Revenue

$28.50M

2023

Valuation

$650.00M

2023

Growth Rate (y/y)

50%

2023

Funding

$82.00M

2023

Valuation

In March 2023, Substack launched an equity crowdfunding campaign on WeFunder to raise $5M at a $585M pre-money valuation and 30x multiple on $20M in TTM revenue, a flat round from their 2021 Series B led by Andreessen Horowitz where they raised $65M at a 102x multiple.

Compare that to the New York Times which is valued at $6.41B—about 2.8x on revenue of $2.31B, or The Athletic, which was acquired for $550M after doing $65M revenue in 2021 for an 8.5x multiple.

Product

Substack is a newsletter platform that enables writers to publish their content, grow their audience, and directly receive subscription revenue from their readers.

Substack provides an easy-to-use interface for writing, editing, and distributing content. It also allows writers to access analytics about their newsletter’s performance, export and import lists of subscribers, and create multiple paid and free tiers.

Key features of the platform include:

Recommendations: Substack's recommendation feature suggests other newsletters to readers based on their interests and the publications they're already subscribed to. This feature helps users discover new writers and content on the platform.

Chat: Substack Chat is a feature that allows writers to have asynchronous group chats with their subscribers. This feature can be useful for discussion-oriented newsletters, especially those focused on politics. Subscribers can chat with each other and with the writer, and it can help build community among subscribers.

Business Model

Substack flipped the business models of predecessor blogging platforms with inbuilt email distribution like Svbtle and Posterous/Posthaven, charging readers instead of charging readers and collecting a 10% take rate on all the money spent on the platform.

Substack is now trying to go from a newsletter platform to a creator network, launching recommendations, the Substack Reader app, and “Explore” to lower CAC for writers and make it less likely that they will move off-platform for a lower take rate.

Additional resources for writers they’ve added like legal support—responses to C&D letters, pre-publication legal review of individual stories—health insurance, and grants are a further attempt to keep writers on platform.

Features like Chat and guest posting help writers get off the treadmill of writing and better monetize their brand through high-margin activities in the same way that Disney can sell toys and license their IP to grow ARPU and monetize their market to the biggest extent possible.

Writing a 1x per week or more newsletter is a big source of burnout for solo creators—by giving them other ways to make money by leveraging their brand, Substack can grow their own GMV while better retaining writers.

Substack’s ultimate aim is to, after unbundling the New York Times by giving the journalists with big audiences a chance to directly monetize their work, rebundle it by becoming a provider of high-quality content across many different niches.

