Why Brex sold to Capital One

Jan-Erik Asplund

Jan-Erik Asplund

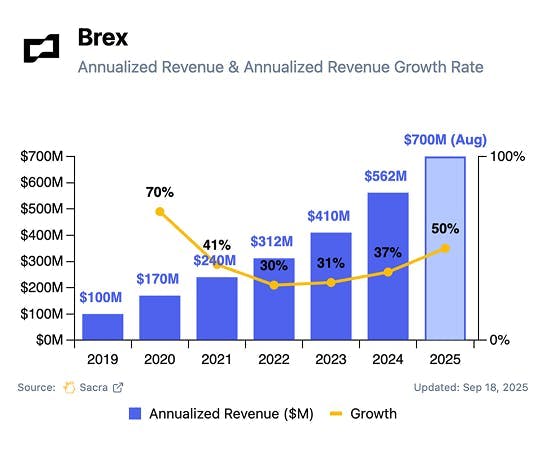

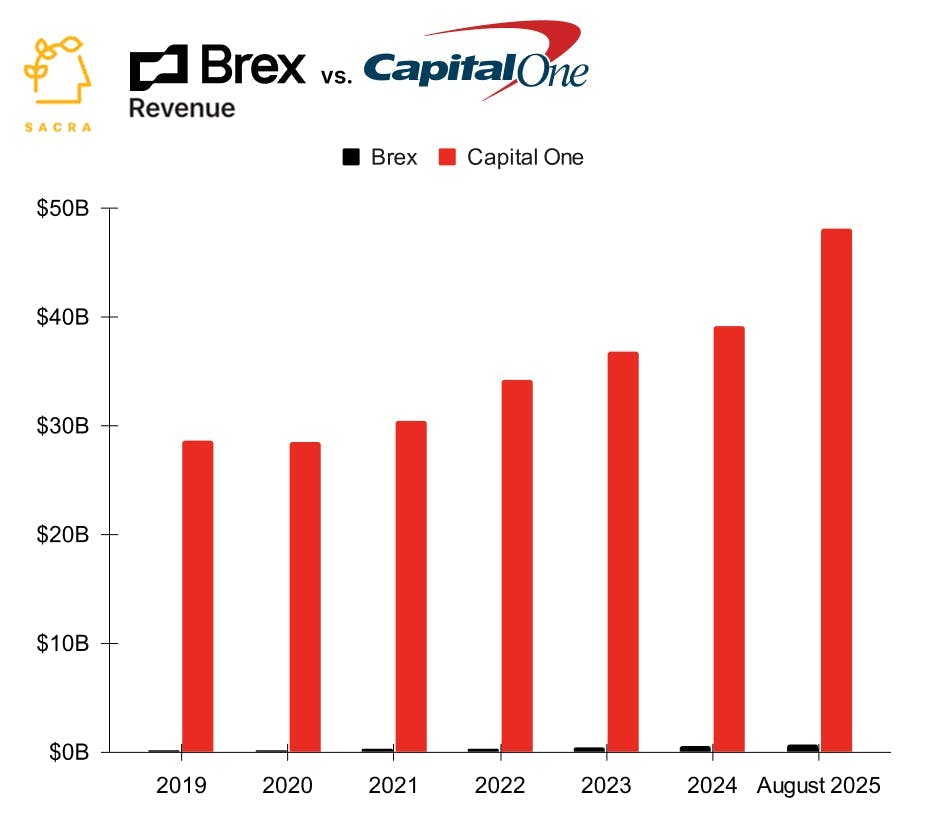

TL;DR: Brex’s $5.15B sale to Capital One reflects both its post-2023 comeback, exiting on the upswing (re-accelerating growth to 50% YoY at $700M in annualized revenue and nearing cash-flow positive) and that it still faces the daunting task of transitioning from a majority interchange model to an enterprise SaaS, AI platform and network to drive multiple expansion. For more, check out our full report and dataset.

