Rappi: The $7B Meituan of Latin America

Nan Wang

Nan Wang

This report contains company financials based on publicly available information and data acquired by Sacra during the preparation of the report. Sacra did not receive any compensation from Rappi for the report. This report is not investment advice or an endorsement of any securities. Click here to read our complete disclaimers.

The on-demand playbook

Join our list for access to more of our exclusive private markets research and company coverage.

Success!

Something went wrong...

Founded in 2015, Rappi was among the first wave of companies from Latin America to go through Y Combinator, and afterwards, they became Andreessen Horowitz’s first investment in the region.

In the six years since, Rappi has become a leading on-demand delivery platform, active in 9 countries and growing at 120%+ CAGR for the last three years.

In our base case, we value Rappi at $7B or 7x EV/2022 revenue, up 75% from the round they closed last year that valued them at $4B or 10x EV/2020 revenue.

The on-demand industry is brutally competitive, characterized by low customer loyalty and high cash burns from significant promotional spend. Rappi, however, has some of the best unit economics of any on-demand platform in the world—in part because LatAm itself is one of the best markets in the world for on-demand delivery, with:

- the greatest route density in the world

- lower labor costs than in the West

- a long growth runway driven by low rates of online adoption.

Two of the biggest economies in the region—Brazil and Mexico—are where Rappi faces its biggest challenges. Nevertheless, Rappi has differentiated itself by offering delivery services beyond food to a broad range of categories in pharmacy, grocery and e-commerce.

With this strategy, they are following a similar playbook to the nearly $250B Chinese super app Meituan. On-demand is a commodity business until the point when a platform establishes ecosystem control: Meituan pulled this off by first capturing consumer mindshare through food delivery, then cross-selling low frequency but high margin products across categories like hotel and in-store services to the same group of customers.

Rappi has found a way to quickly expand across Latin America while keeping its unit economics strong. Today, they are the only native multi-vertical provider amongst their competitors. With its deep local ties and SoftBank-funded war chest, Rappi has a good chance to emerge as the Meituan of Latin America.

Key points

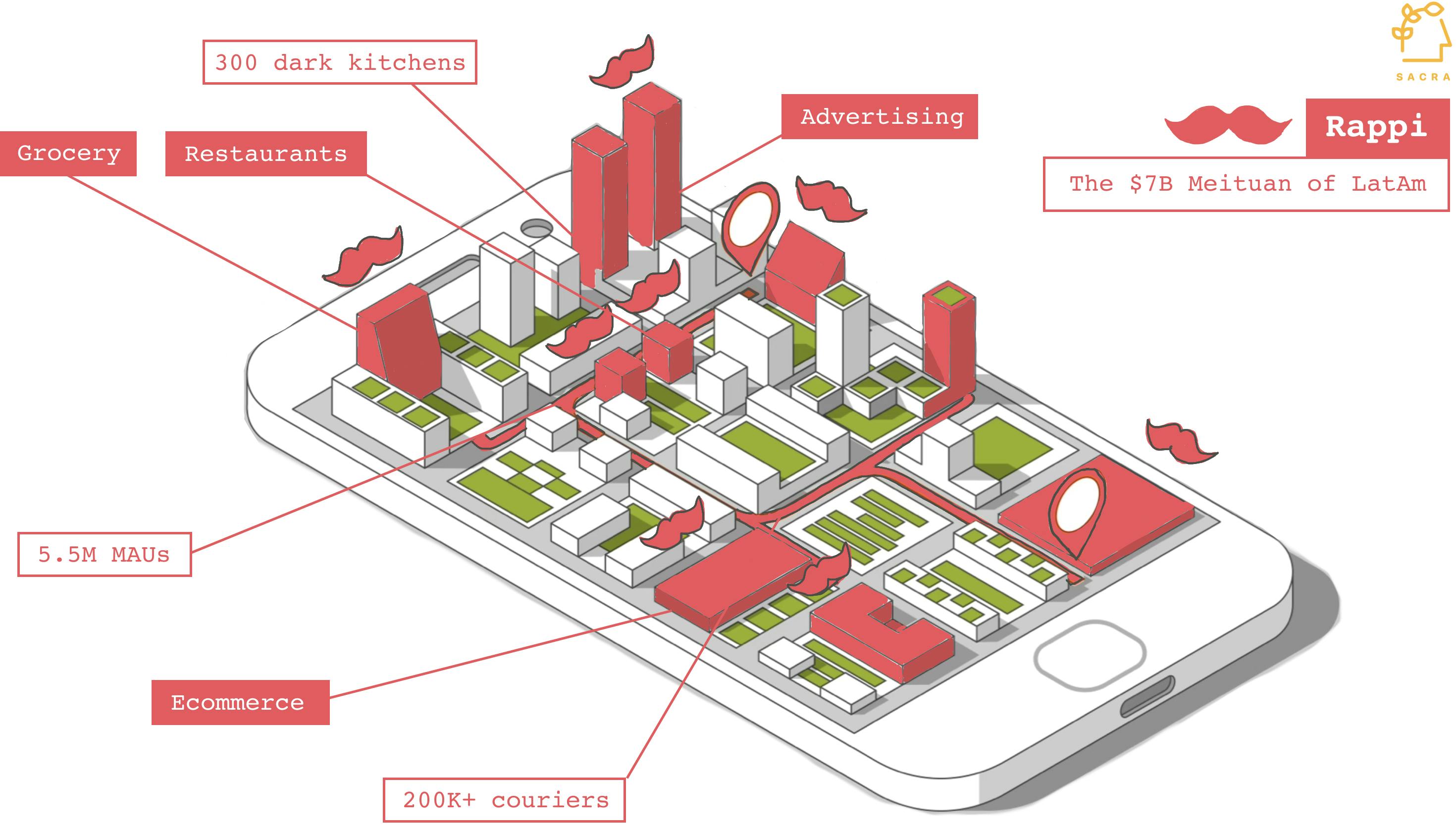

- Rappi is a Latin American on-demand delivery app with two main businesses: a marketplace and a logistics platform. It provides online traffic and last-mile delivery services to merchants. The company is also expanding into adjacent verticals such as e-commerce and travel.

- 75% of Rappi's revenue comes from the commissions collected from merchants and delivery fees paid by customers. Additional sources of revenue include advertising (about 13%) and subscriptions (10%), while ecommerce represents about 2%.

- Rappi has footprints in 9 Latin American countries and 100+ cities, and we believe Rappi is the top 1 or 2 player in the majority of those countries.

