Revenue

$78.00M

2024

Valuation

$746.00M

2025

Growth Rate (y/y)

35%

2025

Funding

$88.60M

2025

Revenue

Sacra estimates that Customer.io hit $78M in annual recurring revenue (ARR) at the end of 2024, up 35% year-over-year.

Customer.io has historically been highly capital efficient, getting to $30M ARR in 2021 on less than $4M raised.

The durability and efficiency of Customer.io’s growth comes from its strong net dollar retention (NDR)—111% in Q2 2023—on par with Klaviyo (NYSE: KVYO) at 110% and Braze at 114% (NASDAQ: BRZE).

Since 2021, NDR has declined across these tools from ~130% to ~110% as budget constraints pushed customers to clean up inactive user profiles—a key pricing value metric—and downgrade pricing tiers to right size their plans.

Valuation

When we first covered Customer.io in May 2021, the company had crossed $20M ARR, growing 70% year-over-year, on less than $4M raised. In August, Customer.io raised $5M from their community, customers, and supporters in a Regulation-CF (Crowdfunding) round on Republic.

In March of the following year, Customer.io raised its Series A backed by Spectrum Equity.

Business Model

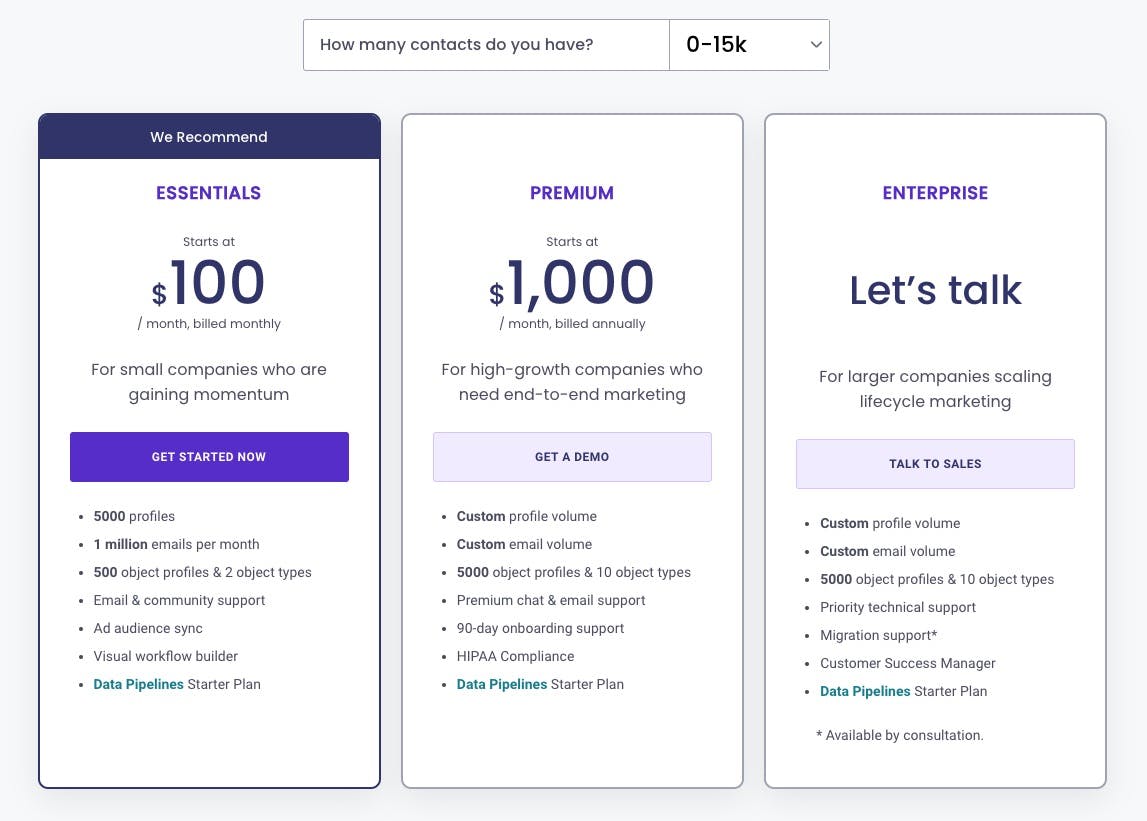

Customer.io is a subscription SaaS company that prices based on the number of contacts a business has as well as how many emails they send per month. This usage-based pricing model allows Customer.io to scale its revenue with the growth of its customers, ensuring that as its customers grow and require more from the platform, they contribute more to Customer.io's revenue.

