Beehiiv vs. ConvertKit vs. Substack vs. Mailchimp

Jan-Erik Asplund

Jan-Erik Asplund

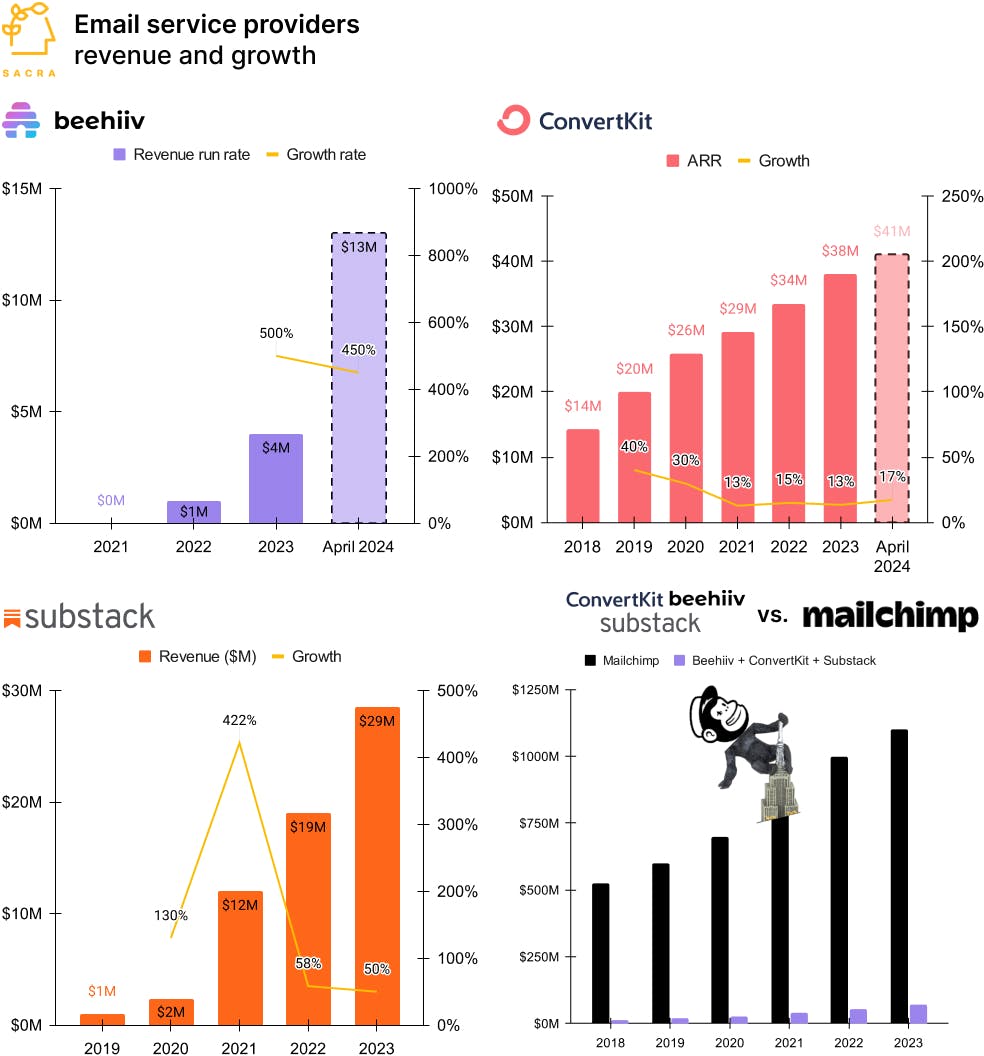

TL;DR: Sacra estimates Beehiiv’s annualized revenue at $13M, up 450% year-over-year. In the creator economy, what was once a battle of the business models between SaaS subscriptions and GMV take rates is now entering its next chapter—the hybridization of the newsletter business across SaaS and ads. For more, check out our reports on Beehiiv (dataset), ConvertKit (dataset), and Substack (dataset).

Key points from our research:

