Canva at $2.55B ARR

Jan-Erik Asplund

Jan-Erik Asplund

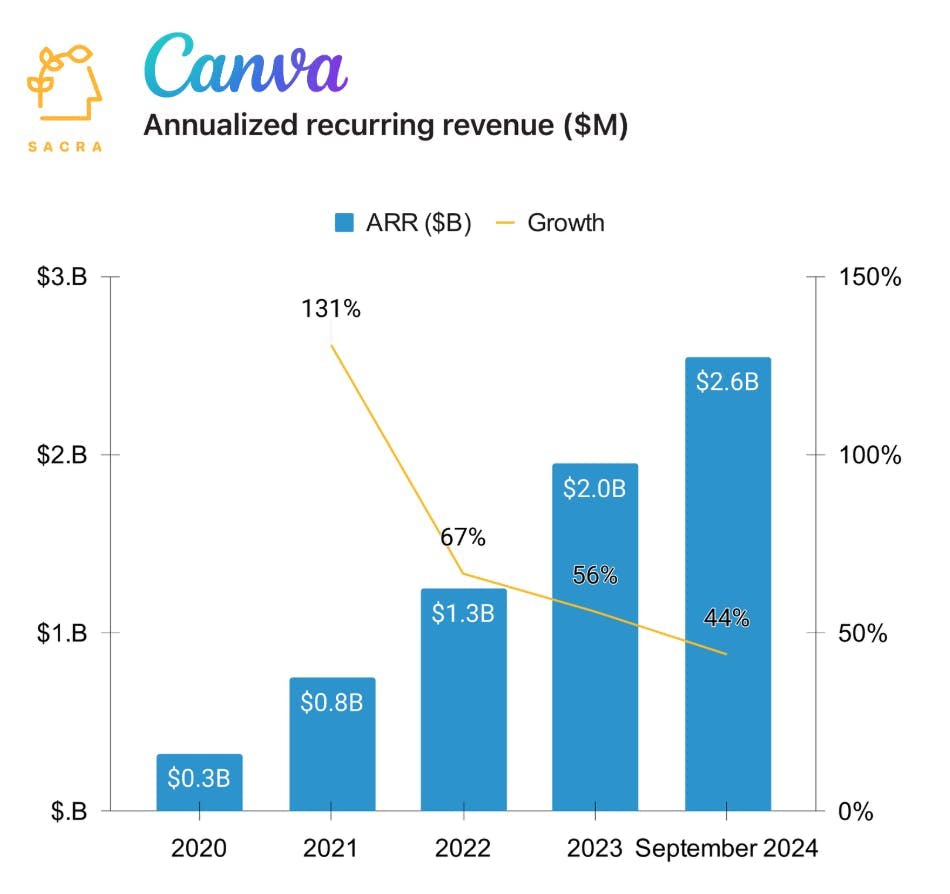

TL;DR: Sacra estimates that Canva hit $2.55B of annual recurring revenue (ARR) in September 2024, up 44% YoY. With its acquisition of foundation model company Leonardo AI, more than 11 billion uses of its AI tools, and 120 AI plugins in its app store, Canva is reinventing itself as an AI company. For more, check out our full Canva report and dataset.

When we last covered Canva in July, it had grown to $2.3B in annual recurring revenue (ARR), growing 50% year-over-year on the back of its rectangle generator for marketers and social media teams.

As they hit $2.5B in ARR growing 44% YoY, Canva is reinventing itself as a full-stack AI company.

Key points from our report:

