Bolt: the $11B Okta of ecommerce

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: At the peak of the 2020-1 tech hype cycle, one-click checkout companies became the butt of the joke and the prime example of VC overexuberance. But now, companies like Bolt (dataset) and Rally are rising again, building end-to-end platforms for ecommerce merchants to help them solve the NASCARification of checkout. For more, check out our interviews with Maju Kuruvilla, CEO of Bolt, and Jordan Gal, co-founder and CEO of Rally.

Key points from our research:

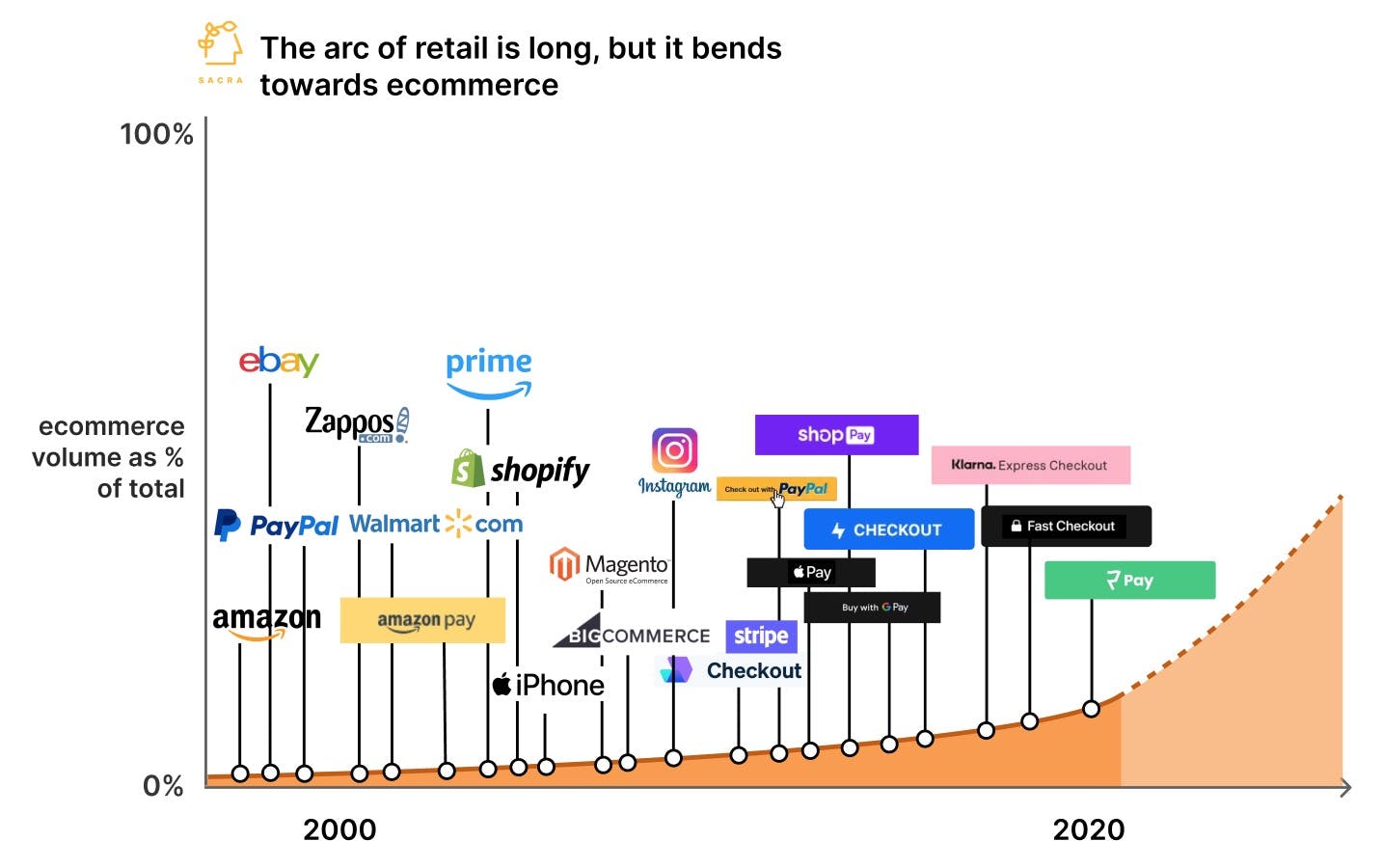

- From the late 1800s hitting $211B in total sales by 1990 (about 3% of all retail sales), mail-order catalogs were the main alternative to brick-and-mortar shopping: you’d check off the items you wanted from Sears Roebuck or L.L. Bean, write a check to cover the amount plus an extra $9.95 for shipping and handling, mail it in, and wait 4-6 weeks for your delivery to arrive. Amazon (NASDAQ: AMZN) brought the mail-order catalog online, with a backend to manage their inventory and process payments by credit card, and shipping in ~5 days.