Customer.io's business primarily targets startups and small-to-medium businesses (SMBs), which constitute around 80% of its customer base. Its product strategy focuses on serving these customers and allows the product to gradually move upmarket as its customer base grows and the platform matures.

Customer.io offers two basic pricing plans: Essentials at $100/month and Premium at $1,000/month. While most features are available in the Essentials package, the Premium plan provides additional services like HIPAA compliant emails, quarterly check-ins with a dedicated manager, SLAs, annual contracts, and access to professional services.

The 2018 launch of the Premium plan marked a significant step for Customer.io towards monetizing larger, enterprise customers. Today, the Premium plan represents 62% of all of Customer.io's monthly recurring revenue (MRR).

Product

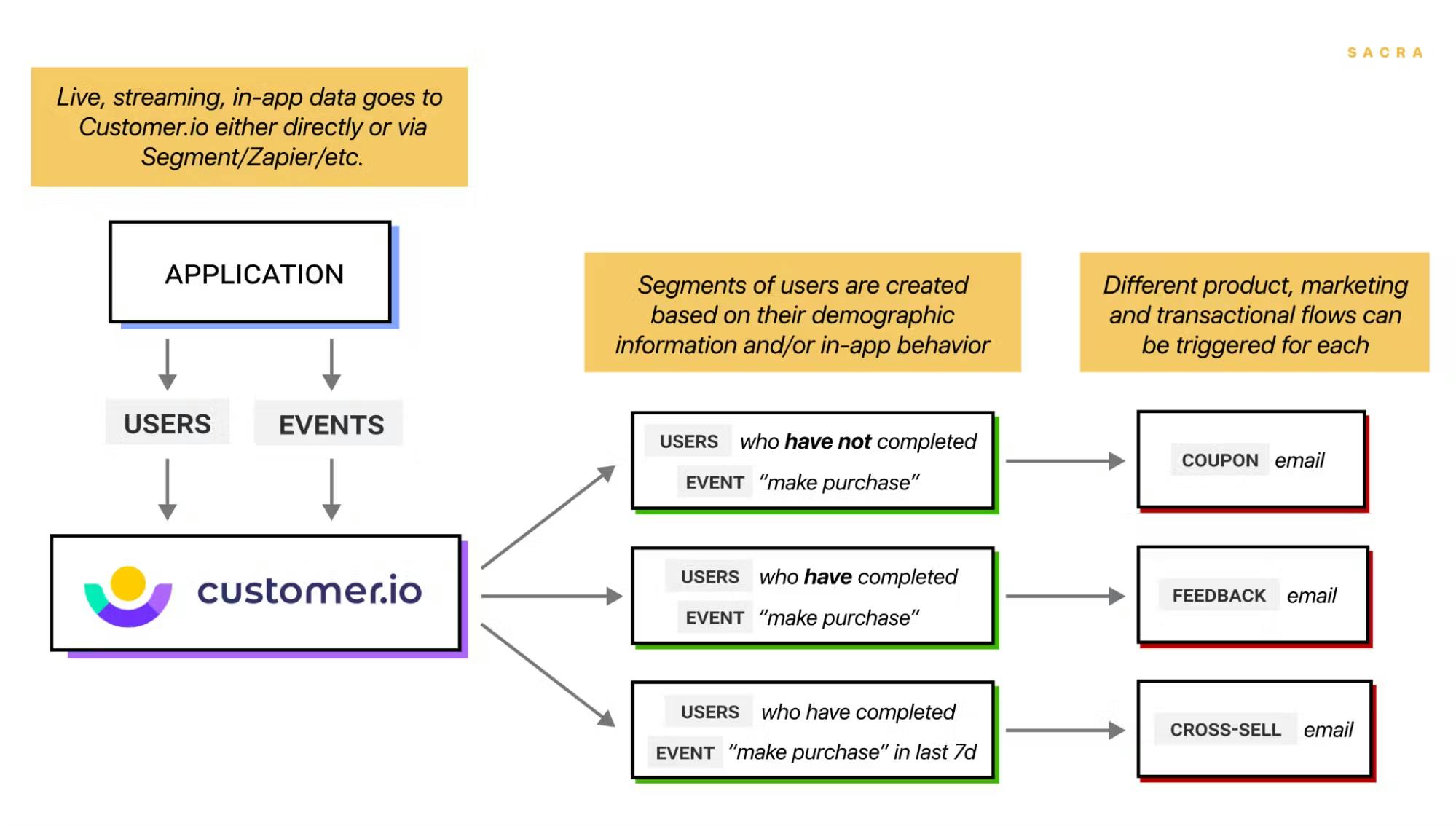

Customer.io is a marketing automation platform that offers personalized customer messaging based on user behavior and in-app activities.

Data is gathered directly from apps or through third-party platforms, enabling targeted email campaigns, SMS, and push notifications.

Customer.io allows teams to send transactional and marketing email campaigns, SMS, and push notifications based on user demographics—like geographical region or primary device—as well as in-app events, like visiting a product page and adding an item to their cart without checking out.

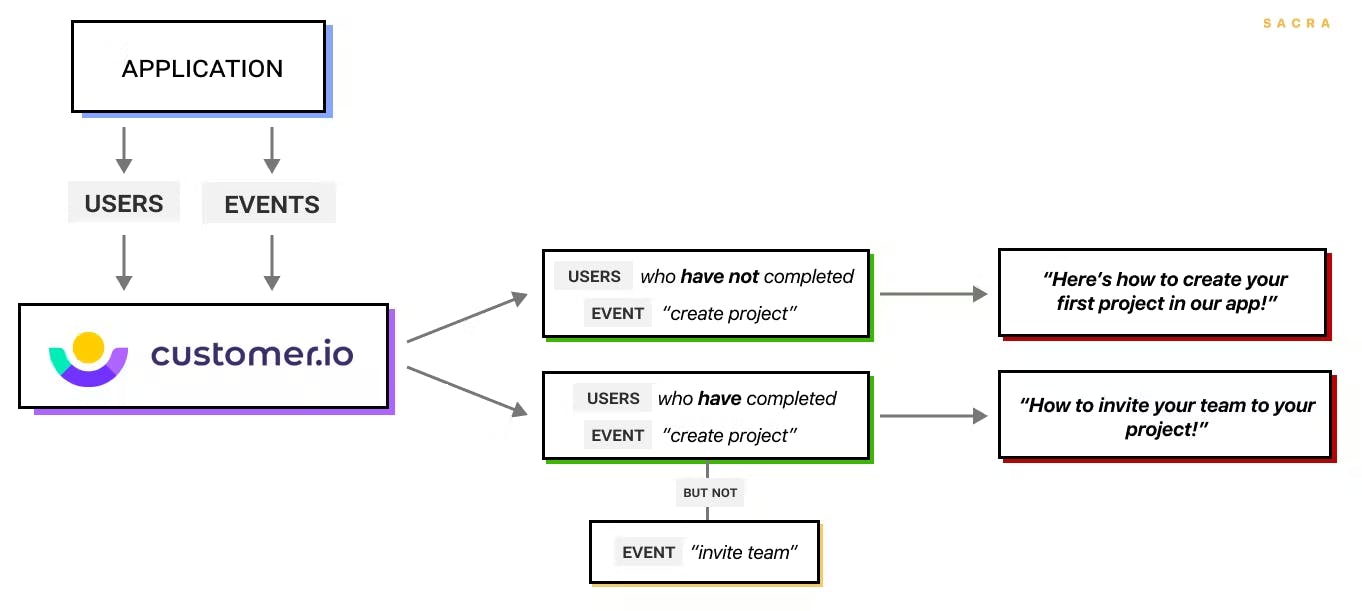

To use it, a real-time feed data is set up to feed into Customer.io. This can include of attribute, event, page view, and device data, among others, and this can be done via Customer.io’s API or via a third-party service like Segment or Hull.

