Linktree: the $33M ARR About.me for Gen Z

Jan-Erik Asplund

Jan-Erik Asplund

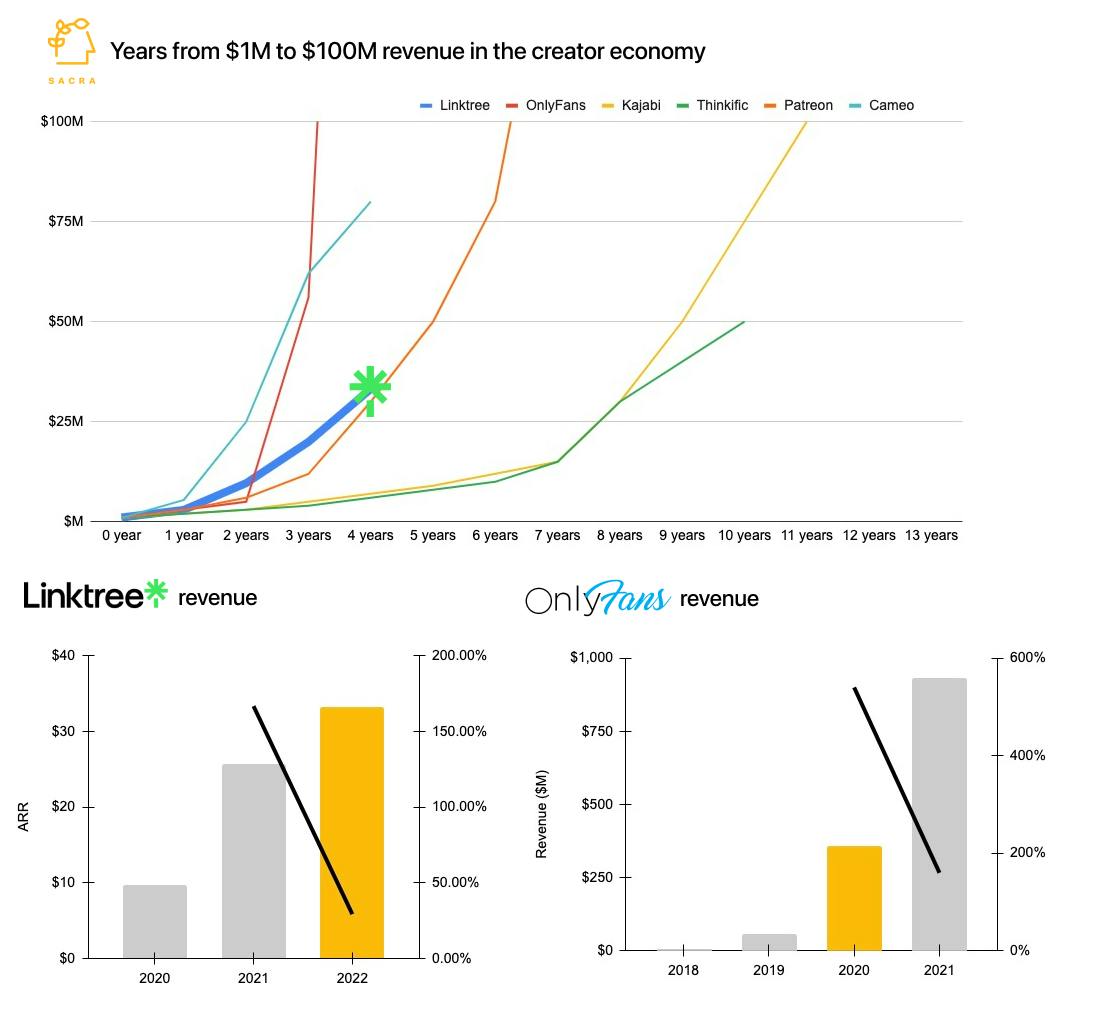

TL;DR: Link-in-bio companies found initial product-market fit as a demilitarized zone (DMZ) that created a buffer between authoritarian, puritanical social media platforms like TikTok/Instagram and debaucherous, prosperous monetization channels like OnlyFans ($932M revenue, $4.8B GMV). For more, check out our coverage of Linktree (dataset) and OnlyFans (dataset), as well as our interview with Beacons CEO Neal Jean.

Check out our weekly email for more insights like this into private companies.

Success!

Something went wrong...