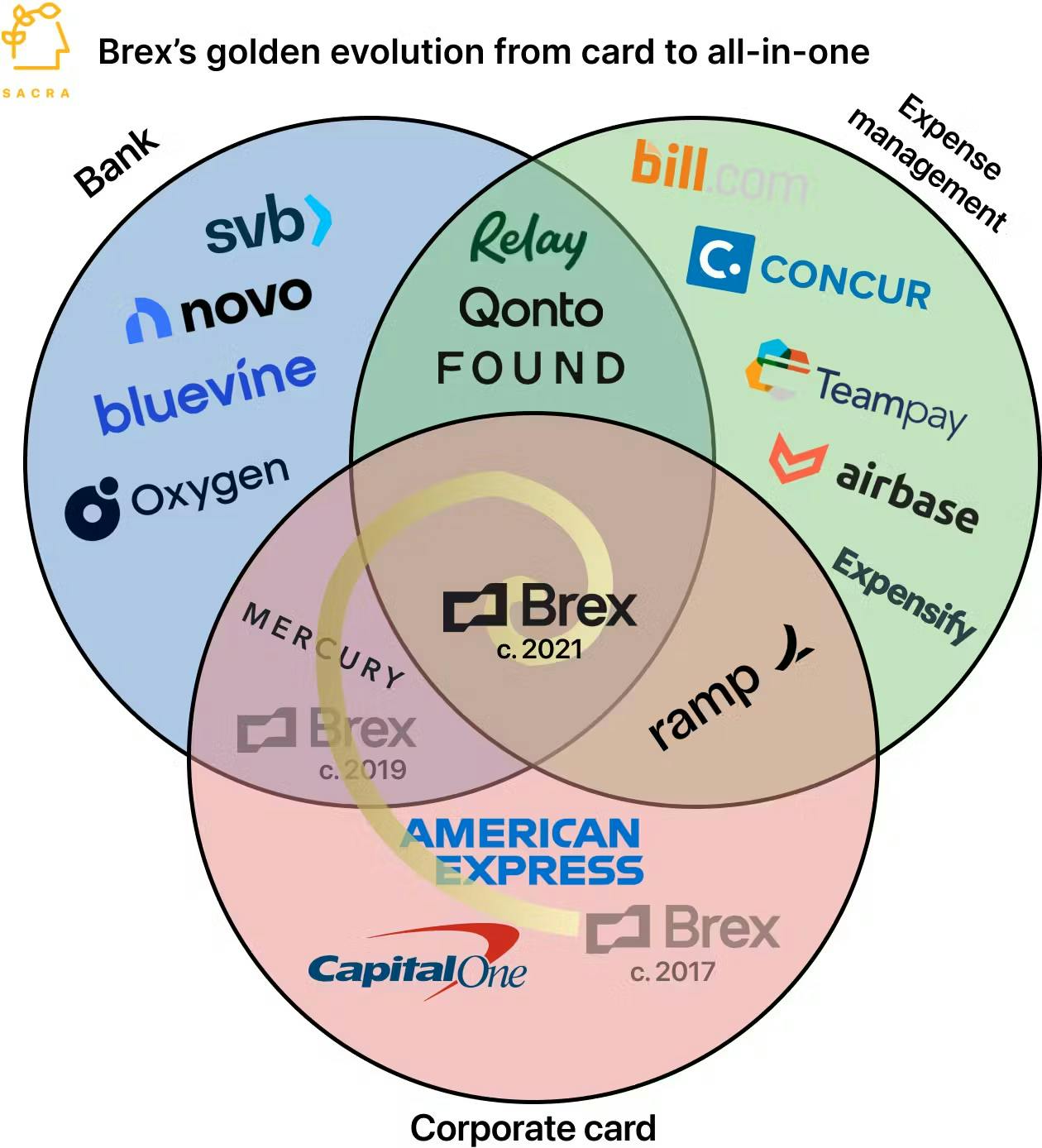

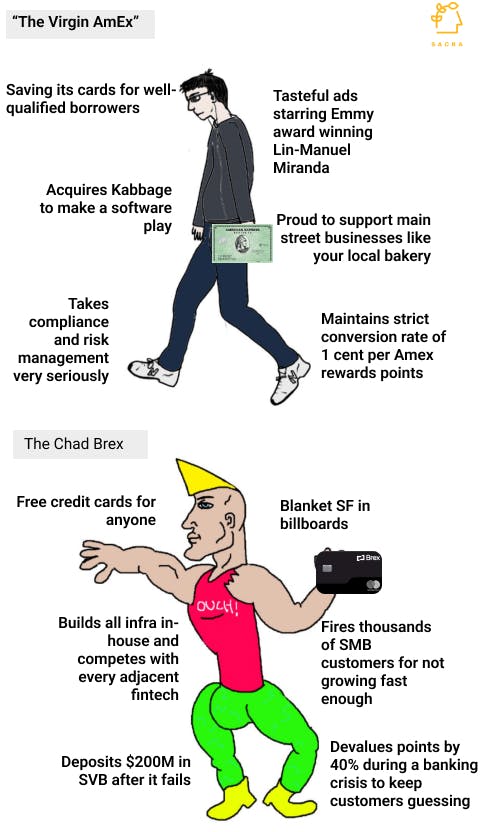

Founded in 2017, Brex hit $100M in annualized revenue in just over a year, at the time one of the fastest growing startups of all time, built on giving underserved startup founders access to credit via free credit cards without any personal guarantee, underwritten instantly by connecting bank balances via Plaid and monetized on the backend via interchange.

We first wrote about Brex, “the anti-Amex”, at ~$312M in revenue as of 2022 as their financial backoffice all-in-one was just taking shape, and we followed up by interviewing Brex’s Chief Business Officer Art Levy about the strategy behind Brex Embedded in October 2024.

In September 2025, we covered Brex re-accelerating to 50% YoY growth & hitting $700M in annualized revenue as of August.

Last Thursday, Capital One (NYSE: COF) announced it was acquiring Brex ($700M annualized revenue, August 2025) for $5.15B in the largest bank-fintech deal in history.

Key points on the deal via Sacra AI:

- Brex’s growth decelerated to ~30% YoY in 2022 and 2023 as it burned ~$22M/month in Q4’22 and ~$17M/month in Q4’23, fighting as the market leader on a two-front war against Mercury ($650M annualized revenue in September 2025) as a B2B neobank challenger, benefitting the most from the SVB collapse on banking & deposits and Ramp ($1B annualized revenue in August 2025) on enterprise finance SaaS, attacking Brex by going deep on expense management & bill pay.

