Canva: the $1.7B/year rectangle generator

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Canva ($1.7B ARR) got product-market fit helping social media marketers throw text on images. Now they’re building a “third place” productivity suite for the visual communication tools—slides, images, and videos—that have become essential for every role in an organization. For more, check out our Canva report and dataset.

Key points from our report:

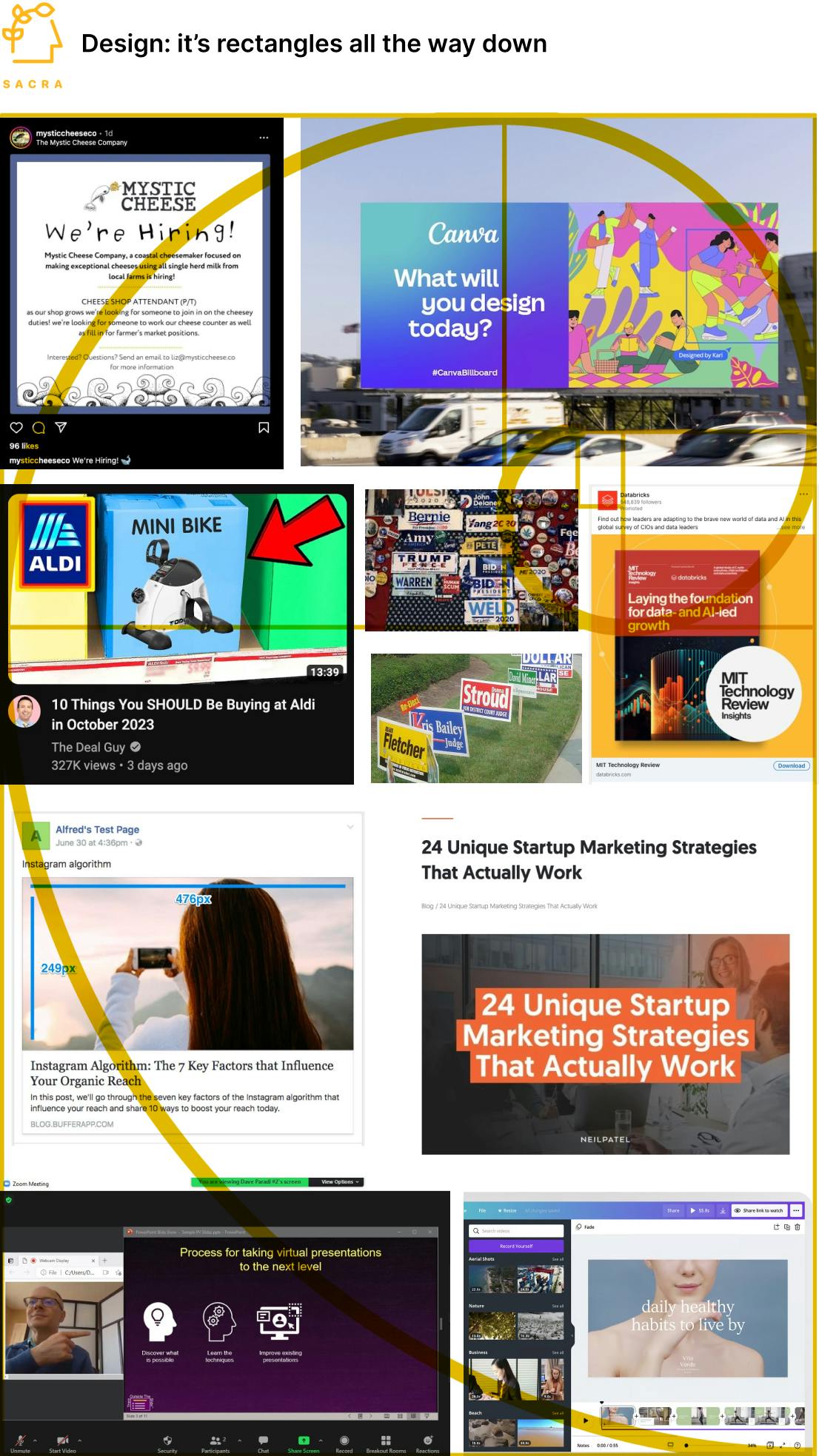

- Twitter launched link previews in October 2013, making their feed more visual and giving marketers more real estate to craft images and stand out in the feed. Circa 2014, social media posts with images were generating 87% more interactions than posts without images on Facebook and 35% more on Twitter.

- Helvetica on top of landscape photos for social media previews became the wedge (ala Instagram’s sepia filter) that got Canva (2013) to 5 million users in 2 years, before replicating that workflow into every digital and physical rectangle, including billboards, business cards, YouTube thumbnails, slide decks and more. Unsplash (2013, acquired by Getty Images in 2021), Pexels (2014) and Pablo by Buffer (2015) emerged in Canva’s wake as additional tools for marketers to use to create fast, free visual collateral and schedule/publish it.

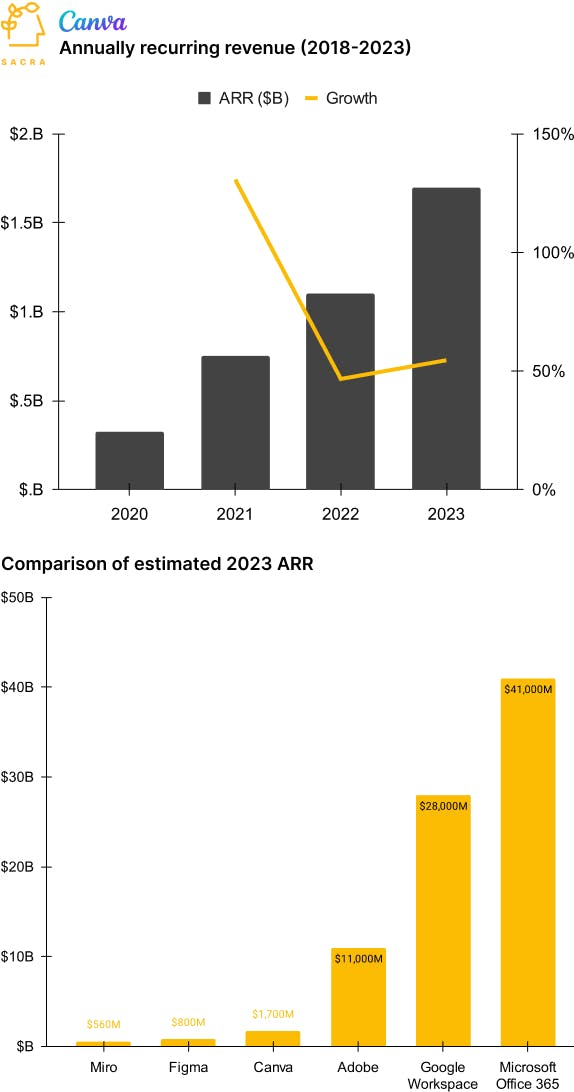

- By reducing design into filling pre-configured rectangles, Canva hit $1.7B in annual recurring revenue (ARR), up 54% from $1.1B last year, with a valuation of $39B giving them a 23x forward revenue multiple. Compare to Adobe at $21B in ARR (up 12%) and a $257B market cap for a 12.2x forward revenue multiple, and Figma, which was acquired by Adobe was on track for $400M ARR (up 100%) at $20B for a 50x forward multiple.

- With instant distribution to 350M organizations that already pay for them, Microsoft Office is now coming after graphic design workflows with Microsoft Designer for generating rectangles and Bing Image Generator (1 billion images created) for instant, copyright-free collateral. Adobe Creative Cloud is using the same bundlenomics to attack Canva from the design tools angle, using the free Adobe Spark and the AI-based Adobe Firefly (3 billion images created) to expand their footprint in the organization to marketers and salespeople.