Customer.io then builds a profile of each user of your product, which teams can use to see and edit their key information—name, email, location, subscription status—as well as see their recent activity and recent correspondence.

Segments can be built off conditional logic and used to send branching messages to two different groups.

Using those profiles, teams can build segments, or groups of users based on some behavior in their app. Segments can be defined by when someone last logged in, or how often they use a particular feature, or whether they added a product to their wish list but haven’t looked at in a certain period of time.

Competition

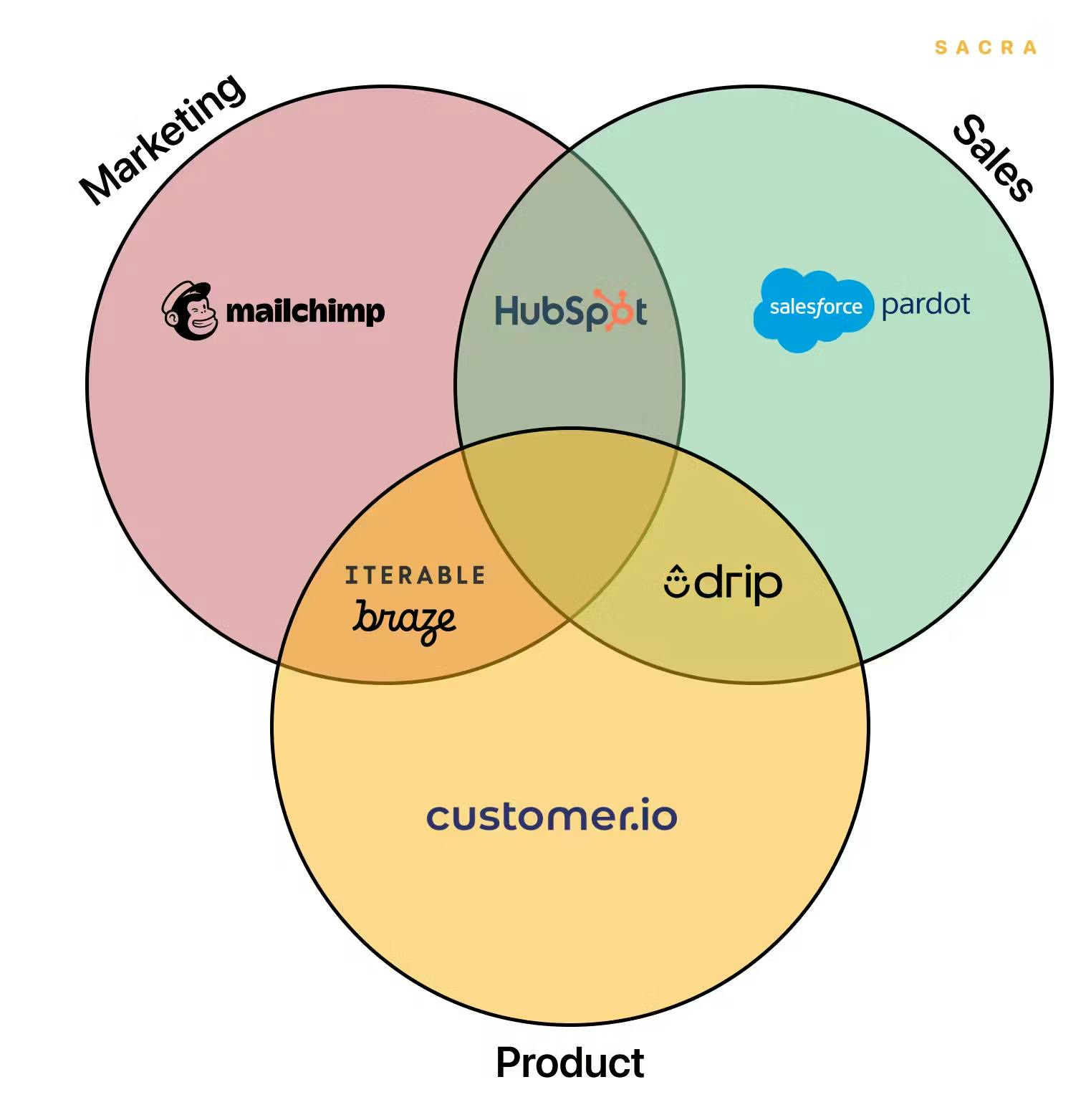

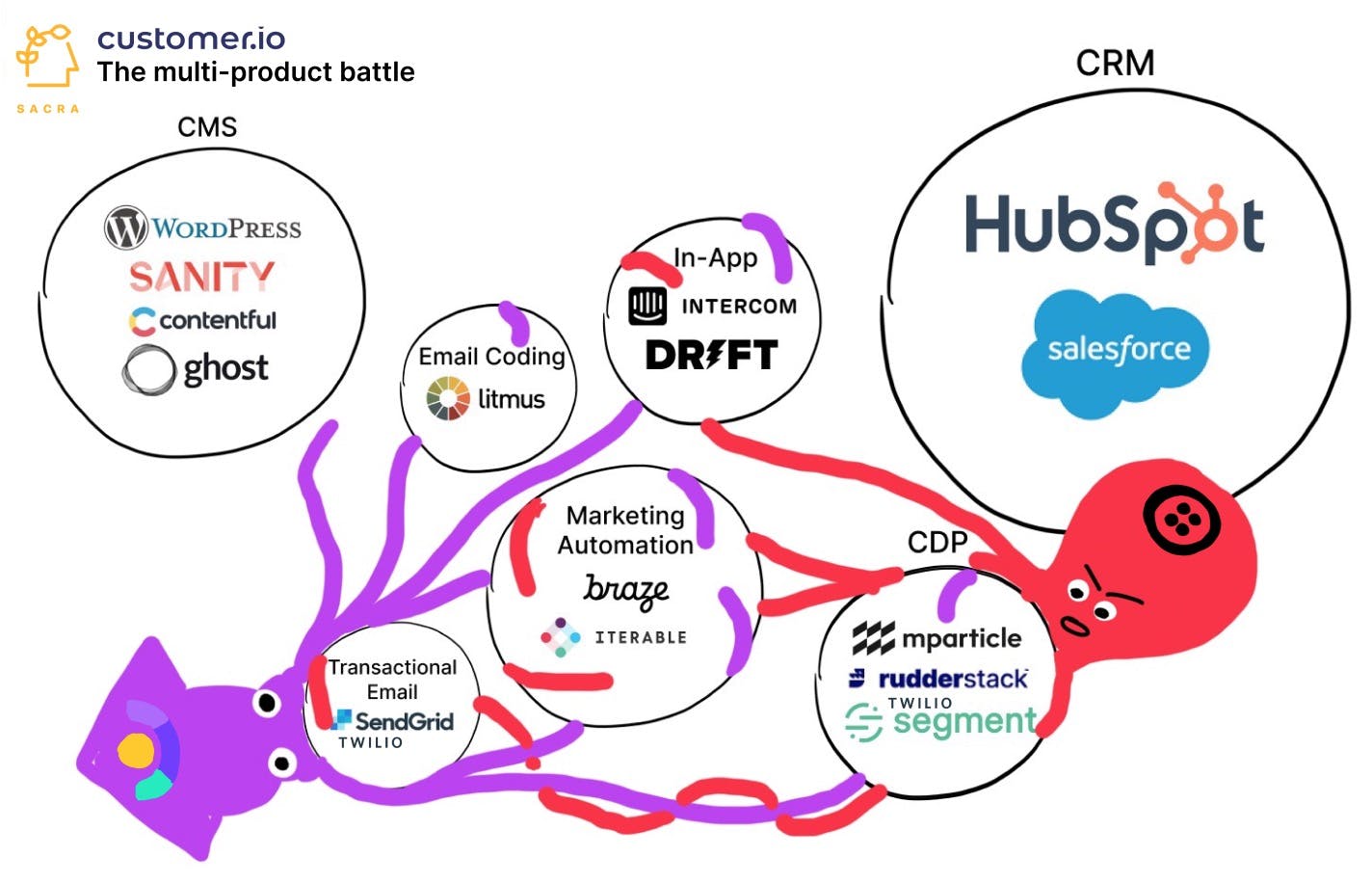

The email industry is large and fragmented, with enterprise-focused suites (HubSpot, Salesforce) and SMB-centric marketing tools (MailChimp, ActiveCampaign, Constant Contact) offering messaging products roughly comparable to those of B2C and mobile-focused players (Braze, Iterable) and technical, product-driven companies (Customer.io).

One of the reasons it’s unlikely that we’ll see a single winner in this space is that different products tend to make sense for different kinds of companies. There are messaging products designed primarily for B2B and B2C companies, for SMBs and startups and enterprises. The most resilient distinction, however, will be between companies with different organizational cultures around growth:

Organizations with a marketing center of gravity: With many non-technical team members involved in key inbound campaign workflows, tools like ActiveCampaign or MailChimp will be the best fit

