Revenue

$1.70B

2024

Valuation

$25.00B

2023

Growth Rate (y/y)

31%

2024

Funding

$2.30B

2023

Revenue

Sacra estimates that Chime hit $1.7B in revenue in 2024, up 31% from $1.3B in 2023.

Compare to Chase’s consumer business (NYSE: JPM) with $49B in revenue and 67M active digital customers for ARPU of $731 and Cash App (NYSE: SQ) with $4.7B in revenue and 23M active customers (2M with direct deposit) for ARPU of $204.

Business Model

The neobank thesis of Chime, Dave ($274M revenue in 2023), Varo ($129M gross revenue in 2023) et al. posited that by wrapping their underlying banking partner like a Bancorp/Stride in marketing and design focused on a specific customer niche, they could drive lower CAC than a traditional bank ($100 per user, vs. ~$650-700 for a traditional bank) and win away the segment.

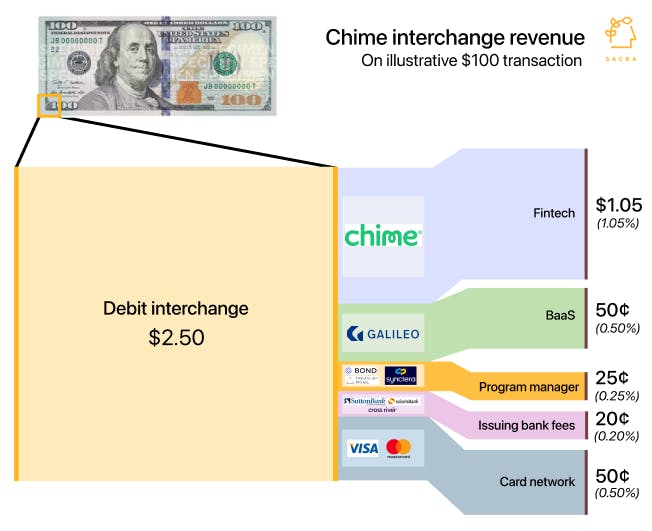

Most neobank revenue comes from the interchange split between the card network and banking partner (Chime gets ~50 cents for each $100 spent via their Chime-branded Visa card) while roughly ~20% comes from service charges like out-of-network ATM fees.

This interchange model is supported by a provision in the 2010 Dodd-Frank Act that lets smaller banks charge higher interchange fees than their bigger counterparts. Instead of making money from lending or charging hefty fees, Chime takes a cut of the interchange fee from its partner banks, Stride Bank and Bancorp.

Product

Chime's neobank (launched 2012) found initial product-market fit marketing to millennials and the 75% of Americans living paycheck-to-paycheck with no-fee accounts and 2 days early access to their wages.

Chime’s no-fee checking accounts, mobile app-based banking, and 2 days early access to paycheck attracted mostly middle-income millennials, living paycheck to paycheck and earning $45,000 annually, who were mostly ignored by the large incumbent banks.

Chime’s customer base doubled in 2020, as it provided a 5-day early access to stimulus checks for customers who had their Chime accounts set-up for direct deposit, and people stuck at home used their mobiles to access banking services.

As of May 2024, Chime has a total of 7M customers, most of whom have direct deposit hooked up to their Chime checking account.

Checking account and debit card: No monthly, low-balance, or overdraft fee bank accounts with a debit card that can be used at 60,000+ ATMs.

Credit builder account: Prepaid account funded by moving money from the checking account where Chime reports the transactions to credit bureaus to build customer’s credit history.

Savings account: A fee-free savings account with 2% APY, compared to 0.01% offered by traditional banks.

Money transfer: A Venmo-like fee-free facility to send or receive money from Chime/non-Chime bank account holders.

In 2024, Chime has announced that it will launch loans of up to $1,000 on 3-6 month payback schedules.