- As Amazon iterated on the customer experience of buying online, a core lesson emerged from 1-click checkout and free same-, one- and two-day delivery via Prime—that by reducing friction to buying online, customers spend much more, with Prime customers spending 2x+. Around Prime’s launch in 2005, the company’s models showed that if a Prime customer made 20 orders per year, the expedited shipping would cost Amazon $160, double the $79 yearly fee for the service—but the bet paid off by growing cart volume, with the Prime line of business now doing $35B a year growing 10% year over year.

- Mobile vastly expanded ecommerce’s TAM but severely degraded the UX, fueling a race to solve 1-click checkout across every platform—with offerings from hardware / operating system companies like Apple Pay (2013) and Google Pay (2013) to payments companies like Stripe Link (2014) and PayPal One Touch (2015) to platform providers like Shop Pay (2017). By 2014, there were more than 1 billion smartphone users around the world, and yet ecommerce sites still had 288% higher sales-per-visit on desktop than mobile that holiday season, with mobile users forced to tap in their shipping and billing information anew on each store from their non-cookied phone and its tiny, on-screen keyboard.

- Between 2019 and 2021, buy-now, pay-later (BNPL) exploded and took over checkout on large purchases by improving conversion rates for merchants with 0% APR loans for consumers via Affirm (NASDAQ: AFRM), Afterpay (acquired by Block for $29B), and Klarna ($1.9B revenue in 2022), with loan volumes rising 1,000%+ from $2B to $24.2B. At its peak, Klarna became the most valuable private company in Europe at $45.6B, feeding an investor frenzy around checkout and networked products that drive conversion.

- Bolt (2014) and Fast (2019) distilled this frenzy around checkout and conversion into a thesis, raising $1B+ largely on letters of intent (LOIs) rather than real revenue—for 2021, Fast (valued then at $584M) burned $10M a month while generating $50K in revenue with ~500 employees. Bolt, on the other hand, generated about $30M in revenue in 2021—both had the ambition to build an ecommerce-wide network of checkouts where shoppers could have their information auto-filled across any site they visit.

- All this fintech innovation resulted in a grotesque proliferation of payment buttons at checkout, with Shop Pay, Buy with PayPal, PayPal Credit, Amazon Pay, Google Pay, Apple Pay, Klarna Express Checkout, Venmo, Amex Express Checkout, Visa Checkout, MasterPass, AliPay, and Stripe Link looking more like the sponsor stickers on a NASCAR race car than part of a clean user experience. This created a paradox of choice at the moment of purchase, actually hurting merchant conversion rates and helping drive the average ecommerce cart abandonment rate up to 77%.

- Just as the glut of social logins between Facebook, Google Plus, Yahoo, Twitter, LinkedIn, Instagram, Evernote, Windows Live, GitHub, Yammer and more gave rise to customer identity and authentication middleware like Gigya (acquired by SAP in 2017 for $350M) and later Auth0 (acquired by Okta in 2022 for $6.5B), the NASCARification of checkout creates the opportunity for checkout and identity middleware to enable any developer to offer a wealth of 1-click options with a single integration. While Fast competed alongside all the other buttons at checkout with yet another button, Bolt, Rally ($18M raised) and Volume ($2.4M raised) instead build end-to-end checkout platforms that save shopper identities across any payment option.

- Like other universal API products, e.g., Plaid, the upside case lies in 1-click checkout's ability to become a fundamental tool that enables new best in class products and experiences—in ecommerce's case, the novel experiences headless developers are creating with Next.js and the wealth of 3rd party APIs instead of tweaked Shopify themes. Bolt and Rally monetize on the size of their shopper networks and the volume of 1-click checkouts they enable, not unlike how Auth0 takes a tax B2B SaaS's unit of monetization, seats, with 120%+ net revenue retention based on its customers' growth.

- The bull case for one-click checkout companies like Bolt and Rally is to become an Okta for ecommerce, enabling the best ecommerce brands to better-convert the 72% of ecommerce purchases that come from non-account guests and grow the $1.5T GDP of ecommerce outside of the major walled gardens and bundles. With the most in-network shoppers and $400M in the bank, Bolt has an early lead and the opportunity to win based on the quality of its product-market fit, with the long journey ahead to 100x its revenue to ~$2.75B/yr to grow into its $11B valuation at the last round of financing.

For more, check out this other research from our platform:

- Jordan Gal, CEO of Rally, on building the Switzerland of checkout

- Maju Kuruvilla, CEO of Bolt, on the NASCARification of checkout

- Bolt (dataset)

- Klarna: The $31B Snapchat of Personal Banking

- Former Klarna merchant partner on why retailers sign up with Klarna

- C-suite at creator economy company on the competitive dynamics of checkout

- Brian Whalley, Co-Founder of Wonderment, on Klaviyo's product-market fit

- Peter Zhou, CEO of Rutter, on building the Plaid for ecommerce