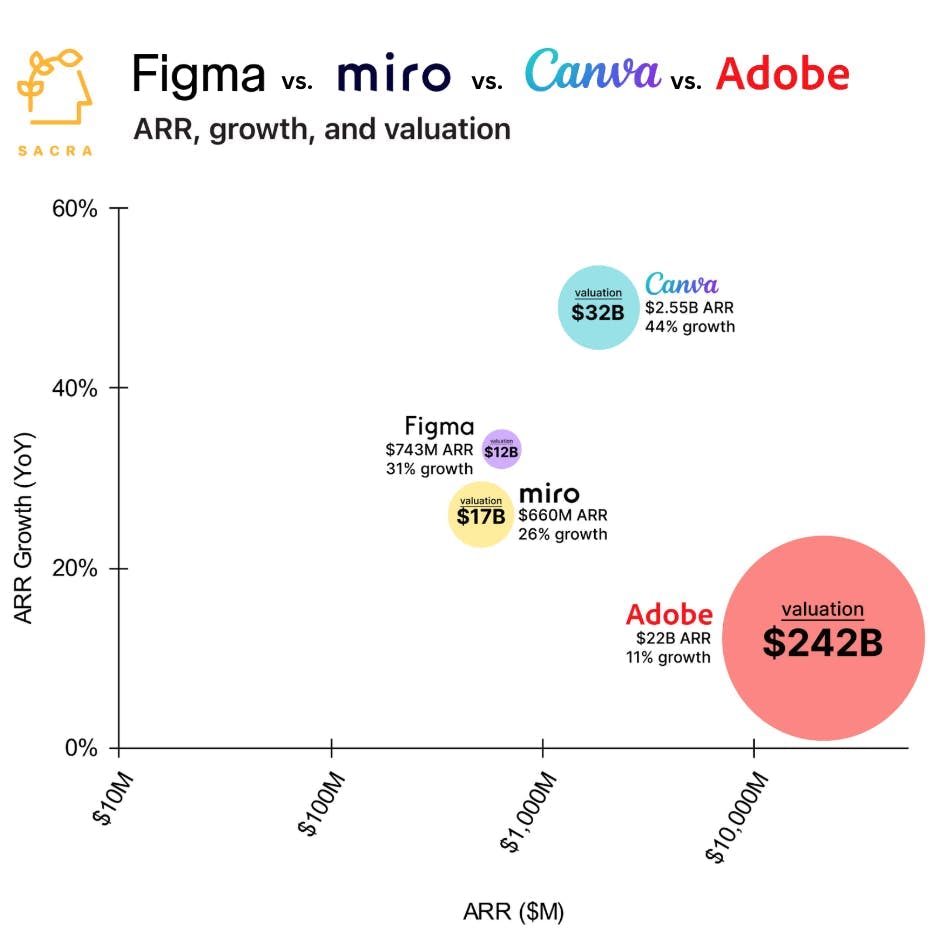

- Sacra estimates that Canva hit $2.55B in annual recurring revenue (ARR) in September 2024, up from $1.7B at the end of 2023 and up roughly 44% year-over-year, valued at $32B as of their October secondary sale for a 12.5x forward revenue multiple. Compare to Miro at an estimated $660M ARR in September (up 26% YoY) valued at $17.5B in 2021 on $300M ARR for a 58.3x multiple, Figma at an estimated $743M ARR (up 31% YoY) valued at $12.5B as of a May secondary sale for a 16.8x multiple, and Adobe (NASDAQ: ADBE) at $21.5B in trailing twelve months revenue as of November (up 11% YoY) valued at $242B for a 11.3x multiple.

- Canva’s full-stack AI strategy combines (1) its own foundation model (Phoenix) through its acquisition of Leonardo AI (for $370M in late July) that “autocompletes in Canva templates”, (2) native AI text, image and video generation features in the app layer powered by OpenAI, Phoenix and Runway ML, and (3) an ecosystem of 120+ plugins for specialized capabilities like AI avatars and voiceovers. Operating profitability for the past 7 years with a highly efficient product-led growth (PLG) sales motion gives Canva the free cash flow to invest heavily into AI and enterprise sales simultaneously without large, repeated capital fundraises.

- Monthly active users (MAUs) have grown 49% YoY to 220M (compare to Discord at 150M, LinkedIn at 300M and Microsoft Teams at 320M) with usage of Canva’s AI tools now up to 800M times per month—up 700% YoY. Strong engagement on Canva’s AI tooling has given it the leverage to increase the price of its Canva Teams plan from $300/year to $500/year, with the upside of 66% higher ACV in advance of their expected 2025-206 IPO.

For more, check out this other research from our platform:

- Canva (dataset)

- Figma (dataset)

- Miro (dataset)

- Canva: the $1.7B/year rectangle generator

- How Figma defied Adobe's bundlenomics

- Product manager at Canva on Canva's shift upmarket

- Jon Noronha, co-founder of Gamma, on building AI-powered slides

- Matthew Moore, Head of Design at Lime, on Figma vs. Adobe

- Head of Brand Design at a Series E startup on Figma's wall-to-wall adoption

- Courtney Scharff, manager of marketing ops at Figma, on Figma's marketing operations stack