Competition

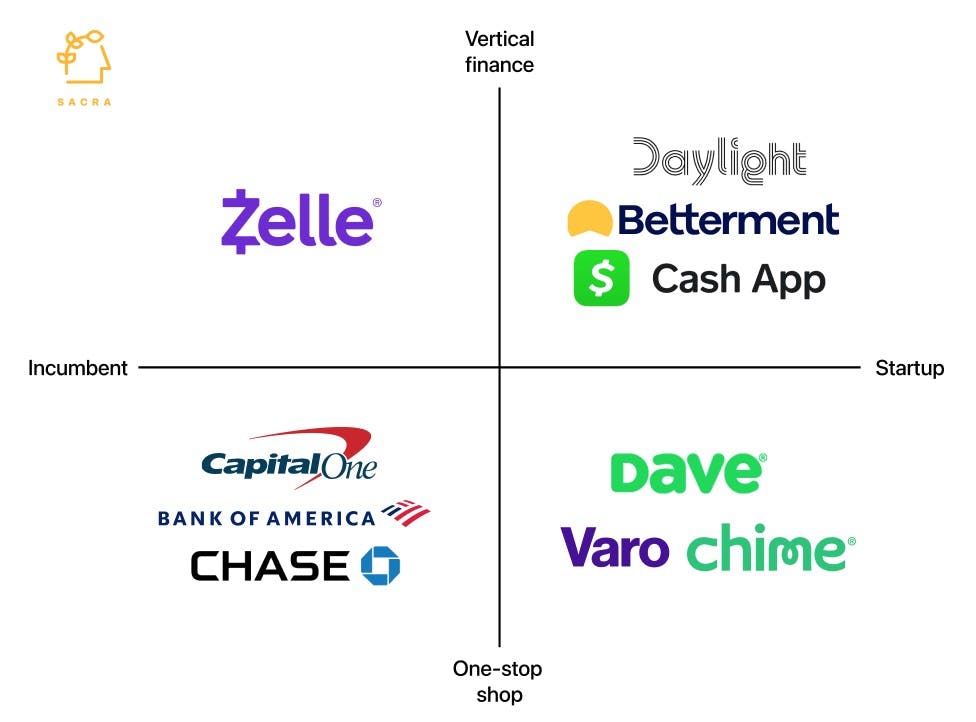

Chime is the biggest private neobank in the world and one of the leading neobanks in the United States.

Chime grew by offering a superior consumer experience through its app, but incumbent banks like Chase and Capital One are closing the gap by improving their digital offering. In the first half of 2022, Chime’s app was downloaded 6.7M times, compared to 7.7M of Capital One, 6.3M of Chase, and 5M of Bank of America.

Chime also faces competition from Block’s CashApp and Paypal’s Venmo, which sell to the same customer base as Chime. For instance, CashApp uses Pinwheel’s direct deposit switching APIs to let users connect their payroll to their CashApp wallet, obviating the need to use a separate bank account.

Fintech infra companies like Marqeta and Lithic enable vertical SaaS companies to embed financial services in their product and cross-sell to their users, such as Uber drivers using Uber’s debit card for most of their transactions or restaurant employees using Toast-issued debit cards for receiving their paychecks and spending money.

TAM Expansion

Lending

In 2023, Chime acquired numerous state licenses for issuing loans, brokering loans, and servicing/collecting consumer debt. These states include Arizona, Idaho, Kansas, and Oklahoma.

In May 2024, Chime confirmed it would officially be launching lending—the single fintech product that has been the biggest driver of increased profits for neobanks around the world.

Lending has the potential to roughly double Chime’s revenues—see Nubank (NYSE: NU) which made $1.6B from lending in 2023 (compare to $1.2B from interchange) and Monzo (£355M annualized revenue in 2023, up 130%) which made £90M from lending in 2023 (compare to £127M from interchange).

Capturing checking accounts

Chime’s total TAM—assuming they don't make an attempt to move significantly upmarket—is the 58% of working adults (about 138 million people) making less than $65K per year.

That cohort spends roughly $28K per year on non-housing expenses, meaning Chime could have an ARPU of roughly $420 via their 1.5% take on interchange for $58B of total potential revenue.

Above that $65K number, almost all the potential customers of Chime already have a checking account at a bank. Below that number, the main threat for Chime is that big banks are already beginning to launch competitive mobile and digital alternatives—see Wells Fargo, which launched early access to paychecks and small-dollar loans in 2022 as they play catch-up to digital neobanks.

Risks

Reduction in consumer spending

Chime could be hit harder than incumbent banks as consumers scale back their spending in an uncertain economic environment as unlike the incumbent banks, Chime’s interchange-based business model is indexed on consumers spending more and more. Also, its paycheck to paycheck customer base is the first to reduce spending as recessionary pressures grow in the economy.

Decline of primary bank account

With more and more Americans opening up multiple accounts across banks, brokerages, crypto apps, and others, the concept of one account being their ‘primary account’ from where they make most of their purchases is depreciating. Customers prefer to move their money to different apps/accounts that provide them better offers/cash-backs/convenience rather than sticking with one bank account.

Funding Rounds

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.