- About.me and Flavors.me created the first social profile aggregators, single-page personal websites that linked out to your other social media profiles—AOL bought About.me and its 400,000 users 4 days after launch for $35M, after which Flavors.me was bought by business card startup MOO. 400,000 people signed up for About.me during its short beta, building simple websites to point visitors to all their early-2000s vintage social profiles—their Foursquares, Flickrs, Facebooks, and Tumblrs. (link)

- Link-in-bio companies like Linktree and Beacons reinvented About.me for Gen Z as a website generator that lets you route traffic from super-platforms like Instagram and TikTok to your content and sources of income. On most super-platforms, users can link their followers out to just one external link—creators put their Linktree or Beacons link in their bio, and it sends their followers to all their other content. (link)

- Link-in-bio companies found initial product-market fit as a demilitarized zone (DMZ) that created a buffer between authoritarian, puritanical social media platforms like TikTok ($300B) and Instagram (NASDAQ: META) to the north which banned not-safe-for-work (NSFW) content and debaucherous, prosperous channels like OnlyFans ($1B) to the south which monetized it. With creators unable to post their adult content or link to their adult content on social media platforms, link-in-bio companies provided them with a SFW link that could then link out to NSFW OnlyFans pages. (link)

- Linktree ended 2021 with 24M users and $26M ARR—today, they’re at around $33M ARR with ~31M users, growing 29% YoY. Link-in-bio products are relatively low-priced SaaS at $5 to $24 per month (Linktree) vs. $29 to $299 per month for a vertical SaaS like Shopify (NYSE: SHOP)—but there are ~50M creators to the ~2.5M online retailers in the US. (link)

- Link-in-bio sits at the strategic position where creators route traffic off platform onto an owned property which gives it the opportunity to capture traffic, de-anonymize traffic and monetize traffic. By building and owning their own audience, creators lower their platform risk and also are able to monetize and drive higher customer LTV over the long-term. (link)

- Platforms are front-running link-in-bio with embedded safe-for-work (SFW) social commerce and native payments via shopping videos (YouTube), live streams (Pinterest, Meta, TikTok) and live game shows with giveaways (Twitch). The rise of live shopping via social media is a reaction to the success of similar events in China, where social commerce GMV hit $360B in 2021. (link)

- Ecommerce platforms like Shopify (with Linkpop) are now launching their own link-in-bio apps, embedding inventory and checkout directly into a simple mobile-first website generator and vertically integrating it into their existing suites of back-office tools. While useful for Shopify-only creators, that vertical integration doesn’t serve creators with multiple types of SKUs across many platforms. (link)

- In the crowded space of link-in-bio itself, companies are drilling down into niche creator segments like Linkfire ($2.7M raised) with musicians to differentiate in a competitive field of 40+ companies from Beacons ($29M raised) to Koji ($36M raised) to Snipfeed ($6.4M). Because e.g. Linkfire is focused on musicians, it can spend more time building features specifically for music SKUs like streaming analytics and embedded integrations with Spotify/Apple Music and other services. (link)

- In short, link-in-bio as a category is dead—what’s emerging out of it is vertical SaaS for creators, a compound product that leads with a mobile-first website builder and storefront, that’s vertically integrated with a creator CRM, marketing automation tools, native embedded SKUs, payments and checkout, and backoffice tools. As Neal Jean, co-founder/CEO of Beacons told us, creators having their own CRM is a key prerequisite for owning their audience, identifying their most engaged fans, and properly monetizing their traffic. (link)

- Via the backoffice, vertical SaaS for creators can monetize OnlyFans and NSFW transaction volume—as companies like Stir ($20M raised) are already doing—in a way that link-in-bio can't on the storefront. Link-in-bio companies have to be careful to avoid becoming explicit and violating their detente with the social media platforms, while back-office platforms sit at an arm’s length to the actual content. (link)

- The upside case is based on growing the GDP of the SFW and NSFW creator economy as vertical SaaS vs. passively routing traffic as link-in-bio—if they can, Shopify shows the way forward as a business, via expanding SaaS revenue through premium tiers like Shopify Plus ($2,000 per month) and monetizing on transaction volume (today 75% of all of Shopify’s revenue). While link-in-bio SaaS is low-ARPU today, there’s a lot of expansion revenue possible if they can index on the upside of the creator success they help facilitate. (link)

For more, check out our coverage of Linktree (dataset), OnlyFans (dataset), our interview with Neal from Beacons, and this other research from our platform:

- Beacons: The Storefront for the Multi-SKU Creator that's Growing 3X Monthly [2021]

- Gumroad: The Android of the Creator Economy that Powered $142M in GMV [2021]

- Dave Nemetz, founder of Reverb Ventures, on the intersection of web3 and the creator economy

- Q&A with Raihan Anwar and Colby Holliday from Friends with Benefits