- We value Rappi at $7B, 7x EV/2022 revenue. This is up 75% from the last round price of $4B, which valued the company at 10x EV/2020 revenue.

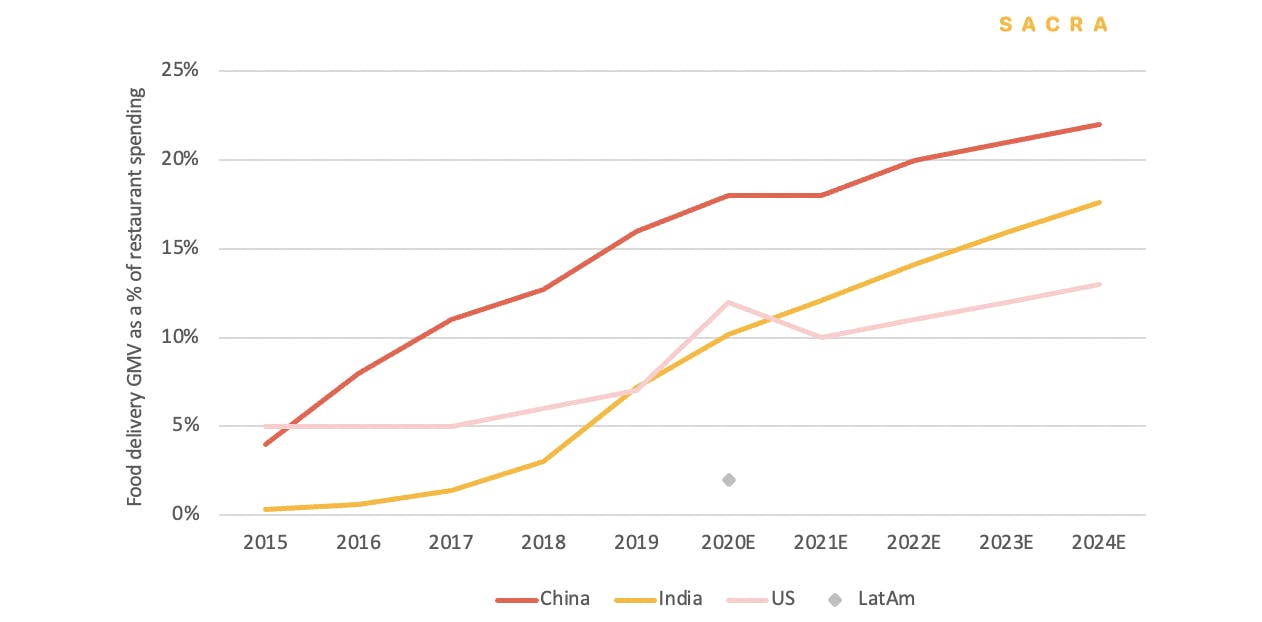

- We expect a long growth runway ahead, with a 3-year GMV CAGR of 50%. Online adoption in Latin America is still at a low single-digit percentage, compared with 10%, 12% and 18% in India, the U.S. and China respectively. Sources of growth are offline to online migration, category expansion and higher frequency of purchase.

- Rappi has 5.5M MAU and a DAU/MAU ratio of 33%, which is significantly higher than the industry benchmark of 8%. Compared to its western peers, Rappi also benefits from a far-higher drop density and access to cheaper labor. We estimate that Rappi has one of the lowest delivery expenses as a percentage of GMV at 10%, compared to 14% from Zomato (India), 16% from Meituan (China) and 32% from Uber Eats (U.S.).

- On-demand markets tend towards consolidation as the need for scale forces smaller players out of the market and brings larger players together. In China, Meituan merged with Dianping and E’le me merged with Baidu Waimai. In Indian and the U.S., the markets are also stabilizing into a duopoly or an oligopoly market structure.

- There are early signs of this kind of competitive rationalization in Latin America. Glovo exited Chile and Brazil in 2019. Uber Eats exited Argentina and Colombia in 2020. Given the hyper-local network effect and high initial capital requirement, we expect the market structure to further consolidate in the next two years.

- Rappi’s future success rests on its ability to increase purchase frequency and cross-sell into more categories. In this, there is a strong parallel with Meituan’s winning playbook. Both companies are using high frequency, low margin verticals to gain mindshare and cross-sell into low frequency but high margin verticals.

- In recent years, Rappi has been expanding beyond food and CPG delivery into e-commerce, travel and merchant advertising. These verticals are complementary to Rappi’s existing services and can expand Rappi’s TAM in the long run through more user scenarios, larger cohorts and higher AOV.

- More than 90% of customers purchase from at least two categories using Rappi. By cohort, purchase frequency increases over time, with an average of 2 purchases per month in year 1, 6 purchases per month in year 3, and 11 purchases per month in year 5.

- Beyond the food and CPG categories, Rappi has significant opportunities in broader logistics and last-mile fulfillment as more consumers adopt the on-demand model and expand into adjacent verticals.

- Rappi’s investors include SoftBank and SoftBank Vision Fund, Sequoia, Andreessen Horowitz, DST Global, TRP and Y Combinator.

Product: The LatAm super app

Rappi was founded in 2015. The business has two key aspects: a marketplace and a logistics platform.

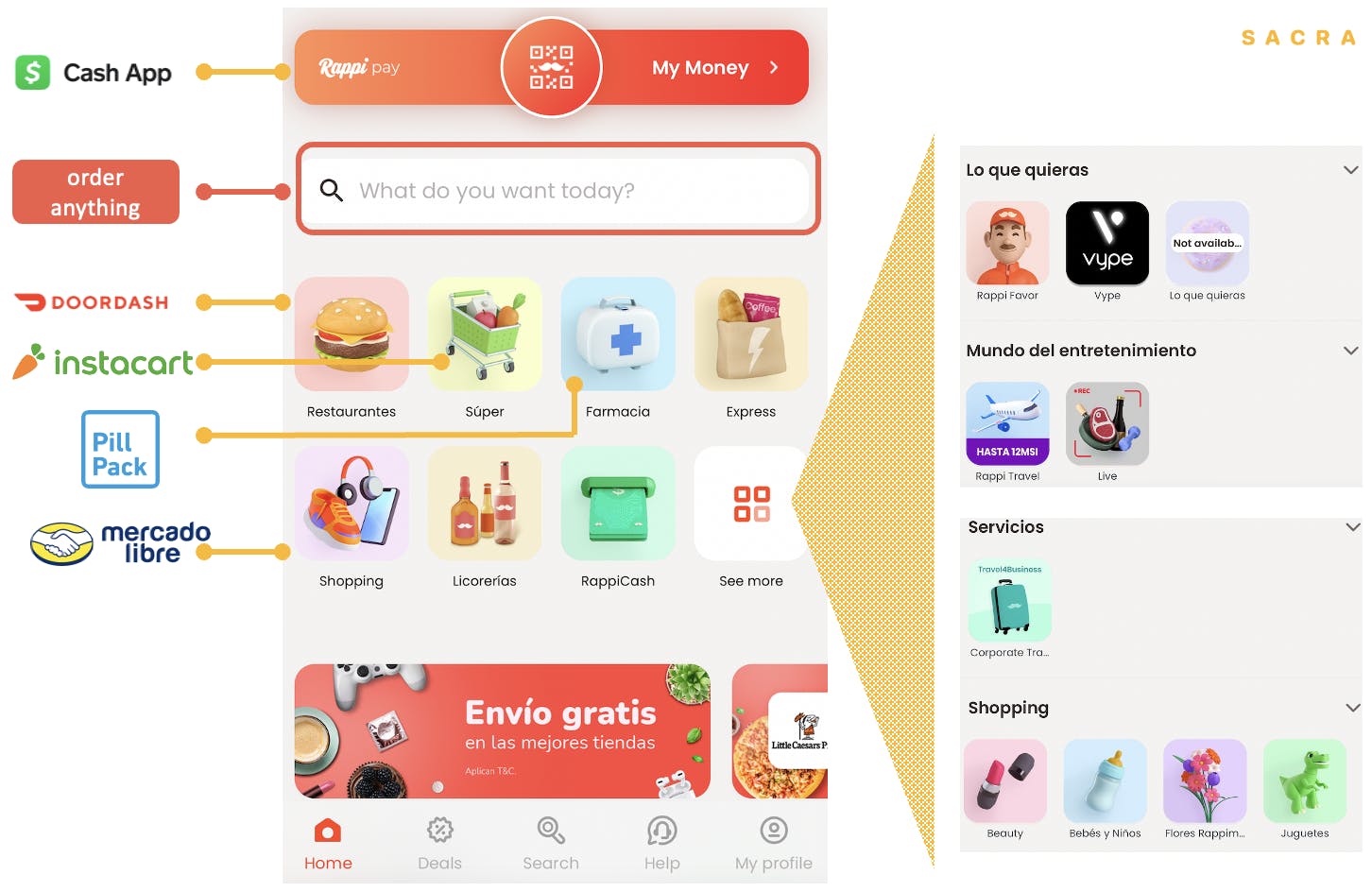

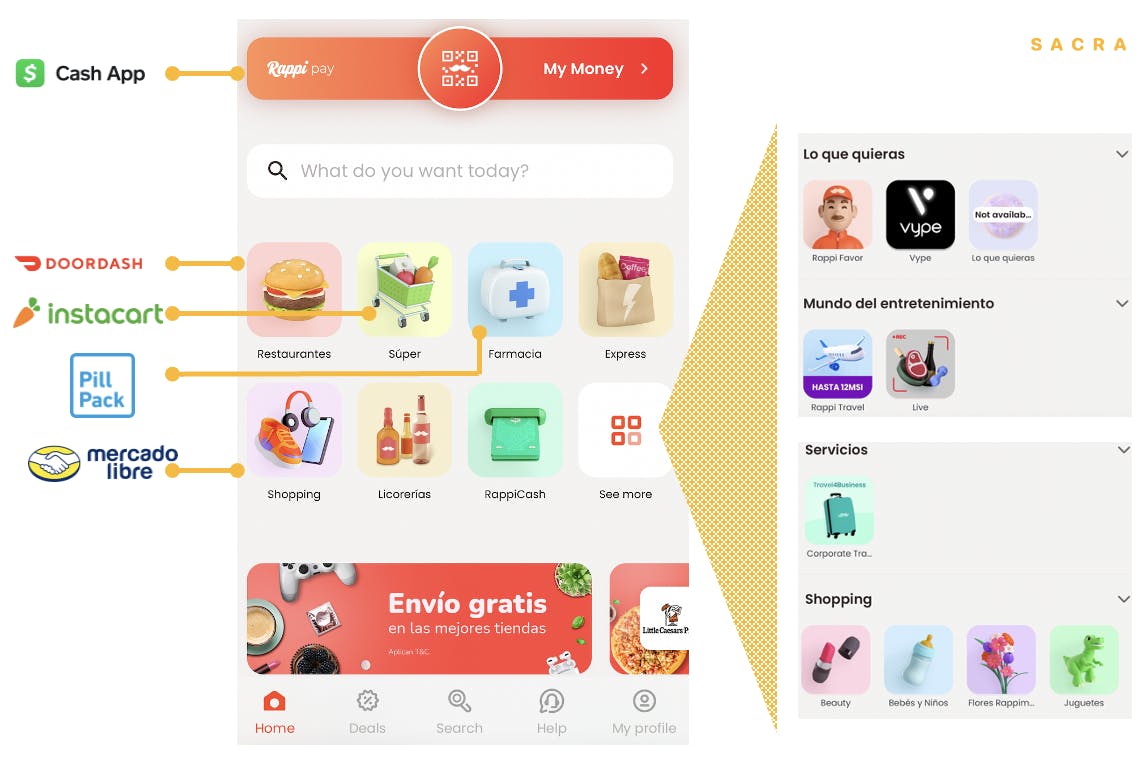

The marketplace combines grocery delivery (Instacart), food delivery (Doordash, Uber Eats), mobile money transfers (Cash App), e-commerce (Mercado Libre), pharmacy (Pill Pack) and 10-minute deliveries from dark stores into one mobile app.

Rappi provides multi-vertical on-demand services across food, groceries, e-commerce, pharmacy, travel and payments.

