Revenue

$4.00B

2024

Valuation

$33.00B

2025

Growth Rate (y/y)

75%

2025

Funding

$1.72B

2025

Revenue

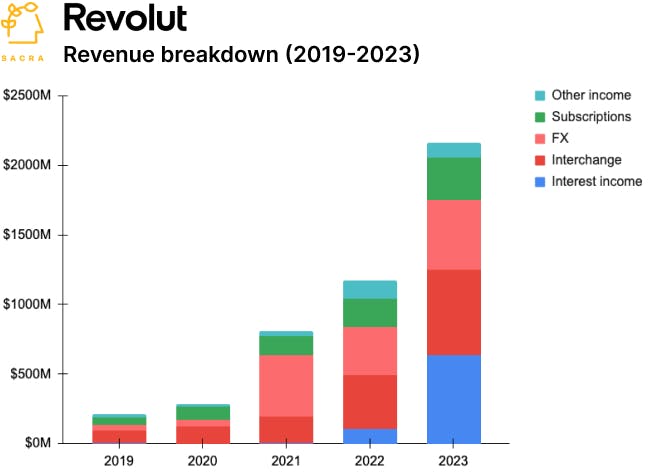

Sacra estimates that Revolut generated $4.0 billion in revenue in 2024, up 75% from $2.2 billion in 2023. The company achieved $1.0 billion in net profit for 2024, more than doubling from $430 million in 2023, while expanding its net profit margin to approximately 25%.

Revenue growth was driven by higher interchange volumes from increased card transactions, growing subscription revenue from its Ultra, Premium, and Metal tiers, and strong trading income from both cryptocurrency and equity trading features. The company's tech-heavy, cloud-based operating model allowed it to keep cost growth well below revenue growth, contributing to the margin expansion.

Valuation

Revolut was valued at $45 billion as of their $500 million employee share sale in August 2024, with Tiger Global Management and Coatue participating.

Based on their last primary valuation of $33B set in their 2021 Series E, Revolut traded at a 40.7x multiple on $810M in revenue.

The company has raised multiple significant rounds, including an $800 million Series E (2021) and $500 million Series D (2020). Notable investors beyond those mentioned include SoftBank Vision Fund, D1 Capital Partners, and Index Ventures.

