How Figma defied Adobe's bundlenomics

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Figma's $20B sale to Adobe reflects both that it beat back Adobe's attempt to break it with bundle economics, and that it faced the daunting task of going multi-product and driving wall-to-wall seat expansion. For more, read our interviews with Lime's Head of Design Matt Moore, a Head of Brand Design at a Series E startup, and a PM at Canva.

Adobe announced today that it has agreed to buy Figma in a deal valued at $20B. At about 58x Figma’s current ARR, that’s both the highest revenue multiple ever paid for a SaaS of that size and the largest private tech sale in history.

Check out our weekly email for more insights like this into private companies.

Success!

Something went wrong...

It's an outcome that's a direct result of how well Figma navigated around both a big incumbent and a congested marketplace for creative tools:

- Figma won over 4M+ designers in 235 countries by shifting design from a siloed, single-player experience to a multi-player, collaborative one. Figma replaced the “export and email” workflow of software like Sketch with real-time UX design in the browser, enabled by WebGL. (link)

- Figma is at about $340M ARR now, growing 100% YoY and projected to cross $400M ARR by end of year. Figma is still in the early stages of cracking the enterprise, with most of their growth to date driven by their freemium, product-led motion.

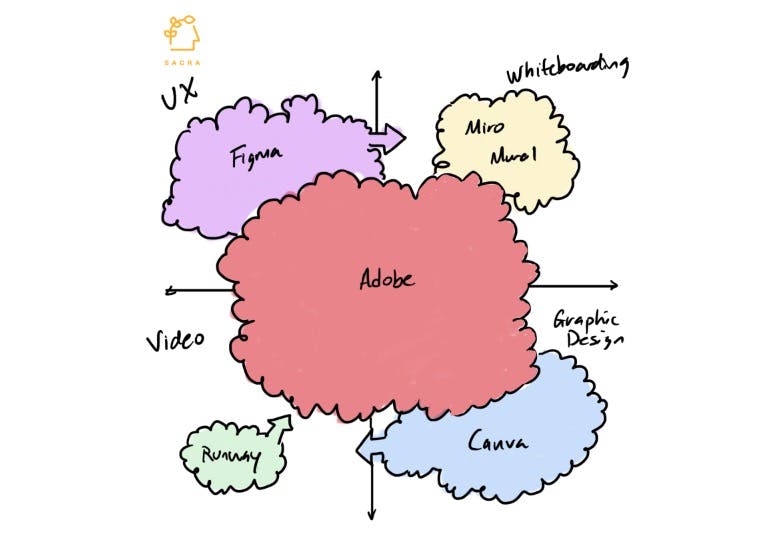

- Figma built product designers into an intolerant minority that refused to use any substitutes, forcing companies to pay for both Creative Cloud and Figma. The lack of equivalents for prosumer tools like Photoshop, Premiere or After Effects makes it hard for Figma to completely replace Creative Cloud inside organizations. (link)

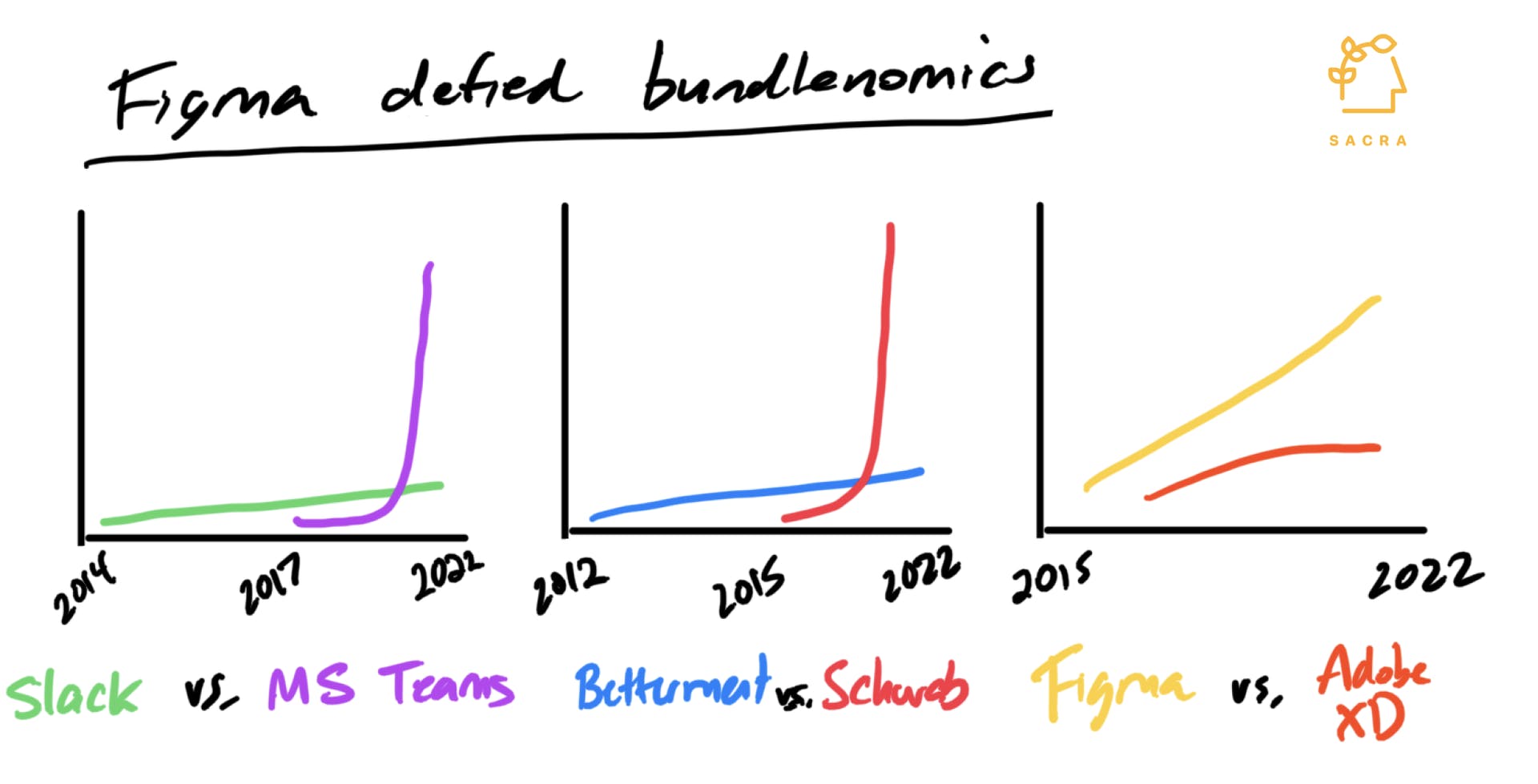

- Even with instant distribution to 26M+ Creative Cloud customers, Adobe XD failed in its attempt to use bundlenomics to dislodge Figma’s dominant position among designers. Figma commanded a premium because of the quality of its growth and product-market fit. (link)

- After raising at a $10B valuation in 2021, the bar was raised even higher—Figma had to find a way to get wall-to-wall seat expansion inside companies and become a product that every company and every person at a company could use. Figma set out to become a multi-product company and build their own bundle that could tie together the needs of both designers and marketers, product managers, engineers, and others. (link)

- Whiteboarding was a key first target with the launch of Figjam, but that space has become more crowded with the COVID-fueled growth of virtual whiteboarding competitors like Miro ($17.5B) and Mural ($2B). Since the beginning of the pandemic, Miro has gone from 5M to 30M users and has begun eating up product management use cases like creating PRDs. (link)

- Meanwhile, Canva ($40B) started off as a graphic design tool, but today is at $1B+ ARR by capturing “non-designer” roles that still regularly need to produce creative collateral, like salespeople and social media marketers. Canva displaces multiple categories of products from productivity tools and video editing to print services. (link)

- And today, users of AI art engines like DALL-E 2, Midjourney and StableDiffusion can generate 5,000 novel images for the price they’d pay a designer to create a single mockup. At roughly $0.005 of compute cost per image generated, these AI engines can drastically undercut human designers on price while driving 80%+ gross margins and continuously improving with more iterations.

- With this half-cash and half-stock sale, Figma gets into $ADBE at a steep discount (the stock is down 42% on the year) and at a 2020-1 era multiple of 58x. Selling from a position of strength meant that Figma could ensure a great outcome for the team and protect against the potential downside of a possible impending recession.

- For Figma, this deal gives the team the backing and firepower to go big—for the company’s recently-30 CEO Dylan Field, it could put him next in the line of succession to Adobe's throne. Salesforce acquired Quip with an eye towards having Bret Taylor succeed Marc Benioff as CEO, and Dylan Field could play a similar role for Shantanu Narayen as Adobe looks to stay relevant.

For more, check out our other coverage on Figma here: