Zapier: The $7B Netflix of Productivity

Jan-Erik Asplund

Jan-Erik Asplund

This report contains company financials based on publicly available information and data acquired by Sacra during the preparation of the report. Sacra did not communicate with Zapier or receive any compensation from Zapier for the report. This report is not investment advice or an endorsement of any securities. Click here to read our complete disclaimers.

Building the no-code super aggregator

Join our list for more of our exclusive private markets research and company coverage.

Success!

Something went wrong...

In early March, Zapier announced a valuation of $5B and annually recurring revenue of $140M—a remarkable feat on just $1.4M raised. Based on conversations with investors and our analysis of Zapier’s revenue and growth figures, we believe Zapier is still about 40% underpriced at that $5B valuation.

Our base case model values Zapier at $7B based on its growth rate, its high penetration and lack of competition in the no-code integrations space, and the rapidly growing market for no-code tools and citizen developers more broadly.

Since 2011, Zapier, led by CEO Wade Foster, has become the de facto logic layer of no-code, where users orchestrate the flow of data between tools that otherwise wouldn’t talk to each other. But quietly, Zapier is also building something much bigger: an aggregator.

While it might seem a strange comparison, Zapier is like Netflix. It’s a master of demand generation, with 6 million people visiting the Zapier website every month. It’s close to its customers. For millions of SMBs, startups, solopreneurs and individuals inside larger companies, Zapier is where their business logic lives: the actual tools behind that logic are incidental, just as the studios that produce content are.

Most importantly, Zapier is in the middle of pulling off the same big, consequential move that turned Netflix into a giant. After convincing app developers (or for Netflix, Hollywood studios) that it was just another distribution channel, Zapier has now effectively modularized those partners. Zapier doesn’t care what tools you use just as Netflix doesn’t care what you watch—they care about what they can learn from how you use the platform.

And the data on millions and millions of SaaS workflows that Zapier collects every day will be crucial if Zapier is going to conquer the big challenges ahead of them:

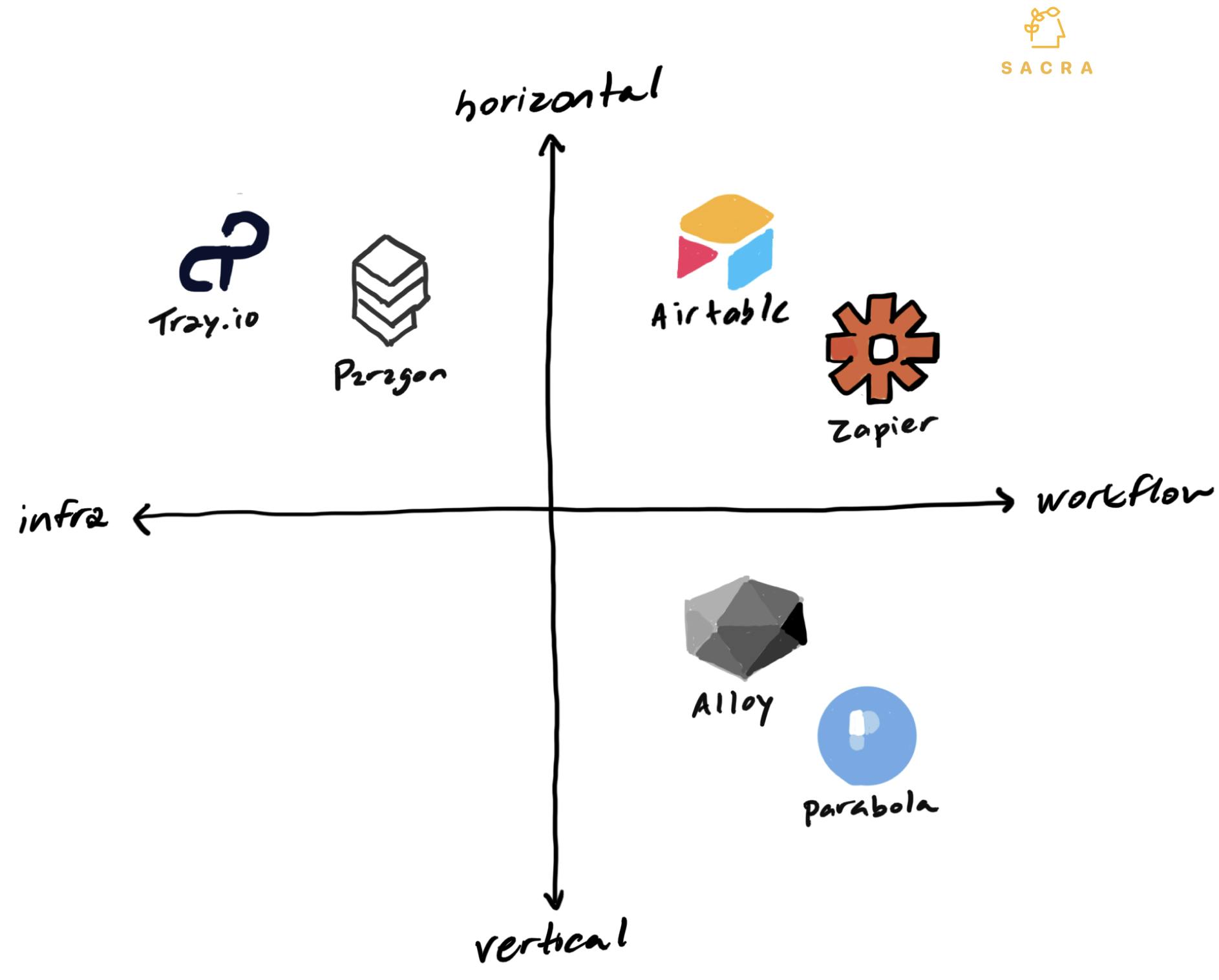

- The disintermediation threat posed by native integration API products like Tray.io and Paragon

- The ability of verticalized, drag-and-drop automation solutions like Parabola and Alloy Automation to peel off Zapier’s market share in specific markets

- Other horizontal tools like Airtable building out their own integration tools to keep users on their own platforms

Unless Zapier attacks these competitive threats head-on, Zapier could ultimately end up like Dropbox: a $10B+ company that could have been worth much more.

Key points

- Zapier is an integration platform and marketplace that gives non-technical end-users the ability to use “triggers” and “actions” to connect SaaS applications that aren’t natively integrated.

- Our model values Zapier at $7B in the company’s base case, about 40% higher than the $5B price at which early investors recently sold stock to Sequoia and Steadfast Financial in a secondary sale.

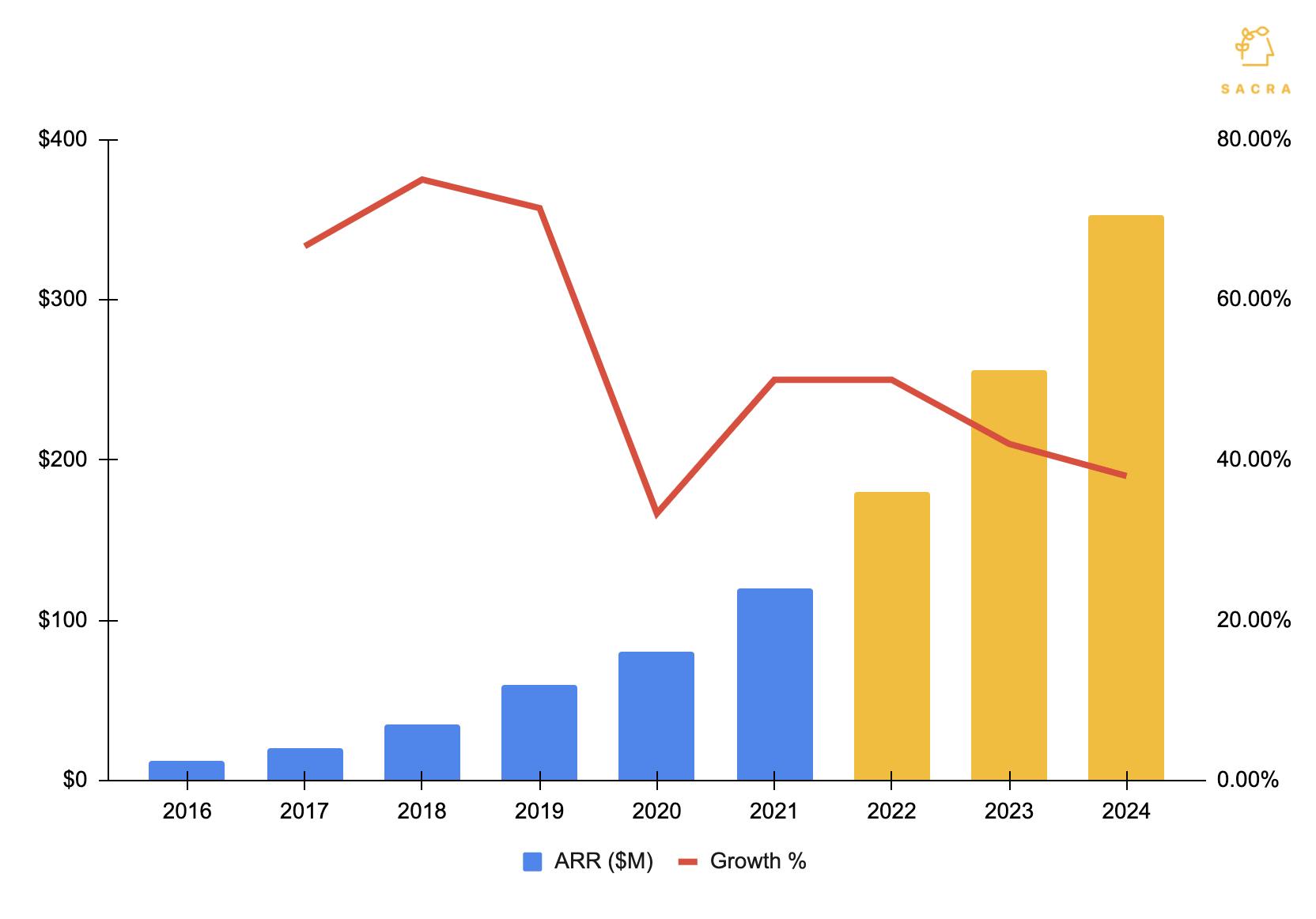

- In March of 2021, Zapier hit $140M in ARR, growing at about 50% from the year before and maintaining a 50% CAGR3, comparable to Shopify and CrowdStrike and faster than Datadog (40%), DocuSign (40%), and Twilio (35%).