- In 2024, Brex began to re-accelerate while cutting headcount and getting close to cash-flow positive, engineering a rarely-seen smile growth curve, hitting 37% YoY at $562M in annualized revenue in 2024 and then 50% YoY at $700M in annualized revenue in August 2025 after rewiring its go-to-market by adding embedded fintech as a channel and driving distribution for its cards through enterprise partners like Sabre (travel), Coupa (procurement), Navan (travel) & Fifth Third Bank (commercial banking).

- At $5.15B, Brex is selling to Capital One at ~7.4x its $700M run-rate (August 2025), an exit timed to monetize its resurgence while still being valued primarily as an interchange-heavy, cyclical payments business—in the ballpark of Klarna at 3.5x ($9.7B market cap on $2.81B TTM revenue, +24% YoY) and Affirm at 6.6x ($22.7B market cap on $3.46B TTM revenue, +34% YoY)—choosing to put a win on the board now, before proof of its next chapter as an enterprise SaaS + AI platform and network can command a higher multiple over time.

For more, check out this other research from our platform:

- Brex (dataset)

- Art Levy, Chief Business Officer at Brex, on the strategy of Brex Embedded

- Brex at $700M/year growing 50% YoY

- Brex: the $400M/year anti-Amex

- Ramp passes Brex

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mercury: the unbundling of Silicon Valley Bank

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- The neobank capital cycle

- Why Stripe bought Metronome

- Amy Loh, CMO of Pipe, on Pipe's next act as embedded fintech

- $400M/year Oneworld of housing

- Bo Jiang, CEO of Lithic, on the power of the cards as a digital payment rail

- René Saul and Fernando Sandoval, co-founders at Kapital, on the fintech opportunity in LatAm