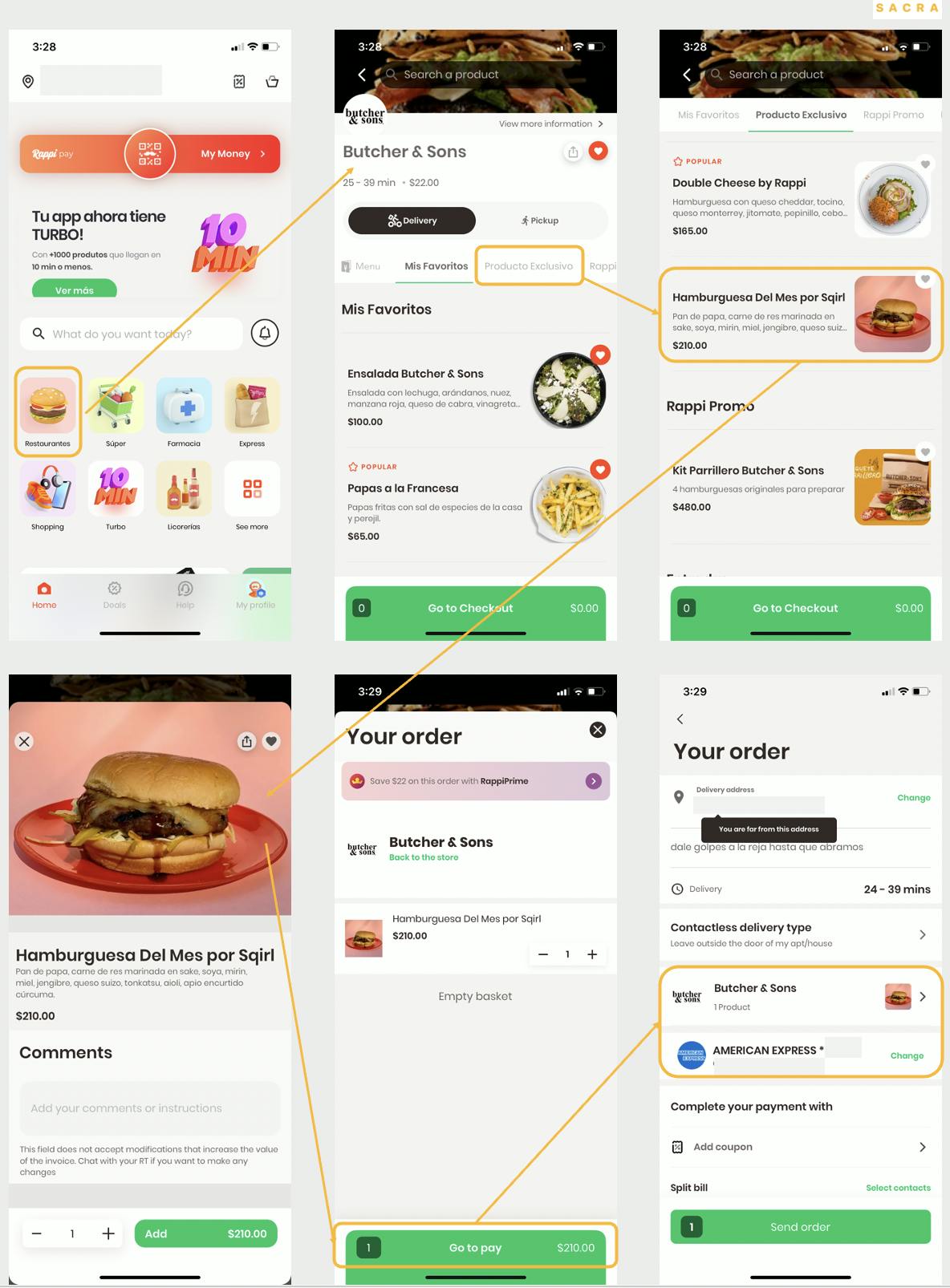

The user journey of placing food delivery on Rappi.

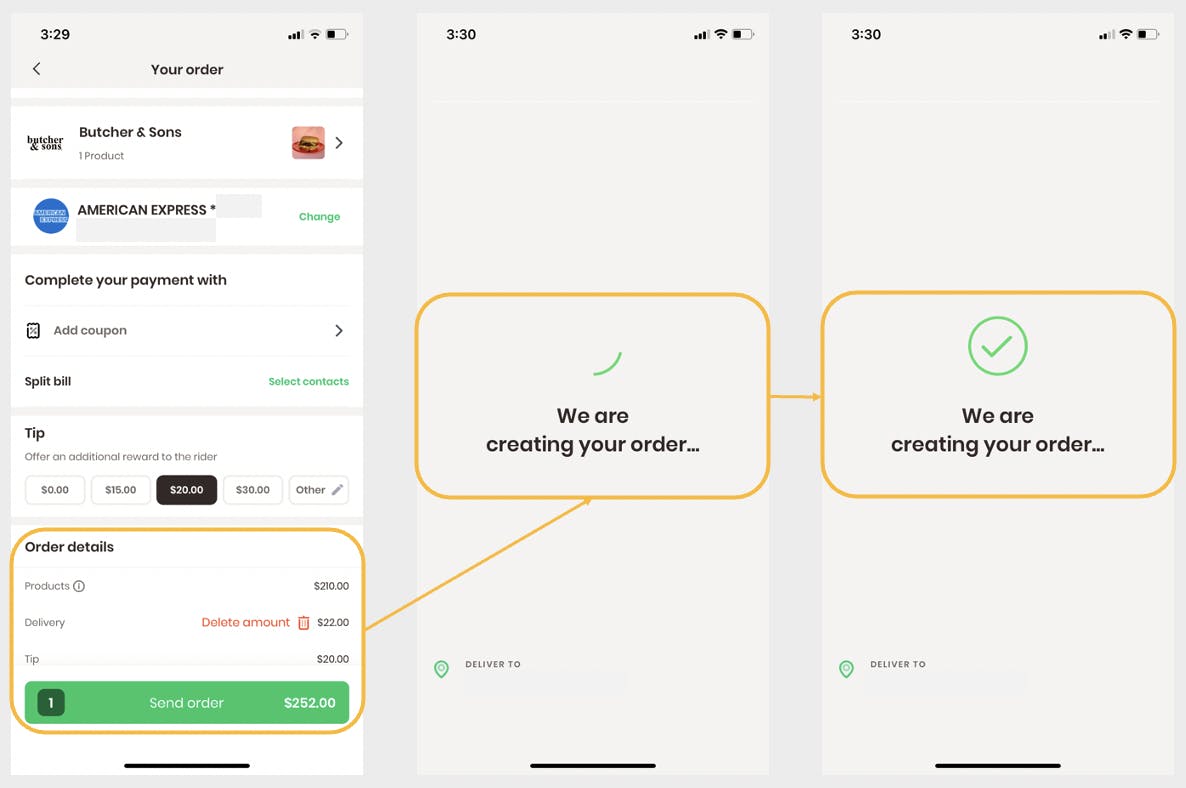

Rappi’s last-mile delivery platform acts as an intermediary between three parties: the consumer, the restaurant, and couriers. The logistics platform leverages traffic from the marketplace and enables merchants to deliver products to customers with a network of 200K+ couriers.

