Revenue

Sacra estimates that Airtable hit $478M in annual recurring revenue (ARR) in 2024, growing 27% year-over-year from $375M in 2023. As of August 2025, Airtable reports roughly 90% gross margins, but has signaled it will prioritize growing its new AI text-to-app business over maintaining those gross margins.

Airtable's recent growth has been driven by enterprise adoption, where Airtable achieved 100% year-over-year revenue growth and 170% net dollar retention—significantly outpacing competitors like Asana (130% NDR) and Monday.com (120% NDR) in their largest customer segments.

Airtable's journey from its initial focus on prosumer customers to enterprise began in 2018, and the company demonstrated remarkable scaling efficiency by growing from $10M to $100M ARR in approximately 3.5 years.

The company's success has been built on its position as a category leader in the no-code app builder space, with a "land and expand" strategy typically starting with marketing and operations teams before expanding across organizations through verticalized offerings like "Airtable for Marketing."

For comparison, in late 2023, competitors Asana ($600M), Monday.com ($757M), and Smartsheet ($987M) showed more modest growth rates between 23-38% YoY, while operating in more traditional project management spaces.

Valuation & Funding

Airtable was valued at $11.7B following its Series F round in December 2021, led by Salesforce and Franklin Resources.

Based on their 2021 revenue of $156M, that round valued Airtable at a 75x revenue multiple.

As of January 2026, Airtable has traded on secondary markets at approximately $4B, according to CEO Howie Liu—a roughly 66% decline from the 2021 peak.

The company has raised $1.4B in total funding across multiple rounds. Liu stated in January 2026 that roughly half of the capital raised remains in the bank and that Airtable is "throwing off cash." Other notable investors include Thrive Capital and Coatue Management.

Product

Airtable offers a collaborative SaaS platform designed to streamline data management for organizations. It combines a spreadsheet interface with relational database functionality, aiming to simplify software creation and empower non-technical users to customize applications without coding.

The core feature of Airtable is its table interface, resembling traditional spreadsheet applications but with enhanced database capabilities. This allows users to establish complex relationships between different datasets, facilitating comprehensive data organization and interconnectivity. Users can integrate various data types, including tasks, project timelines, inventory lists, and rich media such as images and links.

The platform provides versatile viewing options, including grid, kanban, calendar, gallery, and Gantt chart views, each offering dynamic filters and customization features. These options cater to diverse project and operational requirements, allowing users to visualize and interact with data according to their preferences.

CEO Howie Liu has described a radical "refounding" of Airtable to become AI-native (announced September 2025), emphasizing a complete overhaul of both product architecture and organizational processes to prioritize conversational AI as the default interface and core workflow engine.

Airtable's AI posture has three pillars. First, Omni as the AI front door: describe a workflow and it scaffolds a production‑ready base and interface, then helps analyze and iterate. Second, Field Agents as the execution layer: model‑agnostic AI that runs research, content, enrichment, and routing tasks inside apps at scale. Third, enterprise‑grade controls: admin‑managed model choice, workspace‑level enablement, and data boundaries geared to compliance.

This AI-native transformation led to Airtable's first stand-alone product in 13 years: Superagent, launched at superagent.com (January 2026).

Superagent uses "multi-agent coordination"—a central system breaks requests into plans, dispatches specialized agents to work in parallel, and synthesizes results into interactive deliverables rather than chat-style text answers.

The product draws from professional-grade sources including FactSet, Crunchbase, SEC filings, and earnings transcripts, with outputs verified, cited, and traceable. The Superagent launch built on Airtable's acquisition of DeepSky (October 2025), which brought co-founders Chris Chang, Forrest Moret, and Mark Huang plus 12 employees into the company. Airtable also hired former OpenAI executive David Azose as CTO as part of its AI-native repositioning.

