Swiggy at $1.3B revenue

Jan-Erik Asplund

Jan-Erik Asplund

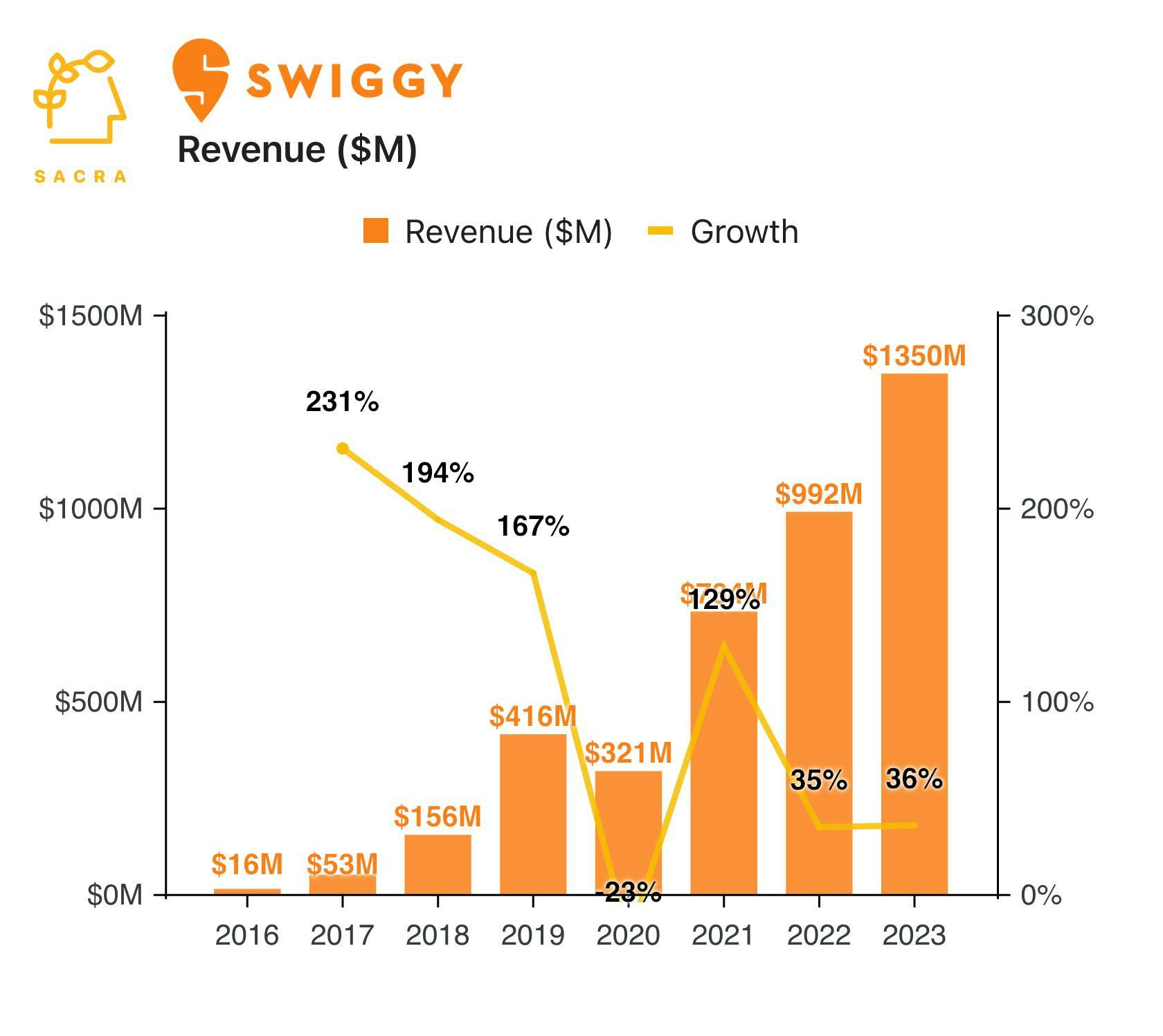

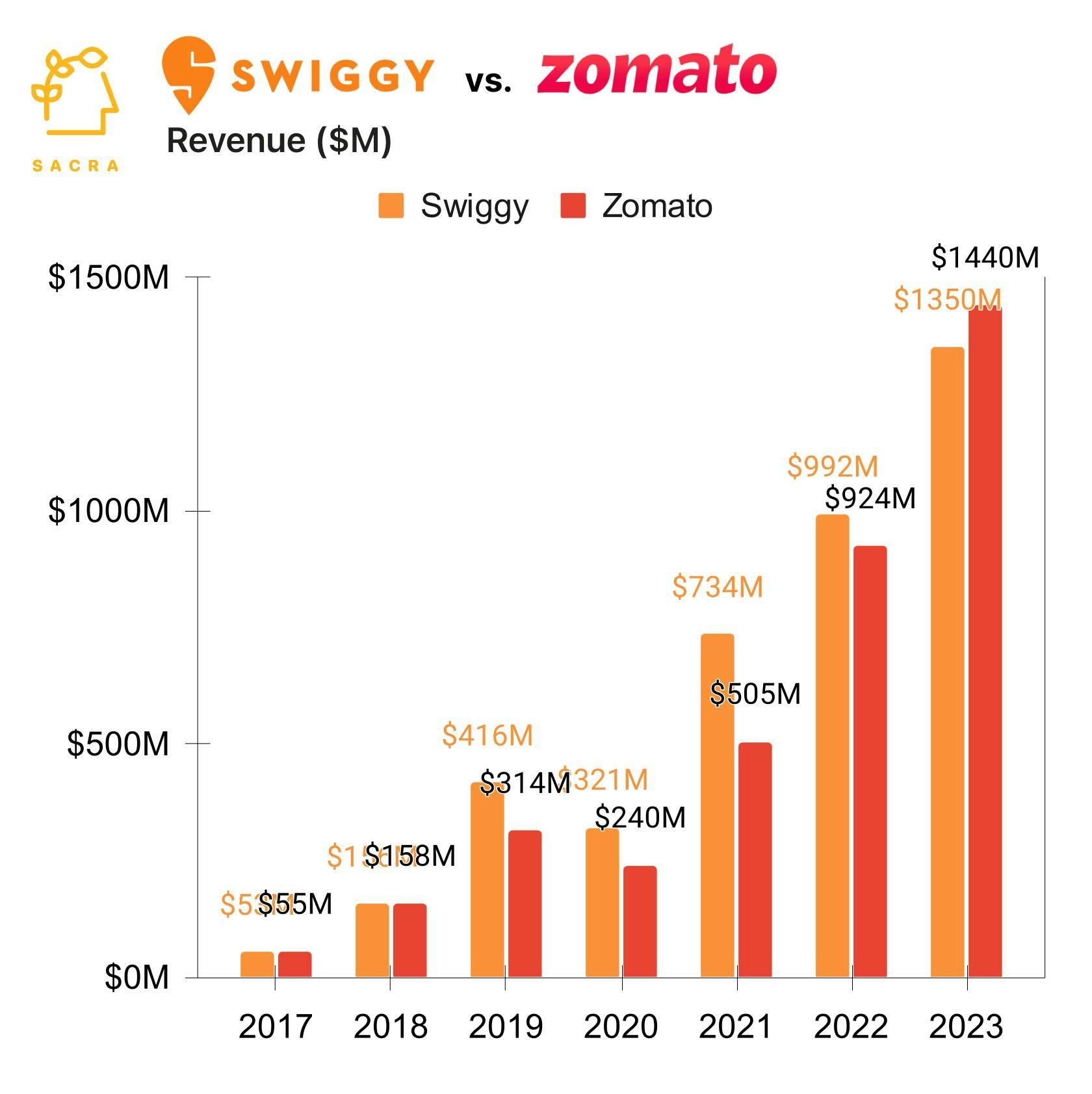

TL;DR: Sacra estimates that Swiggy generated $1.3B of revenue in 2023, up 36% year-over-year, as they race Zomato (NSE: ZOMATO, $1.66B revenue) to build the super app for urban Indian consumers. For more, check out our full report and dataset on Swiggy.

Key points via Sacra AI:

- Zomato (2008), the “Yelp for India”, struggled with adding delivery to their platform due to restaurants’ unreliable logistics and a lack of high quality 3rd-party delivery services—Uber’s (2009) success in on-demand inspired Swiggy (2014) to compete by building its own delivery fleet to enable it to control the customer experience from order to last-mile delivery, growing from $16M in revenue in 2016 to $156M in 2018. Just as Uber went on to leverage its fleet to deliver from restaurants (Uber Eats, 2014), retail (Postmates, 2020) and liquor stores (Drizly, 2021), Swiggy would go on to expand to retail (Swiggy Stores, 2019), parcel delivery (Swiggy Go, 2019), alcohol (Wine Shops, 2020), and groceries (2020), charging restaurants and stores a 15-25% take rate on total order value.

- The tough economics of food delivery in the Indian market—where average order values (AOV) are $5-7 vs. $30 in the US—led to competitors with lower market share like Uber Eats, Ola ($340M in 2023), Foodpanda, and TinyOwl shutting down or being acquired, while the well-capitalized Swiggy ($3.6B raised) weathered