Discord: the $15.2B WeChat for the metaverse

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Discord’s growth slowed by a third in 2022 as crypto declined, in-person meetups picked up and COVID-era phenomena like social audio dropped off. Now, generative AI is emerging as what could be Discord’s next big tailwind. For more, check out our Discord dataset, our Reddit report and dataset, and our interview with Raihan Anwar and Colby Holliday from Friends with Benefits.

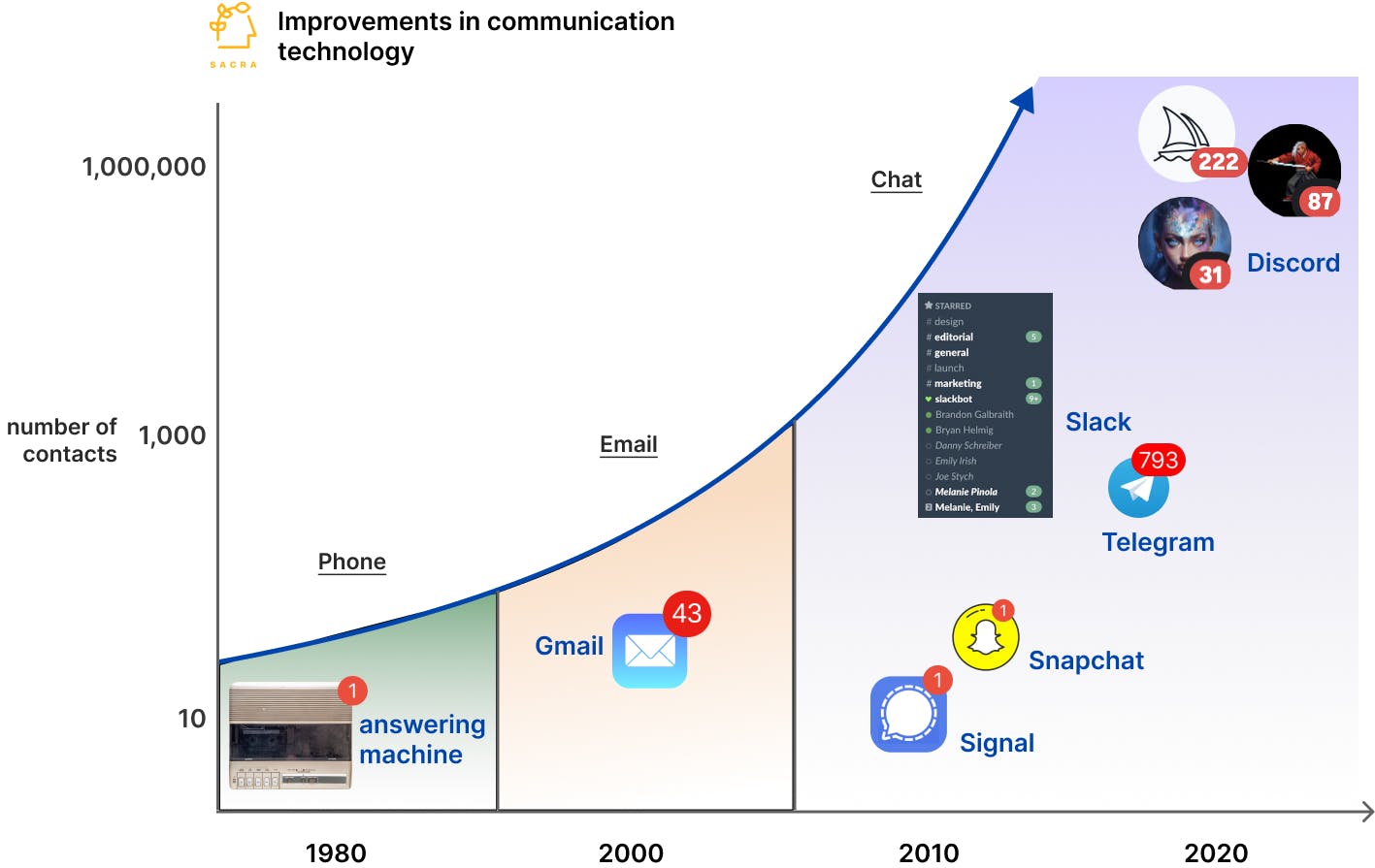

- The online gaming stack circa the late 2000s was a test bed/proofing cabinet for multi-modal remote collaboration tools and practices—gamers playing online together would coordinate through the VoIP of a TeamSpeak, Skype or Ventrilo, share information on phpBB forums, and instant message via AIM or IRC. The remote work practices that many companies adopted in a panic circa March 2020 were second-nature to anyone that grew up coordinating with friends across multiple time zones while playing strategic PC games like Starcraft or Counter-Strike.

- In the early 2010s, text messaging shifted from SMS to rich messaging apps that proved extremely sticky with built-in virality—seeing the launch of WhatsApp (2009), Kik (2010), GroupMe (2010), Signal (2010), Snapchat (2011), MessageMe (2013), Telegram (2013) and Facebook Messenger (2014). Asian chat apps WeChat (2011, China), Line (2011, Japan) and Kakao (2010, South Korea) featuring stickers and emoticons provided the example for how rich group chat’s engagement and growth could serve as a powerful wedge into building superapps.

- Launching in 2015, Discord combined rich group chat with VoIP group calls, giving League of Legends/Dota 2/CS gamers a room to hang out in, plus low-latency voice channels to jump into and communicate for live game play. Slack (acquired by Salesforce for $27.7B in 2021) launched similarly in 2013 as a mashup of business chat functionality and integrations with the playfulness of modern messaging apps including emojis and animated gifs, growing from 0 to 2.3M DAU in 2 years with intercompany communication core to its thesis of replacing email.

- But where Slack charged companies $7-$13 per-seat subscription SaaS for every team member killing its economic viability for communities, Discord flipped that model by making servers free and charging end users a $3-$10 per/mo subscription to unlock features in the chat—enabling large communities with a model that could scale to millions of members. Nitro, Discord’s premium subscription plan, gives users custom emojis, HD streaming, improved file sharing and more—users can also pay an extra $5 to unlock collective perks for their communities via “server boosts”, and lastly, Discord collects a 10% take rate on servers that charge subscription fees to their members.

