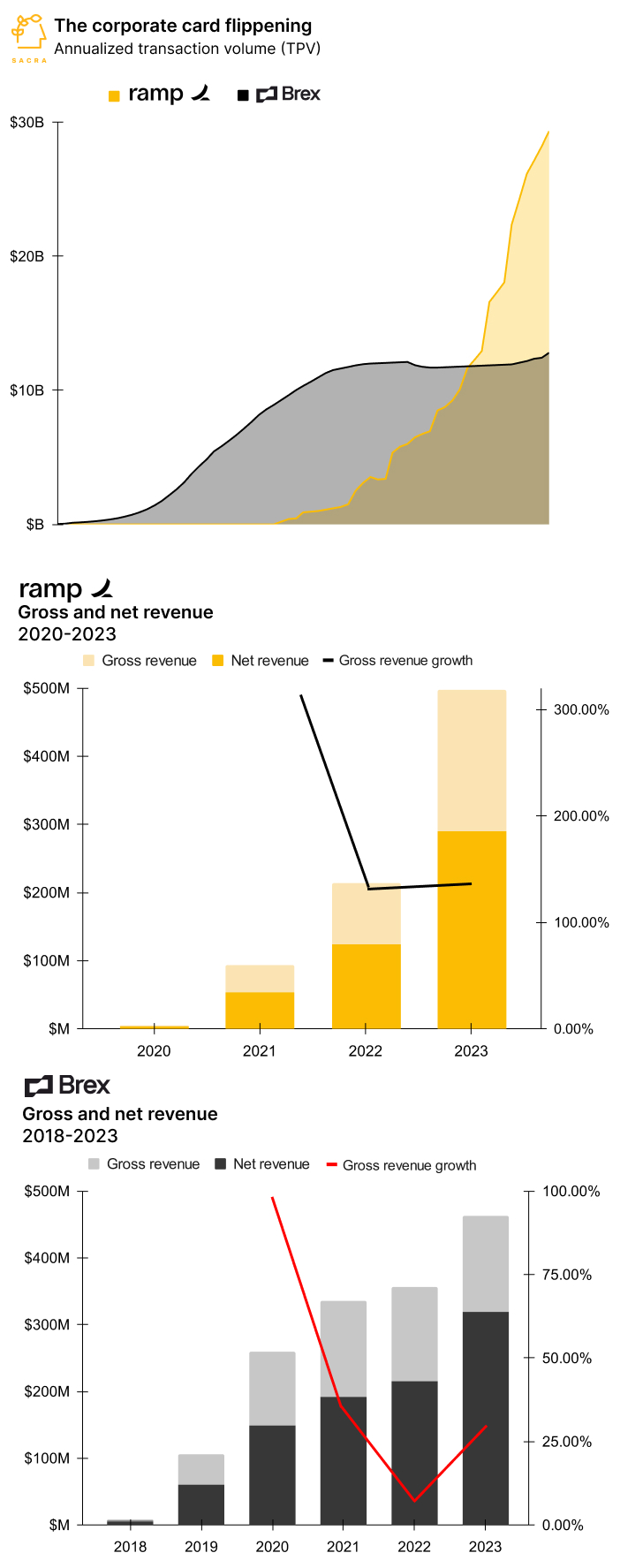

TL;DR: Sacra estimates that Ramp has overtaken Brex in total payments volume (TPV), hitting $30B annualized at the end of 2023 off the growth of Ramp's second product, Bill Pay. Now, the battleground has shifted away from card volume towards B2B subscription SaaS. For more, check out our dataset on the corporate card "flippening" and read our reports on Ramp (dataset) and Brex (dataset).

Using publicly available data points, we modeled total payments volume, gross revenue, and net revenue across cards, bill pay, deposits, and subscription SaaS for both Brex and Ramp.

Our model met the constraints of all publicly published data points—and what resulted was surprising. Click through to take a look at the models for Brex and Ramp (members only) and let us know what you think.

Key points from our research:

- In 2018, Brex launched a corporate card for startups with 10x the credit limit of American Express and soon became one of the fastest-growing startups of all time, raising $1.5B at a $12.3B valuation off $12B annualized TPV at the end of 2021. Ramp launched its competing corporate card two years later in 2020, positioning itself around cost savings for the business rather than rewards like airline miles and points.

- In 2022, Brex shifted its strategy away from TPV as a north star metric to focusing on net revenue and profitability, becoming a mash-up of Ramp (B2B SaaS) and Mercury (banking). Brex's revenue from deposits grew 302% from ~$26M in 2022 to roughly $105M annualized in 2023 as $3B+ flowed into their business accounts after SVB’s March 2023 collapse.