the storm and has grown to $1.35B in revenue in 2023, up 36%, with a 43% share of the duopoly market. Compare to Zomato (NSE: ZOMATO) at $1.44B in revenue in 2024, up 55%, which fast-followed Swiggy on building out a fleet to compete head-on in 1st-party delivery—and has grown its share of the market considerably from just 39% in 2018 to 56% as of 2024.

- Swiggy’s upside case hinges on becoming a "super app" for urban Indian consumers, integrating food delivery, grocery, and other on-demand services to capture a larger share of the $50B Indian food services market, while also expanding into new verticals like advertising and B2B restaurant supply to improve margins and diversify revenue streams. Still unprofitable, Swiggy is expanding its list of SKUs, looking to follow in the pattern of Chinese on-demand giant Meituan ($39B in revenue), which burned cash for 6 years to win market share before becoming profitable by growing AOV, increasing their density of transactions, and improving efficiency.

For more, check out this other research from our platform:

- Swiggy (dataset)

- Swastik Nigam, CEO of Winvesta, on building cross-border fintech

- Raghunandan G, CEO of Zolve, on cross-border banking in India

- Instacart vs Amazon vs Uber

- Pradeep Elankumaran, CEO of Farmstead, on the future of online grocery

- Online Grocery Unit Economics, Sensitivity Analysis and TAM

- The Key Profitability Levers in Online Grocery

- Sebastian Mejia, co-founder of Rappi, on building for multi-verticality in on-demand