Stablecoins > Visa

Jan-Erik Asplund

Jan-Erik Asplund

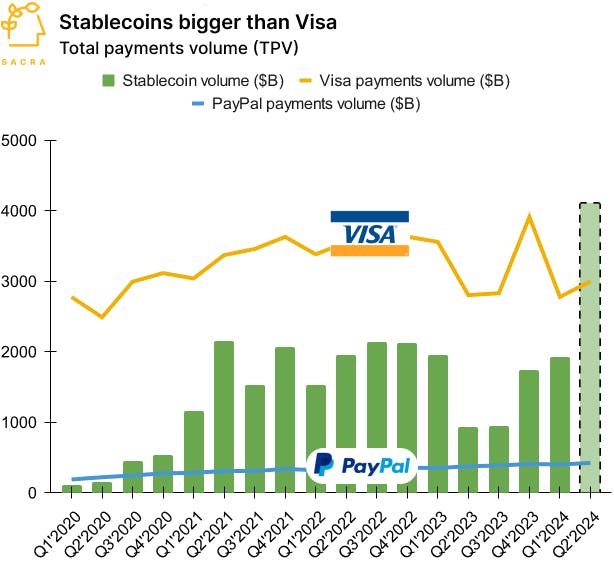

TL;DR: Stablecoins are on track to eclipse Visa (NYSE: V) on total payments volume (TPV) in Q2’2024, propelled by their extreme product-market fit for cross-border money movement. For more from two startups hybridizing tradFi with stablecoins & crypto rails, check out our interviews with co-founder and CEO of Layer2 Financial Bhanu Kohli and Rain Cards co-founders Farooq Malik and Charles Naut.

Key points from our research:

- In 2014, every major marketplace, payments provider and online retailer from Stripe to Microsoft to Steam, Expedia, Reddit, Dell and Fiverr started accepting Bitcoin for payments—between 2017 and 2018, they universally rolled back support. Bitcoin became unworkable for small transactions as network congestion sent the average transaction fee from $0.18 to $50+ with an average transaction confirmation time of more than 60 minutes—for large transactions of $50,000 or more, volatility was the key issue, with even a 1% swing in the price of Bitcoin eliminating payment provider margin entirely.

- Stablecoins like Tether (USDT, 2014) and Circle’s USD Coin (USDC, 2018), on-chain assets pegged to the value of the U.S. dollar, emerged to enable traders to move in and out of crypto positions without the high-fee and high-wait experience of offramping into fiat. Like the Eurodollar, invented post-WW2 to allow banks to transact in U.S. dollars offshore, stablecoins do the same on-chain, making it possible to convert crypto quickly and cheaply into U.S. dollars using alternative networks like Ethereum and Solana.

- During COVID circa 2020, cross-border money movement exploded with the rise in international migration and corporates like Apple diversifying more of their supply chains to Vietnam and India, with total cross-border payment volume hitting $156 trillion in 2022 (up from $128 trillion in 2018). 97% of all cross-border payment volume in 2022 was B2B—$150.7 trillion worth—with $4.4 trillion between consumers and businesses and $800 billion from consumer-to-consumer.

- Stablecoins have found extreme product-market fit in facilitating cross-border payments, with volume growing from $26 billion in January 2020 to $1.4 trillion in April 2024—now on track to eclipse the total payments volume of Visa (NYSE: V) in Q2’2024. Stablecoins win on convenience, enabling cross-border payments to be completed any day of the week (rather than business days only), on speed (in minutes rather than 6 to 9 hours), and cost ($0.0037 vs. $12), with volume split across Tether (47% of the market), DAI, (29% of the market), and USDC (24% of the market).

- Last week, Stripe announced at its Connect developer conference its re-launch of crypto payments powered by USDC, both for the merchant use case of accepting stablecoins as payment and for the platform use case of facilitating instant in-app payments. Stripe’s take rate on stablecoins is 1% vs. the 2.9% they take on cards, but the underlying costs are drastically different—with $0.0037 in fees per transaction, Stripe’s margin is 99.63%, creating an opening for startups to counter-position against their cash cow business model.

- Startups like Layer2 Financial (stablecoin-powered platform payments) and Rain Cards (stablecoin-backed corporate cards) are “arming the rebels” of neobanks, fintechs and payment processors as they take on incumbent tradFi institutions. With stablecoins as the underlying payment rails, startups can offer features like instantaneous transfers, cross-border payments with no wait or fees, and access to the U.S. dollar in places with high currency volatility.

- In response, today every major bank is working on using stablecoins to run their payment rails behind the scenes, from Wells Fargo (NYSE: WFC) to JPMorgan Chase (NYSE: JPM) to Visa to Mastercard (NYSE: MA). The insurgent threat from neobanks and fintechs is to take on the banks’ low NPS (see Bank of America’s -24 score) and high fee business models with new products for lending, cards, investing, and payments that leverage the digital dollarization of stablecoins to go global-first.

For more, check out our interviews with co-founder and CEO of Layer2 Financial Bhanu Kohli and Rain Cards co-founders Farooq Malik and Charles Naut, as well as our other research here:

- Kapital: the $72M/year Nubank for SMBs

- René Saul and Fernando Sandoval, co-founders at Kapital, on the fintech opportunity in LatAm

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Swastik Nigam, CEO of Winvesta, on building cross-border fintech

- Raghunandan G, CEO of Zolve, on cross-border banking in India

- Ex-Chime employee on Chime's multi-product future

- European neobanks are back

- Wealthfront, Betterment, and the robo-advisor resurrection

- Chime (dataset)

- Kraken (dataset)