Rappi’s logistic platform connects consumers, merchants and couriers. It monetizes via commissions, delivery fees, advertising and subscriptions.

Rappi monetizes in four core ways:

- Commissions: Rappi charges the merchants commissions to sell via the marketplace.

- Delivery fees: For each order, consumers pay a fixed delivery fee to Rappi. Then, Rappi pays the couriers.

- Advertising revenue: Restaurants and FMCG companies pay advertising fees to the platform for priority listings.

- Subscriber revenue: Rappi has a subscription membership called Rappi Prime, which provides customers free delivery on orders.

We estimate their revenue mix to be approximately:

- 75% from restaurants and grocers’ commission and delivery services

- 13% from merchant advertising

- 10% from Rappi Prime

- 2% from e-commerce

Rappi has footprints in Mexico, Colombia, Brazil, Argentina, Chile, Peru, Ecuador, Costa Rica and Uruguay.

Rappi has footprints in 9 countries and 100+ cities in LatAm. We estimate that Rappi is the top 3 player in all major countries it is in.

Valuation: Rappi is worth $7B

We value Rappi at $7B, 7x EV/2022 revenue. This is up 75% from the last round price of $4B, which valued the company at 10x EV/2020 revenue.

Rappi has four different business lines. With perfect visibility, we would value Rappi on a sum-of-the-parts (“SOTP”) basis because these business lines have different cost structures and margin profiles. Nevertheless, since the majority of Rappi’s revenue mix is from on-demand segments in food, grocery and consumer packaged goods (“CPG”), we will value Rappi in its entirety using EV/Sales. We consider the higher margin from advertising as an unpriced upside.

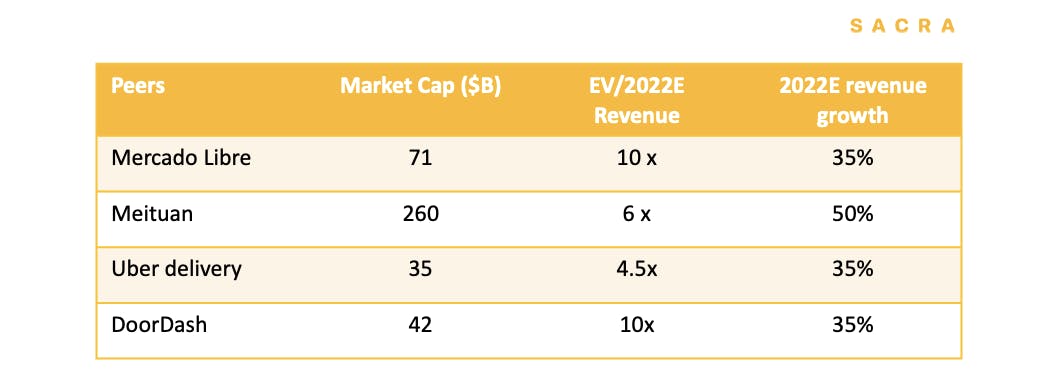

Rappi’s 7x multiple puts it in the middle of the on-demand delivery sector, which trades between a 4x and 10x forward revenue multiple. DoorDash trades at 10x EV/2022 sales and Meituan trades at 6x EV/2022 sales.

Rappi’s international listed peers trade between 4 - 10x EV/forward sales.

We think Rappi has a combination of the cross-sell capabilities of Meituan (6x EV/2022 sales), the LatAm exposure of Mercado Libre (10x EV/2022 sales) and the execution of DoorDash (10x EV/2022 sales).

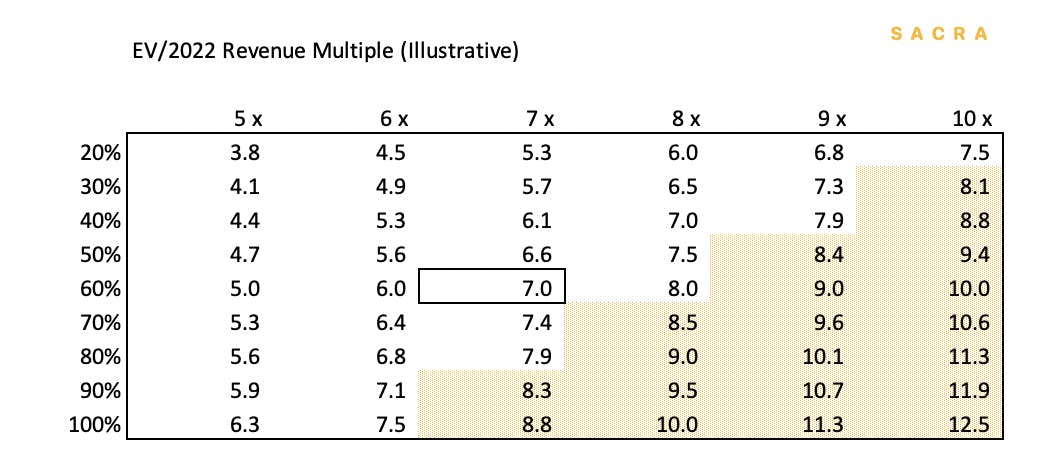

Our base case assumes 60% revenue growth next year and prices the company at 7x EV/2022 sales.

Fundamental to our analysis of Rappi is that the on-demand delivery market in LatAm is fast-growing and immature, with much lower levels of labor cost and online adoption compared to the West or Asia.

While Rappi is in a land grab and acceleration phase now, we think that the LatAm on-demand sector will move from “growth at all cost” to “growth with scale and profitability” in the next two years.

Our three cases for Rappi hinge on how well the company negotiates that shift:

- In our base case: Rappi remains as a top 2 player in Colombia, Mexico, Argentina and Peru, while actively defending its market share in other countries. We assume revenue to grow at 60% CAGR next year through category expansion and higher online adoption, and we also assume mild take rate compression as Rappi shares some of its scale benefits with its merchant partners.

- In our bear case: Rappi struggles to reduce its customer acquisition costs amidst tough competition and ultimately is acquired by a larger player.

- In our bull case: Rappi becomes the leading logistics platform and super app for all of LatAm, renting out its infrastructure to third parties while vertically integrating and cross-selling on its marketplace.

