Stan: from $15M to $27M ARR in 3 months

Jan-Erik Asplund

Jan-Erik Asplund

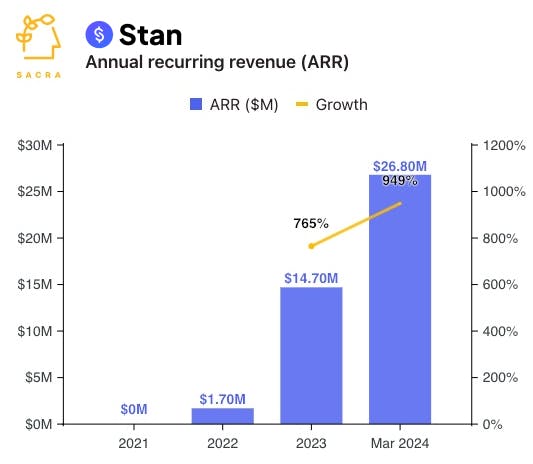

TL;DR: Stan hit $27M annual recurring revenue (ARR) in March 2024, growing ~20% month-over-month every month in Q1'24 from $15M ARR at the end of 2023. To find out how they're accelerating growth as revenue scales—even with 13% gross monthly churn—check out our interview with Stan CTO Vitalii Dodonov, and check out our full Stan dataset here.

Last time we wrote about Stan in February 2024, the startup had crossed $15M in annual recurring revenue (ARR) just 1.5 years after launching, growing 765% year-over-year.

We caught up with Stan co-founder & CTO Vitalii Dodonov to chat about Stan’s growth—and here are our key takeaways:

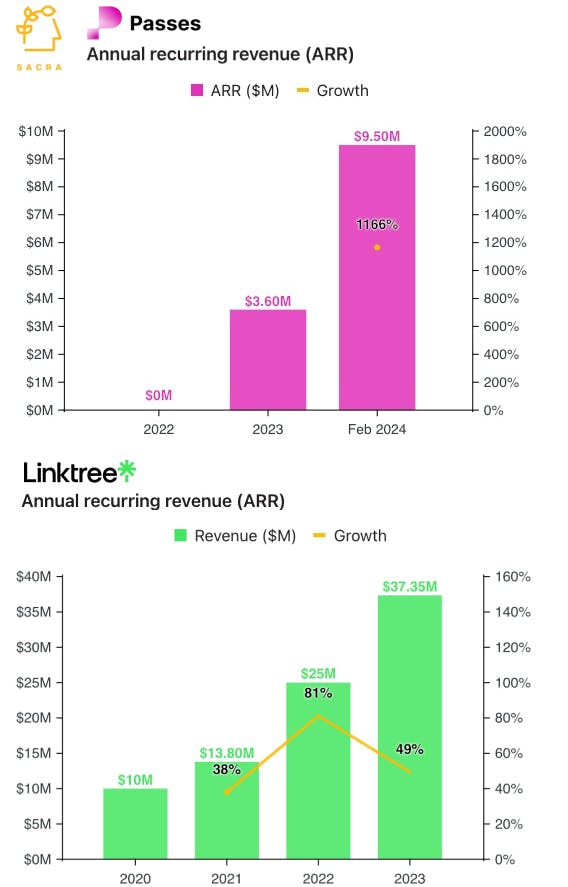

- At the end of March 2024, Stan hit $27M annual recurring revenue (ARR), up 949% year-over-year and nearly 2x from $15M at the end of 2023, with 55,697 customers for average revenue per customer of $482. Compare to Linktree at a Sacra-estimated $49M of ARR at the end of 2023, up 46% year-over-year, and ~340K customers for an ARPC of $144, and Passes at $9.5M ARR in February, up 1,166% year-over-year, with 900 customers for an ARPC of $6,666.

- Stan found product-market fit with the education-focused creator segment—not professionals that sell $10,000+ courses on Kajabi & Thinkific (TSX: THNCF)—but the rapidly growing population of ~10,000 follower spirituality teachers, passive income gurus and social media coaches hanging out and monetizing their followings on Instagram and TikTok. 50%+ of all gross merchandise value (GMV) on Stan comes from digital downloads—PDFs and other lightweight educational assets built in tools like Canva priced between $4 and $30 that teach people how to lose weight, fish, and make money online.

- Word of mouth and referral on high engagement and high growth social platforms has Stan's growth accelerating as its revenue has scaled, mimicking the hypergrowth of link-in-bio startups like Linktree (40M+ users) but monetizing harder at the premium price point of $29/mo. Today, 38% of Stan’s GMV originates from Instagram creators (up from 33% in mid-2023), while TikTok is at 7% (down from 47% in mid-2023) after Stan—which was 90% TikTok creators at launch—de-risked its platform dependence by colonizing adjacent social platforms.

- Stan’s 13% gross monthly churn reflects the high turnover of its super small business customer base, with minimal expansion revenue given its one pricing tier and lack of take rate on GMV, but having strong reactivation as the product leader in its category. Gumroad turned on a 10% flat take rate on GMV in early 2023, 2x’ing their monthly revenue and flipping them from burning cash to generating $10M annualized net profit—in the long run, there’s an opportunity for Stan to monetize at ~2.9% on the back-end in a creator-aligned way by becoming a payment facilitator (payfac) ala Shopify (NYSE: SHOP).

- At 949% year-over-year growth, Stan joins Passes (up 1,166% year-over-year) among the fastest-growing startups in the creator economy, which is now back to life after a lull in 2023. This generation of founders like John Hu at Stan and Lucy Guo at Passes are creator-native, differentiating by building authentic brands around themselves as creators while marketing their businesses at the same time with behind-the-scenes videos on YouTube and Barry’s selfies on Twitter (respectively).

For more, check out this other research from our platform:

- Vitalii Dodonov, CTO of Stan, on building a creator-aligned store-in-bio

- Stan: the $14.7M/year store-in-bio

- Stan (dataset)

- Passes (dataset)

- Gumroad (dataset)

- Linktree (dataset)

- ConvertKit (dataset)

- Beehiiv (dataset)

- Substack (dataset)

- Neal Jean, CEO of Beacons, on building vertical SaaS for creators

- Nathan Barry, CEO and founder of ConvertKit, on ConvertKit’s path to $100M in revenue

- Justin Gage, founder of Technically, on how Substack earns its 10% take rate