Revenue

$1.67B

2024

Growth Rate (y/y)

48%

2025

Funding

$610.00M

2024

Revenue

Click here to access our full Monzo model.

Monzo generated $1.67B in revenue in fiscal year 2025 (ending March 2025), up 48% from $1.1BM last year.

Total customer deposits grew 48% to $22.4B, while their total number of customers grew 25% from 9.7M to 12.2M.

The company's loan portfolio expanded 35% to $2.2B, reflecting strong growth in their lending business.

Monzo achieved a significant milestone in profitability, with pre-tax profits reaching $81.7M in FY2025, compared to $18.8M in the previous year - marking their second consecutive year of profitability.

Valuation

Monzo is valued at $5.9B as of an October 2024 secondary sale, with participation from existing investors GIC (Singapore's sovereign wealth fund) and StepStone Group.

Based on their FY2024 revenue of $1.1B, Monzo traded at a 5.4x revenue multiple.

The company has raised approximately $1.7B in total funding since its founding in 2015. Key strategic investors include GIC (Singapore's sovereign wealth fund), Google's CapitalG and GV divisions, and Tencent. Recent investments have been led by notable firms including Tencent and HongShan Capital.

Business model

Monzo was launched in 2015 to offer a mobile-based consumer-friendly banking experience, compared to traditional banks' branch-based and expensive banking experience. Instead of making money from lending or charging hefty fees, Monzo’s business is anchored on taking a cut out of the financial transactions it processes while giving away core banking products for free.

Its bright-colored debit cards and features like no overdraft fees, quick account opening, instant payment notifications, and Venmo-like P2P money sending, attract younger customers in the age group of 18-34, who form 3/4th of its customer base. Access to customers' financial data enables Monzo to offer new products, which it can push to all 5.8M customers as an app update with no incremental CAC. This has the dual advantage of expanding transaction volume and reducing operating costs.