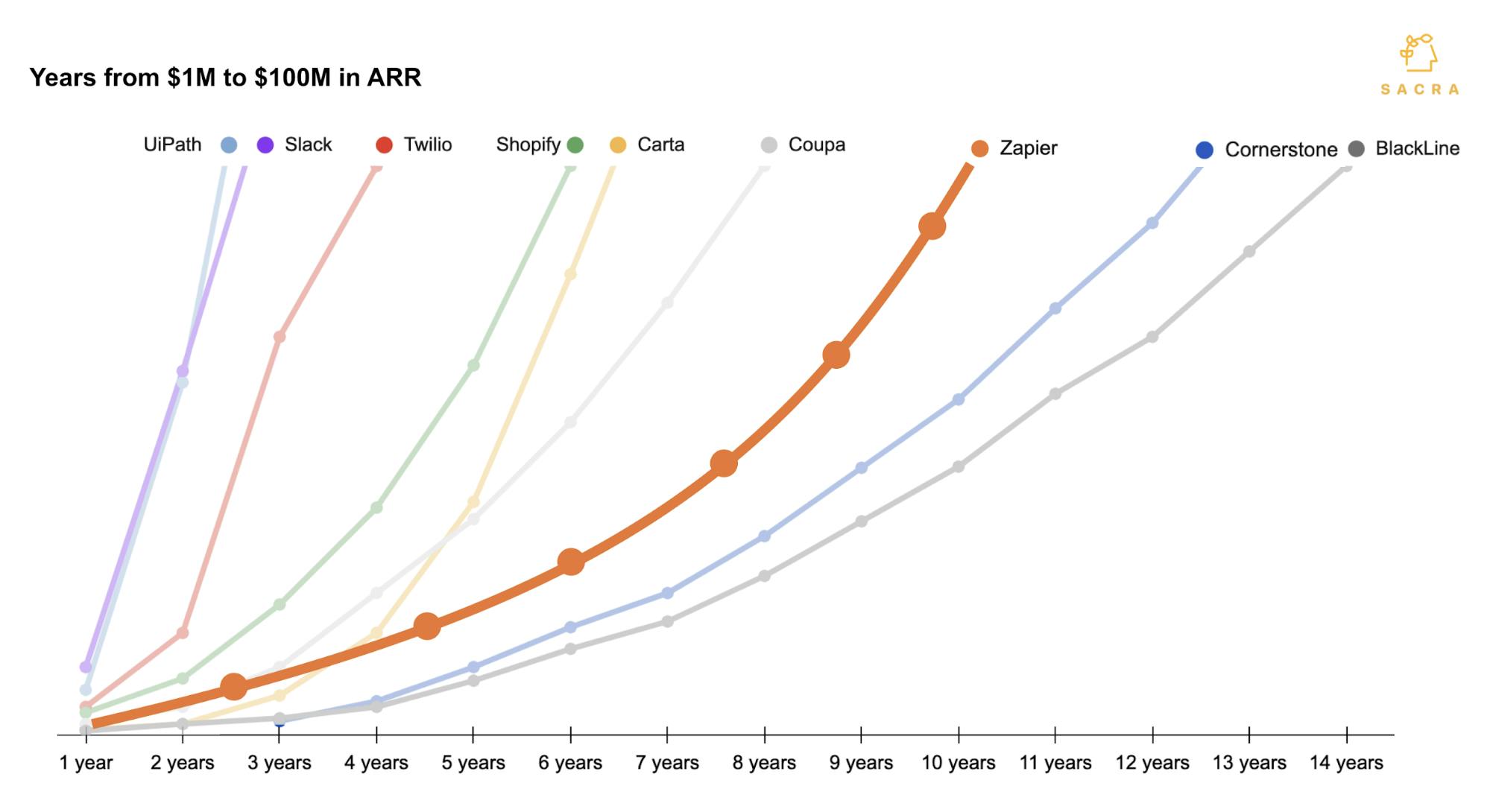

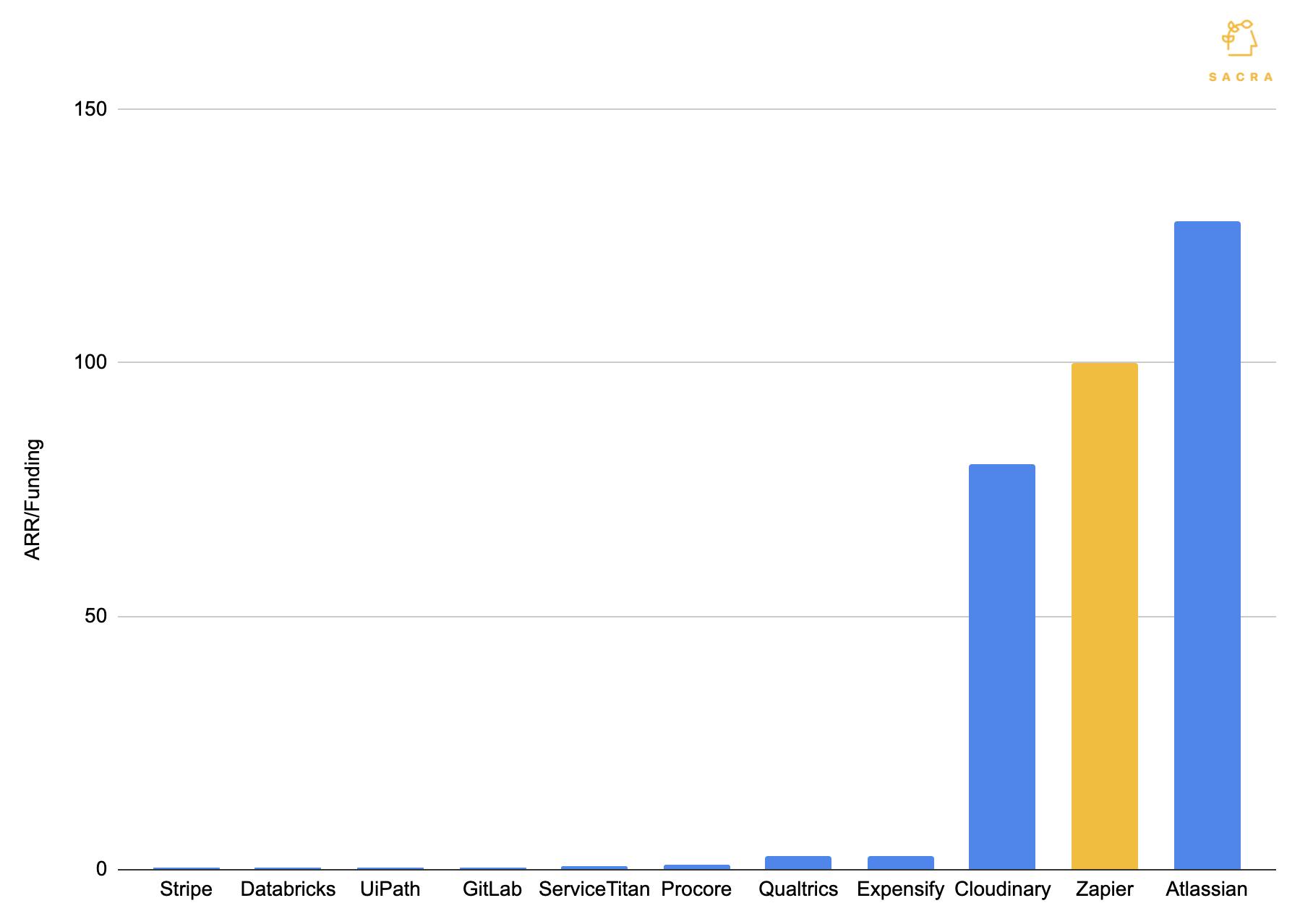

- Despite only raising $1.4M in venture capital, Zapier hit $100M ARR in just under 10 years—compare to Shopify at 6 years and Carta at 6.5 years. Their tiny amount of capital raised gives them a 100x ratio of ARR/funding that puts them in elite territory alongside other largely-bootstrapped companies like Atlassian (128x) and Cloudinary (80x).

- Zapier has a virtual monopoly in the no-code integrations space. By 2020, Zapier had 125,000 paying customers: about 25x as many as competitor Integromat. Zapier’s 3,000+ integrations give them pricing power.

- By programmatically generating SEO-optimized landing pages for each new tool and integration on the platform, Zapier has built a growth machine that has scaled up to 6,000,000 unique pageviews every month, more than sites like Deadspin, Teen Vogue, Gothamist, Seventeen, Saveur or Cook's Illustrated.

- But Zapier risks being disintermediated with the rise of native integration APIs like Tray.io and Paragon, verticalized automation solutions like Alloy Automation and Parabola, and Airtable building its own integrations platform, all of which aim to offer a better user experience around integrations.

- Zapier’s strength is that like Netflix, it has commoditized its suppliers and gotten closer to their customers—now, it has the opportunity to leverage its distribution and mindshare to eat Airtable, create its own Zapier-native data store, and build the no-code super aggregator.

- In our base case, Zapier remains the logic layer of no-code and continues to grow at 37% CAGR to $800M+ in ARR by 2026. In our bear case, growth slows to 20%~ amidst competition from other no-code platforms and native integrations.

- In our bull case, Zapier builds the no-code super aggregator and is able to grow at 50% CAGR for the next five years, growing into a nearly $30B valuation.

Valuation: Zapier is worth $7B on $1.4M raised

Zapier Valuation, Revenue, and Metrics

Members

Unlock NowUnlock this report and others for just $50/month

Zapier was most recently priced at around $5B when a group of early investors in the company sold stock at that valuation to Sequoia and Steadfast Financial.

Based on our model, we believe Sequoia and Steadfast got a good deal. Judging by the speed of Zapier’s growth, its scale, and public comps, we estimate Zapier to be worth about $7B. While about 40% underpriced from our valuation, getting Sequoia and Steadfast on the cap table could make this an extremely valuable long-term trade-off for Zapier’s co-founders (none of whom reportedly sold stock in the sale) particularly in the event that the company decides to go public in the future.

Our base case presumes Zapier’s growth will gradually slow from 51% CAGR3 to 43% by 2024 as the company scales.

That $7B valuation is based on a five-year revenue forecast that has Zapier growing 30-50% over the next 5 years, hitting $800M ARR in 2026. We value Zapier at 15x EV/Sales, in line with the valuation multiple of cloud companies with similar growth.

Our outlook on Zapier is positive given the product’s deep penetration into the startup and SMB integrations space and the rapidly growing industry around no-code development itself. Integromat, one of Zapier’s closest competitors in this space, counted 5,000 paying customers at the beginning of 2020 to Zapier’s 125,000.

Zapier hit $120M in annually recurring revenue at the beginning of 2021 and surpassed $140M in March, up about 50% from the year prior.

Zapier got to $100M in ARR in about twice the time of Shopify, but did so with a fraction of the venture capital.

Zapier, while taking longer to get to $100M ARR than better-funded SaaS companies, still did it in a little under 10 years.

On ARR per dollar raised, Zapier is in rare company with companies like Cloudinary and Atlassian.

What’s more impressive is how capital efficient Zapier’s lack of venture capital made them. Few companies reach $100M ARR without taking in a substantial amount of outside capital. Stripe, Databricks and UiPath, for example, all make $400M+ ARR per year but have raised about $2B each: a 0.2x ratio of ARR to funding. Zapier’s, meanwhile, is 100x.

Our base, bear, and bull cases for Zapier depend on three different trajectories that Zapier could take within the no-code ecosystem:

- In our base case, Zapier continues to serve as the logic layer of the no-code ecosystem for SMBs and startups. ARR hits $800M and growth slows to 35% year-over-year by 2026.

- In our bear case, Zapier is relegated to the long-tail of SaaS integrations, with most SaaS products building their most popular integrations in-house in order to provide a better customer experience.

- In our bull case, Zapier leverages its proximity to end-users and its visibility into millions of SaaS workflows and builds a no-code super aggregator.

All three of our cases have a built-in expectation of strong growth in the no-code space broadly. Reports from P&S and Forrester respectively predict 30-40% year-over-year growth in the market for no-code tools.

Our base case presumes Zapier’s growth rate will steadily slow over the next few years to 35%. While we expect scale to slow Zapier down, the secular growth of the no-code space, the continuing strength of Zapier’s organic SEO-based growth engine, and steadily increasing usage inside startups and SMBs will drive the completion of more tasks and drive more revenue for years to come.

In our bull case, Zapier builds its own version of a data store in order to compete with Airtable, which last year announced the launch of its own native integrations platform. Expanding their ARPU and TAM enables them to grow much faster, at a rate of 50% year-over-year for the next five years, reaching a nearly $30B valuation.

In our bear case, on the other hand, Zapier’s growth rate falls to about 20% year-over-year, with the company struggling to stem churn amidst rising competition from other no-code platforms like Airtable and Webflow and native integrations as facilitated by tools like Tray.io and Paragon.

Product: The no-code integration marketplace driving $140M ARR

Zapier is an integration platform and marketplace that lets non-technical end-users connect and transfer data between the different SaaS applications they use. When a product joins the Zapier marketplace, it becomes interoperable with hundreds of other applications.

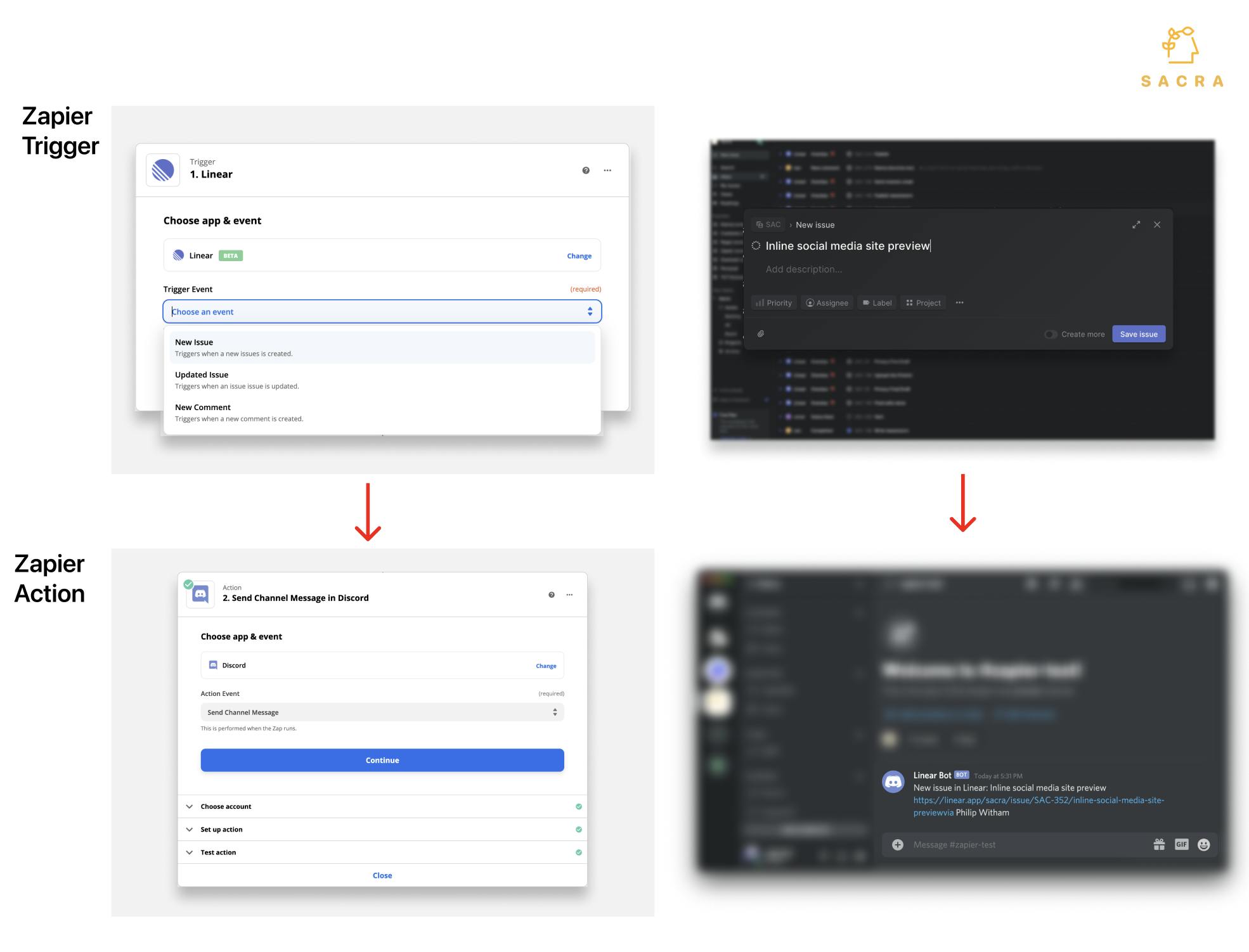

Zapier allows you to create automated workflows where events in one app trigger actions in another app, or multiple other apps via chained steps.