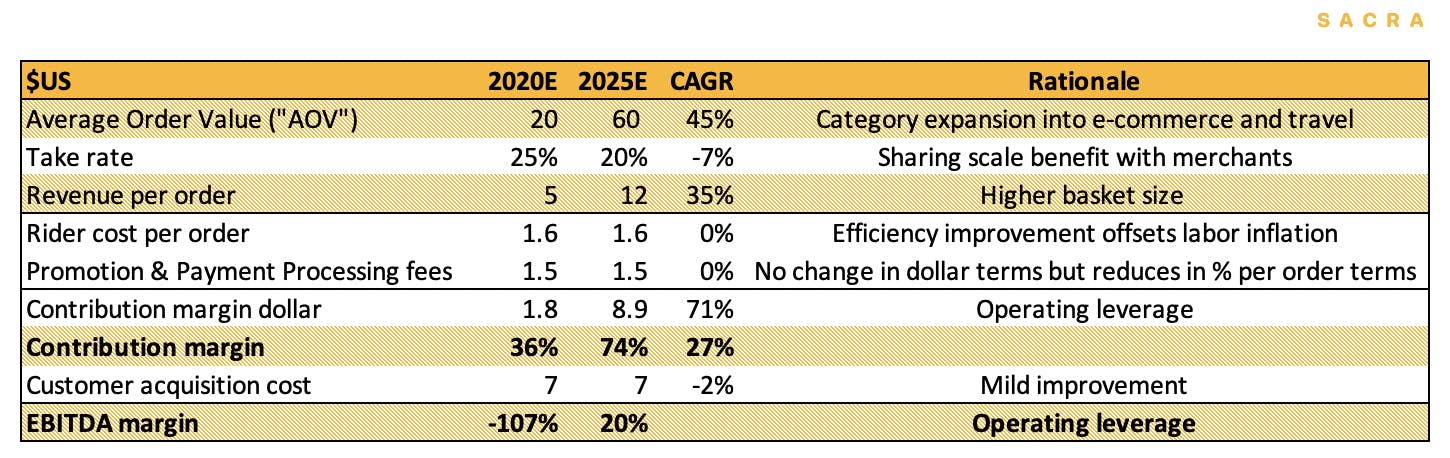

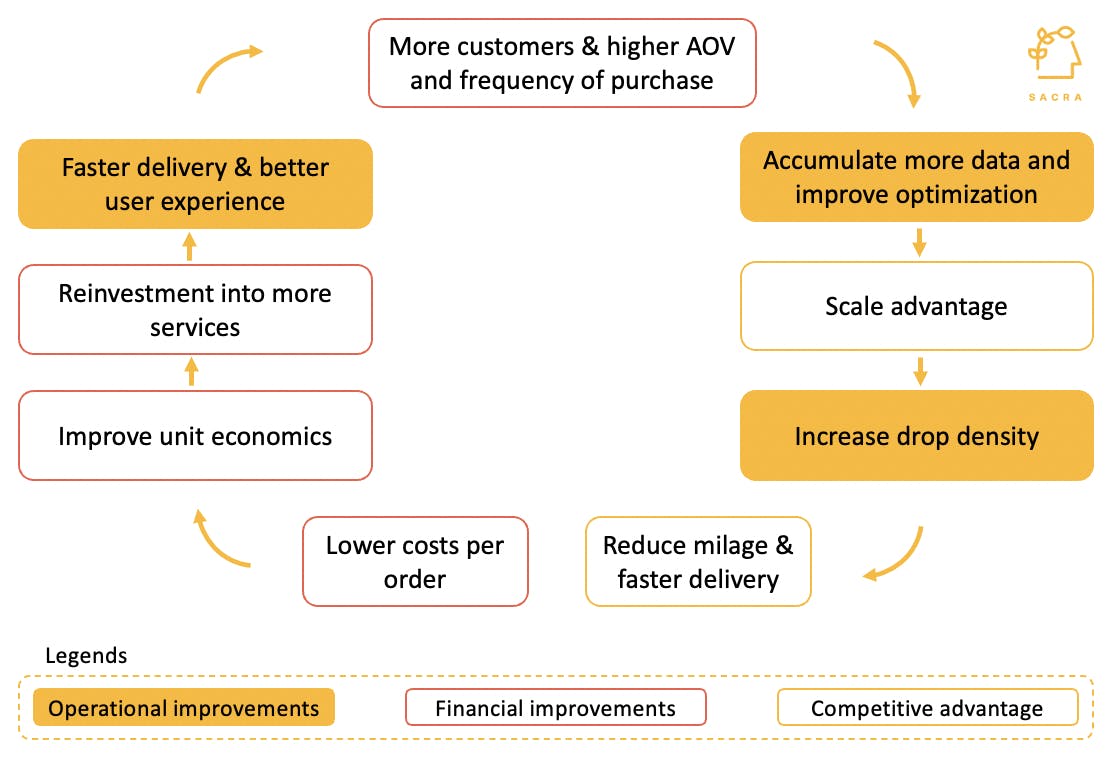

Illustrated unit economics improvement through category expansion, higher AOV and operating leverage.