Product

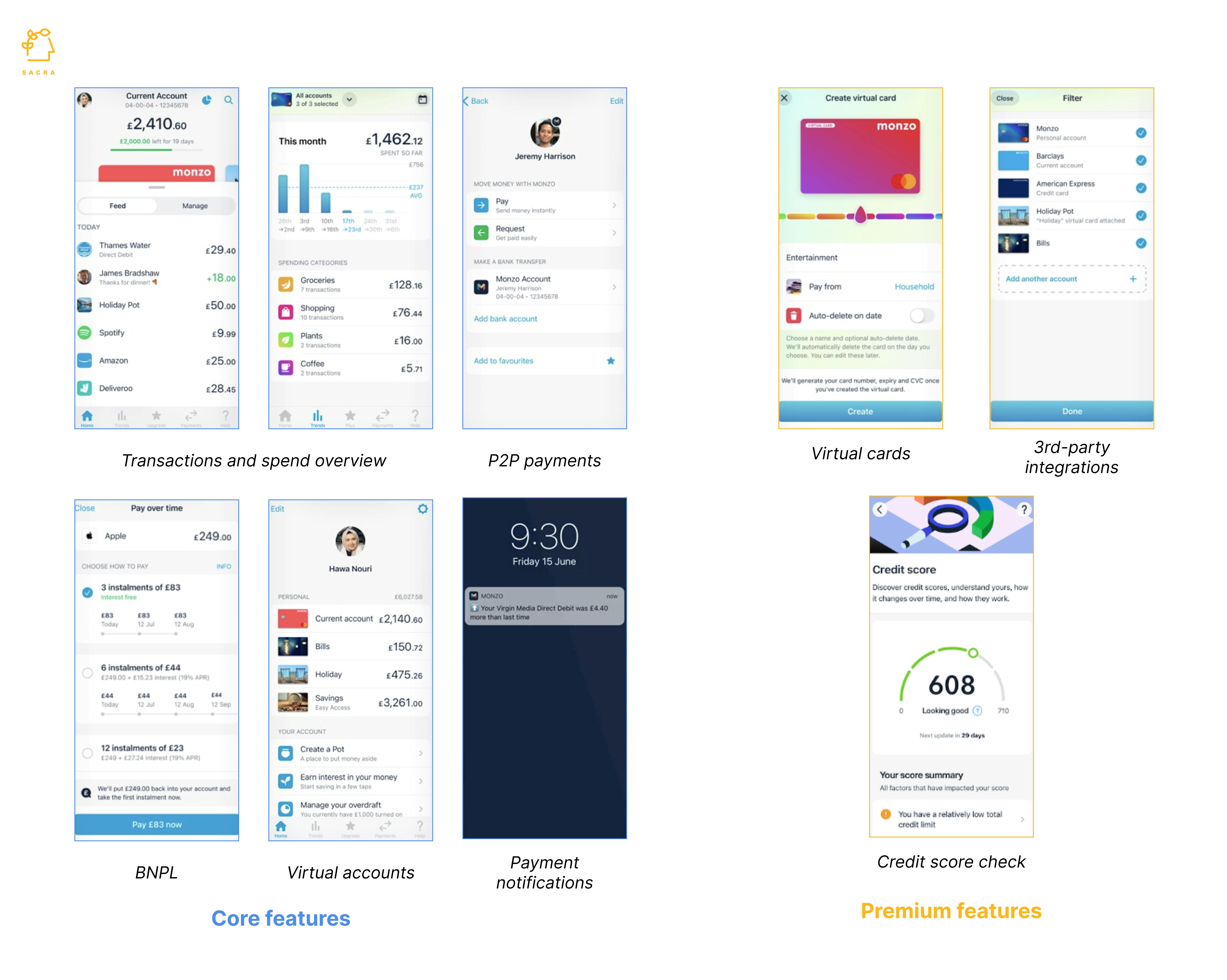

Monzo’s products can be classified into consumer banking, business banking, and personal lending. The features a customer gets depend on their subscription plan.

- Consumer banking: Customers get a checking account and debit card plus features like P2P payments, no overdraft fees, instant notifications, etc. Monzo offers two paid plans at £5 or £15 per month that provide premium cards and features like interest on checking accounts, insurance, virtual cards, and the ability to integrate other cards to Monzo’s app to track expenses.

- Business banking: Business customers get free UK bank transfers and digital receipts, besides basic Monzo features. By paying £5 per month, business customers get the ability to integrate their accounting software to Monzo, virtual cards, multi-user accounts, and invoice management.

- Personal lending: Monzo offers personal loans at 8.9% APR and overdrafts up to £2000. It recently started offering a BNPL product, Monzo Flex, as part of its lending portfolio.

Competition

Monzo is the largest neobank in the UK, with 5.8M customers, compared to 3M of Revolut and ~2M of Starling and Monese each. However, Monzo only has a UK banking license and cannot operate in the EU. With 97% of the UK adults already having a bank account, it means that for Monzo to grow, it has to acquire customers from traditional and neobanks.

Traditional big six banks, including HSBC, Lloyds, and Barclays, have 85% market share. They have taken steps like dropping or curbing overdraft fees and improving the mobile app experience to stem the loss of customers. Neobanks increased their market share to 8% in 2021, primarily consisting of digitally native younger consumers. While Revolut and N26 focus on geographical expansion, Starling focuses on B2B banking and selling BaaS to fintechs, Monzo positions itself as the everyday bank for everyone with an uncomplicated core banking experience.

TAM expansion

Layering more consumer banking products

The UK financial services market is relatively dis-aggregated, with customers using Monzo for banking, eToro for crypto, Freetrade for equities, and Atom for mortgage. The opportunity for Monzo is to aggregate this demand on its platform through its own products or third-party partnerships where Monzo acts as the distributor. Monzo’s customer base is predominantly less than 34, so it can grow with them to offer different products at different lifecycle stages.

Expanding business banking

Monzo has more than 250,000 retail customers who also own small businesses. Thus, Monzo has an opportunity to grow its business banking portfolio by targeting SMBs in two ways. One is to offer more core banking products like SMB lending, business credit cards, and forex management. The other equally significant opportunity is to provide SaaS such as credit cards-based expense management and account payables management, directly or through third-party integrations.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.