- Multimodal large language models (LLMs) like Google’s Gemini and OpenAI’s GPT-Vision ($1.3B ARR) that can process both text and images threaten simple design tools like Canva by being drastically cheaper than a marketer’s time (at roughly $0.005 per image) and further democratizing design by replacing what-you-see-is-what-you-get (WYSIWYG) editing with natural language prompting. Where Canva applies one editing technology to different kinds of rectangles, Gamma (50K new users per day) and Tome (1M users in 134 days) are forging a new interactive, responsive “mini-website” form factor with natural language as a core input.

- Canva is working backwards from their ownership of the rectangle and connecting it to businesses’ internal workflows, from collaboration, approvals, permissioning, publishing, analytics, and brand management to working with external stakeholders. That push into the enterprise is allowing them to now drill down into different types of rectangles like collaborative whiteboards competing with Figma (projected $800M ARR in 2023) and Miro (projected $560M ARR in 2023), slides competing with Google Slides (2B+ Workspace users), and one-page websites competing with Squarespace ($931M revenue).

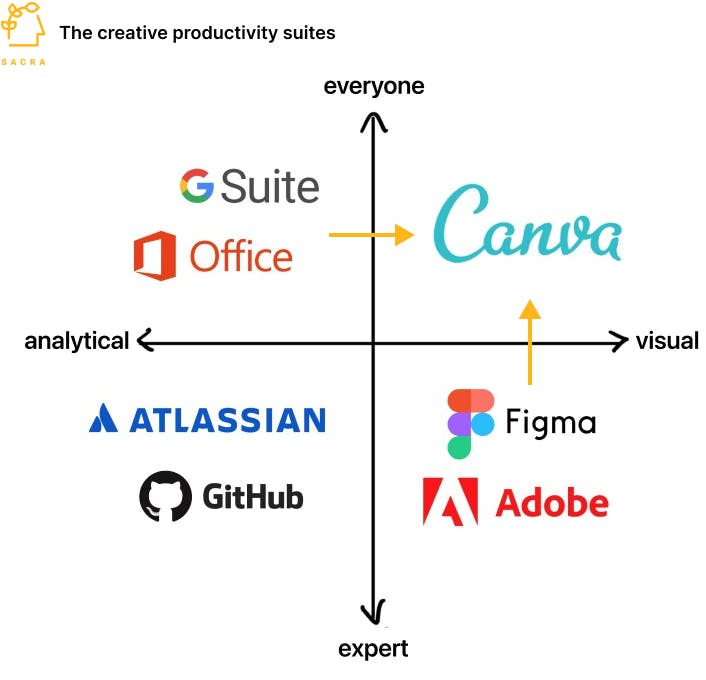

- Canva’s long-term goal is to entrench themselves as a “third place” productivity suite between Adobe/Figma and Google Workspace/Microsoft Office just as Starbucks made the coffee shop the third place between home and work. Propelling this trend forward will be the continued post-COVID shift in enterprise budgets away from things like from real estate and operations and towards the productivity software that remote teams need to get work done.

For more, check out this other research from our platform:

- Canva (dataset)

- Figma (dataset)

- Miro (dataset)

- Product manager at Canva on Canva's shift upmarket

- Jon Noronha, co-founder of Gamma, on building AI-powered slides

- Matthew Moore, Head of Design at Lime, on Figma vs. Adobe

- Head of Brand Design at a Series E startup on Figma's wall-to-wall adoption

Product update: Sacra Net

We've upgraded our reports and documents by programmatically enriching them with context about the startups discussed.

Hover over company names for context on companies inside of Sacra reports and interviews, then click through to the Sacra company page to learn more.

We identified 12,000+ mentions of startups in our interviews and reports.

Check out our recent interview with Geoff Charles, VP of Product at Ramp, to see this in action.