Mercury: the unbundling of Silicon Valley Bank

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: As Silicon Valley Bank collapsed last week, $3B+ in funds flowed through the startup ecosystem to other startups, particularly neobanks Mercury and Brex. This catalyzing event gives Mercury the opportunity to aggregate startup demand, build the Booking.com of startup banking and create a new gathering place for technology startups and capital. For more on Mercury’s strategy to build for safety and engagement, check out our interview with Immad Akhund, CEO at Mercury.

Key points from our research:

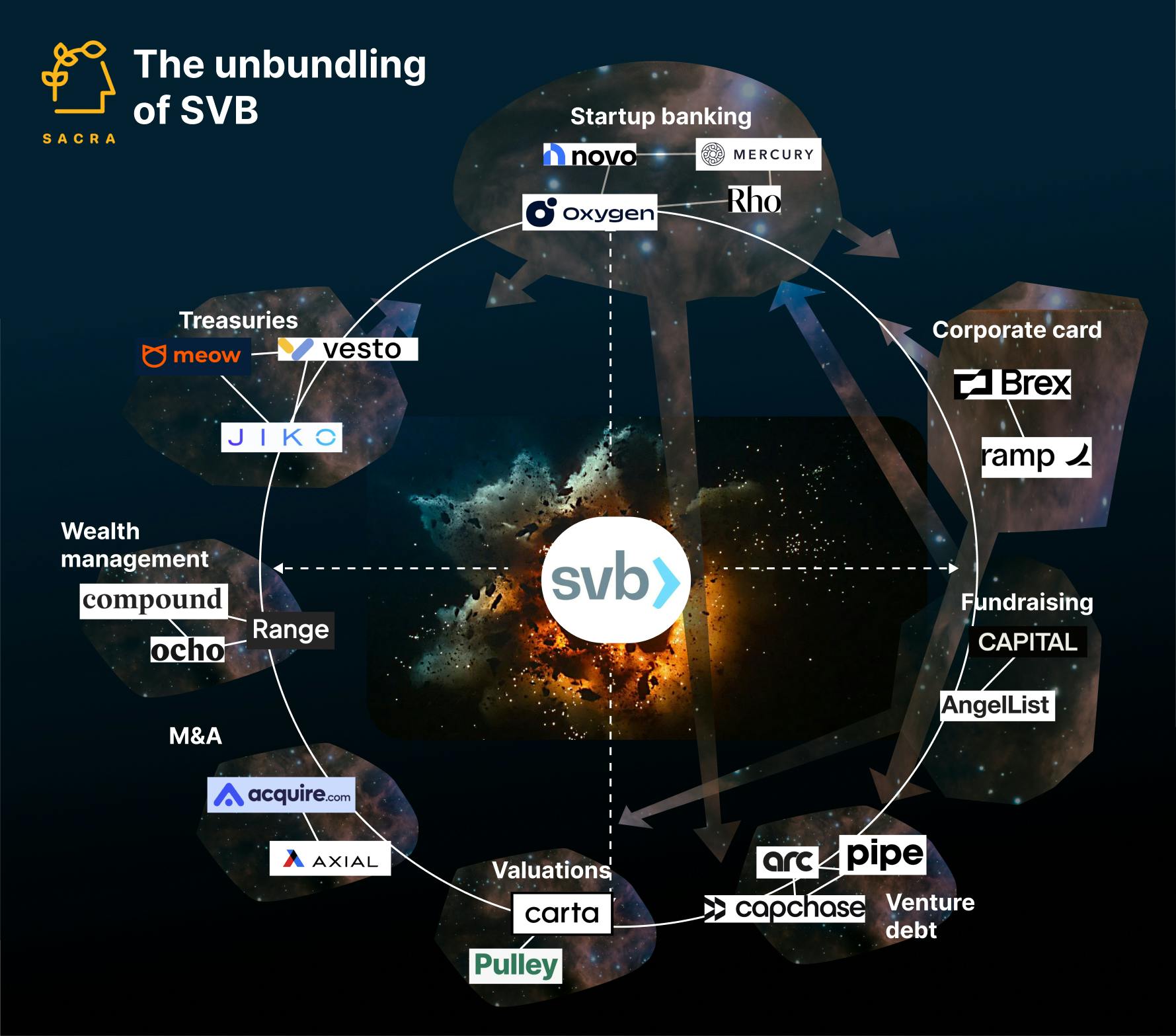

- Silicon Valley Bank (SVB) was founded in 1983 to serve an unattractive segment of commercial banking, companies with zero revenue but large deposits—otherwise known as venture-backed startups. Over 40 years, SVB accumulated more than $200B in total assets across the startup/VC ecosystem, with Valley institutions like Sequoia, Kleiner Perkins, and Stanford Research Park serving as feeders. (link)

- SVB’s growth left it vulnerable to bottom-up disruption from Mercury and Brex (both founded in 2017), which offered bank accounts and corporate cards to underserved startups outside the core Silicon Valley clique (e.g., international startups). Similar to consumer neobanks like Chime ($1.85B revenue in 2022), Mercury and Brex launched as UI layers on top of infrastructure products like Marqeta (Brex credit cards), Synapse (Mercury banking) and Lithic (Mercury IO credit card), substituting easy-to-use digital products in place of people-driven services and verticalized to best serve a specific customer segment. (link)

- SVB got unbundled during COVID and then unwound completely in 48 hours, with Mercury and Brex initially emerging as the primary beneficiaries, with Mercury adding $2B+ in deposits and thousands of customers in a week. Speed and safety drove companies to Mercury and Brex, which as neobanks, are both designed to absorb depositors at scale and diversify funds across multiple partner banks for FDIC coverage ($3M and $2.25M respectively) and money market funds. (link)

