Why Stripe bought Metronome

Jan-Erik Asplund

Jan-Erik Asplund

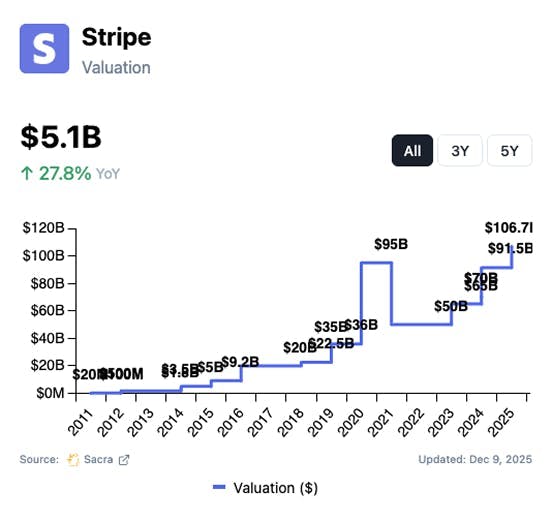

TL;DR: Stripe's $1B acquisition of Metronome follows its strategy of building high-margin software on top of payments, this time vertically integrating metering to own the billing stack for AI companies like OpenAI and Anthropic that need to ingest millions of usage events per second. For more, check out our full report on Stripe.

In December 2025, Stripe announced the acquisition of usage-based billing platform Metronome ($128M raised, A16Z, last valued at $470M) for $1B.

Founded in 2020 by ex-Dropbox engineers Scott Woody and Kevin Liu, Metronome is used by companies like OpenAI, Anthropic, Databricks, and NVIDIA to bill on tokens, GPU seconds, and other usage metrics.

Key points via Sacra AI:

- As subscription emerged as the dominant business model for cloud SaaS, recurring billing platforms like Zuora (founded 2007, IPO 2018, taken private by Silver Lake/GIC in 2024), Chargebee (founded 2011, $469M raised) and Recurly (founded 2009, $39M raised) emerged to handle the key challenges with recurring billing including proration, dunning & payment retries, invoicing, and revenue recognition. In 2018, Stripe launched its own subscription management product Stripe Billing, priced at or below its competition (~0.7% of volume on top of ~2.9% for payments) and within the pay-as-you-go framework of Stripe payments, expanding its take rate with its customers, increasing lock-in to the platform and cutting off at the knees the subscription billing platforms attempting to switch its customers away from Stripe to Adyen (AMS: ADYEN), Checkout.com or Braintree (NASDAQ: PYPL).

- Usage-based pricing came out of the infrastructure layer starting with AWS (launched 2006), then Twilio (founded 2008), Stripe (founded 2010), and later Snowflake and Datadog, demonstrating that charging for consumption (compute, SMS messages, API calls, storage) generated higher net revenue retention & easier expansion vs. the high-friction upsell conversations of feature-tiered subscriptions. In the AI age circa 2023, all of the fastest-growing companies including OpenAI, Anthropic, Midjourney & Perplexity, have been usage-native from day one, bending SaaS business models generally into incorporating metered pricing based on usage (credits, tokens, GPU seconds) and outcomes (per resolution) in increasingly multi-dimensional pricing schemes.

- Stripe's acquisition of Metronome for ~$1B in December 2025 gives it a fully-featured usage-based billing offering, already in use by top AI companies like OpenAI, Anthropic & Databricks, that it can bundle into Stripe Billing & vertically integrate with payments versus upstart metering platforms like Orb ($44M raised, Menlo Ventures), Lago ($34M raised, FirstMark) & Sequence ($19M raised, A16Z). Built to handle millions of usage events per second, Metronome is both data platform and billing engine, ingesting raw usage events, supporting complex multi-meter pricing, credits, and caps & aggregating billable metrics in real-time versus building usage into the lower-throughput Stripe Billing which often involves handling high-value metering logic in-house and on customer-managed data warehouses like Snowflake.

For more, check out this other research from our platform:

- Stripe (dataset)

- Salesforce, Amplitude, and the fat data layer in B2B SaaS

- Tristan Handy, CEO of dbt Labs, on dbt’s multi-cloud tailwinds

- dbt Labs vs Databricks vs Snowflake

- Cribl: the $120M/year Ramp of data observability

- Stripe vs Apple

- Banking-as-a-Service: The $1T Market to Build the Twilio of Embedded Finance

- The future of interchange

- "Plaid for X" startups

- Kevin Kang, co-founder of Reap, on stablecoin-native business models in fintech

- Stablecoins > Visa