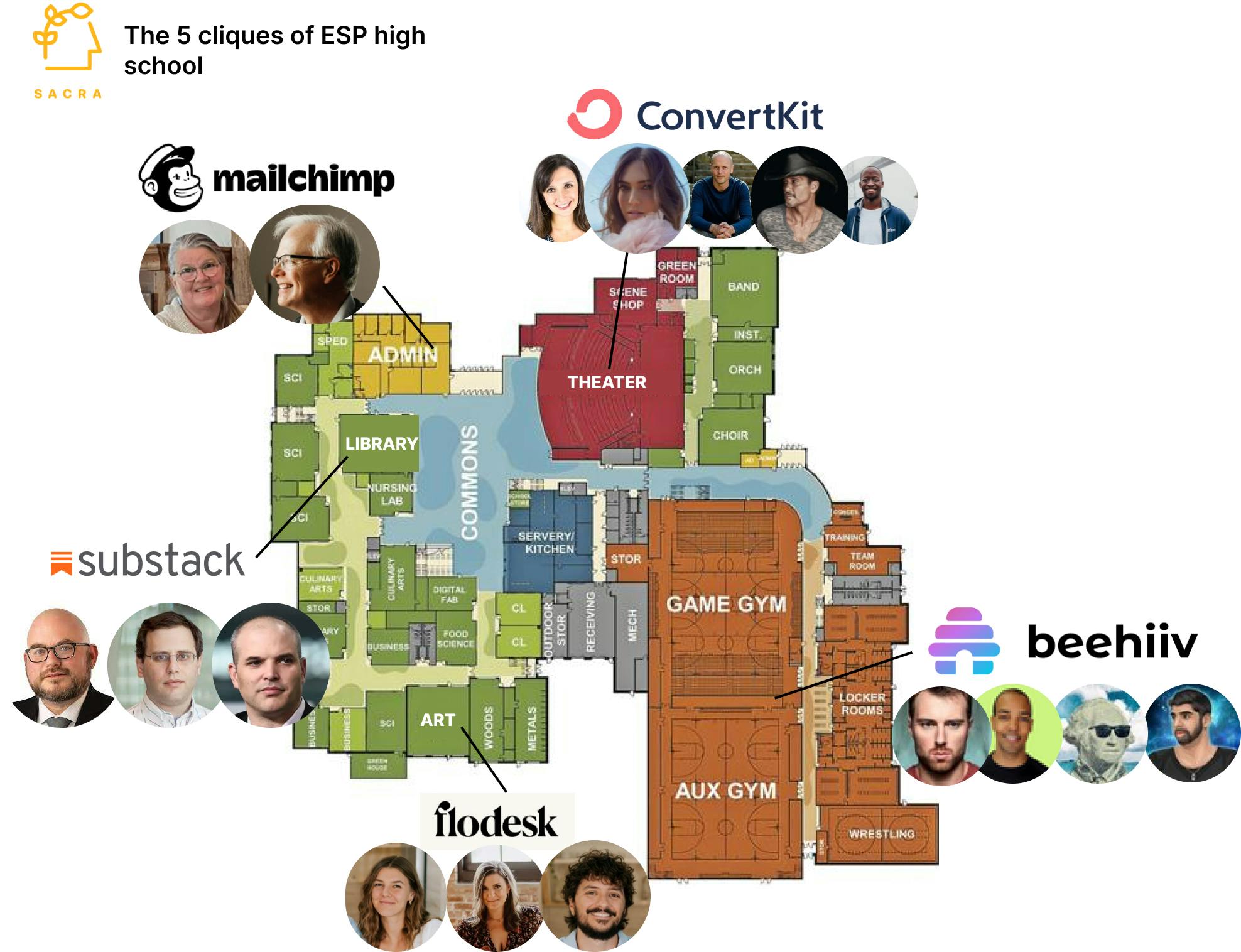

- Launched by ex-Morning Brewers (acquired by Business Insider for $75M) in November 2021, Beehiiv built for the emerging trend of business gurus launching newsletter brands like Shaan Puri’s Milk Road (sold for $10M after 12 months with 250K subs) and LeQwane Lynch’s The Alerts Daily (sold to Overtime with 35K subs). Beehiiv designed their email platform as a hybrid of Substack’s brand-centric approach and ConvertKit’s upfront subscription SaaS business model that undercut Substack’s 10% take rate.

- Sacra estimates that Beehiiv is at $13M in annualized revenue as of April, up 450% year-over-year (for a 17x multiple on their $224M valuation per their current Wefunder round) with 70% of revenue coming from subscription SaaS and 30% coming from ads via Ad Network, which they launched in Q3’23. Compare to ConvertKit at $41M in annual recurring revenue (ARR) as of April, up 17% year-over-year, valued at $200M as of their 2021 secondary sale (a 5x multiple on today’s estimated revenue), and Substack at $29M revenue for 2023, up 50% from $19M in 2022, valued at $650M as of their March 2023 Wefunder round (a 22x multiple on today’s estimated revenue).

- Beehiiv’s current growth momentum puts them on a potential trajectory to pass Substack and ConvertKit in revenue in 2026, pushing both Substack and ConvertKit to innovate by hybridizing their business models across subscription SaaS and ads and deepening their creator & sponsor networks. Substack has compromised on its anti-ads position by piloting ads within creator publications while ConvertKit has driven >100% net dollar retention via the cross-side network effects that come from its ad and recommendation networks.

For more, check out this other research from our platform:

- Nathan Barry, CEO and founder of ConvertKit, on ConvertKit’s path to $100M in revenue

- Beehiiv (dataset)

- ConvertKit (dataset)

- Substack (dataset)

- Stan (dataset)

- OnlyFans (dataset)

- Justin Gage, founder of Technically, on how Substack earns its 10% take rate

- Neal Jean, CEO of Beacons, on building vertical SaaS for creators

- How Shaan Puri's podcast landed him a $4M rolling fund

- ConvertKit vs. Beehiiv vs. Substack

- ConvertKit at $38M ARR

- Substack: the $19M/year content LVMH

- Stan: the $14.7M/year store-in-bio

- Linktree: the $33M ARR About.me for Gen Z

- Passes: the $9.5M/year softcore OnlyFans growing 1166% year-over-year