Weee! vs. Instacart

Jan-Erik Asplund

Jan-Erik Asplund

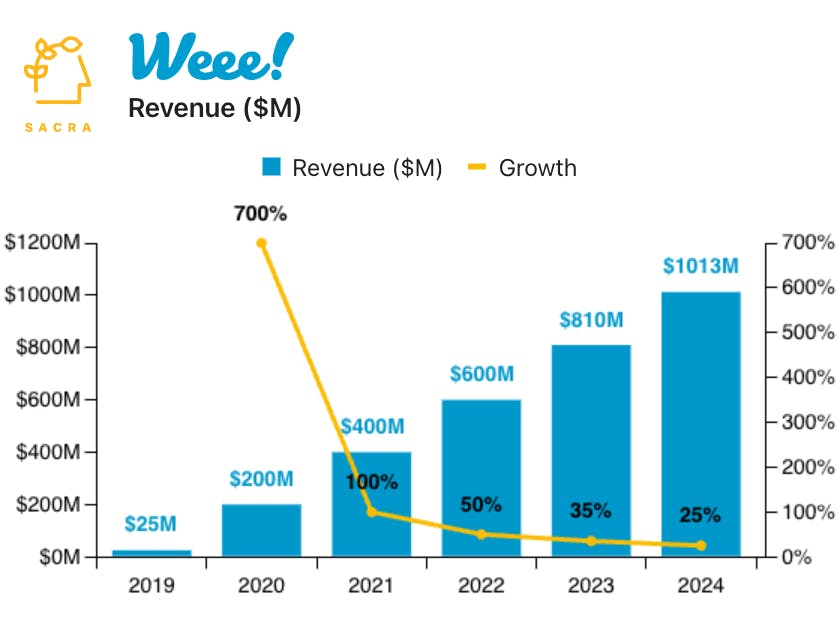

TL;DR: Starting as a WeChat group-buying service for Asian groceries, Weee! has evolved into a vertically-integrated online ethnic supermarket capturing 40-50% of customers' monthly grocery spend through specialized selection and 30-50% lower prices than local markets. Sacra estimates Weee! hit $1.013B in revenue in 2024, up 25% from $810M in 2023. For more, check out our full report and dataset on Weee!

Key points via Sacra AI:

- Initially launched in 2015 as a WeChat group-buying service connecting wholesale vendors with Chinese immigrants in the Bay Area—Weee! leveraged those connections to suppliers to launch a marketplace in 2017, directly sourcing fresh fruits, produce and other items from 300+ American producers and exclusive Asian partners and delivering through their own last-mile network of distribution hubs and delivery drivers. Unlike local Asian markets that rely on regional distributors/middlemen, Weee!’s direct sourcing enables higher gross margin (25-30% vs traditional grocers' 15-20%) and prices that are up to 50% lower, driving high average order value (~$250 monthly spend).

- As Weee! has grown from 9 states to delivering 40K daily orders across the entire contiguous United States, Sacra estimates Weee! generated $1B in revenue in 2024, up 25% from $810M in 2023, last valued at $4.1B in their $425M February 2022 Series E led by SoftBank Vision Fund for a 6.8x multiple on 2022 revenue of $600M. Compare to traditional Asian grocery chains like H-Mart with $2B in revenue from 100+ physical stores and 99 Ranch Market with 69 stores, while venture-backed ethnic e-grocery competitors like Umamicart, Sarap Now, and Kim'C Market maintain smaller regional footprints with 5-10% market share—and online grocery incumbent Instacart (NASDAQ: CART) at 800k daily orders and $3.3B in trailing twelve month revenue (15% take rate on delivery vs. Weee!’s full retail margin as a direct sell), growing 9% YoY, valued at $12.6B for a 3.8x multiple.