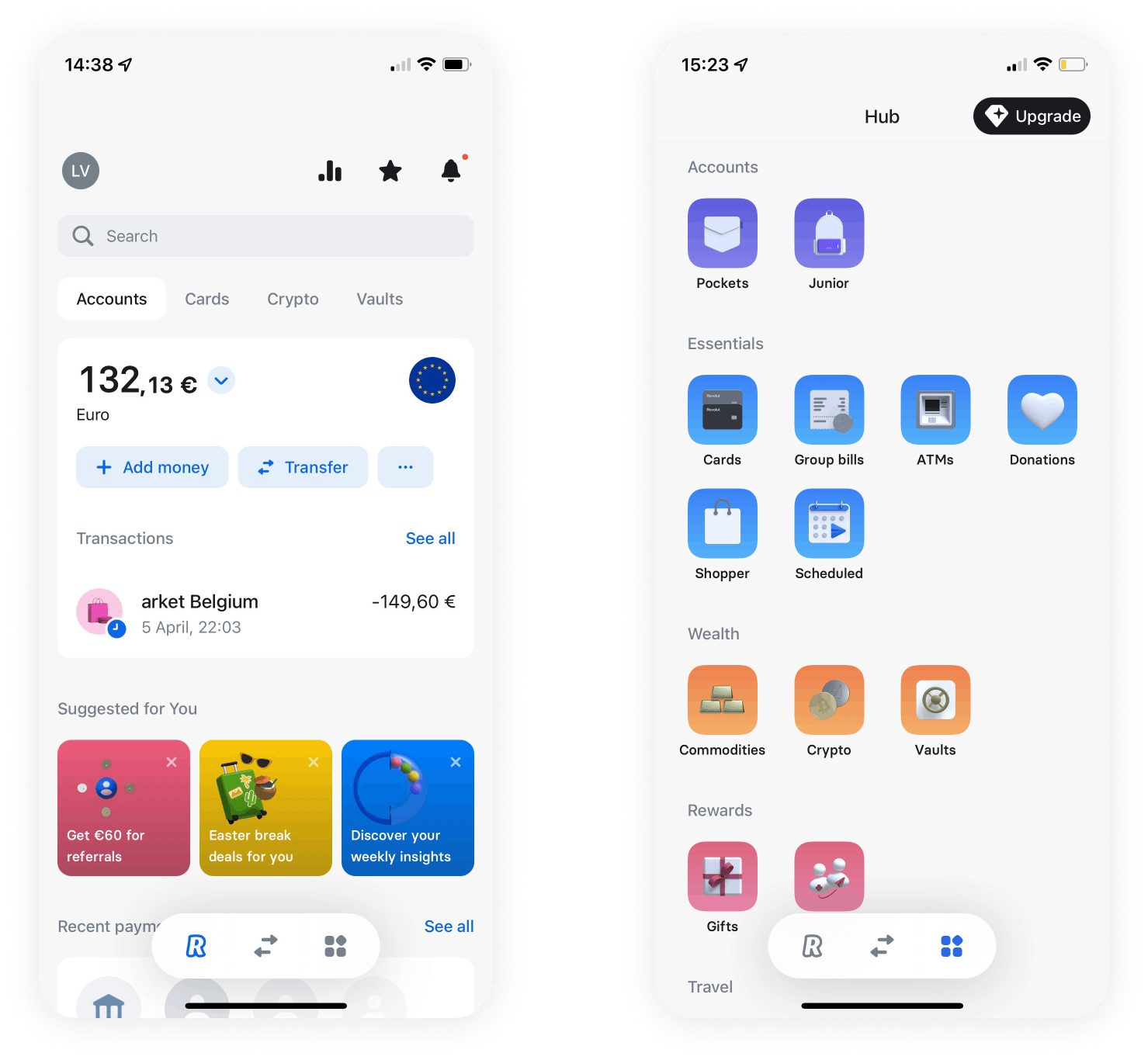

Product

Revolut found its initial product-market fit by offering a prepaid forex card with lower transaction fees than the legacy banks, making it popular with young digitally-native travelers. Over time, Revolut has bolted on more products for this demographic, using it as an engine to finance its larger vision of building a global financial super app with neobanking, investing, and other features.

Revolut has a banking license for the EU (and, as of August 2024, the UK) and offers different products in different countries depending on its banking license and local regulations. Its products can be categorized into retail banking and business banking.

Retail banking has everyday banking products, investments, and travel & forex:

Everyday banking: P2P Payments, debit cards, budgeting, financial planning, junior accounts, subscription management, and bill splitting.

Investments: Crypto, stock and commodities trading, and interest-bearing saving accounts.

Travel & forex: International remittances, currency exchange, and hotel booking.

On the business banking side, Revolut has cards and accounts, payments, treasury, and SaaS.

Cards and accounts: Employee debit cards, virtual cards, multi-currency accounts.

Payments: Send and receive payments in multiple currencies, payment links, and payment gateway.

Treasury: Fx forwards and crypto trading for businesses.

SaaS: Business spend management, digital invoicing, and integration with apps like Xero, QuickBooks, and Sage.

Business Model

Revolut launched in 2015 as a multi-currency card and app focused on offering interbank FX rates and eliminating hidden fees for travelers and expats sending money abroad.

Revolut's no-fee, mobile-first value proposition allowed it to grow rapidly through word-of-mouth and referrals compared to the high customer acquisition costs of incumbent banks.

Revolut's initial hook was helping travelers avoid the 3-5% FX markup and ATM withdrawal fees charged by banks and currency exchanges when spending money abroad. Revolut could make money on the interchange from each transaction while allowing customers to spend internationally at no cost. This made Revolut cards a must-have for frequent travelers and remote workers.

The company then expanded into seamless and instant peer-to-peer payments, especially for transfers between different currencies, as well as allowing customers to receive their salary a day early.