Business Model

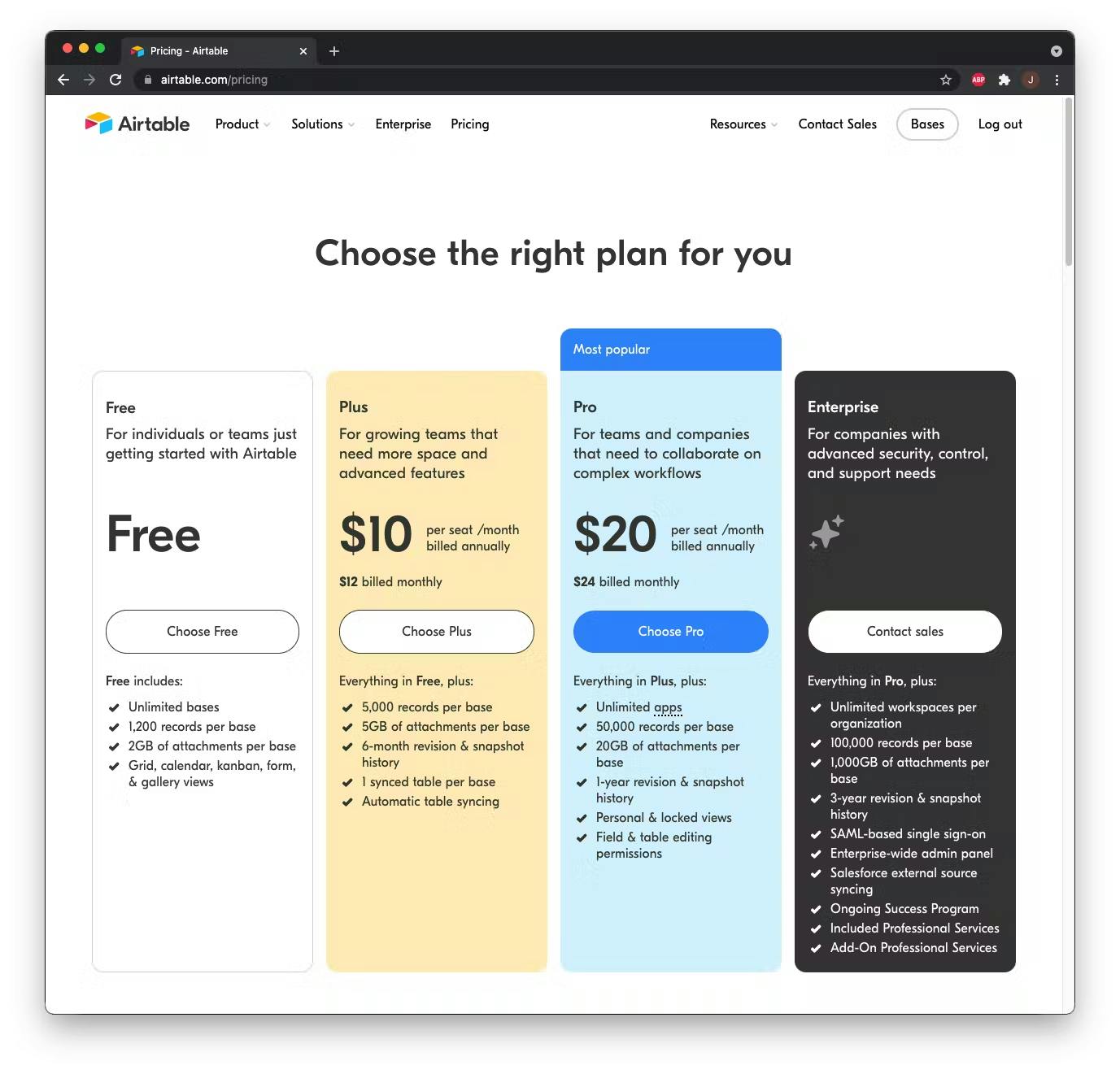

Airtable operates as a B2B SaaS collaboration platform, offering a flexible pricing structure based on a per-seat model and tailored plans to accommodate different organizational requirements. The pricing tiers include a free plan, along with two paid options: Plus at $10 per month and Pro at $20 per month per seat, with an enterprise plan available for larger organizations needing advanced features like single sign-on (SSO) and identity federation.

The Plus and Pro plans offer a comprehensive suite of features to address diverse organizational needs. Notably, the Pro plan provides unlimited app usage, supports up to 50,000 records per base, and includes personalized views, advanced organization options, custom scripting capabilities, and data synchronization from various external sources, including Salesforce. These features are particularly advantageous for larger teams or those demanding more sophisticated data management and control mechanisms.

Airtable's growth strategy revolves around increasing seat numbers and raising per-seat prices. This entails enhancing the platform's utility across organizations and developing features to foster adoption across different departments, thus expanding the user base and facilitating transitions to higher-priced tiers.