The core design paradigm of the product is the trigger-and-action:

- User chooses an action in one of their apps they would like to serve as a “trigger”

- Whenever that trigger event takes place, it sets into motion a “zap”

- The zap performs one or more “actions” which can create, read, update or delete information in that same app or another app

A basic Zap might trigger upon the receipt of an email in a particular inbox, ingest the subject line and text, and pipe the results into a Slack channel. But with multi-step automations, conditional logic, looping, and native transformations, Zaps have the potential to be highly complex.

Companies can build a ‘stack’ out of tools that wouldn’t otherwise talk to each other using nothing more than Zapier.

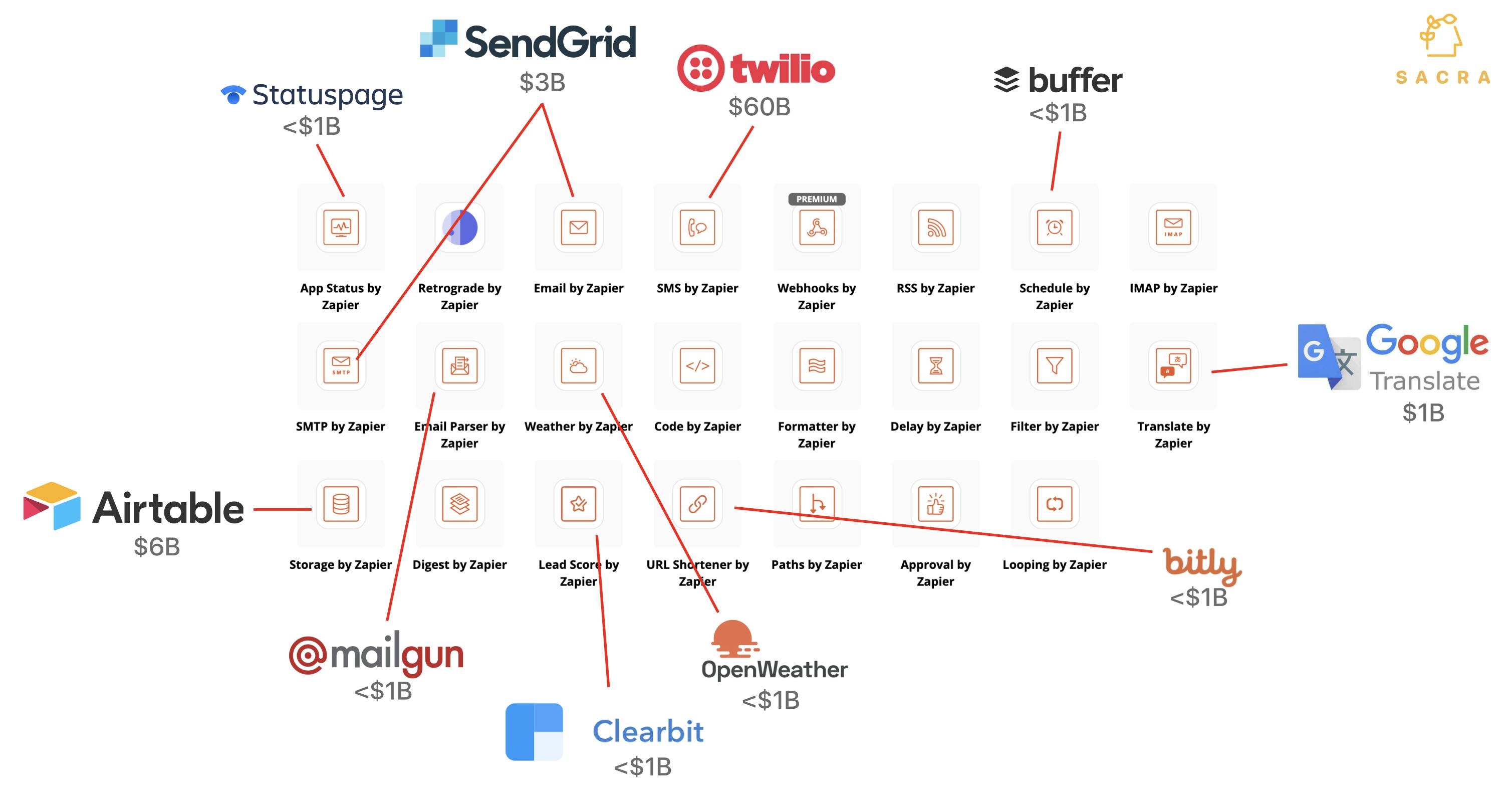

With native Zapier actions, Zapier users can also manipulate the data that they pull out of their connected apps in various ways without having to sign up for another tool: they can parse text, set up a delay, pull in the weather or the status of an app, translate text, and more.

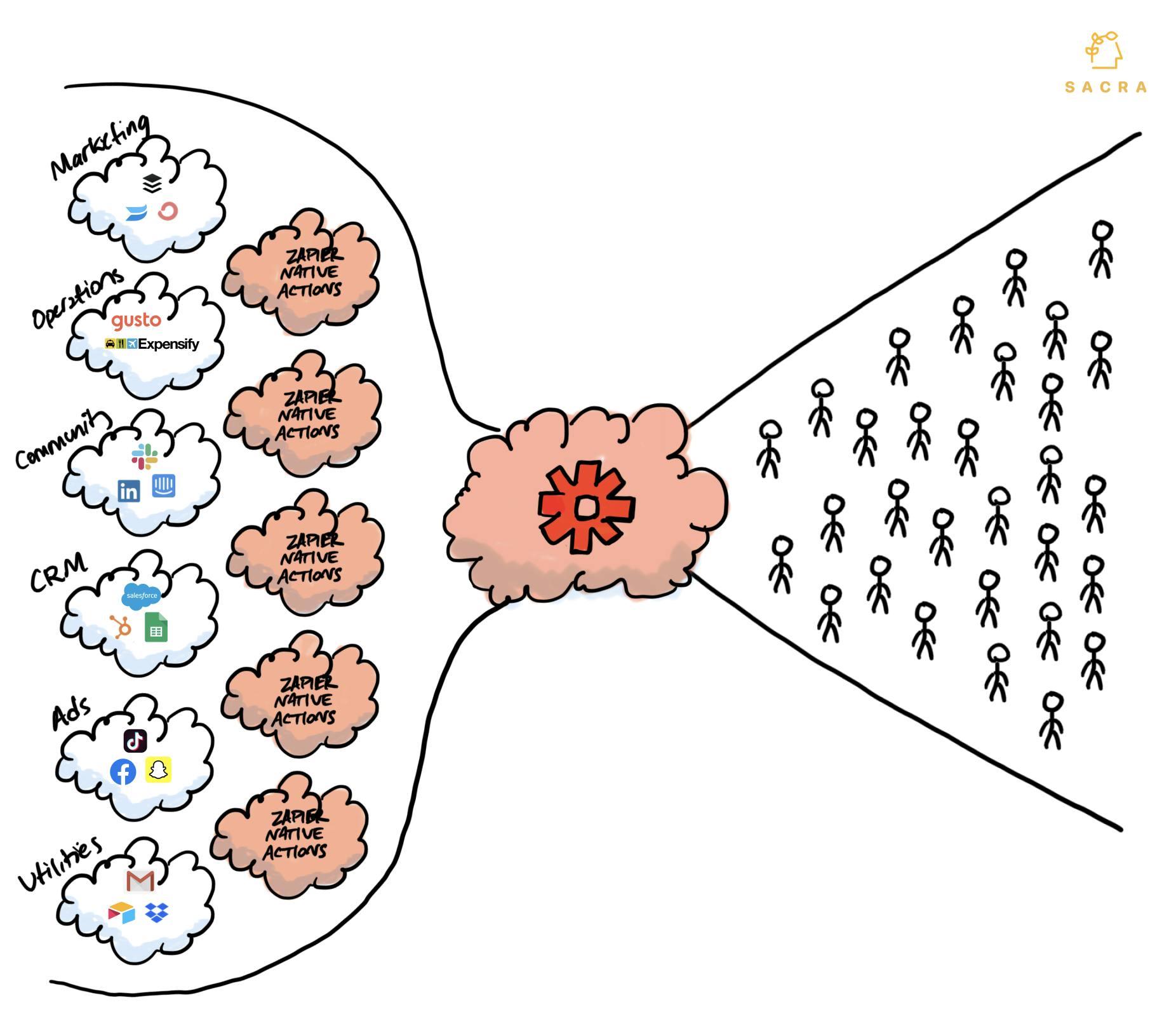

For end-users, Zapier covers a long tail of integrations between SaaS applications that aren’t handled natively—a list that was long when Zapier first launched and has only grown with the expansion of the SaaS world itself. Sales teams use it to populate lists of leads, marketing teams use it to funnel social mentions or create scheduled posts, operations teams use it to maintain internal tools.

Many of these functionalities are covered by vertical tools, but Zapier has the advantage of being compatible with any stack out of the box.

- Discoverability: Zapier’s SEO dominance means that they’re often the first result for any Google search involving app integrations, and this can be a powerful acquisition tool for SaaS tools.

- Extensibility: With a Zapier integration, a SaaS tool can advertise hundreds of integrations with other tools and ensure that their users won’t churn simply because they can’t connect their data to some other tool in their stack.

Companies like Airtable have found that Zapier both serves as a useful lead generation engine and that the leads generated by Zapier tend to be more valuable, with the increased use of automations being a leading indicator that a customer will retain and be an active user.

Analysis: From API of APIs to the no-code Netflix

At the turn of the century, APIs were one of the main advantages cloud software companies had over their non-cloud competitors. While migrating all their data to the cloud might be disruptive or time-consuming in the short-term, companies that chose to switch received a massive benefit: interoperability.

Instead of relying on one end-to-end provider or a series of disconnected silos, companies could now stitch together their own stack from a series of best-in-class, API-equipped providers.

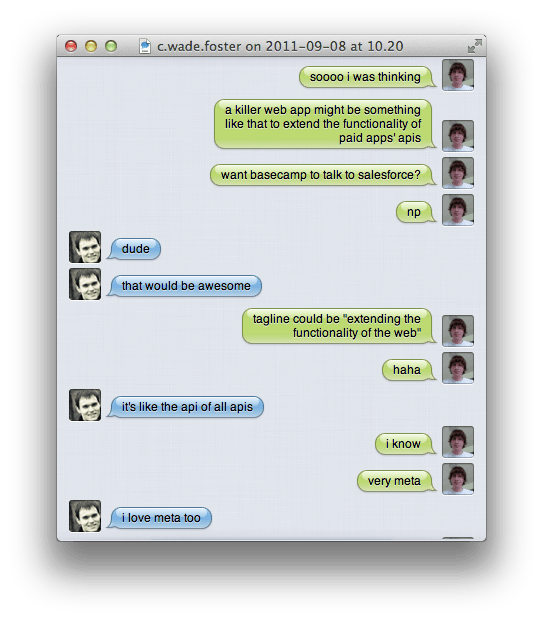

The instant message conversation that first seeded the idea of Zapier.