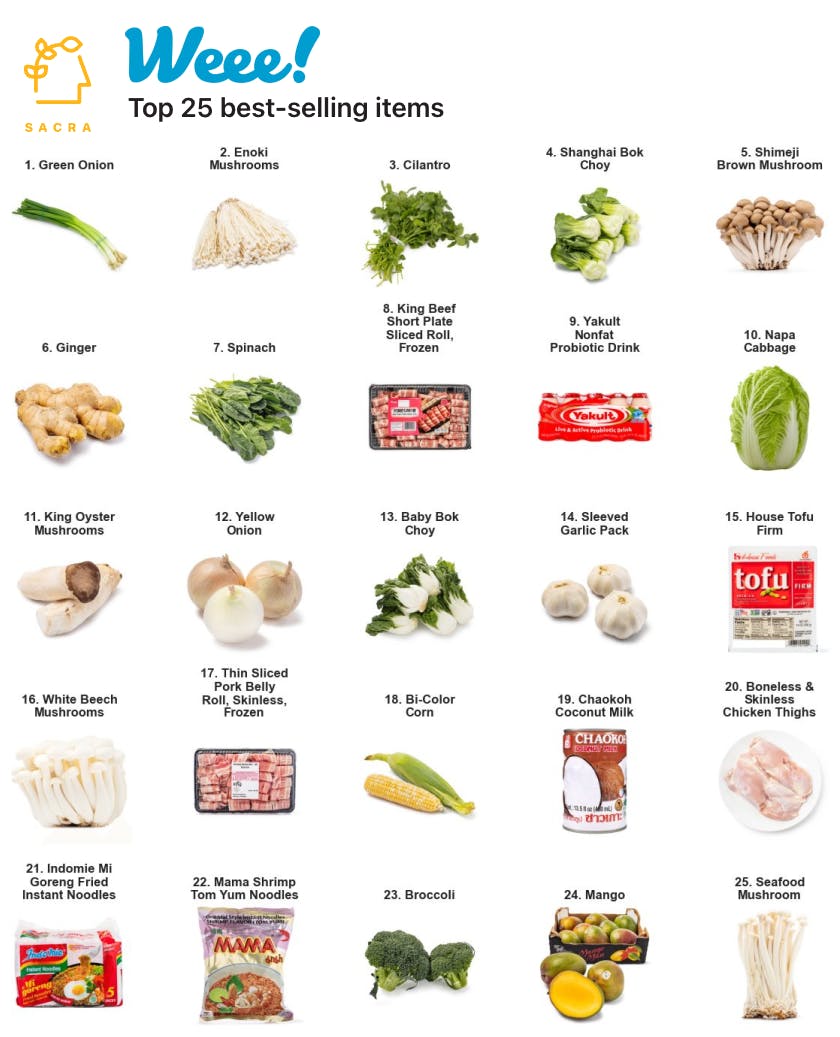

- With Americans increasingly consuming ethnic foods—e.g., Korean food consumption among non-Asians is up 127% since 2017—Weee!’s customer base has become 30% non-Asian American, setting the stage for Weee!’s transition from niche marketplace to the ethnic food aisle for the internet. At 10,000+ SKUs growing by 500 per week with expansion into Vietnamese (2% of their best-selling items sold), Indian (1%), and Thai (8%) cuisines, Weee!’s focus on 1) high-quality perishables (fruits and vegetables represent 57% of the 100 best-selling items) and 2) niche ethnic goods like Yakult milk drink and Lao Gan Ma chili crisp has it capturing 40-50% share of its customers' monthly grocery budgets (vs. 5-6% for Instacart), with $250 average monthly spend and 2.3x purchases per month.

For more, check out this other research from our platform:

- Weee! (dataset)

- GrubMarket (dataset)

- Swiggy (dataset)

- Instacart vs Amazon vs Uber

- Pradeep Elankumaran, CEO of Farmstead, on the future of online grocery

- Online Grocery Unit Economics, Sensitivity Analysis and TAM

- The Key Profitability Levers in Online Grocery

- Sebastian Mejia, co-founder of Rappi, on building for multi-verticality in on-demand