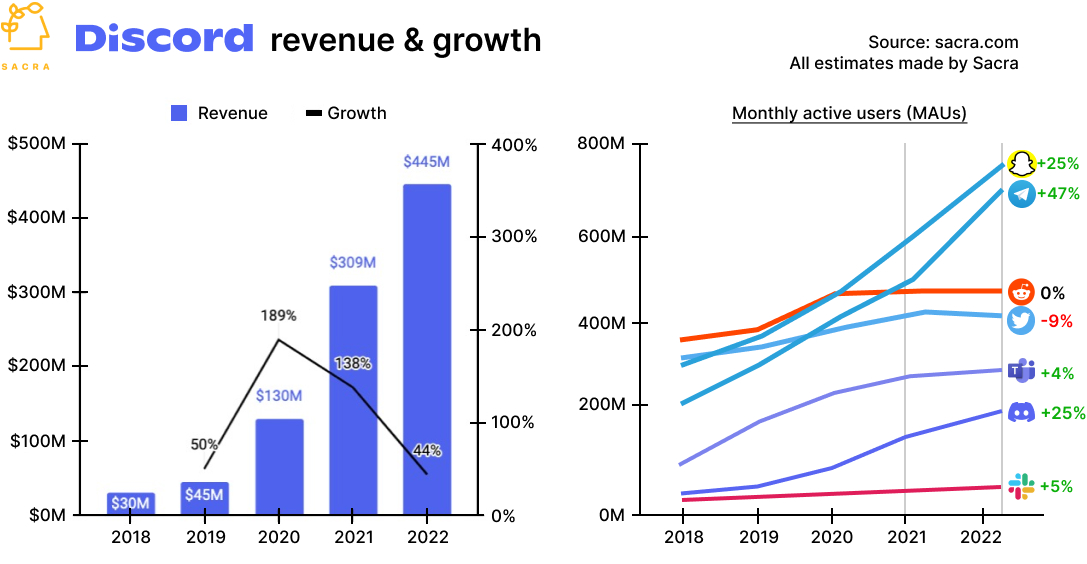

- By the end of 2022, Discord hit $445M in revenue, growing 44% year-over-year, last valued at $15.2B or a 34x multiple on current revenue with roughly 175M monthly active users (MAUs) for $2.54 ARPU. Compare to Reddit at $510M in revenue in 2022, growing 36% year-over-year, last valued at $10B or a 20x multiple on revenue, at $1.19 ARPU, and Snapchat (NYSE: SNAP, $14B) at $4.53B in revenue, growing 12% year-over-year, valued at $17.65B at the end of 2022 or a 3.9x multiple on revenue, with ARPU of $2.58.

- COVID, the boom in crypto, and the shift from in-person to metaverse served as a huge tailwind for pseudonymous group chat apps like Discord (growing 587% from 2019 to 2021), Telegram (~700M MAUs, growing 47% YoY) and Signal (~50M MAUs, growing 25% YoY) with Discord in the best position to monetize via its subscription SaaS model, as Telegram and Signal only made money from donations. Telegram’s foray into virtual currencies with its $1.7 billion initial coin offering (ICO) ended with a lawsuit from the U.S. Securities and Exchange Commission (SEC)—otherwise, it took them until July 2022 to launch its version of Discord Nitro, Telegram Premium.

- From 2020 to 2021, Discord aggressively launched new features to eat up adjacent use cases across community, creator economy and B2B, from Stages (Clubhouse) to Server Video (Zoom), Scheduled Events (Hopin), and Threads (Slack). As COVID unleashed a valuable avalanche of synchronous and asynchronous chat needs (both text and video) that Discord raised $900M to go after—Zoom (NASDAQ: ZM, $19B) and Slack added $50B to their market caps as COVID hit—its ambitions turning from dominating gaming to dominating all group communication.

- Post-COVID, Discord’s growth slowed down from 138% YoY to 44% as crypto went into a decline, in-person meetups picked back up and COVID-era group chat phenomena like Clubhouse dropped off. Clubhouse went from 14.2M downloads in mid-April 2021 to barely 700K in April 2022, while OpenSea lost 90%+ of its volume between January and August 2022.

- While Discord has low ARPU ($2.54) that’s comparable to other pseudonymous social products like Reddit (~$1.30) versus what Facebook (~$45) or Instagram (~$35) can achieve via real identity and targeted ads, Discord’s user-supported subscription model enables them to build for their customers and avoid the perils inherent to an ads-based model endemic to large social media sites. Discord embodies what Elon Musk is trying to build with Twitter (~$10) as a user supported subscription product immune to the pressures of big advertisers to moderate their content.

- Having proven its model durable across industries and trends including gaming and crypto, Discord is currently indexing on the upside of its next big tailwind, AI, with AI art generator Midjourney (~$750K in monthly sales) hosted on Discord, as is its 15.6M-strong community (the largest of any Discord server). The entire Midjourney app experience is baked into Discord, from creating art via DM’ing the Midjourney Discord bot using the “/imagine” command, to payments via subscribing to the Discord server, to consumption of the through the channel feed.

- With OpenAI’s ChatGPT reviving the notion of chat as a platform and a wedge into building a superapp, the upside case for Discord and Telegram lies in building a WeChat for the metaverse—the destination app for virtual socializing, gaming, AI apps and more, with payments and apps built into the conversational interface. While Telegram has a significantly larger and faster growing user base (700M MAUs up 47% YoY vs. 175M MAUs up 25% YoY), Discord has far greater revenue scale ($445M revenue in 2022 vs. Telegram’s sub-$10M) and better access to the public markets.

For more, check out this other research from our platform:

- Discord (dataset)

- Reddit (dataset)

- Q&A with Raihan Anwar and Colby Holliday from Friends with Benefits

- Erick Calderon, CEO of Art Blocks, on the evolution of NFT marketplaces

- Dave Nemetz, founder of Reverb Ventures, on the intersection of web3 and the creator economy

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Edo Liberty, founder and CEO of Pinecone, on the companies indexed on OpenAI