Intercom's $250M/year AI bet

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Intercom is betting their $250M/year business 100% on customer service and leveraging LLMs to turn their chat window real estate on 25,000 customer sites into their next step function in growth. For more, check out our Intercom report and dataset, as well as our interview with Intercom co-founders Eoghan McCabe and Des Traynor.

- The 1st generation of chatbots—tools like Facebook Messenger bots (NASDAQ: META) and Drift ($135M revenue in 2022)—were phone tree-style bots with fully scripted paths that got their best traction with companies like DoorDash (NYSE: DASH) and Uber Eats (NYSE: UBER) where 87% of requests relate to 16 delimited issues. Designed for consumer use cases with an extremely high volume of requests but a limited surface area of potential problem categories, 1st gen bots functioned by guiding users through a series of conditions—”Did you want to talk to sales? Did you want to talk to support?”

- The 2nd generation of chatbots—tools like Intercom’s Resolution Bot (2018)—used fuzzy matching to answer questions with pre-written, curated answers, which could get teams to ~50% resolution rates, but required a significant investment of time to create and maintain rules and documentation. Intercom found that the economics around Resolution Bot didn’t make sense for most customers or that too much convincing was necessary to show their value.

- What we’re seeing now—with the emergence of LLMs like OpenAI’s GPT-4—is a 3rd generation of chatbots, like Intercom’s Fin, that can ingest a customer’s support docs and use LLMs to interpret the meaning behind a question, provide an answer, and autonomously resolve 80% of queries. These 3rd-generation chatbots require none of the human curation or setup of previous-generation bots, allow users to interact with them in a human way, and with the launch of the GPT-4 API, are 80% less likely to respond to queries with disallowed content and 40% more likely to produce factual responses.

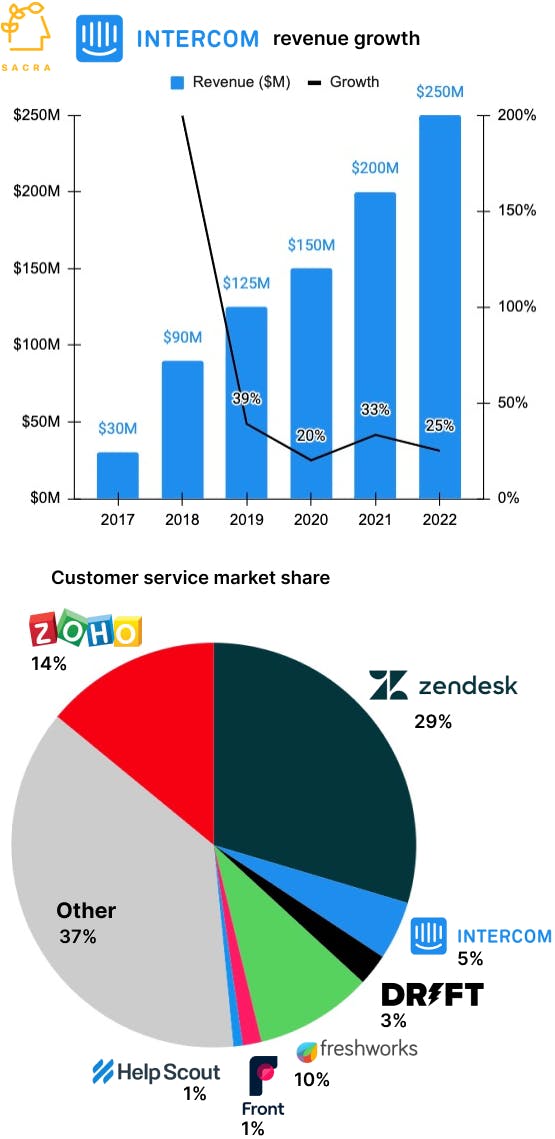

- Today, Sacra estimates that Intercom is doing about $250M revenue, growing 25% year-over-year, with more than 25,000 companies as customers and 600M+ users sending 500M+ messages every month. Compare to Drift at about $118M in revenue in 2022, growing 35% year-over-year, with 5,000+ customers, and Zendesk at about $1.58B in revenue in 2022, growing 22% year-over-year, with 170,000 customers.

