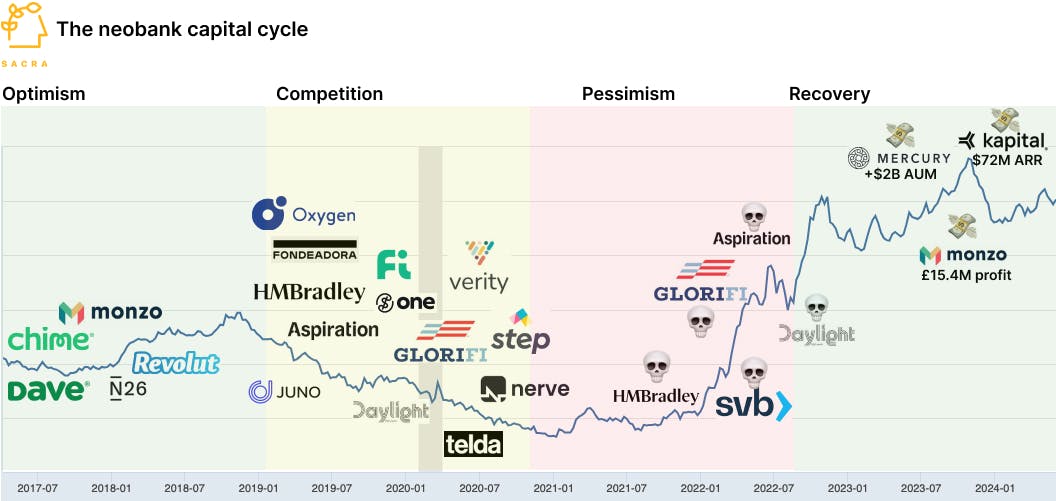

The neobank capital cycle

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: The higher interest rate environment of the last few years forced underperforming neobanks to shut down, but the top players are doing better than ever. Neobanks that weathered the post-ZIRP storm are growing 100% YoY, getting profitable, and building financial super apps. For more, check out our reports on Monzo (dataset), Kapital (dataset), and Chime (dataset).

Key points from our report:

- In the late 2010s, investors were bullish on digital neobanks like Chime (US), Monzo (UK), and N26 (Germany) because of their rapid growth to millions of users and their structurally lower CAC vs. traditional banks (~$100 vs. $650-700). Digitally-native and 100% online, with no existing fee-based revenue to protect, neobanks could offer differentiated features like fee-free checking and early paycheck access, attracting customers away from big banks (see: Bank of America’s NPS score of -24).

- During COVID, CACs went up across the industry as new neobanks proliferated, but when interest rates fell to 0%, it exposed that most of them were swimming naked, with only 5% being profitable. While traditional banks shifted their focus to generating more revenue from fees, neobanks were constrained in doing so because of how they’d positioned against fees—they were entirely reliant on the low-margin revenue from interchange (0.7 to 1.5% of transaction volume) to make money.

- As interest rates increased from 0% to ~5%, the outlook for the top neobanks has brightened, with accelerating revenue growth from deposits and lending (interest income was up 167% YoY at Monzo). Rising rates made it hard for most neobanks to raise money and keep going—niche players like Aspiration (climate-conscious banking), GloriFi (anti-woke banking), and Daylight (LGBTQ banking) were hit particularly hard.

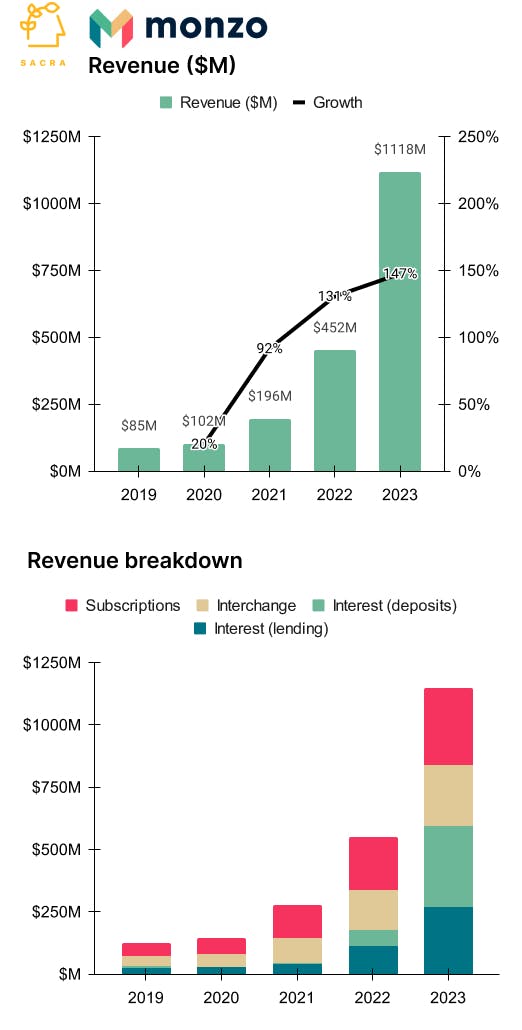

- In 2023-4, CACs have gone down post-consolidation and we’ve seen neobanks that weathered the ZIRP storm get profitable (Monzo and Revolut), rebundle the startup finance stack post-SVB (Mercury), and launch lending and BNPL into new segments like LatAm SMBs (Kapital). In 2023, Monzo generated $1.1B in gross revenue, up 147% year-over-year, with 51% of revenue from interest (23% from loans and 28% from deposits), 27% from subscriptions, and 21% from interchange.

- Today, neobanks are pursuing two strategies to grow ARPU and aggregate their segments: 1) they’re colonizing adjacent finance and back-office products to build financial super apps, and 2) they’re aggressively expanding geographically via partnerships. By layering on the high-margin revenue from products like B2B financing, mortgages, and personal loans, neobanks are setting themselves up to survive the next downturn.

For more, check out this other research from our platform: