Revenue

$500.00M

2024

Valuation

$1.62B

2024

Growth Rate (y/y)

97%

2024

Funding

$209.00M

2024

Revenue

Sacra estimates that Mercury hit $500M in annualized revenue in 2024, up 97% YoY from $254M in 2023.

Mercury's revenue derives from three primary streams: interest income from customer deposits (currently around $20B), interchange fees from corporate card transactions, and subscription software priced between $35-350 monthly for finance workflow automation.

The company experienced explosive growth following Silicon Valley Bank's collapse in early 2023, capturing $2B in new deposits within just five days as startups sought safer banking alternatives. This windfall significantly accelerated Mercury's revenue trajectory, particularly from interest income.

Mercury's expansion into subscription software for bill payment, expense management, and invoice processing has positioned it in direct competition with Brex and Ramp, diversifying beyond its initial banking-focused model. This SaaS component provides a more predictable revenue stream compared to interest income, which fluctuates with rate environments.

Product

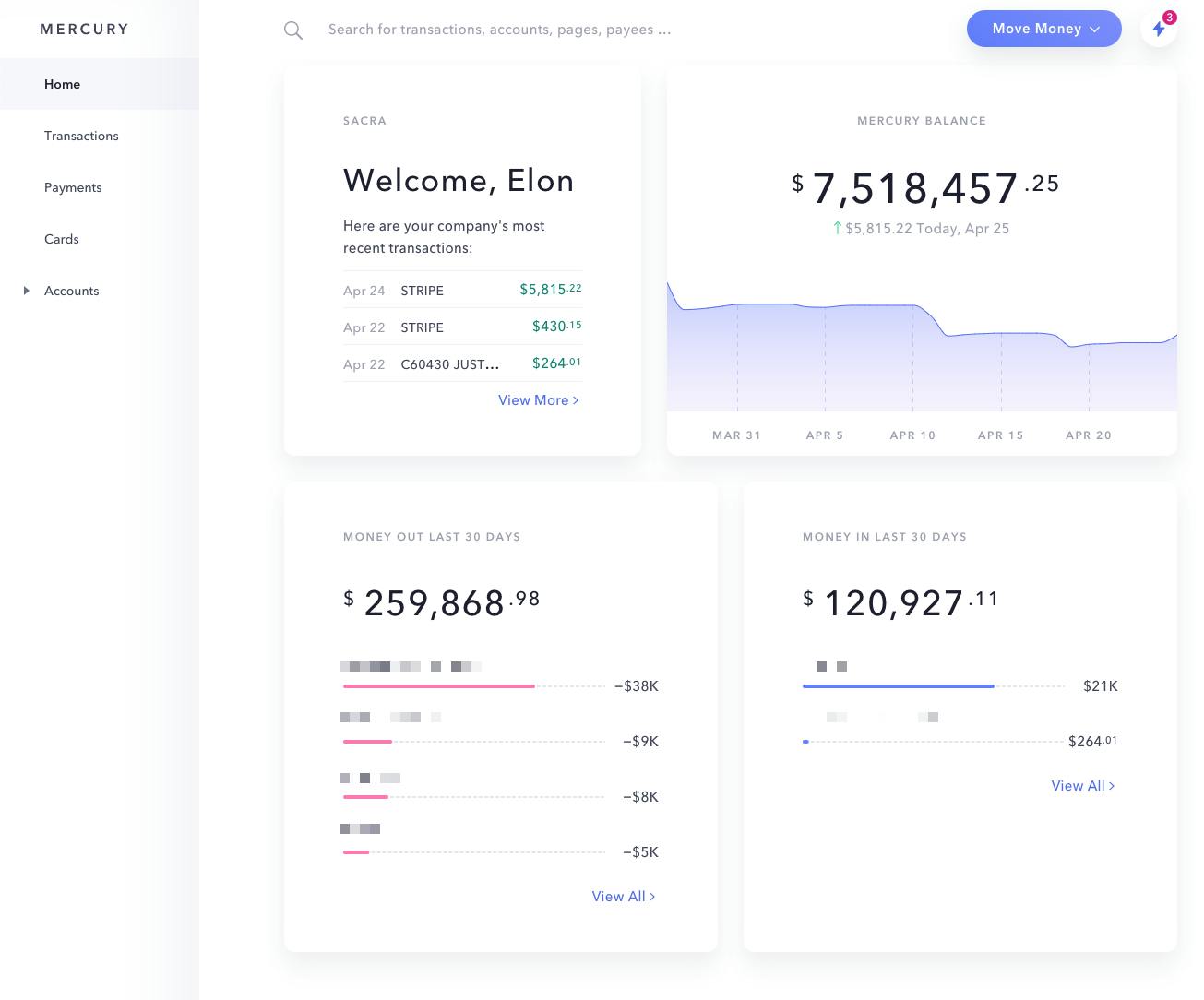

Mercury found product-market fit with early-stage startups by reducing the friction in opening a new bank account. It provides fast online bank account approval without any manual interventions, zero-fee banking products, and a modern UI compared to the legacy UI of existing banks such as SVB.

Mercury's dashboard

Mercury offers banking products and venture debt to startups. Its banking products include FDIC-insured saving/checking bank accounts, physical/virtual debit cards, cash management, wire transfers, and banking API access. It recently launched venture debt for VC-backed startups.

Banking products

Mercury’s banking products are free without monthly account maintenance fees, overdraft fees, or wire transfer charges. It offers two pricing tiers (a) Standard, which has no minimum balance requirements and (b) Tea Room, with a minimum $250K deposit that gives access to new products like cash management and dedicated on-call support.

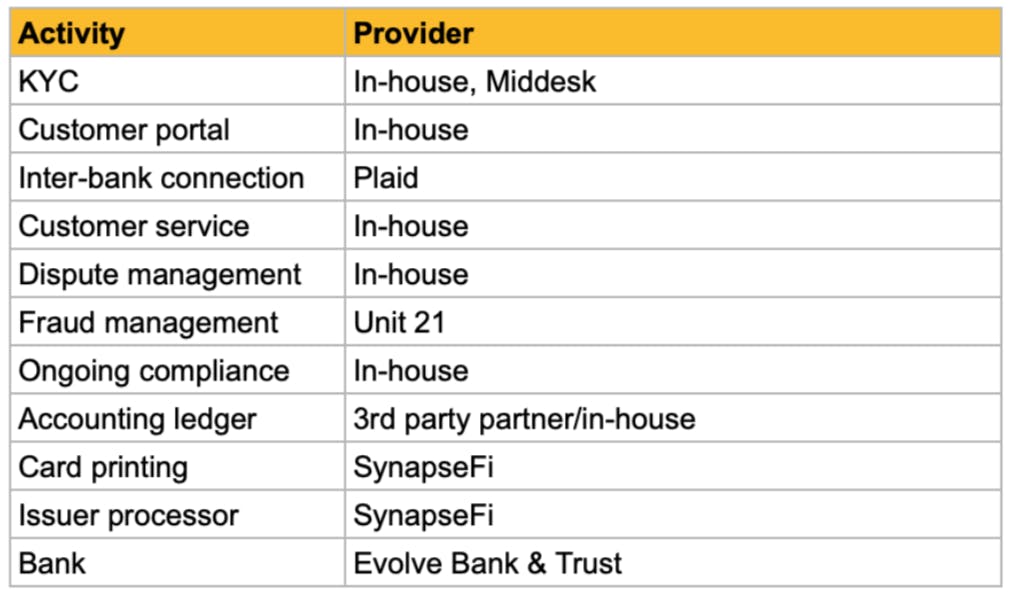

Mercury’s banking stack

Mercury’s UI is designed to reduce time spent doing everyday tasks such as sending money using ACH/money transfer, searching through transactions, and tracking money inflow/outflow. Mercury provides features that fit well with a startup’s digital workflows, such as APIs for bulk/programmatic payments, custom user permissions, and native integrations with payment processors & accounting software.

Mercury uses SynapseFi as the BaaS provider and Evolve Bank and Trust as the charter bank.

Venture debt

Mercury launched its venture-debt product in March 2022. It provides up to 48 months term loans to startups that have already raised $2M+ from institutional investors. Evolve Bank offers the loans, and Mercury monetizes through origination fees and interest (expected to be 4-5%). It also receives a warrant/right to purchase equity in startups' common stock.

Startups can apply for debt through Mercury’s website, submit documents prepared for the earlier VC round and use the funds flexibly for their business goals. Mercury wants to make its venture debt product different by avoiding the spreadsheets & documentation required by banks such as SVB and First Republic.

Ecosystem

Mercury also runs non-monetized community initiatives such as Investor DB and Mercury Raise. Investor DB is a list of seed and pres-seed investors for startups. Mercury Raise is a startup and VC introduction platform.

Mercury needs customers that grow fast and raise a lot of venture capital, allowing it to monetize through deposits/cards. Investor DB and Mercury Raise provide Mercury with direct relationships with high-growth startups that can become future customers. Mercury Raise has worked with 270+ startups and made 1500+ introductions between VCs and Startups.

Business Model

Mercury is a neobank that provides business banking services to startups and tech companies, generating revenue through three primary channels.

First, Mercury earns interest income from customer deposits (currently around $20B), sharing this revenue with their partner banks. This deposit-based model is particularly lucrative with venture-backed startups that maintain large cash balances after fundraising.

Second, Mercury collects interchange fees when customers use Mercury-issued corporate cards for transactions. These fees are paid by merchants each time a card is used.

Third, Mercury offers subscription software priced between $35-$350 monthly for financial workflows like bill payment, expense management, and invoice processing.

Additional revenue streams include fees from processing international transactions, providing access to debt financing, and cash management services.

Mercury's competitive advantage stems from its superior user experience compared to traditional banks like SVB, combined with a product-led growth strategy that minimizes sales costs. The company builds community and generates referrals among the startup ecosystem.

While initially focused purely on banking, Mercury has strategically expanded into workflow software to compete more directly with expense management platforms like Brex and Ramp. This expansion allows Mercury to capture more value from existing customers while maintaining its core position as the modern banking solution for startups.

Competition

Mercury operates in the fintech banking and financial services market for startups and growing businesses, competing across several distinct segments.

Incumbent banks

Mercury's primary competition comes from traditional banks serving startups, most notably Silicon Valley Bank (now part of First Citizens) which historically dominated startup banking with $175B in deposits before its collapse. Mercury has accumulated $20B in deposits, positioning itself as "SVB with good UX" for tech companies.

Other competitors include traditional banks with startup-focused divisions like JP Morgan and Bridge Bank, as well as neobanks like Brex that offer banking services alongside other products.

Fintechs

In this category, Mercury faces direct competition from Ramp and Brex, both valued at over $10B. While Mercury generates revenue primarily from interest on deposits and secondarily from interchange fees, Ramp and Brex have built their business models primarily around interchange revenue from corporate cards.

Ramp has expanded beyond cards into comprehensive finance automation, targeting entire organizations through expense management, procurement, and treasury services. Their recently launched Ramp Treasury offers 2.5% yield on business accounts.

Brex positions itself between Mercury and Ramp as an all-in-one solution for SMBs while also targeting enterprise expense management.

Financial workflow software

Mercury has expanded into subscription software ($35-350/month) for bill pay, expense management, and invoice processing, putting it in competition with specialized providers like Bill.com and broader platforms like Rippling ($13.5B valuation), which offers payroll and HR services alongside financial tools.

TAM Expansion

Mercury has tailwinds from rising interest rates and the post-SVB banking landscape, with opportunities to expand into adjacent markets like comprehensive financial back-office solutions and vertical-specific banking services.

Interest rate environment and deposit growth

Mercury's business model benefits significantly from the current high interest rate environment. With $20 billion in deposits generating substantial interest income, Mercury has reached $500 million in annualized revenue. This revenue stream provides capital for expansion into new markets.

The collapse of Silicon Valley Bank created an unexpected tailwind, driving $2 billion in new deposits to Mercury in just five days. This event accelerated Mercury's growth trajectory and highlighted the demand for modern banking alternatives among startups and tech companies.

Expansion into finance automation

Mercury has already begun expanding beyond pure banking with subscription software ($35-350/month) for workflows like bill pay, expense management, and invoice processing. This positions Mercury to compete more directly with Ramp and Brex in the broader finance automation space.

The company could further expand into treasury management, procurement, and other financial back-office functions. These adjacent markets offer natural extensions of Mercury's core banking services.

Vertical-specific banking opportunities

Mercury's strong position with startups and tech companies provides a foundation to expand into other verticals with similar banking needs. E-commerce businesses, professional services firms, and other SMBs represent significant untapped markets.

By tailoring their banking and financial software solutions to the specific needs of these verticals, Mercury could replicate their success with tech startups across multiple industries. This vertical expansion strategy could dramatically increase their addressable market beyond their current tech-focused customer base.

Risks

Banking partner dependency: Mercury's reliance on partner banks like Choice Financial creates significant regulatory exposure.

The FDIC's concerns about Choice Bank's anti-money laundering practices highlight how Mercury's customers remain vulnerable to their banking partners' compliance issues. As Mercury scales to $20B in deposits, regulatory scrutiny will intensify, potentially forcing disruptive partner changes or limiting growth in certain markets.

Interest rate vulnerability: With Mercury reaching $500M in annualized revenue largely from interest income on deposits, they face acute sensitivity to interest rate fluctuations.

Unlike competitors with interchange-dominant models, Mercury's profitability could deteriorate rapidly in a falling rate environment. Their recent expansion into subscription software ($35-350/month) may not sufficiently diversify revenue streams before the next rate cycle shift.

Competitive squeeze from both directions: Mercury faces increasing pressure from both traditional banks upgrading their technology and fintech competitors expanding into banking.

Funding Rounds

|

|

||||||||||||||||||

|

||||||||||||||||||

|

|

||||||||||||||||||

|

||||||||||||||||||

|

|

||||||||||||||||||

|

||||||||||||||||||

|

|

||||||||||||||||||

|

||||||||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.