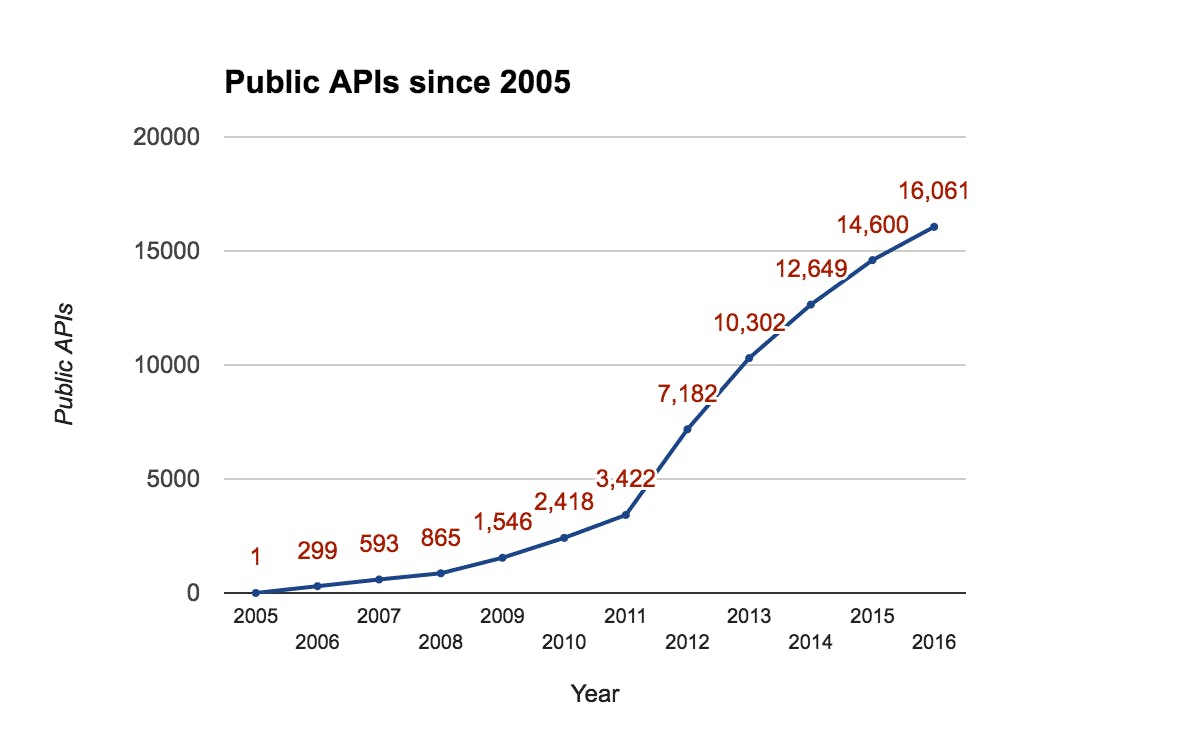

From 2006 to 2011, the number of public web APIs grew from 299 to 3,422. Companies with huge API investments like Salesforce, eBay, Facebook, Flickr, Amazon, Foursquare and Twilio built platforms and grew rapidly because with the ability to extend their own functionality with third-party partners, they could facilitate an ecosystem that was far more valuable than the best silo.

The number of public APIs increased 10x between 2009 and 2016. (Source: Readme)

Zapier got to $100M in ARR in under ten years riding and extending this tidal wave of growth. Outside the top companies were thousands that wanted to be part of the open ecosystem of the cloud but couldn’t write integrations for every tool their customers might use with theirs. Zapier offered them something easier: instead of writing integrations for all these different tools, just write an integration with us.

What Zapier provided was a universal “switch board”, allowing all these different tools to speak to each other. Data would be piped into Zapier, and it would be piped back into the other tools that a customer was using. This way, companies could easily provide the extensibility that their customers wanted while expending the minimum amount of developer time on the task—a powerful value proposition when every extra cycle is more time to focus on building your own product.

The number of public APIs would go on to grow from 3,422 in 2011 (the year Zapier was founded) to 16,061 by 2016, while the number of apps with which Zapier had integrations would go from a few dozen to more than 750. Today, Zapier is used by startups, SMBs, solopreneurs, creators, and teams inside growing companies to integrate with more than 3,000 applications.

For many, it operates as a hacky yet mission-critical piece of duct tape connecting tools that don’t offer any other form of interoperability. One solo entrepreneur we talked to was frank in admitting that he would be willing to pay Zapier 5x what he currently does simply because it saves hours of manual data entry.

As the number of SaaS APIs grows, we believe Zapier will continue serving in this fundamental role for millions of customers, with significant pricing power, and with a growing list of integrated applications. But long-term, Zapier faces competition that could undermine this core business.

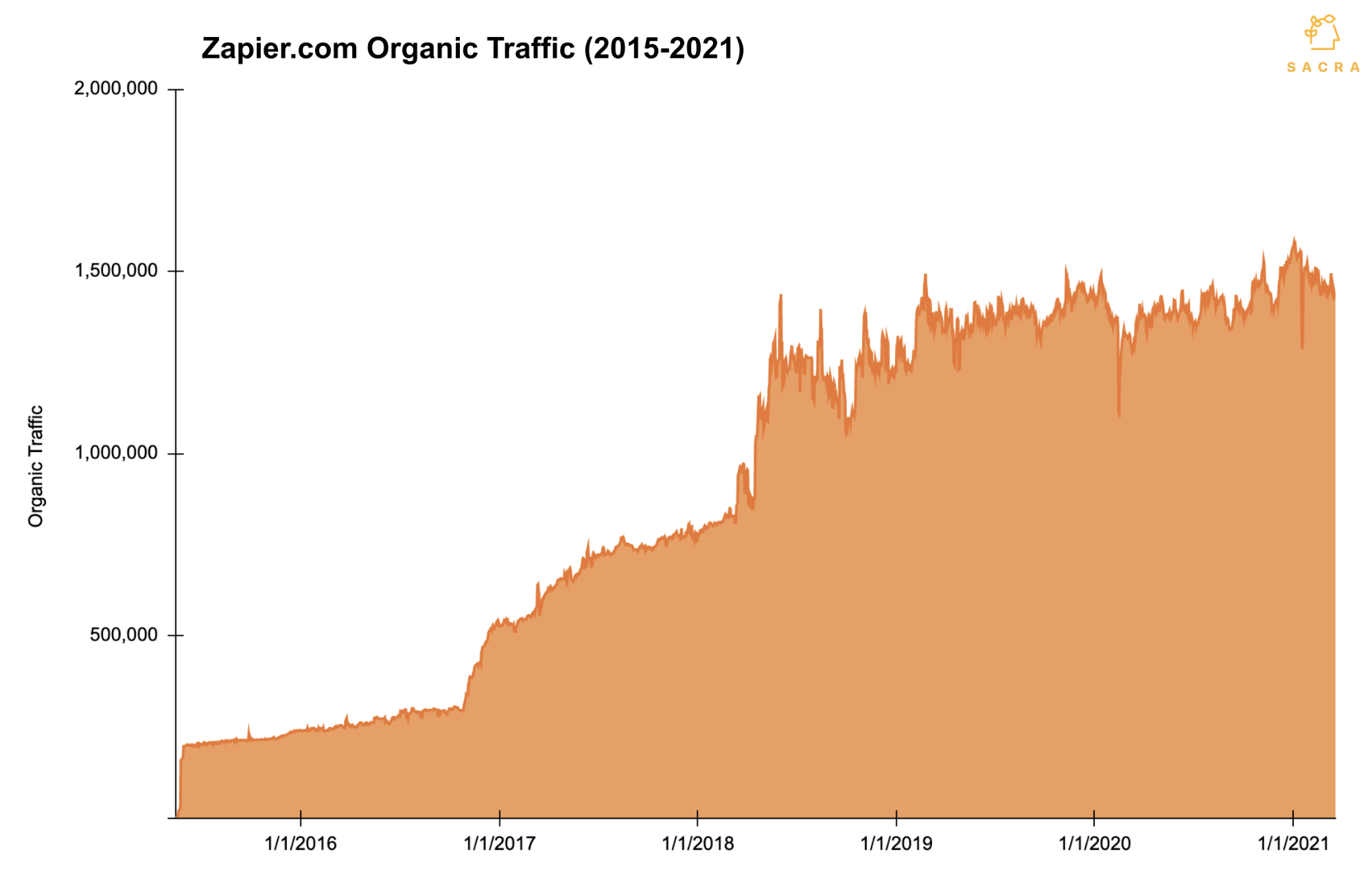

1. The 6,000,000-view-per-month SEO growth engine that got Zapier to $140M ARR

Taking $1.4M in venture capital and turning it into a $140M ARR business is a remarkable feat of capital efficiency. Core to Zapier’s ability to do this without spending millions of dollars in other people’s money—while competing with VC-funded IFTTT—was building one of the most impressive SEO machines in SaaS ever.

You may have seen a Zapier landing page if you’ve ever searched Google for how to integrate two pieces of software. They have tens of thousands of such pages as of 2021:

- “discord twitter integration” (#1 ranking)

- “shopify square integration” (#1 ranking)

- “basecamp slack integration” (#2 ranking)

- “discord steam integration” (#1 ranking)

- “slack facebook integration” (#1 ranking)

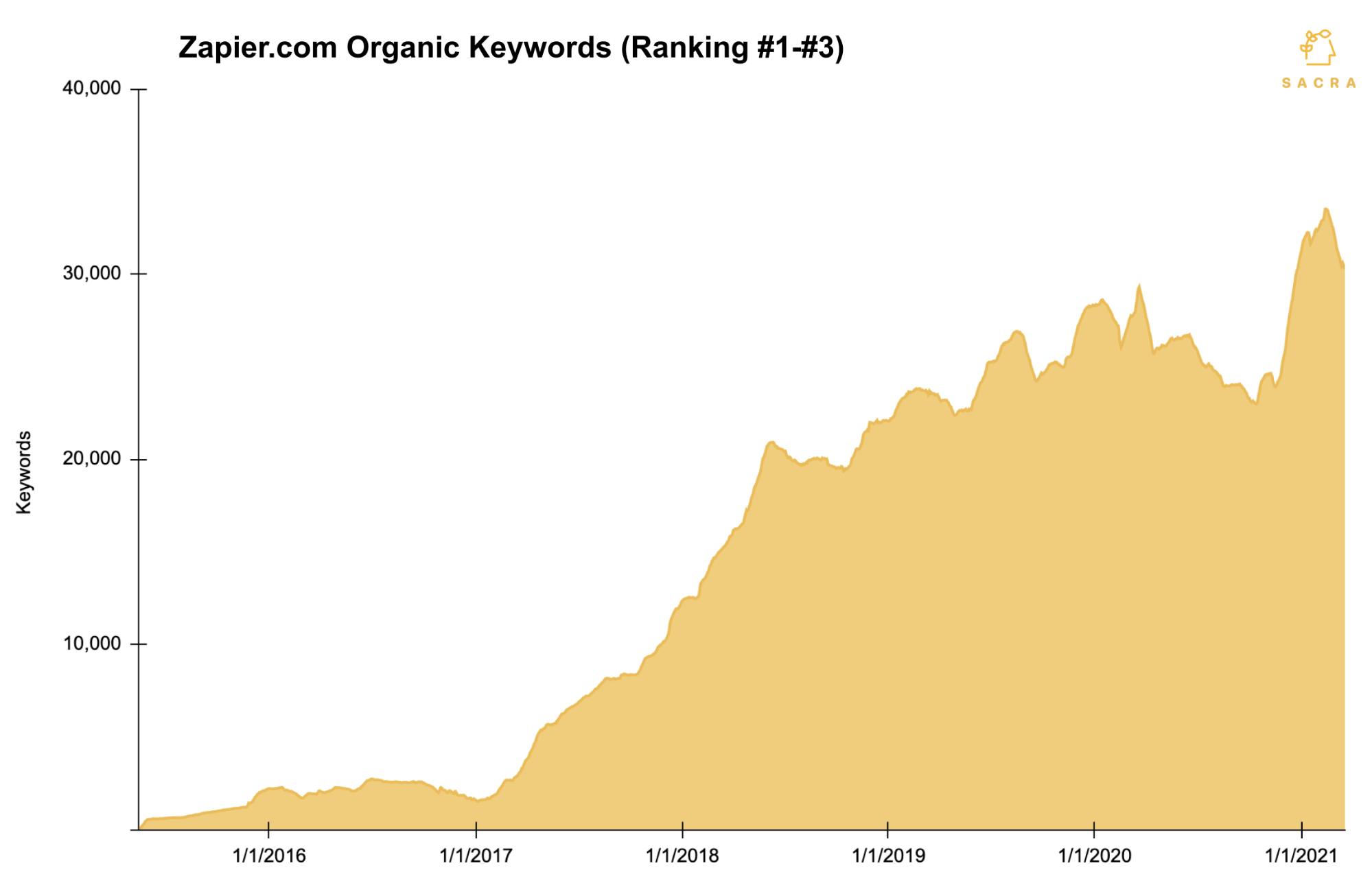

Between 2016 and 2021, Zapier’s traffic has grown by more than 7x to 6M+ unique visitors per month, and the number of unique terms for which Zapier ranks between #1 and #3 has grown from 2,000 to more than 30,000. The secret to Zapier’s success here is simple: new landing pages are published automatically as new apps join the platform, meaning they can be pushed out at huge scale with virtually no human effort required, and their content is almost entirely user-generated content.

Zapier gets about 50% of its overall traffic from search, a channel which they have tripled the size of overall over the last four years.

The main engine of growth for Zapier’s SEO strategy is the number of landing pages ranking between #1 and #3 in Google search results.

Zapier started building landing pages for tools that had integrated with the platform early on. The team knew that searches like “dropbox google docs integration” were common, and these pages were an attempt to get Zapier ranking for those searches.

- It costs nothing to have a #1 search result, and can drive thousands of qualified leads every month, especially if you sell to individuals, startups or SMBs and your pages are as well-tailored to satisfying the searcher’s intent as Zapier’s were.

- Over time, unlike the traffic you get from temporary social media spikes, organic traffic compounds. You get traffic into perpetuity despite only having to spend time building that page once.

- Also, it would only get easier for Zapier to execute on this strategy as their site grew and their domain became more highly ranked by Google itself

Programmatically generating these landing pages turned SEO from a marketing tactic to Zapier’s main growth engine.