The company adopts a modified "land and expand" approach akin to product-led growth (PLG) strategies. Initial adoption typically starts at grassroots levels within organizations, with teams utilizing Airtable for tasks such as content tracking, operations management, social media scheduling, and product management. The platform's versatility and ease of use facilitate adoption across various teams.

To facilitate expansion, Airtable's customer success and services teams are pivotal. They engage with organizations to drive deeper adoption, assist in base design, and provide training and certifications, ensuring maximum value extraction and integration into workflows, thereby enhancing stickiness and reducing churn.

Additionally, Airtable identifies upsell opportunities through user behavior analysis, monitoring factors such as data volume, app usage, integrations, and collaboration patterns. This data-driven approach enables tailored engagement and upsell strategies, facilitating transitions to higher-tier plans.

In summary, Airtable's business model is characterized by adaptability, scalability, and a profound understanding of organizational dynamics. The strategic emphasis on expanding within organizations, combined with robust service offerings, positions Airtable to sustain growth by delivering value across teams, increasing seat sales, and achieving higher price points.

Competition

Airtable competes across four fronts: all-in-one workspaces, automation layers, cloud suite incumbents, and project-centric “work OS” platforms.

Each category presses on a different axis—authoring, integration depth, distribution, or standardized workflows.

All-in-one workspaces

Notion and Coda bundle documents and databases into a single authoring surface and pull usage toward a unified wiki-plus-tracker.

Notion’s native databases and Coda’s Packs narrow the gap on lightweight apps inside docs. These tools win when knowledge sharing and project notes sit next to structured records.

Airtable defends with deeper relational modeling, multi-view interfaces, and a richer schema for operational data at scale.

Automation and integration layers

Zapier overlaps with Airtable where workflow, storage, and UI meet—its Zaps tie apps together, Tables persist data, and Interfaces collect it.

That stack absorbs many simple CRMs, request queues, and intake-to-action flows Airtable might otherwise capture.

n8n pushes from the technical end with open-source, self-hosted automation that appeals on control, cost, and extensibility.

Security-sensitive teams route workflows through n8n and keep Airtable as a front-end or data store—reducing lock-in to any one vendor.

Cloud suites and spreadsheets

In many cases, Google Sheets and Microsoft Excel remain the default data canvases because they ship with the suite and fit familiar habits.

Google’s decision to shut down Tables and steer users to Sheets and AppSheet underscores how the suite favors horizontal primitives over a direct Airtable clone.

That shift preserves Google’s distribution advantage while removing a head-to-head entrant.

It also leaves Airtable competing more against a billions-of-users baseline than a like-for-like Google database.

Work OS and project platforms

Monday.com and Smartsheet come from project management and standardize cross-team workflows with templates, dashboards, and automations.

They encroach on database-style use cases as customers formalize processes into boards and sheets rather than free-form tables.

These platforms win in exec-visible planning and portfolio reporting where governance, status roll-ups, and role-based controls dominate.

Airtable wins when teams need flexible data modeling first, and project views second.

TAM Expansion

AI-native platform evolution

Airtable's September 2025 refounding as an AI-native company positions it to capture the $150-200B generative AI productivity market.

The launch of Omni for conversational app building and Field Agents for automated research and content generation expands use cases from internal tracking to decision-support and knowledge-work automation.

The January 2026 launch of Superagent, a standalone multi-agent research product, demonstrates Airtable's ambition to monetize AI workflows beyond its core database platform.

Enterprise data infrastructure

HyperDB's general availability enables Airtable tables to hold up to 100 million rows with direct connections to Snowflake, Databricks, and Salesforce.

This positions Airtable to capture system-of-record workloads that previously required custom SQL or specialized low-code platforms, unlocking deeper wallet share within Fortune 500 data estates.

The ability to query enterprise data warehouses without duplication while maintaining Airtable's user-friendly interface creates opportunities in regulated verticals like life sciences, financial services, and government.

Vertical solution expansion

Airtable's 170% enterprise net dollar retention demonstrates the success of pre-built vertical packages like Airtable for Marketing.

Extending this model to specialized industries such as life sciences quality management, financial client onboarding, and public sector case management can multiply ARR without proportional increases in customer acquisition costs.

The company's Apps by Airtable library provides pre-configured applications that enterprises can deploy in minutes rather than building from scratch, accelerating time-to-value in new verticals.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.