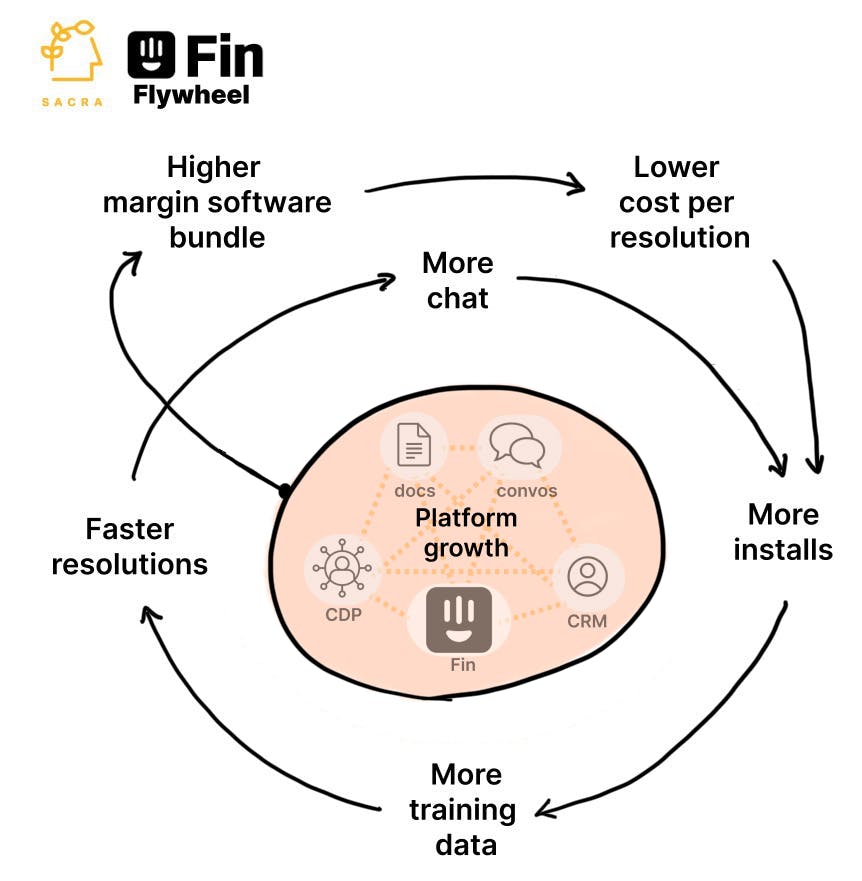

- Building a B2B chatbot from an LLM’s non-deterministic output requires major software and data scaffolding—CDP to integrate private customer data, Inbox with previous conversations giving it access to tone & voice, and CRM to tie everything together with the most recent customer touchpoints each with bidirectional read/write. AI augments humans by segmenting out situations where customer service tasks can be automated vs. those where AI orchestrates human teams to come in and provide the human touch.

- In the near term, the business challenge for Intercom lies in cannibalizing its subscription SaaS model that monetizes customer support team members on a monthly per-seat basis, replacing that with a transactional $0.99 per conversation resolution charge. The long-term bet lies in shrinking the size of the customer service market, dominating it as the deepest and richest AI offering and driving margin via value-added software on top.

- Customer service juggernaut Zendesk (taken private for $10.2B in 2022) has launched its own AI tools into the customer service back-end—augmenting support teams with automated triage and pre-populated responses—with instant distribution into their 170,000 customers representing 30% of the global customer service market. As the incumbent, Zendesk has the most to lose from AI disruption, resulting in its focus on speeding up customer service teams rather than automatically resolving and eliminating support inquiries entirely.

- Given its chat-centric model to customer support, Intercom’s incentives align with driving the north star metric of percent chats resolved instantly—to create a virtuous cycle where that delightful customer experience actually attracts a net increase in customer engagement through Intercom chat. Like Plaid ($250M revenue in 2022), Intercom has the opportunity to brand and aggregate demand for a specific, trusted B2B experience that lives inside of a customer’s app.

- In its upside case, Fin catalyzes Intercom’s colonization of the entire customer service software suite, by offering customers more personalized chatbot responses and faster resolution times in return for adopting more to all of the Intercom customer service platform. With AI, a winner-takes-most dynamic could emerge where—like Amazon (NASDAQ: AMZN)—aggregating demand creates economies of scale on the supply side that drive down the cost of automated resolution with savings passed back to the customer to grow a platform moat as the cheapest, fastest and best.

For more, check out this other research from our platform:

- Eoghan McCabe & Des Traynor, CEO and CSO of Intercom, on the AI transformation of customer service

- Intercom (dataset)

- Drift (dataset)

- Attentive (dataset)

- Postscript (dataset)

- Colin Nederkoorn, founder & CEO at Customer.io, on the CDP layer in messaging

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future