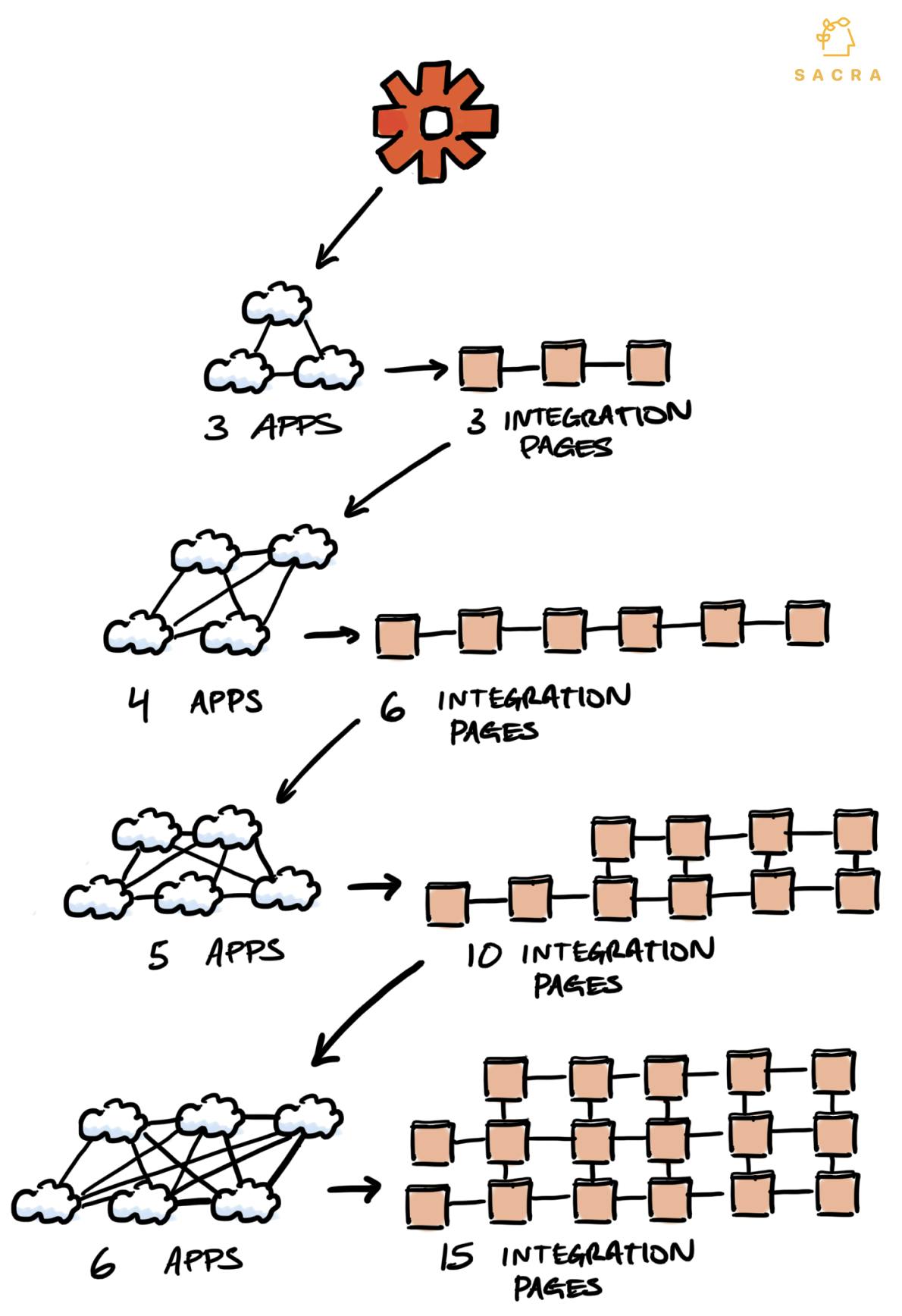

Each new app that integrates with Zapier spawns n(n-1)/2 new SEO-optimized landing pages.

As the number of pages being created on Zapier grew into the tens of thousands, Zapier became the dominant place on the internet that you would reach if you Googled for how to integrate virtually any two tools. This strategy drove Zapier’s entire growth engine:

- More landing pages means more traffic and users

- More traffic and users attracts more Zapier partners and the creation of more integrations

- More integrations means more users and more landing pages advertising those integrations.

And as Zapier became more and more popular, their authority in Google became stronger, increasing the likelihood that they would appear first on a given search results page and lessening the likelihood of a competitor being able to get their pages to rank first—with the #1 result for any search soaking up 33% of all demand on average.

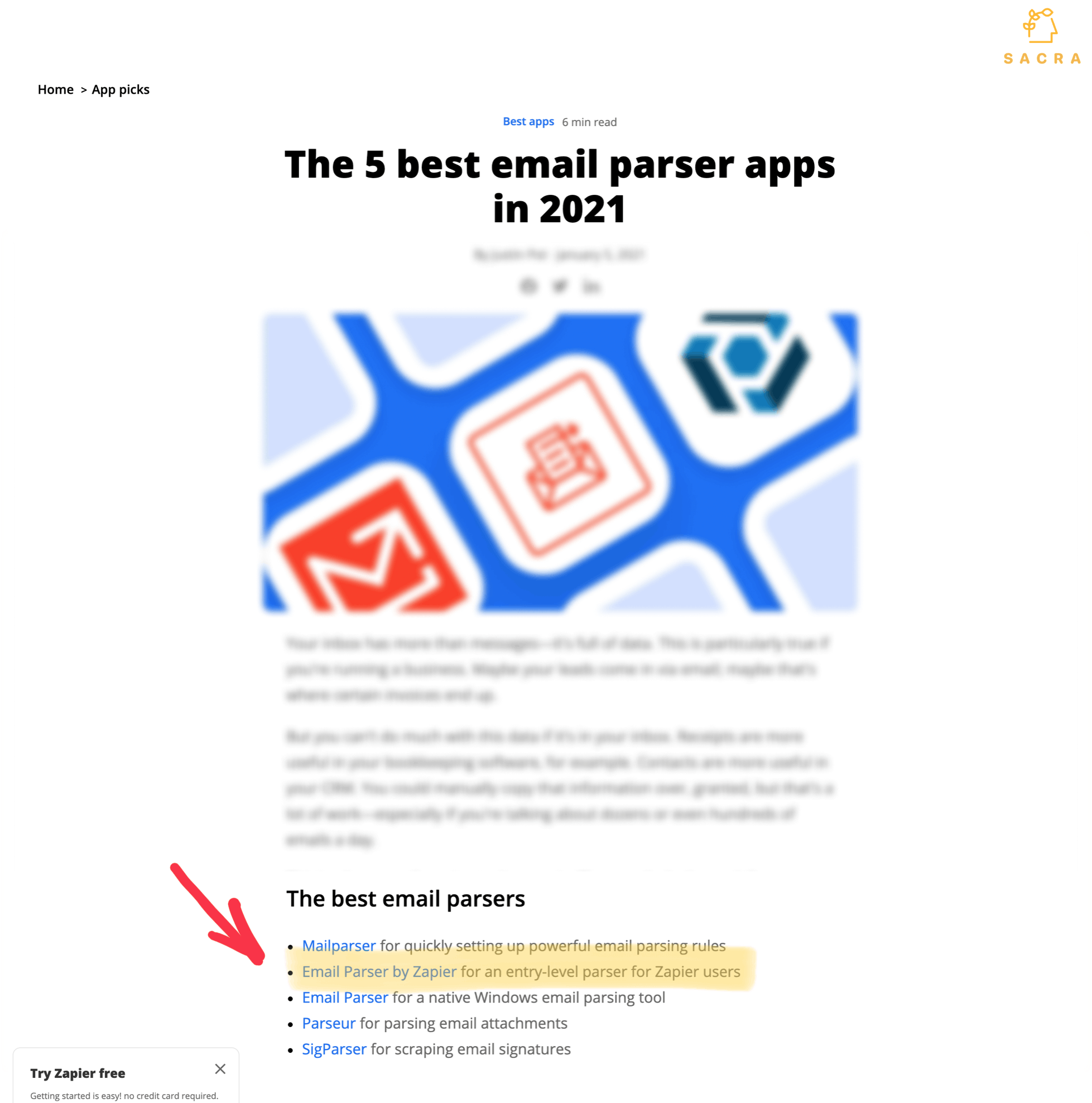

Zapier’s marketing content collects lists of the “best” products for different verticals.

All of this organic growth put Zapier closer and closer to the forefront of the customer experience. Bottom-up demand for the product began growing, with customers of other SaaS tools going to Zapier, realizing the integrations with other tools they could be using, and then asking the companies who built the products they use to get on Zapier.

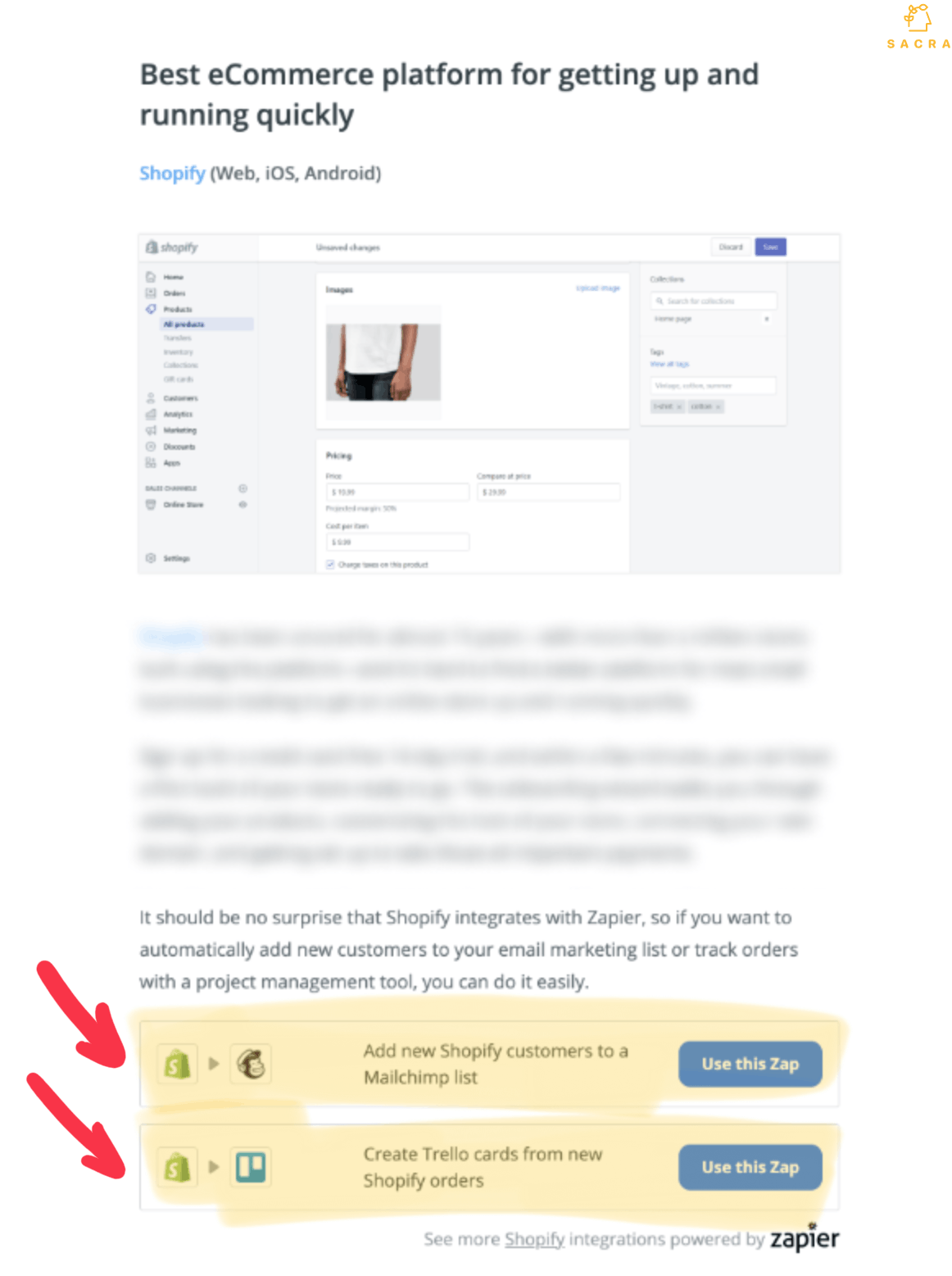

Zapier using its top position in search to advertise Zapier-integrated products—and its own native actions.

At the same time, Zapier was becoming more and more an opinionated aggregator of applications rather than simply a form of connective tissue between them.

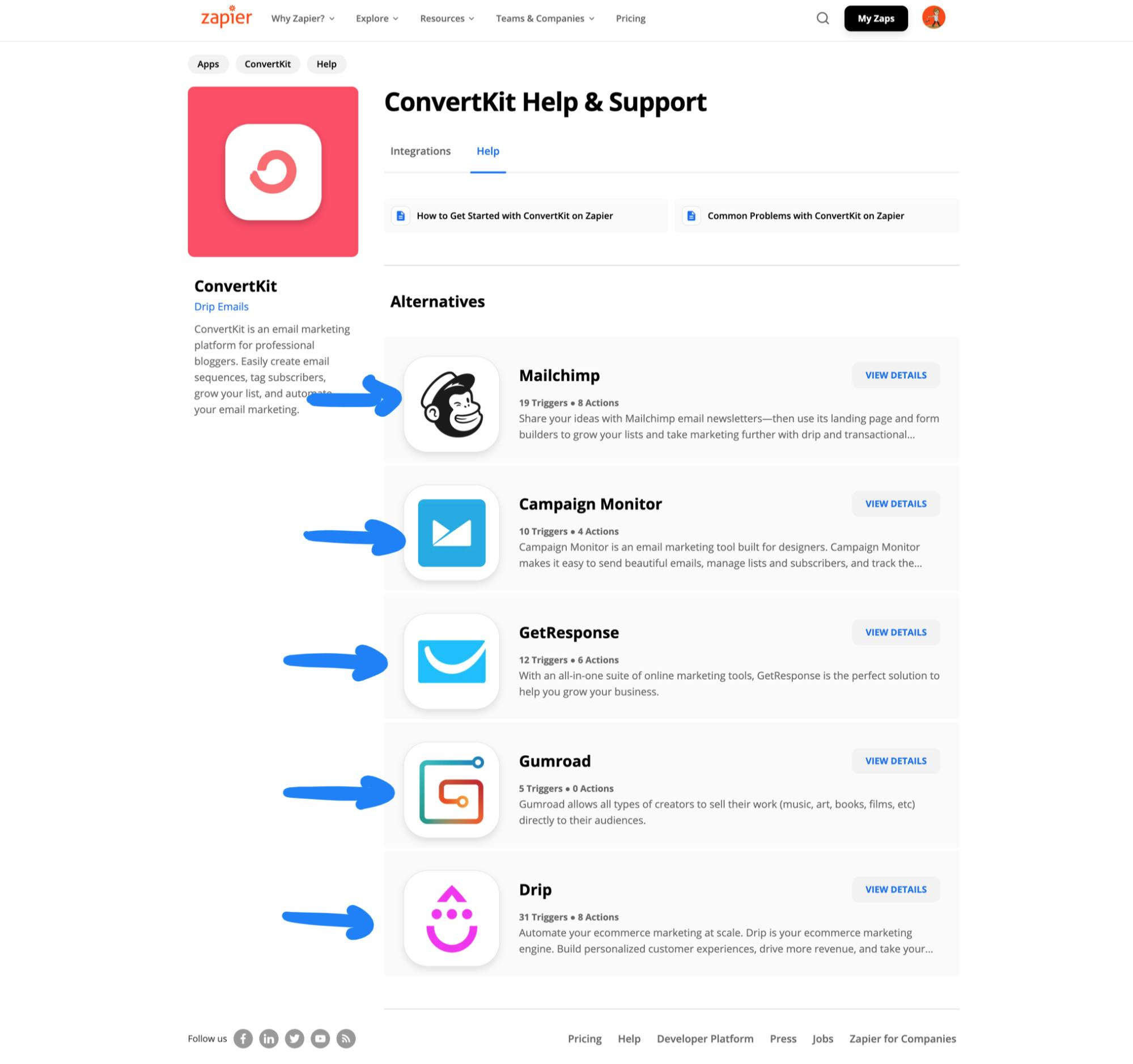

Zapier advertises the competition on the landing pages that they build for their integration partners.

Realizing that users would occasionally run into issues with one of the products they were using or thinking of using in an integration, Zapier started offering recommendations for alternative tools to use on their various product landing pages.

Rather than simply a piece of glue between products, Zapier was becoming an ecosystem unto itself—a marketplace for applications driving discoverability and setting standards versus merely a utility you might use to connect them.

This growth strategy would help propel Zapier to $100M+ in ARR in nine years. It would also come to test the relationships between Zapier and its partners.

Zapier had an incentive to be as helpful as possible to its partners early on when they had to attract more of them to the platform to make the product useful, but over time, partners began writing integrations themselves. Zapier became a destination and an onramp to these various tools.

Partners began to realize that Zapier now had the power to treat them as commodities: interchangeable parts that could be swapped out with any other similar product. (See our expert interviews for more on this)

Working with Zapier still made (and makes) sense for many SaaS platforms, and that’s especially true when thinking about the ‘long-tail’ of integrations that will never make sense to write in-house. But Zapier’s rapid growth and proximity to customers would eventually come to present a potential conflict for some partners—and help motivate them to start looking for ways to reduce the need for Zapier on the part of their customers.

2. How the drive towards better user experiences could force Zapier to the margins

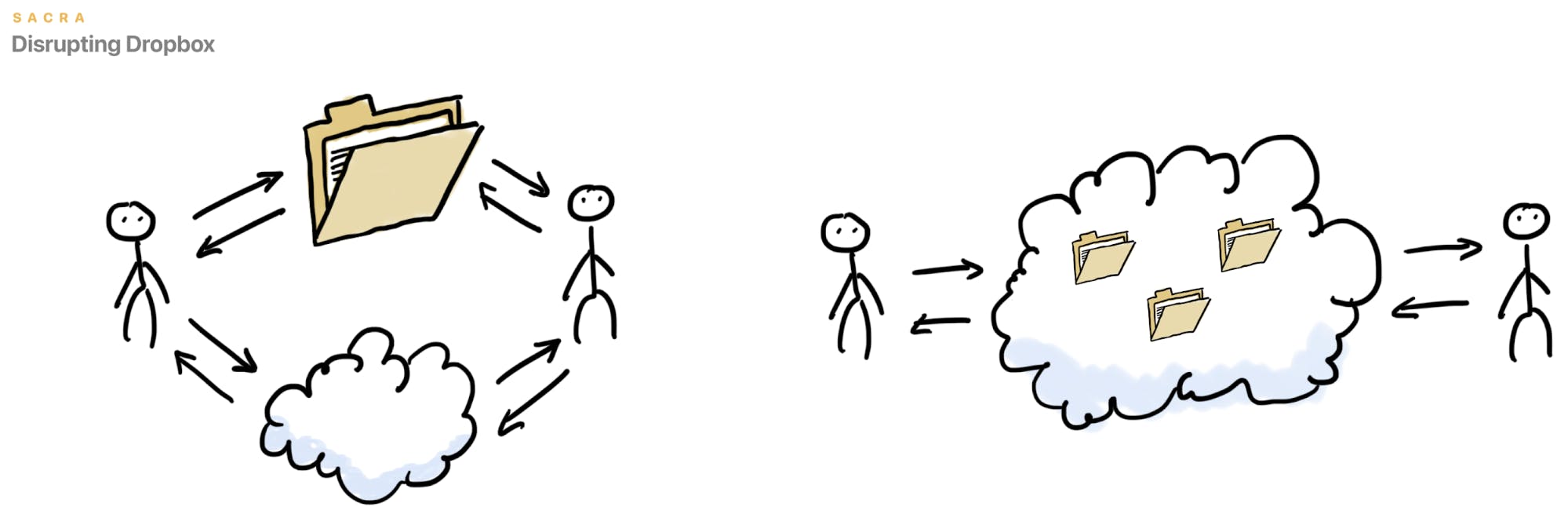

The bear case for Zapier involves the company being disintermediated much in the way that Dropbox was. For Dropbox, the file-in-the-cloud was its core concept, but over time, that concept became outdated. SaaS applications began building their own collaboration and file storage features, and as they did, it gradually made less and less sense to use separate apps for collaboration and file storage. The idea of file-in-the-cloud was distributed.

Dropbox was undone when file storage and sharing became a commodity/component of all cloud apps—the same could happen to Zapier.

For Zapier, the core idea is the trigger-and-action integration. For years, this was a vital corrective to the fact that there were so many SaaS products with APIs that weren’t natively integrated. But as the concept of enabling non-technical users to build their own tools has been popularized, and the value in building native integrations more recognized, the threat of Zapier’s value being similarly distributed across the ecosystem has become more real.

Dropbox, of course, is still a $10B+ business. And Zapier’s margins, momentum, and capital-efficient approach to growth mean a $10B+ outcome is still very likely. But long-term, these trends could be a problem.

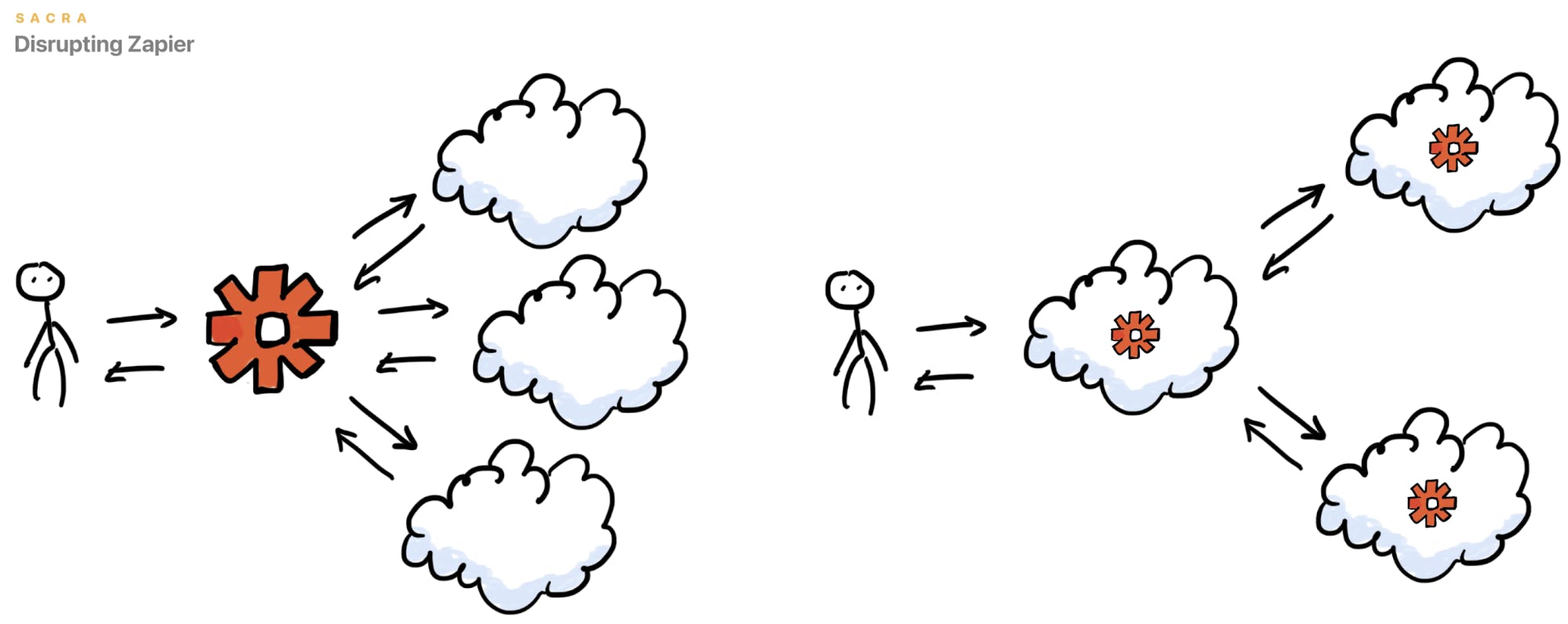

Zapier is a horizontal product—designed for no specific automation use case.

The core of the issue is that Zapier is a horizontal product, designed for maximum interoperability. Being compatible with 3,000+ apps is a huge value proposition for Zapier–but that breadth comes with a lack of depth:

- Native integrations offer end users a smoother, more robust experience, because users don’t have to go off-platform to configure the connection and because app developers have more control over the environment

- Vertical-specific platforms like Alloy Automation and Parabola allow end users to build automations just like the ones they would in Zapier, but with a more modern, drag-and-drop editor made possible because they’re serving a much more limited range of use cases.

That lack of depth hasn’t stopped Zapier from building a multi-billion dollar business—one reason we believe that they’re undervalued—but long-term, it could be a problem.