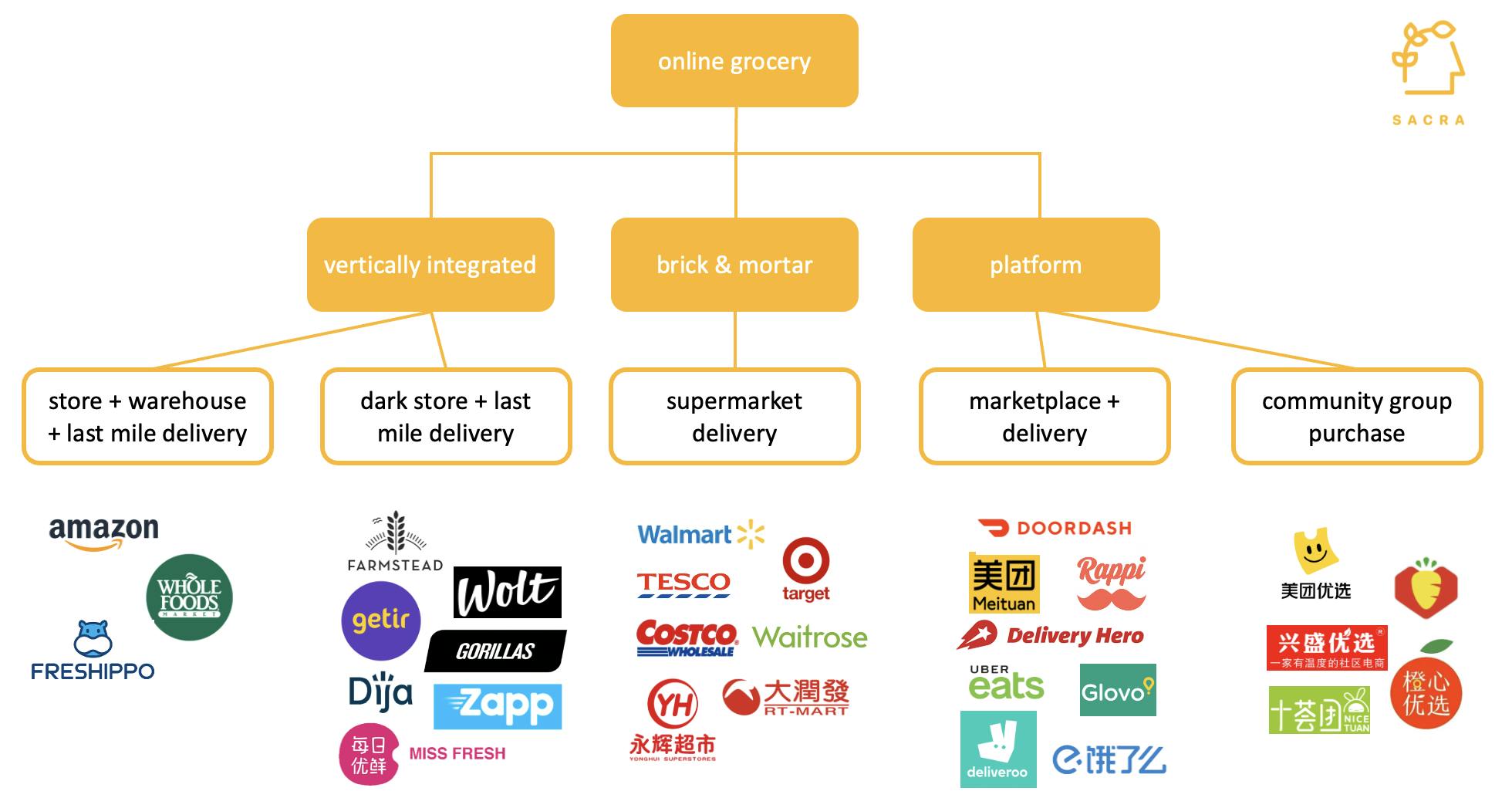

The Key Profitability Levers in Online Grocery

Members

Unlock NowUnlock this report and others for just $50/month

The Key Profitability Levers in Online Grocery

Members

Unlock NowUnlock this report and others for just $50/month

An important question is what kind of margin profile the business can achieve eventually. We think Rappi’s path to profitability hinges on:

- Order size: An increase in AOV has a positive impact on revenue per order.

- Order frequency: As the platform includes more merchants and more categories of services, customers will transact more frequently on Rappi.

- Promotions/discounts: We assume promotions and discounts would reduce over time as customers form more purchasing habits and have more trust in the platform.

- Delivery costs: We assume rider cost remains roughly flat and delivery efficiency improvement would offset labor inflation.

- Operating leverage: Category expansion, scale advantage and higher-order density would lower operating expense on a per order basis so incremental revenue would drop to the bottom line.

In our bear case, we think Rappi would either be acquired by a larger player or outcompeted by more superior business models. For example, Olo is building white-label on-demand delivery platforms for restaurants. The advantage of this model is that the restaurants own their customer relationship, instead of outsourcing lead generation to a third-party aggregator. We include other risks in our base case in the appendix.

In our base case, Rappi enjoys high density and low labor costs, two important structural advantages compared to its western peers. Rappi would remain as the top 3 players in all operating countries with 50%+ GMV growth through category expansion and higher adoption; margin improvement through lower delivery cost and operating leverage. We assume an operating margin break-even by 2025.

In our bull case, Rappi would emerge as the leading logistic platform of LatAm. Not only it succeeds in cross-selling with best-in-class net revenue retention and a full range of merchant coverage, but also it excels in higher-margin businesses, such as advertising, renting out its logistic infrastructure to third parties. Expanding into vertically integrated food delivery operations with marketplace + 1P logistics + dark kitchen would also contribute towards margin improvement for the overall business.

Analysis: How Rappi can build the first LatAm super app

To better understand how Rappi’s business will evolve, we can look at some of Rappi's more mature peers to take cues on how the market structure will unfold in LatAm.