These features attracted expats sending money to family abroad and young consumers dissatisfied with the clunky apps and slow transfers of traditional banks. With this engaged user base, Revolut was then able to layer on other financial products with higher margin such as crypto and stock trading, savings vaults, device insurance, and merchant acquiring for SMBs.

Like other neobanks, Revolut operates a freemium model, with tiered subscription plans for users who want higher limits and premium features. Its Standard plan is free and comes with a UK account and Euro IBAN, a debit card, and free transfers in 30+ currencies.

Its premium plans offer unlimited FX exchange, higher ATM withdrawal limits, as well as perks like travel insurance and airport lounge access for £2.99 to £12.99 per month.

On the business side, companies can sign up for accounts with multi-user access, expense management, and API integration, with plans starting at £25 per month.

Competition

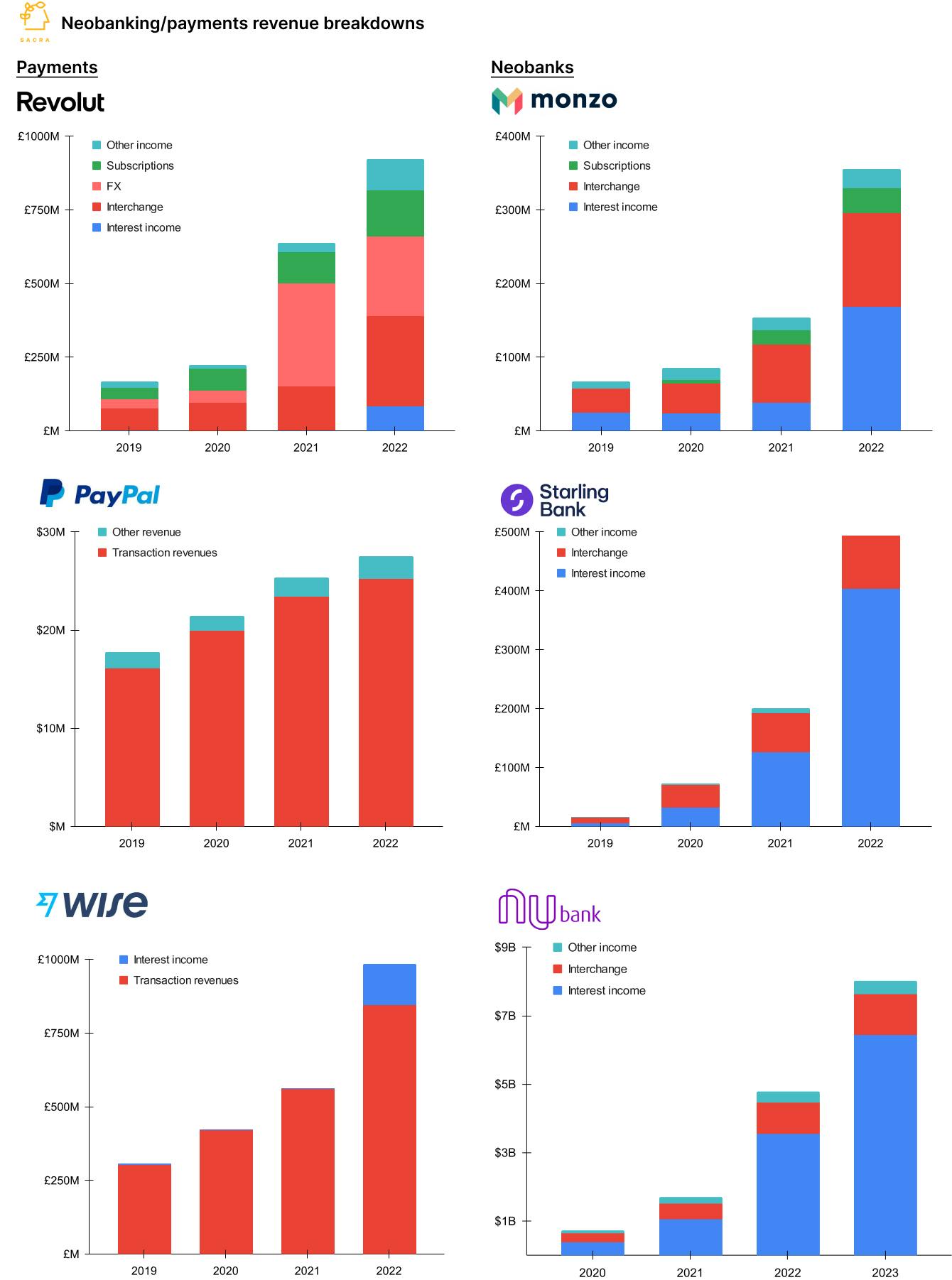

As a compound app with peer-to-peer payments, foreign exchange, and traditional checking accounts, Revolut competes with different categories of products and does so across different geographies.

Foreign exchange

A core use case and revenue driver for Revolut is sending money abroad and accessing money while traveling internationally. Revolut takes a percentage of the currency conversion.

This pits Revolut against Wise, a global leader in cross-border payments. Like Revolut, Wise monetizes largely on foreign exchange fees.