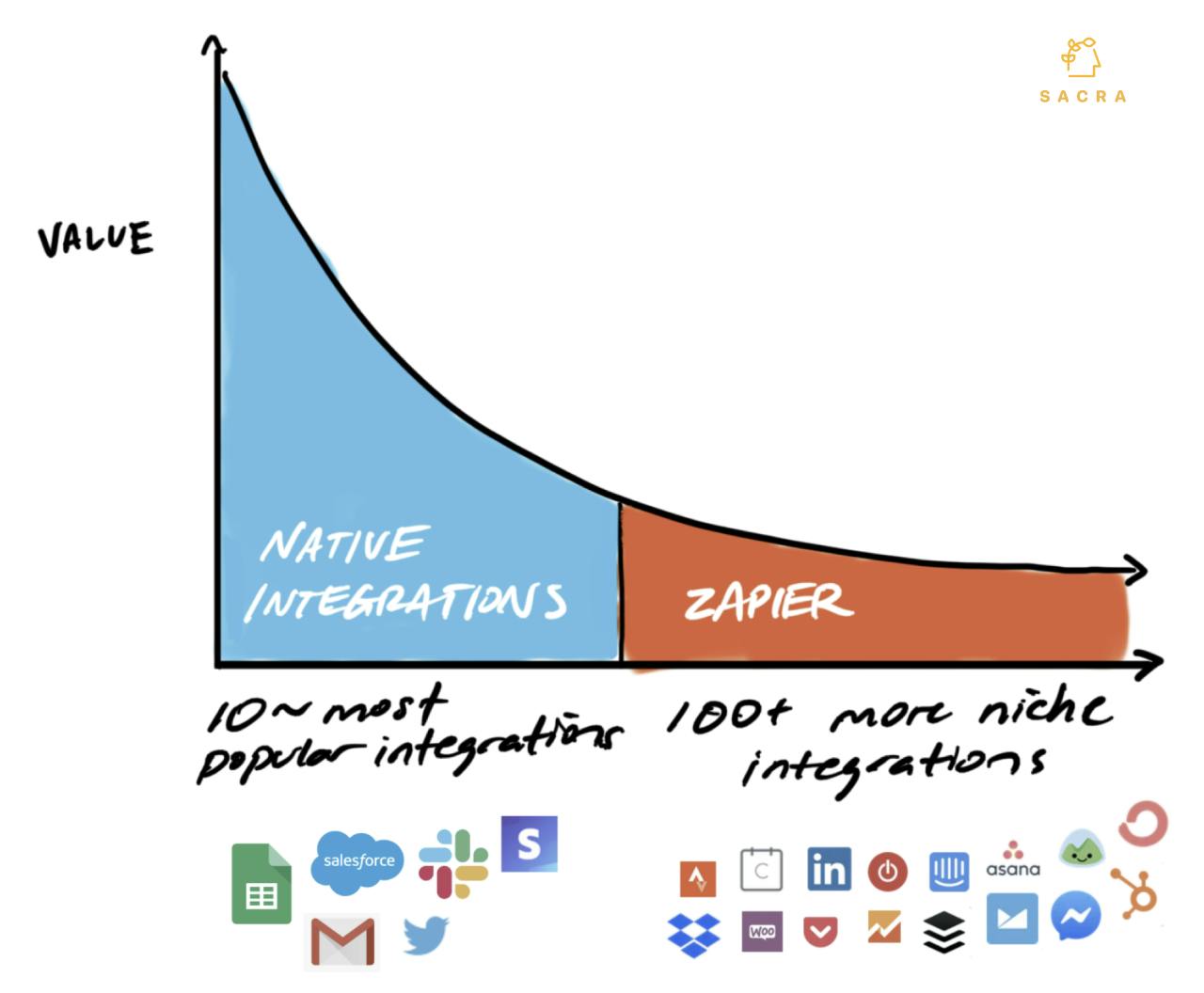

There’s a future where companies natively integrate with their 10~ most popular partners and relegate the rest (which represent 5-10% of usage) to Zapier.

If more Zapier partners start building their own native integrations with the help of APIs like Tray.io or Paragon and/or Zapier customers start building the brunt of their automations in vertical-specific tools like Alloy Automation (e.g. “Zapier for e-commerce”) or Checkbox (e.g. “Zapier for human resources”), it will cut into the number of tasks being completed in Zapier, which will cut into the revenue that they generate.

Zapier must walk a fine line between supporting its partners and ensuring that they stay integrated with Zapier versus prioritizing their own native integrations.

These vertical-specific tools are valuable because they index on functionalities underdeveloped inside Zapier, like looping an action over a large dataset, which an ecommerce store owner might use to mass-alter a group of products or run their delivery process.

Tray.io and Paragon, meanwhile, look to make it as easy as possible for SaaS companies to spin up a range of integrations that look and feel completely native. That’s important because companies want to keep barriers to activation as low as possible. Forcing their users off-platform to set up an integration with another tool risks churn and it keeps them from learning what kinds of features their users might need in the core product.

There’s evidence to suggest Zapier is aware of these different threats. In interviews, current and former Zapier partners said that while Zapier collected usage data from its third-party partners, it did not share any of that data with its partners. That’s the kind of data that would, for SaaS products, be highly useful in determining which handful of native integrations to build.

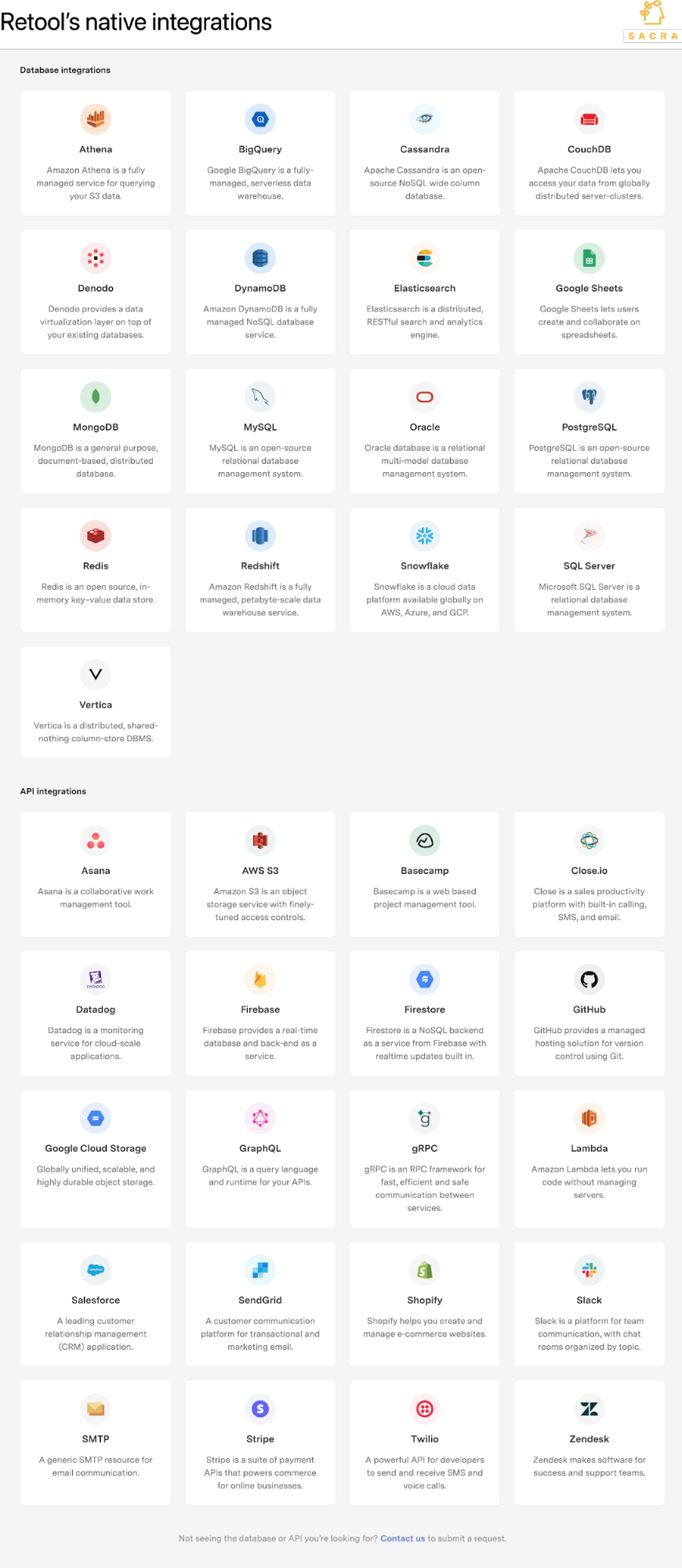

Low-code product Retool offers native integrations with dozens of tools—an indication of how native integrations are increasingly seen as a core part of the product experience.

Still, end-user expectations around integrations are growing, and for many in the newest wave of no- and low-code tools like Retool, building integrations in-house is key. Integrations, for them, are a means of improving the onboarding and overall experience of using their product—not extending its functionality to thousands of outside apps, but making it work with the few most important ones.

There’s a future where companies use some mix of native integrations and Zapier. Native integrations would be reserved for mission-critical integrations that a large portion of users rely on. Zapier would then be a way to serve the long tail: people with hyper-specific and less valuable use cases. The long-term question is how quickly then that long tail would continue to grow—and whether it would be able to make up for the revenue lost from the head.

