Roy Ng, co-founder and CEO of Bond, on BaaS's business model

Nan Wang

Nan Wang

Background

Roy Ng is the co-founder/CEO of Bond, the banking-as-a-service platform. We spoke with Roy as part of our research into fintech and banking-as-a-service, with the goal of understanding how Bond thinks about connecting sponsor banks and fintechs, winning in this emerging market, and what the future economics of the space will look like.

Questions

- What differentiates Bond from other issuer processors and BaaS platforms?

- How is Bond positioned versus issuer processors like Marqeta, Lithic and Highnote, and BaaS platforms like Treasury Prime, Unit, and Synapse?

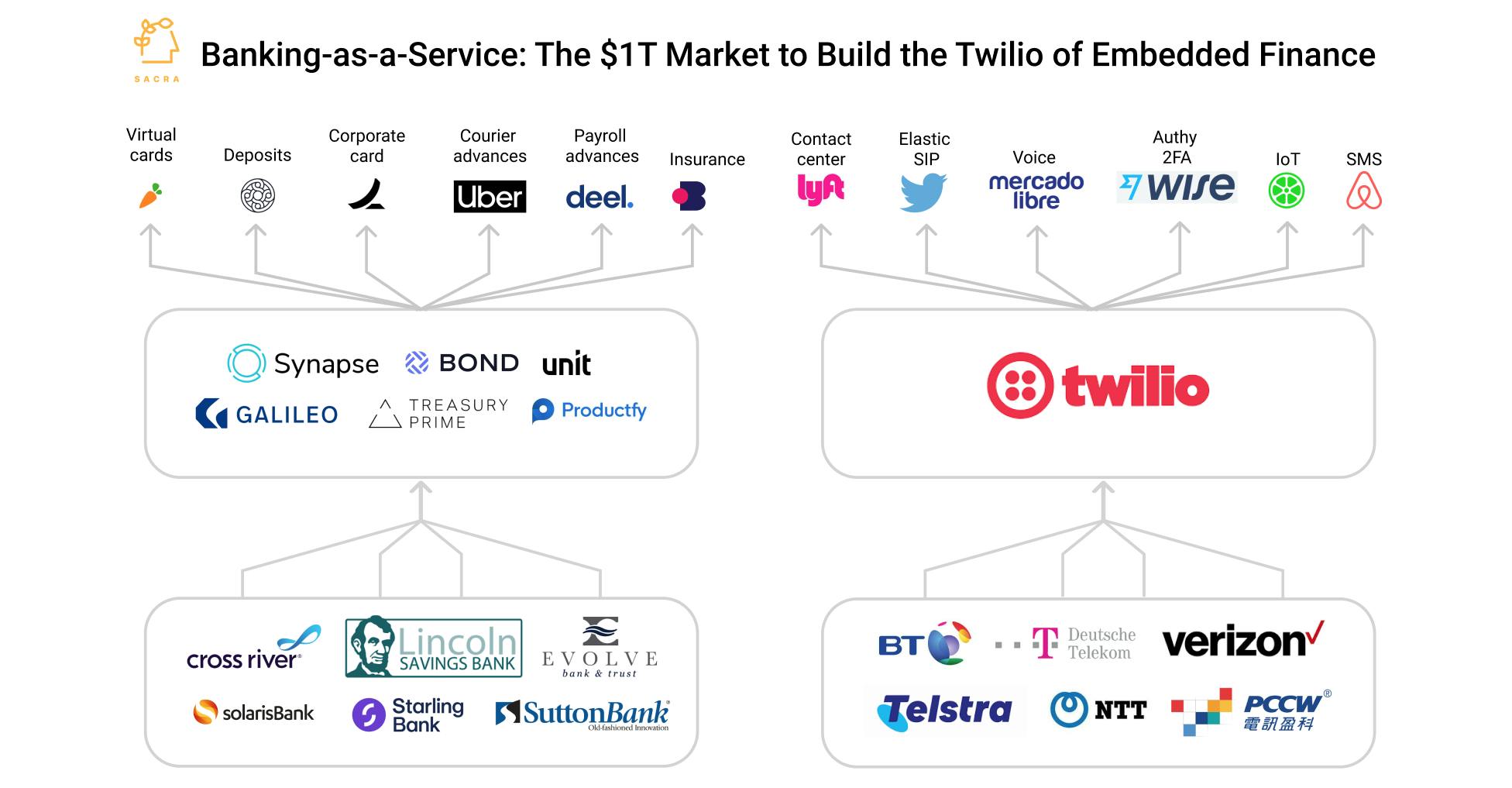

- You were the COO at Twilio. BaaS is akin to the Twilio of finance, being the platform between legacy banking systems and fintech customers or embedded finance players, as well as being developer-first and monetizing through a usage-based model. How has your experience at Twilio helped you to build Bond?

- The BaaS customer base is akin to a venture portfolio. For example, Square is a home run winner for Marqeta. For new companies with less of a track record on performance, what can BaaS platforms do to attract these kinds of homerun customers?

- We could broadly categorize the customer base into fintechs, embedded finance/digital brands, and then the gig economy. Could you talk about your view on the future in terms of growth potential or BaaS adoption for these different end customer bases? How does that feed into your product roadmap?

- Right now, fintechs are taking a larger cut of the interchange split because they own the end-customer relationship. How do you see the power dynamics of interchange split changing as fintechs and embedded finance scale?

- Along that train of thought, could you speak about who would capture most of the value across the value chain?

- How do app developers think about adapting SaaS to monetize off interchange and other fees, versus using their original business model -- for example, SPaaS -- as a way to drive engagement towards that model?

- Could you talk about the cost model? On one hand, there are the card networks and the sponsoring bank, and on the other hand, platforms also integrate with third-party providers. What makes the supply-side integrations sustainable and cost-effective?

- How do you think about aggregating demand in relation to your supply-side providers, since part of the idea of aggregating demand is disintermediating suppliers?

- Could you talk about initial adoption and then expansion to other products as it relates to this promise of BaaS, of a single vendor for all your banking infrastructure needs?

- Is there anything that you think is important about your business and the sector that we haven't talked about?

Interview

What differentiates Bond from other issuer processors and BaaS platforms?

Roy: We call Bond an embedded finance platform. Embedded finance means that any software company, any technology company, can take what we call "primitives" via APIs and SDKs to incorporate those tools in order to offer banking products. There are three pillars to our products. One is accounts, which is basically bank accounts, the DDA accounts. The second is cards: credit cards, debit cards, consumer and commercial. The third piece is money movement: ACH and bill pay, wires, etc. Those three buckets of capabilities are what we offer to our brand customers.

What we see as the biggest thing that's happening in fintech right now is, not only is there more innovation coming out from fintech -- like from the neobank standpoint, different kinds of digital-only banking services for specific segments of the population -- but also vertical enterprise software becoming a bigger and bigger delivery mechanism, a financial services product. That's why we built Bond.

When you talk about what differentiates Bond, a big part of it is that we're built enterprise-grade, meaning we are an agnostic platform that works with multiple bank partners and with different kinds of technology vendors, in order to create a stack that is flexible and can grow with various of our customers. A customer might want to start with a debit product and over time grow into a credit product or a lending product. You could do that on our platform end-to-end. It's not like, "Look, here's a stack that is just really for this product. Here's another stack for another product." We really help with the entire life cycle of our brand customers.

Another really big part of the differentiation is our team. I think enterprise skills mean that we have an enterprise-level team that understands how to do these things at scale. We recently announced a new chief product officer, Helcio Nobre. He was chief product officer at Rapyd, which is a fairly large fintech as a service. He joined us a few months ago. We also brought on a new chief sales officer, Laura Kane, who came to us from Quadpay. Before that, she was the head of enterprise sales at PayPal for North America. And we also have a new GC, Sandrine Cousquer-Okasmaa, who used to run the legal function for Goldman Sachs' embedded finance-like business. Brian Chevalier-Jordan, who heads up marketing, used to be the CMO for SoFi's student loan refinance business, which is SoFi's largest business. We've been able to attract probably the best talent in the industry.

How is Bond positioned versus issuer processors like Marqeta, Lithic and Highnote, and BaaS platforms like Treasury Prime, Unit, and Synapse?

Roy: We partner with issuer processors, so we're actually agnostic to them. Right now, we partner with an issuer processor that does both credit and debit for us, but we've been in discussions with others, including some of those that you just listed, around potential partnerships because different issuer processors are good at different things. Certain issuer processors only do debit -- for example, you mentioned Marqeta, they're generally a debit processor -- versus others may do credit. We want to be agnostic to that.

Back to my original thesis around enterprise-grade, you don't want to be stuck with one processor. You want to be able to work with multiple processors as you continue to address your customer's needs.

You were the COO at Twilio. BaaS is akin to the Twilio of finance, being the platform between legacy banking systems and fintech customers or embedded finance players, as well as being developer-first and monetizing through a usage-based model. How has your experience at Twilio helped you to build Bond?

Roy: I think the biggest thing around Twilio is: be the advocate of the developers, be the advocate of the innovators. There are many innovations happening in technology, and at Twilio, we're basically an enabler of these innovators, helping them figure out, "Are there things they could do to enhance their communications with their end customers or their partners, via Twilio as a communications platform?"

I think about it very similarly at Bond, where we are enabling people with a lot of great ideas to better serve their users and their communities with financial products. So, be it a bank account or card product or lending product, we really think through, "What is the simplest way for a developer to get up and running and start building a financial services product?"

A lot of developers are not fintech experts. A big part of it is our docs and our guides that walk through some of the idiosyncrasies of financial services and what you need to understand in order to build. Otherwise, if I were to give a developer, "Here's a bunch of docs and APIs, and just go build," without understanding a context of how some of these things work, it's going to be fairly challenging. One of the things I learned at Twilio is that, while communications are a bit more straightforward than banking, it still takes a lot of domain expertise to understand the intricacies of communications, like how do you white label yourself so that you don't get blocked as spam. There's a lot of things that go into very specific industry regulations and constraints. One of the things we aim to do at Bond is to educate our developers and educate our customers on, "This is why you need to approach this problem a certain way."

You asked about differentiation. One of the things is that we are what we call a "program manager" for our brands. A program manager takes care of the entire program on behalf of that customer. Not only are there technology pieces for them to build upon, but they also have a program management function within Bond that helps them with things like compliance, so that they don't need to build out a massive compliance team to make sure that that product is running safely and soundly.

Early days, we brought on a very seasoned compliance team. We brought on the chief compliance officer at Affirm to be our chief compliance officer. Before Affirm, Arlene Dzurnak was the chief compliance officer at Celtic Bank, so did a number of programs with Celtic Bank and a number of fintechs including Square and Square Capital. So, lots of knowledge in terms of how to launch and scale programs.

My view is, while I was COO at Twilio, I think the industries of financial services and communications are very different. In finance, there's this overarching piece of advice and program management that is so critical for brands in order for them to launch successful programs. It's not just, "Hey, here's some developer tools. Go do it. And that's it. I'm done." There's a program management piece that is very specific to the industry. Getting the right program manager to be part of your program is extremely important -- just as important as the technology itself.

The BaaS customer base is akin to a venture portfolio. For example, Square is a home run winner for Marqeta. For new companies with less of a track record on performance, what can BaaS platforms do to attract these kinds of homerun customers?

Roy: Luckily, we've not done too much from an outbound marketing standpoint. The majority of our customers come to us just from inbound word of mouth. We have not spent a single dollar outside of making our website on customer acquisition. We haven't bought any Google AdWords or anything like that. What this tells you is this is a market that's ripe and that really needs a service like Bond. When customers come to us, we talk to them about what is their use case, what is their core product. Many times, they already have core solutions that they offer in the market, and what they want to do is augment that core solution on top of some financial services product that they believe will drive more loyalty with their users or drive additional revenue opportunities.

We look at each company on a case-by-case basis and see whether we'd be a good fit for them to launch onto our platform. A big part of it also is we need to make sure of KYB, meaning know your business. We do pretty extensive KYB on every company that we consider, both from a compliance standpoint as well as from, "What is the likelihood for a company addressing this space to be successful?" For example, we're talking to a bunch of neobanks that want to address different segments of the population. What do we believe would be the winner?

To your point, if you serve the right customer, inevitably you will grow along with them. This is not dissimilar to, back in the days, WhatsApp with Twilio. WhatsApp and Uber were some of the biggest customers of Twilio. You mentioned Square's being one of the biggest customers of Marqeta. Another one is Peloton, which is one of Affirm's biggest customers. A big part of it is just to think deeply about, "What are the right customers that will really be able to take the products that we enable them to offer to grow their business?" We spend a lot of time on that in terms of attracting the right customers, not just any customers.

We could broadly categorize the customer base into fintechs, embedded finance/digital brands, and then the gig economy. Could you talk about your view on the future in terms of growth potential or BaaS adoption for these different end customer bases? How does that feed into your product roadmap?

Roy: What we've seen inbound, coming to us, is there's quite a lot of both -- about 50/50 -- in terms of fintechs versus what I call "vertical software." They all embed finance, because most fintechs -- unless you're a Square or LendingClub where you get your own banking charter -- are leveraging a bank partner because they don't want to get a bank charter and they don't want to be regulated like a bank. They want to be a tech company.

Squire is a really good example of vertical software. Squire is an application that enables barbershops to manage their business better, from managing their bookings to the finances -- it's an all-in-one platform. When Squire came to us, they saw that a lot of barbers in their customers' barbershops had an issue around cash flow. A lot of these barbers get paid every two weeks via ACH and a payroll system, and some of them need to take out payday loans to make ends meet in between these pay periods.

The challenge was to build something that enables them to have instant access to their pay. So we developed with Squire what we call Squire Card: the moment you check out of your haircut, the net pay plus the tip goes directly on the Squire Card, and the barber can literally walk out of the barbershop and start spending it, buying groceries for their families or whatever it is. That's a paradigm change for that particular community because you're now able to address them in a very specific way. I believe vertical software like Squire has a huge opportunity and a huge role to play in delivering financial services products, partially because they're already working with these users in a different capacity, like booking their appointments and things like that.

So there's that connectivity already in terms of what they do, versus fintechs, which is digital banking. There are huge opportunities in digital banking, with the likes of Chime and a number of others, in terms of giving a much more user-friendly experience and capabilities and features that traditional brick-and-mortar banks do not offer today. I do think there's a lot of interesting angles that still have not been come up with, be it digital banking for a particular ethnic population or for new types of activities. Like the creator economy: these are folks that are making a lot of their day-to-day revenue from YouTube, Instagram, and they may have specific banking needs.

I think there's opportunity in both, but I do see that the larger opportunity is really in vertical software. I've been a student of software for a very long time. We went from on-prem software to cloud software, then over the past five to seven years, it was taking that cloud software and dividing it up by verticals. You can have software for healthcare industries, software for restaurants -- basically end-to-end software that's now addressing more and more of these specific verticals. The deeper the vertical software goes, the more relevant they are in providing that financial services product to the end-users. There are many more touchpoints to go into the various populations that they serve, to generate both revenue and data and drive loyalty with their core business.

That said, our customer base today is about 50/50 between pure fintech versus vertical software. We're bullish on both, but I do see, over the long term, the vertical software folks really having an advantage because they're adding another layer to the product that they're already offering users.

Right now, fintechs are taking a larger cut of the interchange split because they own the end-customer relationship. How do you see the power dynamics of interchange split changing as fintechs and embedded finance scale?

Roy: From day one, we've been a big advocate for fintechs and/or brands who are offering products to take the disproportionate amount of the interchange, because they're the ones generating and originating the customers and these customers spend because of them. When we work with our bank partners and others, we look to maximize the economics for all of our customers.

Over time, I believe there's going to be an opportunity to be a completely utility-based platform where it doesn't matter if your transaction is $5 or $50,000, the utility from that transaction is the same in terms of the computing power that it takes to process that transaction. I think that's going to be the great equalizer. We're moving toward that type of model, where instead of interchange base on our side, the interchange is basically kept at the customer side and the bank side, but we're really a technology utility platform. For some of the companies that we engage with, we take interchange, but for most of them we serve as the infrastructure platform, so infrastructure-based pricing. Not dissimilar to AWS or other kinds of utilities that you've seen in the past, including Twilio.

Along that train of thought, could you speak about who would capture most of the value across the value chain?

Roy: Our customer will capture the most in terms of interchange, then the banks, and then Bond some, if at all.

How do app developers think about adapting SaaS to monetize off interchange and other fees, versus using their original business model -- for example, SPaaS -- as a way to drive engagement towards that model?

Roy: In the end, a lot of these companies are looking to offer financial products. Yes, there's an interchange component to it, but for some of the largest companies, it's a way to better engage their customers and get data. Data is something that I think a lot of people don't talk about in embedded finance.

I had a conversation with the CFO of a very well-known consumer sporting goods brand. Historically, they distributed their shoes and their products via places like Foot Locker. Over the past three to four years, they've started building their own app so that they could better engage with their end consumer. And over time, what you see when you talk to the CFO of this publicly listed, very large company is that what they want to focus on is the customer experience that, "I could use my embedded finance instrument, or card, to be able to not only buy products for my own brand but also buy products outside of that brand."

I'll use a public example like Apple. Apple has Apple Card. Apple partners with Goldman Sachs as the underlying bank to offer this card. Apple obviously wants their customers to be able to buy more laptops and more iPhones through that card. But remember, that Apple Card can be also spent in other places in your day-to-day life, on other things that you're buying. If it becomes your primary card, Apple has a really good window into how you spend and your user behavior. Companies spend a lot of money trying to understand their most loyal customers' behavior.

I would think interchange is important, it's a dimension, but I think that the data side is just as important for these digital brands as they're thinking about launching an embedded finance service.

Could you talk about the cost model? On one hand, there are the card networks and the sponsoring bank, and on the other hand, platforms also integrate with third-party providers. What makes the supply-side integrations sustainable and cost-effective?

Roy: I'll talk about Bond, and I'm not going to comment on other folks. We're an aggregator of demand, in terms of, "Hey, look, we have X number of customers. We could bring volumes to all of the players that we work with." So be it the sponsor banks or the technology vendors that we work with, we could drive a lot more volume to them when we are aggregating multiple customers, versus if you are a brand or a customer that wants to build it yourself, you would have to integrate and engage with every single one of those pieces and you're not going to get the economies of scale as if you use a platform like Bond. That's how, as volumes go up on our customer side, we could drive more and more cost savings back to our customers because the aggregate power of our customers enables us to deliver the best possible cost to our customers.

How do you think about aggregating demand in relation to your supply-side providers, since part of the idea of aggregating demand is disintermediating suppliers?

Roy: Because there is so much demand out there, I think part of it is we drive a lot of volume to the supply side. We get them free business in some ways. In fact, one of the banks that we work with pays us to basically drive demand onto their platform. From my perspective, it's a win-win for them, because on their own they may not have the reach and the distribution that they have with a platform like Bond. We go out there and talk to brands, we know what are the latest use cases and where users are getting a lot of benefits, and we introduce these kinds of ideas to the people that come to us. So be it a processor partner or KYC partner, we bring them a lot of business through embedding on our platform.

One piece is economies of scale. The second is, if we do see that there's a gap in the market on certain capabilities, we'll build our own. Right now our idea is: if there are best of breed players out there that know what they're doing in a specific area, we'll leverage them to make sure that our customer gets the highest quality product that's available today. But over time, as we see that a particular vendor is not particularly fast on one thing, we may go build that ourselves to make sure that the entire end-to-end process is a very smooth line.

If you think about embedded finance and what we do, there are many steps and many things that need to happen in order to launch a program live. To think that you could build it soup to nuts, from the very beginning to the very end, it's near impossible. It's going to take you many, many years. I think the best approach to doing it is looking at best of breed and then thinking about where we're going to augment ourselves to make the entire experience the best.

Could you talk about initial adoption and then expansion to other products as it relates to this promise of BaaS, of a single vendor for all your banking infrastructure needs?

Roy: Let me address two pieces. One is the expansion path of our brands, but there are also the sources of demand.

Some of our sponsor banks are already at the stage where they don't want to work directly with the digital brands. They want to work through a platform like Bond, so we are the ones who are going to be aggregating demand for the banks. They may also refer us opportunities as they see them, but they understand how complex it is and how long it takes for a brand to work directly with the bank and figure out all the different parts to piece together to come up with a program. So there are banks that have decided, "Look, 99% of my fintech programs should come through a platform." That's where we get some of the inbound demand: through the sponsor banks themselves.

Back to the path of a customer growing from an initial product to the next product, I would say we're still early innings right now. We have a few customers that are already going to the next path. We have one customer that issued a debit card and is now looking to issue lending. They have enough data in their system to say, "Look, I know how much you worked. I could push you a $5,000 loan, and you could take it right away. I could push the proceeds directly onto the card that you already have." That makes for a very seamless experience. This is not dissimilar to Square Capital. Square Capital works with merchants, and they're like, "Wow, your fruit stand's doing really well. Do you need some expansion capital? Let me give you some money to continue to grow your business."

As these brands see customer adoption, they already know where the next place to go is in terms of further engaging and adding value to the end-user and the end customer. And Bond is the enterprise-grade platform that can continue working with you from your first product to your 10th product.

Is there anything that you think is important about your business and the sector that we haven't talked about?

Roy: I think that the data piece is really important. We invested in data very early as a platform. If you think about banking as a service, you could think about one piece as the APIs -- everybody talks about their APIs -- which I view as the pipes that enable something to happen. You can launch a product as a result of having the pipes.

But the thing that floats inside the pipe, which is the data, is the piece that is really critical in order to make sure that, one, these programs run in a compliant way both for the bank partners as well as for your brands to monitor. Two, the data is incredibly valuable for our brand partners in terms of understanding the demographic of their customers and being able to think about, "Well, now that I've launched, let's say, a debit card, is the right thing to launch a credit card or a lending product? Based on the data that I'm seeing, where should I go next in terms of my product?"

The data piece is probably the most important and one of the biggest things that we invested in early. My co-founder was previously the head of data science at SoFi, the big fintech. When we started the company, we knew that the API piece was important, but the underlying data architecture and nomenclature around everything that goes into it, all the pieces that plug onto their platform -- there needed to be a uniform data model. So we spent a lot of effort and time on building that right, before we built all of the instrumentation and all the APIs that go along with it.

If you are a brand and you launch a debit card, you can go into our portal and see exactly the users that went through your KYC flow, which ones passed, which ones failed. For the ones that failed, you can click in there and see all the reasons why your KYC failed and how much of it went to manual review versus just completely failed. You can also see how many cards you issued, how much people are spending on the cards, the merchant MCC codes that are associated with their purchases; you can see where they are distributed. If you want to dig into specific transactions, you go to the Bond ledger to see all the details around specific transactions and users.

That's the power of data, when you have that all cleanly mapped out onto one platform, to be able to see that. You can imagine that the sponsor banks also want to see some parts of these data as they're going through their audits and they have regulators coming in to take a look at the different programs they support. So the data is incredibly valuable for both the brands that are issuing the product and also the sponsoring banks that are working with us.

Disclaimers

This transcript is for information purposes only and does not constitute advice of any type or trade recommendation and should not form the basis of any investment decision. Sacra accepts no liability for the transcript or for any errors, omissions or inaccuracies in respect of it. The views of the experts expressed in the transcript are those of the experts and they are not endorsed by, nor do they represent the opinion of Sacra. Sacra reserves all copyright, intellectual property rights in the transcript. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any transcript is strictly prohibited.