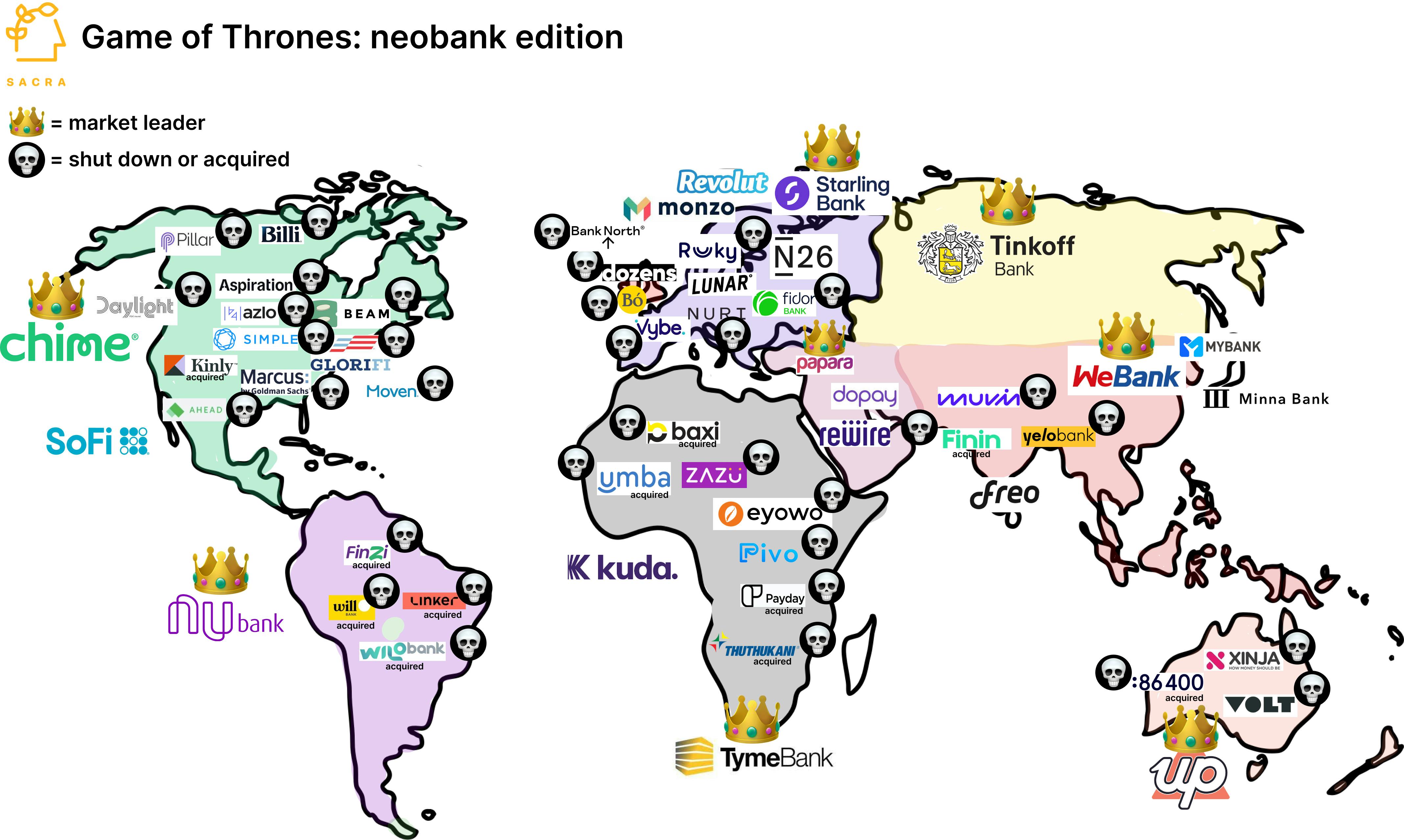

Revolut has banking services available in 30+ markets largely thanks to their EU-wide banking license, but is not the top neobank in terms of deposits in most countries. Many users pair a Revolut account for international transfers with an account at their country's top local neobank.

UK banking

Since it took until 2024 for Revolut to get a UK banking license, Monzo and Starling have established themselves as the leading UK neobanks for checking/current accounts. Monzo has 7.4M accounts and Starling has 3.6M as of their latest filings.

Monzo was the first big challenger bank in the UK and rapidly acquired customers when it obtained its banking license in 2017. It is generally more trusted than Revolut for core banking.

Starling skews higher income than Monzo, with £2944 average deposits per account vs £811 for Monzo. Both are growing accounts at ~28% annually.

EU banking

Outside the UK, Revolut is making the biggest push to become a primary checking account in European countries that lack a dominant local neobank.

This includes markets like Romania, France, Poland, Spain and Ireland based on app download data. Revolut has an EU-wide banking license to help with this expansion.