Organizations with a sales center of gravity: With many non-technical team members involved in prospect nurturing and conversion, a tool built around a CRM like HubSpot or Salesforce will be the best fit

Organizations with a product center of gravity: With many technical team members involved in the user/customer lifecycle, a more extensible, flexible tool like Customer.io or Iterable will be the best fit

Over time, marketing stacks become more complex, with different companies striking different balances between marketing, sales, and product focused tools.

The messaging platforms, in order to expand their TAM and keep their customers around as they mature, have to transition as well. HubSpot did it by building out a CRM on top of their suite of inbound marketing tools, and Salesforce did the same in acquiring marketing automation tool Pardot.

Today, Customer.io has carved out a niche with engineering-centric companies or companies that have engineering resources to dedicate to marketing.

The risk is that as companies grow and their teams grow to include more and more non-technical members, they will have to look for alternatives as those new team members find Customer.io challenging to use or can’t have ownership over their own projects.

TAM Expansion

While other companies have contracted over the recession-like conditions in 2022-3, Customer.io’s strong balance sheet has enabled it to make strategic acquisitions of companies like Gist (in-app messaging) and Parcel (email coding)—products with strong brands run by small teams that solve specific problems around email—to round out their product and add talent to the company.

These acquisitions bring Customer.io closer to parity with tools like Braze and Litmus, helping their ability to retain email marketers and developers

Today, Customer.io is putting itself in competition with a wider array of companies, including Twilio and Litmus, as it moves towards becoming a multi-product, platform company.

But rather than build an all-in-one platform for everything from email to CRM to CMS, Customer.io is looking to eat up adjacent use cases in a capital-efficient way by building the most interoperable platform for customer data, attracting other SaaS companies to build on top of their foundation.

Using Data Pipelines, a SaaS company can use Customer.io as their customer data platform while using any other tool—Braze, Iterable, etc.—to send messages to their customers.

Customer.io's goal is to challenge Twilio across transactional email ($3B market), marketing automation ($10B), CDP ($5B) and in-app messaging ($5B) from the vantage point of building rich orchestration layers vs. Twilio’s approach built on API middleware.

Risks

Customer growth and retention: Today, Customer.io is more suited for technically-inclined teams and companies. As a client company grows and onboards more non-technical members, it might be compelled to look for more user-friendly alternatives, impacting Customer.io's retention rates.

Data portability: The use of third-party data integration tools like Segment or Hull makes data more portable, reducing the barriers to switching to another service. This could increase the churn rate if customers find an alternative that better meets their needs.

Funding Rounds

|

|

||||||||||||

|

||||||||||||

|

|

||||||||||||

|

||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.