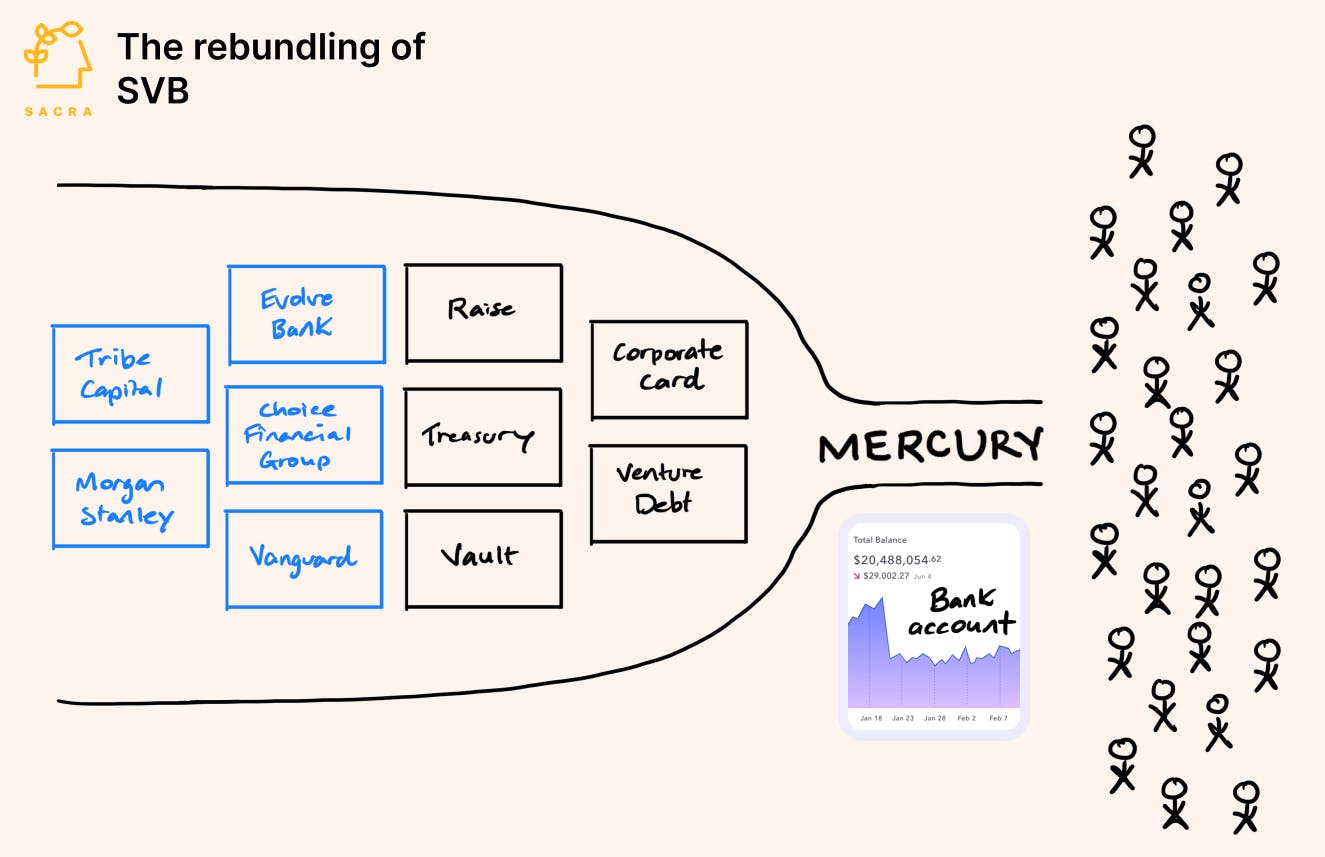

- Contrary to the banking business model of borrowing short and lending long, as a software company, Mercury generates revenue from (1) revenue sharing with partner banks on deposits, (2) interchange on their debit and credit cards (3) international wire fees and foreign exchange and (4) revenue sharing of the interest rate on venture debt. Compare with Brex which also monetizes with pure B2B subscription SaaS, selling their expense management software Empower to enterprises. (link)

- Mercury is becoming the Booking.com of startup banking, aggregating demand using free checking accounts and the best banking experience to commoditize suppliers (partner banks) who pay for access to Mercury’s customer base. Booking.com aggregated demand for hotels by dominating Google search results, which forced hotels onto their platform and gave Booking.com the ability to get 5% commission on each transaction. (link)

- As Mercury, Brex, AngelList, Stripe, Carta and Ramp attempt to aggregate startup demand and sell more products in their customer base, their offerings have begun to overlap, turning partners into frenemies and a new competitive set that will no doubt intensify in competition over the coming years. Look to see these companies move into incorporation (Stripe Atlas), cap table (Carta) and fundraising (AngelList) as they look to create a neo-SVB which consolidates all the services a founder needs from the very first moment of company formation. (link)

For more, check out our interview with Immad Akhund, CEO at Mercury, and this other research from our platform:

- Stripe (dataset)

- Mercury

- Bo Jiang, co-founder and CEO of Lithic, on the key primitives in card issuing

- Peter Hazlehurst and Kris Hansen, co-founders of Synctera, on BaaS in 2023

- Anthony Peculic, Head of BaaS at Cross River Bank on vertical banks and BaaS providers

- Shamir Karkal, co-founder and CEO of Sila, on the modern payments stack

- Founder of neobank company on the importance of picking the right sponsor bank