However, N26 is the biggest neobank in Germany and other Euro neobanks like Bunq in the Netherlands have strong holds on their home markets. This geographic specificity makes pan-European expansion challenging.

Latin America

Revolut announced in April 2024 that it had received Mexican banking authorization, allowing it to offer a wider range of financial products and services in Mexico.

As Revolut looks to expand beyond Europe, Latin America is a key growth region. It benefits from more linguistic and regulatory cohesion compared to Europe.

However, Nubank is the dominant player, with 87.7M of its 93.9M global customers in its core market of Brazil. It has also successfully expanded to Mexico and Colombia.

With $8B in revenue across LatAm, Nubank has established itself as the bank to beat for any neobanks entering the region. But the market remains large and underserved.

TAM Expansion

Revolut’s main TAM expansion strategy to date has been to continue to expand to more geographies and cover more financial transactions for its customers.

Geographic expansion

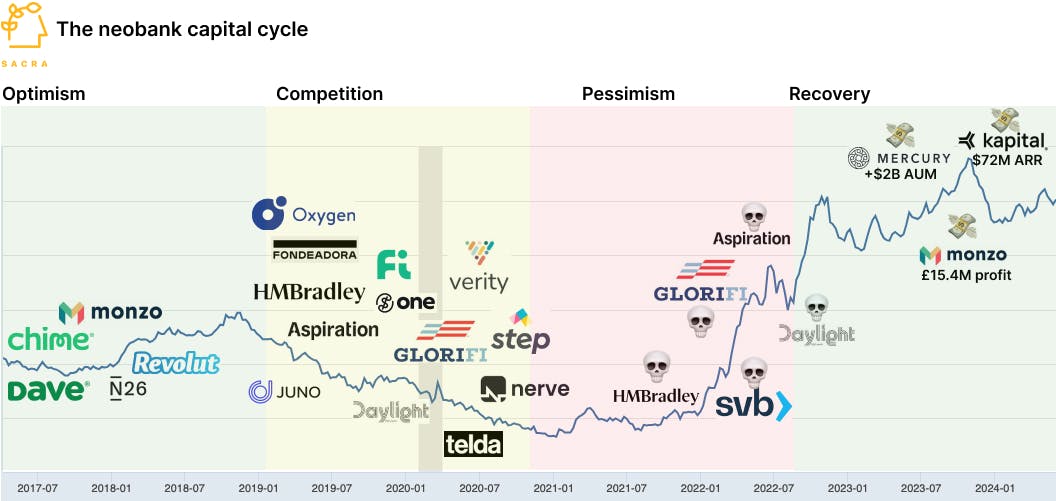

With 40M+ customers across the world with support for 140+ regions and banking services available in more than 30 countries, Revolut has already proven its ability to scale internationally. Expect this to accelerate in the years to come—particularly with the wave of neobank shutdowns that we've seen in the last few years.

