Wealthfront, Betterment, and the robo-advisor resurrection

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Betterment and Wealthfront survived the robo-advisor purge by building the biggest brands in the space—before the cost of customer acquisition (CAC) soared to $650+. With interest rates rising, both put up record growth numbers in 2023 through their high-yield cash accounts, buying them time to figure out their next phase. For more, check out our reports on Betterment (dataset) and Wealthfront (dataset) and our interview with a former employee of Chime.

Key points from our research:

- Betterment (2008) and Wealthfront (2008) built the two biggest pure-play robo-advisors on the market and inspired dozens of copycats by layering delightfully-designed, digitally-native personal finance and investing dashboards on top of exchange-traded funds (ETFs) from Vanguard. Instead of collecting commissions on trades or charging a monthly subscription, Betterment and Wealthfront charged a fee of 25 basis points of AUM, with the first $10,000 invested coming for free.

- Growth slowed to low double-digits for both Wealthfront and Betterment in 2021 and 2022 with the rise of meme investing via Robinhood (NASDAQ: HOOD, up 89% in 2021) on one hand and Vanguard and Schwab (NYSE: SCHW) launching their own lower-priced robo-advisors on the other. All the robo-advisors that failed to hit the ~$16B AUM threshold necessary for profitability—all of them except Wealthfront and Betterment, with their huge head starts—ended up shutting down or getting acquired for their customer bases, like LearnVest, Hedgeable, Blooom, Smartly, WorthFM and Swell Investing.

- As interest rates have climbed to 5.25-5.50%—the highest levels since 2001—Betterment and Wealthfront’s AUM growth has re-accelerated, growing 50% and 77% respectively, driven by demand for their high-yield checking account products. Betterment and Wealthfront’s 4.75-5.50% APY cash management products monetize at a higher rate—~40 basis points per dollar deposited vs. 25 basis points on their robo-advisor product—while simultaneously serving as customer acquisition engines.

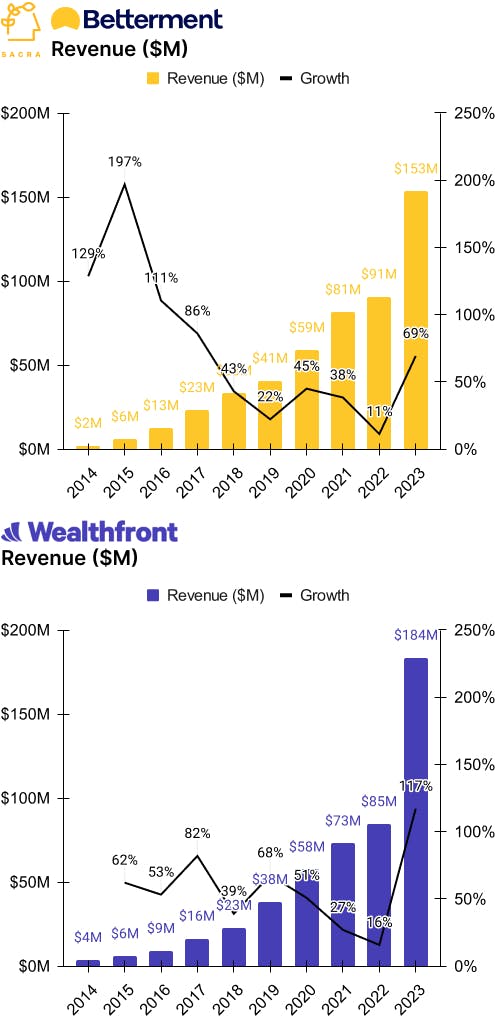

- Sacra estimates that Betterment generated $153M of revenue in 2023, up 69% from $91M in 2022 off an average of $39B in AUM—compare to Wealthfront at $184M of revenue in 2023, up 117% from $85M in 2022 off an average of $43B in AUM. Compare to Revolut at $2B of revenue in 2023, up 82% from $1.1B in 2022 with 71% year-over-year growth in deposits, and N26 at $328M of revenue in 2023, up 27% from $259M in 2022.

- The future for Betterment and Wealthfront hinges on continuing to grow their average AUM per customer, which went from $27K and $40K respectively circa 2017 to $50K and $70K circa 2024. With the Fed already promising rate cuts in the near future, Betterment and Wealthfront have bought themselves time to build the products they need to retain their higher-AUM customer relationships even in a low-interest rate environment.

For more, check out this other research from our platform: