Gumroad at $21M

Jan-Erik Asplund

Jan-Erik Asplund

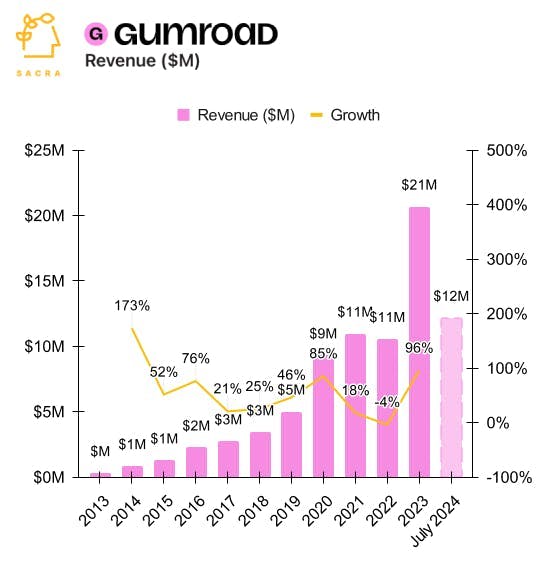

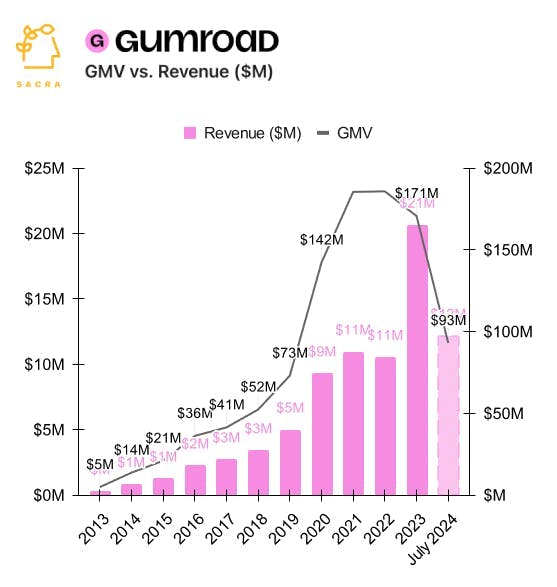

TL;DR: Gumroad flipped from burning cash to making $9M in profit when it increased prices in 2023, but behind its $21M of revenue (up 96% YoY) is a 2.5 year decline in GMV. Its upside case today lies in the growing Gumroad family of businesses—Flexile, Helper, Iffy, and others. For more, check out our full Gumroad report and dataset.

We previously covered Gumroad in 2021 when founder & CEO Sahil Lavingia rebooted the company from a venture-backed business to an equity crowdfunded one. Post-COVID creator tailwinds, we wanted to follow up on Gumroad as a bellwether for the creator economy.

Key points via Sacra AI:

- In early 2023, Gumroad doubled its monthly revenue from $1M to $1.8M and flipped from burning cash (-$1M net in 2022) to generating $9M in net profit for 2023 by raising prices to a flat 10% transaction fee from a variable 3.5-8.5% take rate. This change brought Gumroad in line with the business models of creator economy companies like Substack (10% take rate) and Patreon (up to 12% take rate), with new SKUs like calendar bookings, services, and tips to help creators offset the higher take rate by generating more revenue.

- The near-term revenue step function increase masked a longer-term decline in GMV, which fell from its COVID peak of $185M in 2021 to $171M in 2023—a trend finally now showing up in monthly revenue, down ~7% YoY as of July 2024. Creator marketplaces like Substack, Gumroad and Cameo tend to be supply driven, leaving them lacking two-sided network effects and vulnerable to SaaS-centric upstarts like Beehiiv on newsletters ($13M ARR, growing 450% YoY) and Stan on storefront ($27M ARR, growing 949% YoY).

- The upside case lies in the growing Gumroad family of businesses—Flexile for contractor payroll ($36K ARR), Helper for customer support, and Iffy for API-based content moderation—which it finances with its substantial positive cash flow. Gumroad is building a software stack for its philosophical approach to building companies—1-person startups with part-time contractors compensated in cash, equity, and dividends—that has the potential to assemble into a vertical software suite for creators.

For more, check out this other research from our platform:

- Gumroad (dataset)

- Stan (dataset)

- Substack (dataset)

- Beehiiv (dataset)

- Vitalii Dodonov, CTO of Stan, on building a creator-aligned store-in-bio

- Stan: from $15M to $27M ARR in 3 months

- Gumroad: The Android of the Creator Economy that Powered $142M in GMV [2021]

- Neal Jean, CEO of Beacons, on building vertical SaaS for creators

- Beehiiv vs. ConvertKit vs. Substack vs. Mailchimp

- C-suite at creator economy company on the competitive dynamics of checkout

- Creator economy marketer and co-founder on building a sustainable business online

- Gumroad creator on Gumroad's economics and user journey

- Creator economy entrepreneur on content distribution and monetization

- Online educator on the economics of online course creation