Latin America is the clearest opportunity given the factors mentioned above: it has a large population, growing middle class, and it is a more cohesive market in terms of regulations and population than Europe. Revolut will here look to take share from Nubank.

The company also still has runway to eat up checking account share across Europe as it obtains more country-specific banking licenses. Southern and Eastern Europe seem particularly ripe here, as they lack strong in-country players like Bunq in the Netherlands and N26 in Germany.

Finally, Revolut will likely look to follow Monzo in making a bigger push to the US and Canadian markets—North American expansion is difficult, with heavily entrenched legacy financial institutions as well as high-growth upstarts like Chime, Dave and SoFi, but represents a huge TAM.

Full-service banking

To date, Revolut has largely been a payments product monetizing on interchange and FX fees. But it is increasingly looking to rebundle more banking services.

Expect Revolut to follow in the footsteps of Monzo, Starling, and Nubank by dramatically scaling up its deposit base and rolling out more lending products.

Lending in particular has huge revenue potential. At Monzo, growing the loan book took their lending revenue from £38M in 2021 to £168M in 2022. Nubank made $1.6B from lending in 2023.

Mortgages, personal loans, and BNPL products could expand Revolut's ARPU as it captures primary checking accounts. Higher interest rates make deposits attractive as well.

Crypto and stock trading, already popular within the Revolut app, could also be expanded and further monetized, similar to Cash App's approach.

Stablecoins

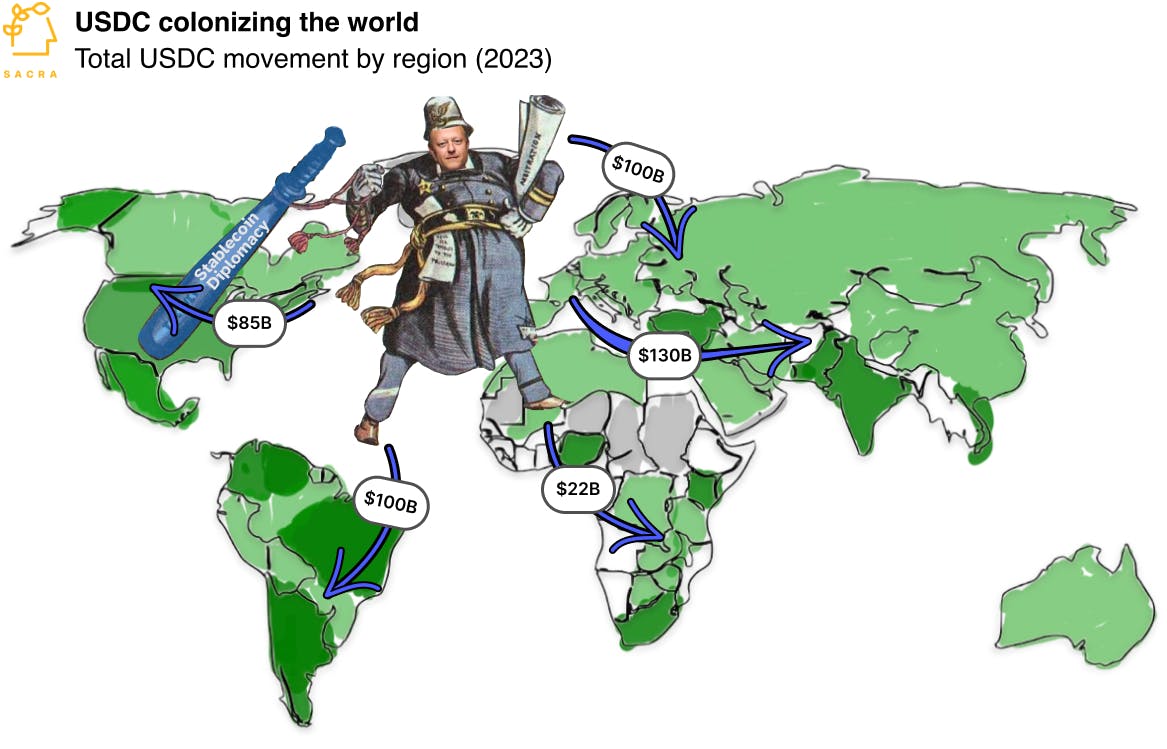

Revolut has a significant opportunity to accelerate its business and expand its TAM by leveraging stablecoins, especially in regions like Latin America and South/East Asia.

Stablecoins, particularly USD-denominated ones like USDC, are seeing rapid adoption for cross-border transactions due to their speed, low cost, and ability to provide stability in the face of local currency volatility.

For Revolut, integrating stablecoins could dramatically lower the cost and speed up the settlement of cross-border payments for its users.

Compared to traditional wire transfers that can cost ~$50 and take days to clear, stablecoin transactions settle in minutes for a fraction of a cent.

Similarly, in South and East Asia, countries like India, Vietnam, and the Philippines are leading the world in crypto adoption, driven by a combination of a large remittance market, unstable local currencies, and a relatively underdeveloped banking system.

The key tradeoff for Revolut would be the potential loss of revenue from FX fees, which currently make up a significant portion of its interchange income. However, the massive potential for wallet share expansion and user acquisition in these markets may more than offset those losses.

By becoming the default neo-bank and payment provider for a rising global middle class transacting in digital dollars, Revolut would have a path to dominating the financial lives of the next billion users coming online.

Risks

US expansion

The US is a critical market for for Revolut's future growth. Revolut has 300,000+ users to whom it offers banking products through Metropolitan Commercial bank and Sutton Bank. However, the US has numerous incumbent neobanks such as Chime, Dave, and Varo, and the regulatory landscape is very different from the UK or EU.

Revolut’s first US CEO quit in 2021, and its competitor N26 already exited the US due to slow growth and high cash burn. In this context, it is challenging to foresee Revolut gaining a significant market share in the US.

Interest rates

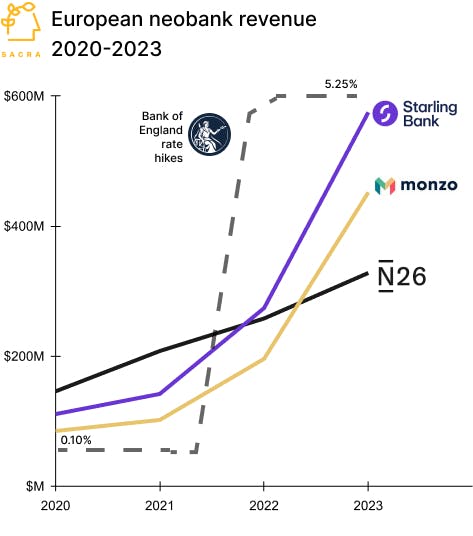

The significant increase in interest rates from nearly 0% in 2021 to over 5% by 2023 was a major tailwind for neobanks during this period. As interest rates rose, neobanks like Revolut were able to generate substantially higher net interest margins on their customer deposits.

This interest income became a key driver of revenue growth and helped many neobanks like Monzo and Revolut achieve profitability for the first time. The higher rates also made deposit funding more attractive compared to relying solely on interchange fees from card transactions.

However, this also highlights the interest rate risk that neobanks are exposed to. Much of their recent success and rapid growth has been fueled by the rising rate environment.

If interest rates were to fall back toward zero, it would put significant pressure on their business models. Lower rates would compress net interest margins and reduce the revenue neobanks can generate from their deposit base. This could stall their progress toward profitability and force them to seek other sources of revenue such as fees, which may alienate their customer base.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.