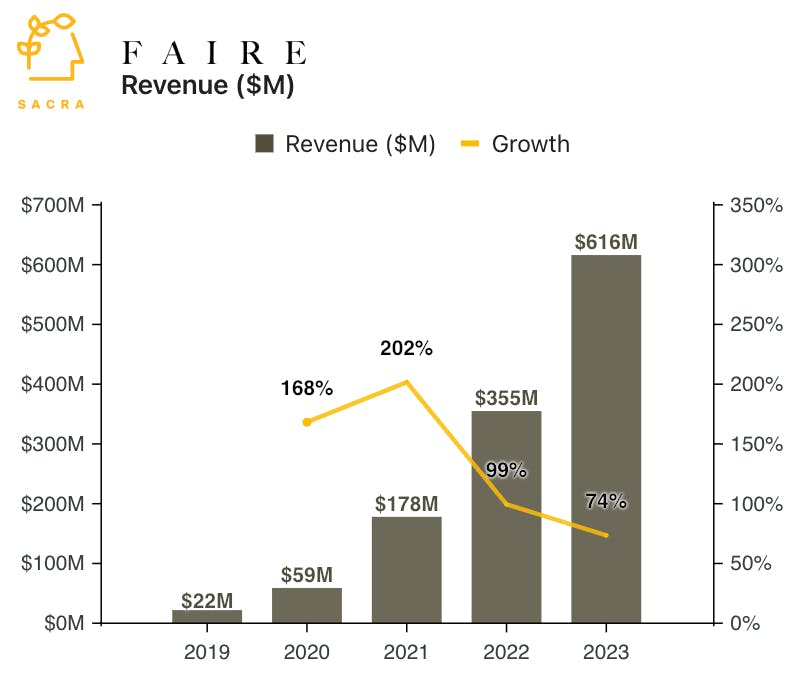

Faire at $616M/year growing 74%

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Sacra estimates that Faire hit $616M in revenue in 2023, up 74%, as they expanded their B2B wholesale retail marketplace to 100+ countries. For more, check out our full report on Faire and our members-only dataset on Faire’s GMV, take rate, retailer growth, and ARPU.

Key points from our update:

- Sacra estimates that Faire generated $616M in revenue in 2023, up 74% year-over-year from an estimated $355M in 2022, for a 35x revenue multiple on their $12.6B valuation as of their Series G extension in May 2022. Compare to B2B marketplace NuORDER which was acquired by Lightspeed POS in 2021 for $425M at a 21x revenue multiple on $20M in revenue growing 30% year-over-year.

- Faire began an aggressive geographic expansion in 2021-2, launching first into the UK and Australia—they’re now the clear market leader with 100+ countries around the world, 2x bigger than their main European competitors, Ankorstore and Qogita. With 800K+ retailers on its platform as of 2023, Faire is looking to further expand TAM through better retailer discovery and matching, net-60 lending, and building software tools to power retailers' wholesale purchasing, inventory management, and operations.

- Today, Faire’s average gross margin per order is around 73-75%—compare to Etsy (NASDAQ: ETSY) at ~69% with its B2C model, which incurs higher support and infrastructure costs compared to a Faire’s higher-AOV B2B marketplace. On a typical $1,000 transaction, Faire collects a $150 cut upfront (commission), collects $24.30 in processing fees (2.4% + $0.30), and incurs ~$30 in COGS (~17%)—with a negotiated rate with their payment processor of ~1.75% at scale, they’d net $126.8 per transaction.

For more, check out this other research from our platform:

- Faire (dataset)

- Ameet Shah, partner at Golden Ventures, on the economics of vertical SaaS marketplaces

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- ShipBob: TikTok's $500M/year fulfillment arm

- Klaviyo: the $665M/year HubSpot for ecommerce

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Brian Whalley, Co-Founder of Wonderment, on Klaviyo's product-market fit

- Sampad Swain, CEO of Instamojo, on building ecommerce infrastructure for D2C 2.0