Competition

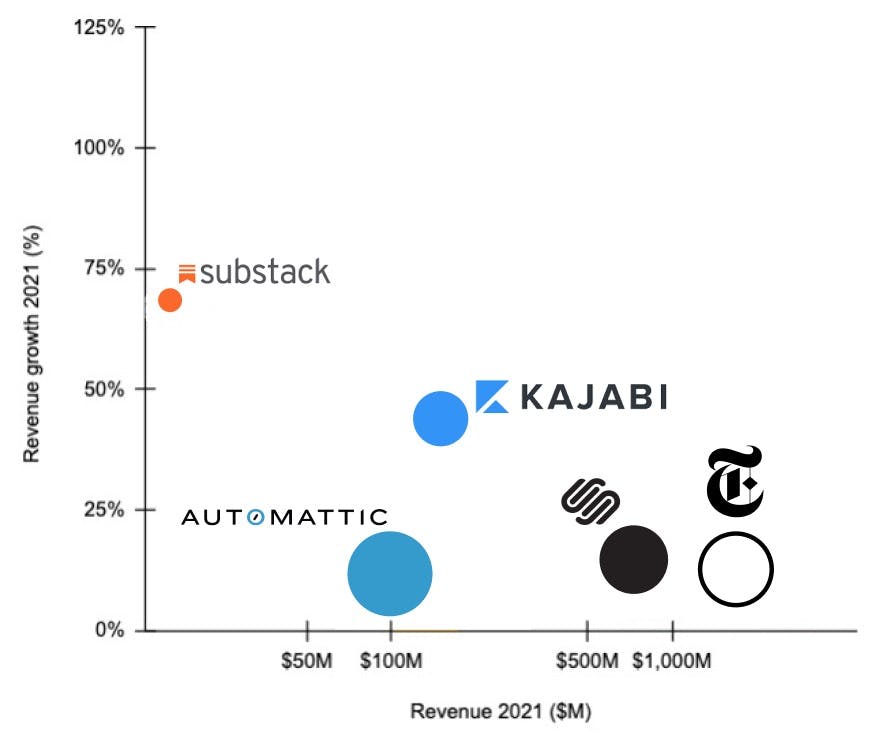

Substack competes with roll-your-own options like Ghost and Wordpress, alternative email newsletter tools like Beehiiv and ConvertKit, and creator platforms like Kajabi, Teachable, and Podia.

Products like Ghost allow writers to spin up personal sites and email newsletters with means of charging readers for premium access—but they charge via a monthly SaaS fee rather than taking a cut of each transaction completed by a reader.

This gives writers better economics, but leaves them on their own when it comes to distribution and design.

Beehiv and ConvertKit offer different takes on the same basic product stack as Substack: a toolset for creating emails, distributing them and charging for them, building an email list. Like Ghost, they charge on a monthly SaaS basis rather than taking a cut of each transaction like Substack.

Also like Ghost, these platforms largely don’t have a discoverability component, which means that writers are on their own with distribution—however, ConvertKit and Beehiiv is more optimized than Substack when it comes to growth marketing. Beehiiv and ConvertKit, unlike Substack, offers tools for building a bigger audience through referrals and advertisements.

Companies like Kajabi, Teachable and Podia are in a different category of platforms that allow creators to build courses, communicate with their community, and create and distribute content. Like the other platforms mentioned above, they charge on a monthly SaaS basis instead of taking a cut of all the money that is paid to a creator, and so can offer better economics than a Substack.

TAM Expansion

Substack is gradually growing from a tool that allows writers to set up and monetize their own email newsletters to a network for both readers (to discover and engage with new writers) and writers (to get recommended by other writers, access infrastructure and resources, and better monetize).

The common assumption is that Substack will leverage the accessibility of its core product to become an aggregator of email newsletter and other kinds of content, but the upside case for Substack lies not in becoming a generic aggregator, but as a luxury publishing network across a growing number of niches.

Substack is unbundling the New York Times by giving the journalists with big audiences a chance to directly monetize their work—then rebundling it as a loose network with shared infrastructure and writerly resources behind it.

What Substack can do is eat up all the niches across publishing where talent currently resides in "Old Media"-style institutions—from sports to entertainment to lifestyle writing.

Substack could also potentially expand into other forms of content, such as podcasts and video. The platform has already experimented with audio content through its partnership with Anchor, and there is potential for Substack to become a one-stop-shop for independent creators looking to monetize their content across multiple formats.

Risks

There are several key risks to Substack's business model, including:

Burnout: The typical Substack newsletter churns paid subscriptions at roughly 50% per year. For writers, that means that to make $50K per year while charging $8/mo, they need to get to 900 paid subscribers—from there, they have to add 31 new paid subscribers every month just to break even. Cranking out high-quality content to consistently meet that bar can lead to burnout—and burnout, on a wider scale, can eat away at the Substack user base and brand halo.

Migration: Substack’s reputation as a place for high-quality writing is a big part of why other writers go there—if those high-quality writers, who will tend to earn the most and therefore cede the most revenue back to Substack via its take rate, decide to start leaving Substack for DIY options or other platforms, it could send their customer acquisition motion and business model into a death spiral.

Funding Rounds

|

|

|||||||||||||||||||||

|

|||||||||||||||||||||

|

|

|||||||||||||||||||||

|

|||||||||||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.