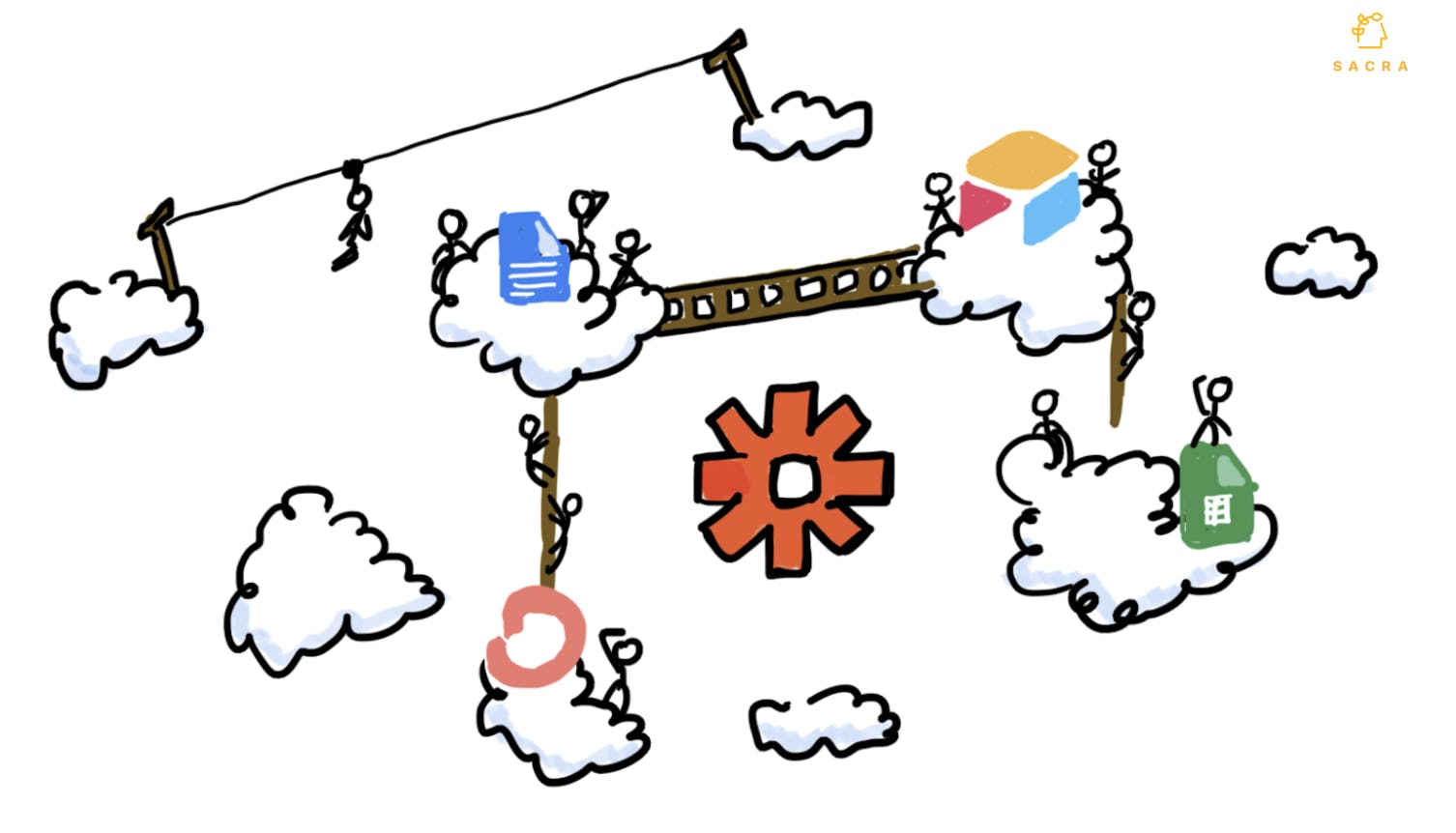

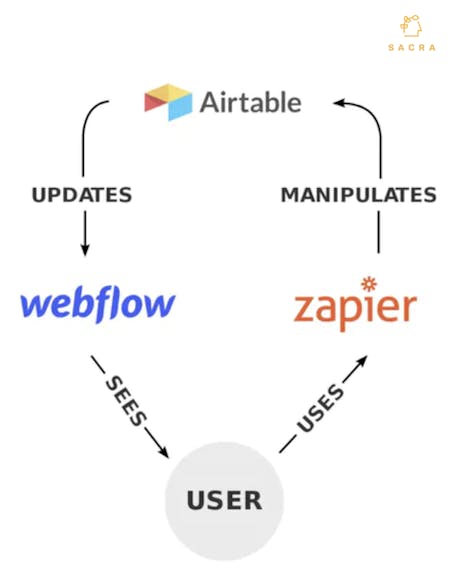

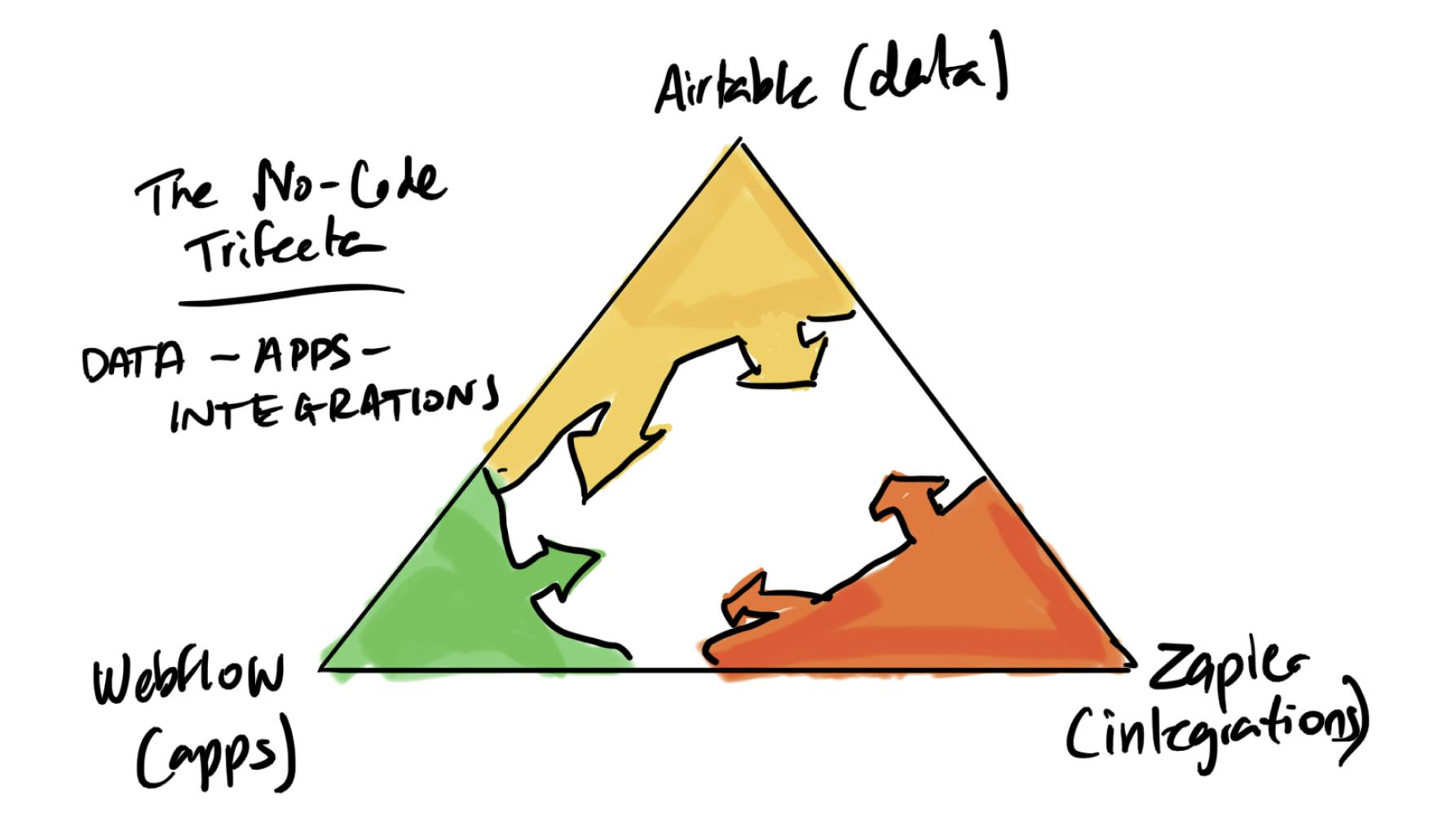

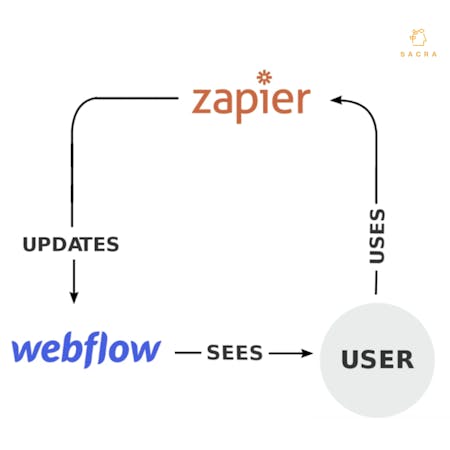

3. Zapier’s path out of the unstable triad of the AWZ stack

The term “AWZ stack” was coined by Zapier CEO Wade Foster for the three products—Airtable, Webflow and Zapier—frequently used together in no-code projects. It works in something like a model-view-controller (MVC) pattern:

- End-users interact with an app’s logic through Zapier

- Zapier listens to and updates the database stored in Airtable

- Webflow exposes and visualizes the contents of the database to the public

You can think of Zapier-Airtable-Webflow as a “no-code MVC”, with Zapier as the controller (first point of contact with user).

This triad, despite the complementary nature of the tools today, is not stable. We’re seeing the AWZ stack converge on itself as the different products in it look to build a better user experience:

- Airtable is building its own integration platform to erase the need for Zapier and a marketplace so users can share their automations with the community.

- Webflow is moving backwards into data management via CMS so their users can spend less time going back and forth between Webflow and Airtable.

As these functionalities overlap, it creates redundancy—data being stored across multiple platforms—and extra cost for users.

The “AWZ” stack of Airtable, Webflow and Zapier is no longer a stable triad, with Airtable encroaching on Zapier and Webflow moving backwards into data management.

To win, Zapier should be doing the flip of what Airtable is trying to do in building its own integrations platform: disintermediating Airtable by building its own Zapier-native data store.

In this strategy, there are echoes of Netflix’s evolution from content channel to aggregator:

- Before Netflix was a hub for original movies and television, studios saw it as just another distribution channel—more or less another HBO or Showtime.

- Gradually, they realized that Netflix was commoditizing them by making all of their content available at all times, and was building a huge subscriber base and an incredibly sticky user experience in the process.

With Zapier, similarly:

- Companies saw it as a way to reach many more potential customers by writing a few basic integrations.

- As they’ve scaled to 3,000+ integrations, Zapier has effectively commoditized the apps on its platform, any one of which can be switched out at will with a range of similarly compatible competitors.

And where Netflix cultivated closer relationships with its users by breaking television’s linear structure, Zapier has done it by breaking the limits of apps’ different APIs and creating an ecosystem where any product can integrate with any other product. Netflix commoditized time; Zapier commoditizes apps.

There’s been pushback to both:

- Studios would try to fight back against Netflix by withholding their top content from the platform, rethinking their licensing deals, and launching their own streaming apps.

- On the Zapier side, apps like Airtable and Hubspot have started restricting Zapier’s access to certain API endpoints while they build out native integrations that they think will provide a better customer experience.

The problem for the studios, in the end, was that Netflix had years to use their content to build up an audience of millions and gather data on that audience’s interests, and by the time “The Office” and “Friends” left Netflix, the platform had become an original content powerhouse.

Zapier has similar structural advantages. Their website is massively popular with startups, SMBs and solopreneurs looking for help with productivity and SaaS products—the search data makes clear that for many of them, it no longer matters what tool they use, just that it works well with Zapier:

- “zapier crm integrations” (#1 ranking)

- “zapier email parser” (#1 ranking)

- “zapier webhooks” (#1 ranking)

- “zapier email” (#1 ranking)

- “zapier forms” (#1 ranking)

While Zapier—like Netflix—was originally seen as a harmless middleman, these searches show how powerful Zapier has become in the productivity world

Zapier has gone from modularizing apps to producing its own native actions the same way Netflix went from modularizing content to producing its own movies and TV.

And Zapier has realized that it can use this demand and its understanding of people’s workflows around SaaS to build its own kind of “original content”: native actions. All of the data flowing in and out of all the SaaS products partnered with Zapier feeds into Zapier’s ability to replicate the functionality of those products in the form of native actions.

Zapier’s mindshare in the no-code space gives them a powerful advantage when it comes to understanding what users need:

- Zapier’s blog gets a magnitude more traffic than direct competitors like Automate.io or Integromat.

- It also gets 2x the organic traffic of Webflow and nearly 3x that of Airtable—the two companies that are Zapier’s closest competitors here.

Zapier’s problem, however, is that it lacks a data store: Airtable owns the data layer of no-code. A Zapier data store would go a long way towards removing the main constraint on Zapier’s utility today, which is the lack of deep utility.

As they stand today, Zaps get complex quickly, and they’re always going to be limited by the constraints of the two APIs on either side of the trigger and the action, which means Zapier will never be able to provide the same level of control and frictionless user experience that apps can provide natively.

Having user data stored inside Zapier could change that. With customer data living inside Zapier instead of Airtable or Google Sheets, Zapier could gain control over the next part of the MVC diagram of no-code. They could own not just the “controller” but the “model”, allowing them to own and improve even more of the user experience

Netflix’s commoditization-and-integration strategy relied on the Netflix user experience being better than watching television in a linear, time-bound format. Compared to Zapier, native integrations are generally still superior.

With their own data store, however, Zapier would turn their user experience problems on their head:

- All of Zapier’s integrations would become native integrations. Zapier would go from being a back-up plan if an app doesn’t have native integrations to being a platform that provides near-native integration with 3,000+ apps and a bevy of generic actions.

- Zapier would solve the no-code data problem. Without a centralized database (like Airtable), your data ends up scattered across the dozens of different tools you use to run your business: all of the ConvertKits and Ghosts and Todoists and Wordpresses and Substacks.

- Unlike Airtable, Zapier wouldn’t have the challenge of convincing people to store their data in a new tool. They’re already hooked into all the SaaS tools that you know and use on a daily basis—they already have your login information and your authorization to pull data out of them. All they’d have to do is pull it all into one place.

The ultimate vision: Zapier becomes the primary aggregator of all SaaS applications and the main conduit between them and millions of business users around the world.

What Zapier would become, in this vision, is the place where all of your data and business logic lives.

It wouldn’t matter what tools you were using for your CRM or your ads or marketing, because your primary touchpoint with that data would be through Zapier. Eventually, Zapier would learn even more from how you use your tools, and offer even more native actions to replace your existing stack. Zapier would be the conduit through which the entire no-code ecosystem runs: a no-code super aggregator.

The future of Zapier

There will always be businesses and individuals looking to pipe data between tools that don’t talk to each other. Odds are good that Zapier will continue to build a big(ger) business serving them—especially as tens of millions of new no-code builders are minted, whether they are individuals or SMBs.

And Zapier’s closeness to end users—embodied by their SEO-oriented growth strategy—means they will likely continue to be a big channel through which many SaaS apps reach new users.

But as native integrations become more widespread, Zapier’s role could gradually be diminished—companies could bring their most-used integrations in-house, leaving Zapier to handle the long-tail of more niche or even hobbyist automations. If Zapier is duct tape, a more integrated SaaS ecosystem could mean less need for it.

Zapier does have two powerful things going for it, however. Because Zapier only raised $1.4M in venture capital, the team has the cushion to build without pressure from their investors. And with their close proximity to the SaaS application workflows of millions of users, they have an extremely high resolution view into how people use their tools.

Appendix

Disclaimers

- Sacra has not received compensation from the company that is the subject of the research report.

- Sacra generally does not take steps to independently verify the accuracy or completeness of this information, other than by speaking with representatives of the company when possible.

- This report contains forward-looking statements regarding the companies reviewed as part of this report that are based on beliefs and assumptions and on information currently available to us during the preparation of this report. In some cases, you can identify forward-looking statements by the following words: “will,” “expect,” “would,” “intend,” “believe,” or other comparable terminology. Forward-looking statements in this document include, but are not limited to, statements about future financial performance, business plans, market opportunities and beliefs and company objectives for future operations. These statements involve risks, uncertainties, assumptions and other factors that may cause actual results or performance to be materially different. We cannot assure you that any forward-looking statements contained in this report will prove to be accurate. These forward-looking statements speak only as of the date hereof. We disclaim any obligation to update these forward-looking statements.

- This report contains revenue and valuation models regarding the companies reviewed as part of this report that are based on beliefs and assumptions on information currently available to us during the preparation of this report. These models may take into account a number of factors including, but not limited to, any one or more of the following: (i) general interest rate and market conditions; (ii) macroeconomic and/or deal-specific credit fundamentals; (iii) valuations of other financial instruments which may be comparable in terms of rating, structure, maturity and/or covenant protection; (iv) investor opinions about the respective deal parties; (v) size of the transaction; (vi) cash flow projections, which in turn are based on assumptions about certain parameters that include, but are not limited to, default, recovery, prepayment and reinvestment rates; (vii) administrator reports, asset manager estimates, broker quotations and/or trustee reports, and (viii) comparable trades, where observable. Sacra’s view of these factors and assumptions may differ from other parties, and part of the valuation process may include the use of proprietary models. To the extent permitted by law, Sacra expressly disclaims any responsibility for or liability (including, without limitation liability for any direct, punitive, incidental or consequential loss or damage, any act of negligence or breach of any warranty) relating to (i) the accuracy of any models, market data input into such models or estimates used in deriving the report, (ii) any errors or omissions in computing or disseminating the report, (iii) any changes in market factors or conditions or any circumstances beyond Sacra’s control and (iv) any uses to which the report is put.

- This research report is not investment advice, and is not a recommendation or suggestion that any person or entity should buy the securities of the company that is the subject of the research report. Sacra does not provide investment, legal, tax or accounting advice, Sacra is not acting as your investment adviser, and does not express any opinion or recommendation whatsoever as to whether you should buy the securities that are the subject of the report. This research report reflects the views of Sacra, and the report is not tailored to the investment situation or needs of any particular investor or group of investors. Each investor considering an investment in the company that is the subject of this research report must make its own investment decision. Sacra is not an investment adviser, and has no fiduciary or other duty to any recipient of the report. Sacra’s sole business is to prepare and sell its research reports.

- Sacra is not registered as an investment adviser, as a broker-dealer, or in any similar capacity with any federal or state regulator.