Stablecoin diplomacy

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: As B2B neobanks in the U.S. raced to offer FDIC insurance and treasury products in the wake of SVB's collapse, a parallel trend has played out in LatAm, where stablecoins like USDC are growing rapidly as a way for businesses to de-risk against currency volatility. For more, check out our interview with Kapital co-founder and CFO Fernando Sandoval.

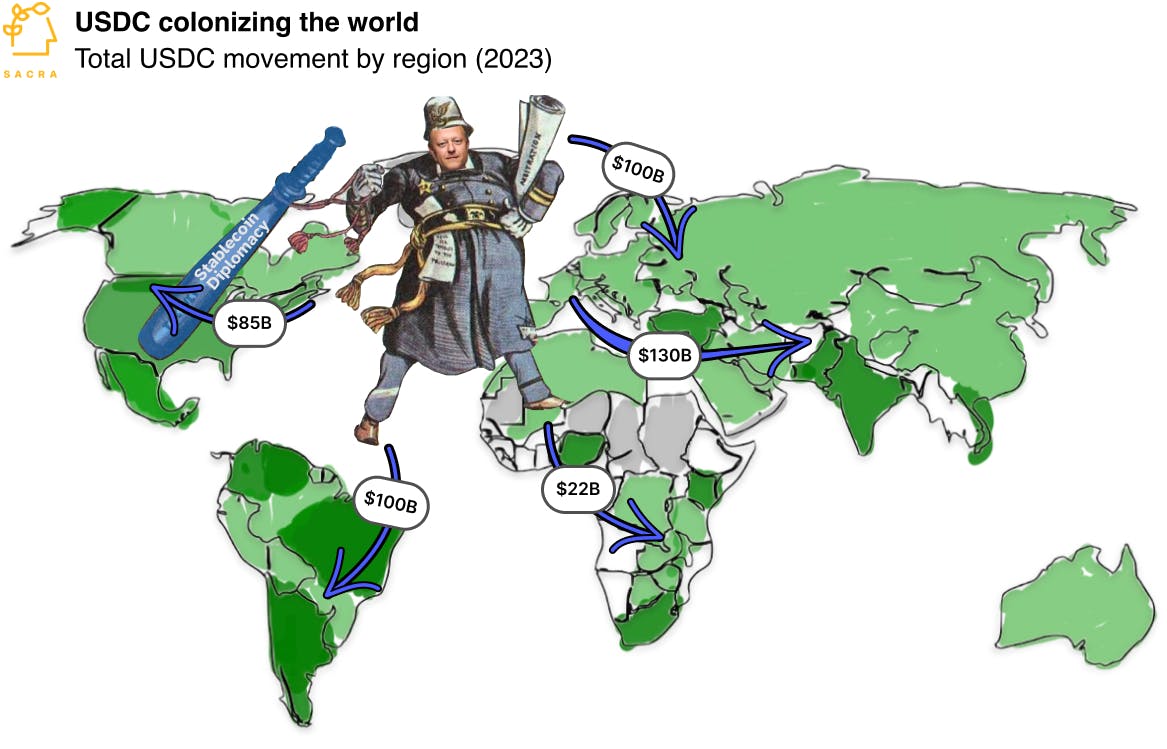

We wrote previously about the rapidly growing transaction volume of USD-denominated stablecoins like Circle's USDC.

Recently, we caught up with Fernando Sandoval, the CFO of Mexican neobank Kapital and co-founder—along with René Saul, Eder Echeverria-Arroyo and Arjun Sethi—to learn more about how USD-denominated stablecoins have become a core treasury management tool for businesses in LatAm and elsewhere outside the bubble of the West.