- Sacra estimates that Ramp has surpassed Brex on total payments volume, flippening them in 2023 as they hit $30B in TPV across both card and bill pay, growing 209% year-over-year. Amid a wider pullback on card spending—see total volume on American Express cards growing just 7% last quarter to $1.68T annualized, their weakest growth in ten quarters—Ramp's TPV growth was sustained by expanding customers into its second product, bill pay, which has a lower monetization rate of ~0.1%.

- Ramp’s strategy is to leverage their ownership over card and bill pay workflows into their higher margin SaaS product Ramp Plus while keeping headcount relatively low—with about 900 employees vs. Brex’s 1500—for capital efficiency. That up-market motion brings Ramp into competition with enterprise spend management companies like SAP Concur (~$2B in revenue, 20%+ YoY growth), Coupa ($725M in revenue), and Zip ($1.5B valuation).

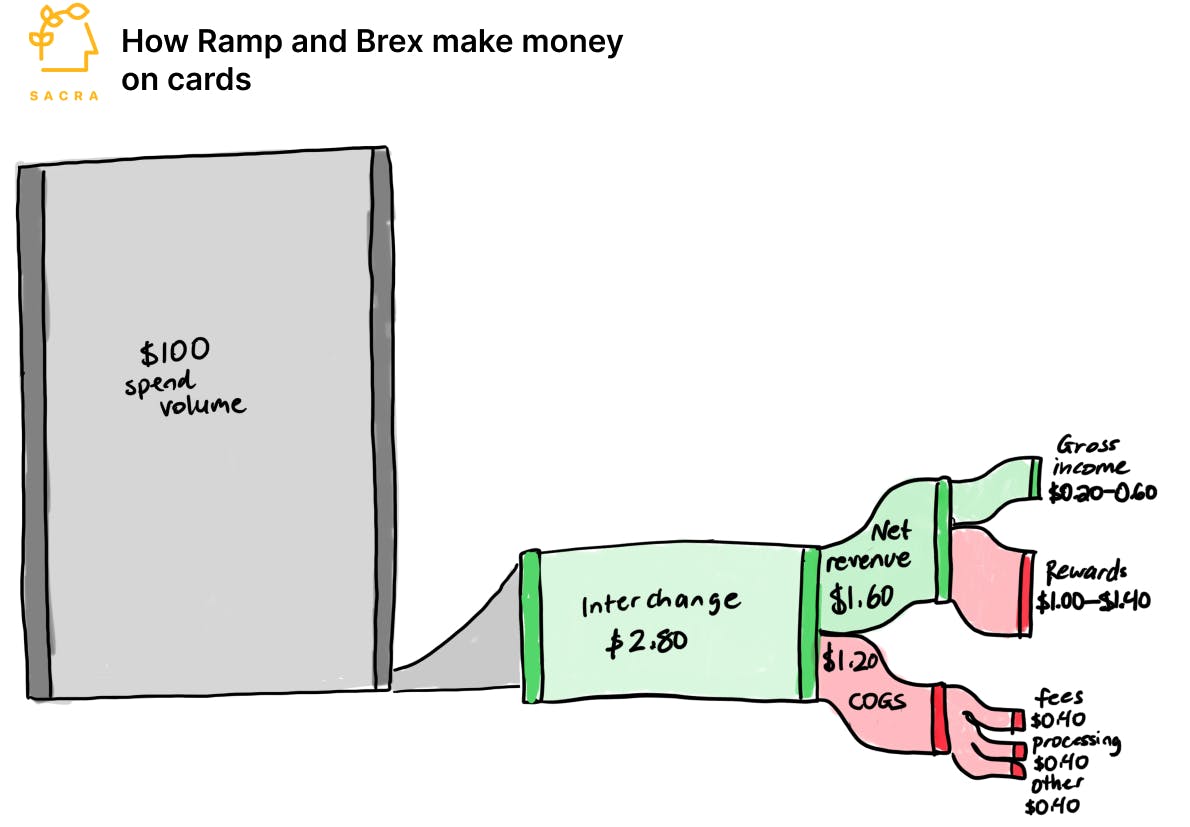

- Post-ZIRP, the fintech narrative has moved on from the vanity metric of TPV towards net revenue (1.6% of total payment volume for cards), high-margin software revenue and true recurring subscription revenue. While Brex's main rival Ramp gravitates towards enterprise SaaS, Brex now looks more like Mercury in retrograde—where 90% of Mercury’s revenue comes from interest on deposits and about 10% comes from interchange, Brex's revenue is about 61% interchange, 33% deposits, and 6% SaaS—with both competing over the all-in-one SMB finance and banking solution.

For more, check out this other research from our platform:

- Corporate card flippening (dataset)

- Ramp (dataset)

- Brex (dataset)

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Banking-as-a-Service: The $1T Market to Build the Twilio of Embedded Finance