Here are our key takeaways:

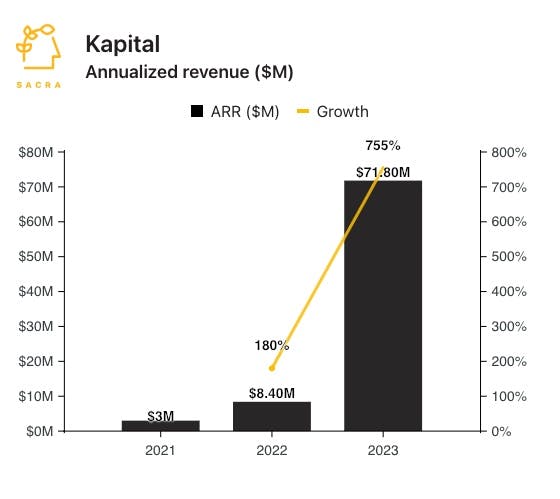

- Kapital ($72M in annualized revenue as of the end of 2023) has seen product-market fit around their stablecoin treasury product that lets companies deposit money and hold it in Circle's USD-denominated stablecoin USDC, with "almost every company" using it to de-risk against the high volatility of local currencies like the Colombian peso. This mirrors the emergent product-market fit in the United States post-Silicon Valley Bank collapse where neobanks like Mercury, Rho and Brex offered increasing cumulative FDIC insurance to attract & calm depositors and startups like Meow, Vesto, and Treasure Financial launched high-yield treasury products to protect depositors' cash in a high interest rate, inflationary environment.

- As payment rails, Kapital uses USDC to settle international transfers for their customers fast (in minutes) and cheaply (~$0.0037 per transaction) vs. paying ~$50 to send a wire and 1-3% on currency exchange fees. Fast and cheap cross-border payments are a key need for businesses in LatAm where the percentage of non-domestic digital commerce can hit 70%+ as in El Salvador (74%), Guatemala (73%), and Bolivia (67%) vs. ~26% for the U.S. and U.K.

- While incumbent banks move money slowly & expensively and monetize on each transaction, Kapital is aiming to be fast & cheap and drive volume through value-added products like Kapital Flex (buy-now-pay-later for B2B procurement) and engagement & retention for its core subscription SaaS platform. Kapital’s revenue mix reflects this counterpositioning, with 40% of revenue coming from SaaS and 60% from interest income on cards, loans, and products like Flex, in which Kapital pays suppliers instantly and gets repaid by customers over time.

- LatAm is now one of the fastest-growing regions in the world for stablecoin usage, with Circle’s USDC the big winner thanks to its transparency around its holdings, which consist of strong assets like US treasury securities ($9.2B), US cash ($1B), and US treasury repurchase agreements ($15B). Currencies throughout LatAm can fluctuate wildly in value, particularly around elections—the Colombia peso was the second-fastest depreciating currency in LatAm in 2022, hitting 5,000 pesos to 1 dollar, then rising in 2023 to 4,000 pesos to 1 dollar (currently the ratio is 3,800:1), making it now the fastest-gaining major currency in the world.

- With $31 trillion in cross-border payments being denominated in U.S. dollars—90% of all cross-border trade in LatAm and 80% in the rest of the world outside Europe—stablecoins pegged to the dollar like USDC are positioned to form the rails of a new global-first payments infrastructure. Look to international neobanks in countries without pervasive banking infrastructure and huge incumbents—like crypto adoption leaders India, Nigeria, and Vietnam—as the places where this kind of innovation will flourish first.

For more, check out this other research from our platform:

- Fernando Sandoval, co-founder of Kapital, on stablecoins for cross-border payments

- Farooq Malik and Charles Naut, co-founders of Rain, on stablecoin-backed credit cards

- Bhanu Kohli, CEO of Layer2 Financial, on stablecoin-backed payments for platforms

- Stablecoins > Visa

- Kapital: the $72M/year Nubank for SMBs

- René Saul and Fernando Sandoval, co-founders at Kapital, on the fintech opportunity in LatAm

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Swastik Nigam, CEO of Winvesta, on building cross-border fintech

- Raghunandan G, CEO of Zolve, on cross-border banking in India

- Ex-Chime employee on Chime's multi-product future

- European neobanks are back

- Wealthfront, Betterment, and the robo-advisor resurrection

- Chime (dataset)

- Kraken (dataset)