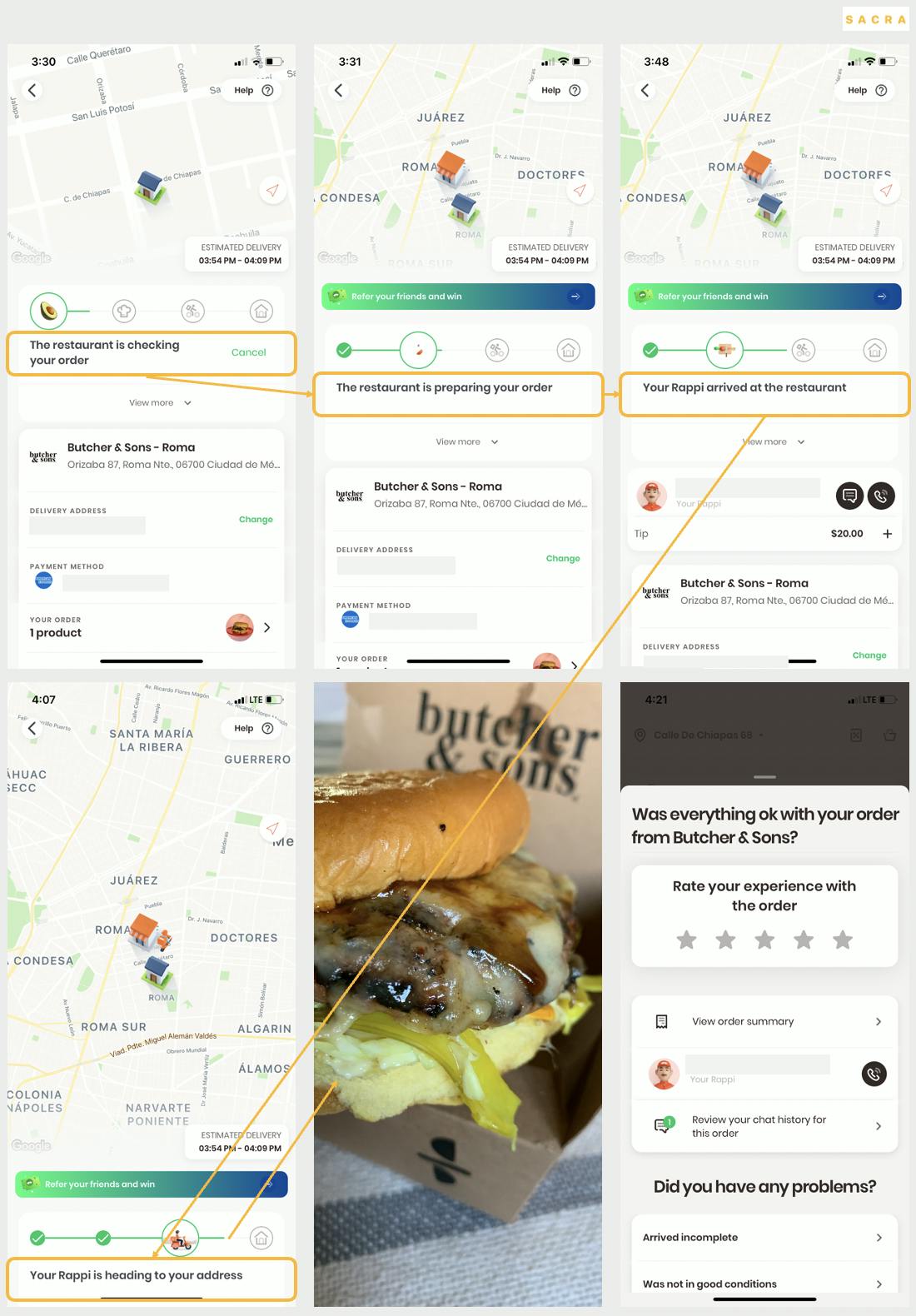

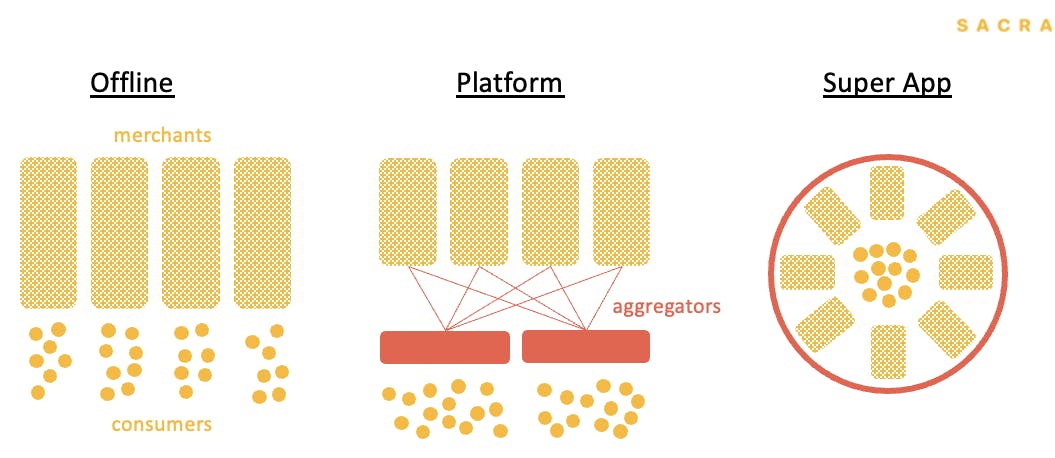

Historically, there are three distinct stages of evolution in on-demand companies. In the beginning, restaurants and merchants are 100% offline. The on-demand delivery value chain is modularized. Dine-in and food-at-home are entirely organized by customers directly.

Three stages of evolution in the intensely competitive on-demand market.

In the second stage, a flurry of marketplaces and aggregators begins to emerge. During this stage, on-demand delivery remains highly fragmented and competition is intense.

This is where we think Rappi is currently—with the exception of Colombia where it is a clear leader, in every market Rappi is battling it out with several other on-demand giants for supremacy.

Eventually, however, that competition drives margins lower and lower. The need to get scale to make the unit economics work—more couriers, more merchants, and more users—forces consolidation, with both smaller players exiting the market and larger ones joining forces.

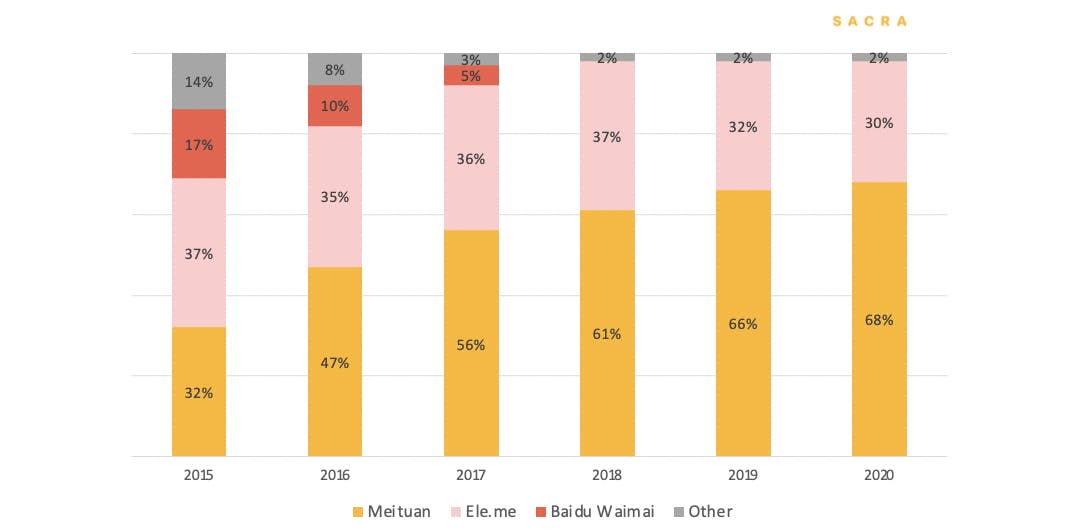

Chinese food delivery market settled into a duopoly. Meituan gained market share. Baidu Waimai merged with Ele.me in 2018. (Source: company disclosures)

In China, Meituan merged with Dianping and E’le me merged with Baidu Waimai. Chinese on-demand market has stabilized in a duopoly market structure. In Indian and the U.S., the markets are also stabilizing into a duopoly or an oligopoly market structure.

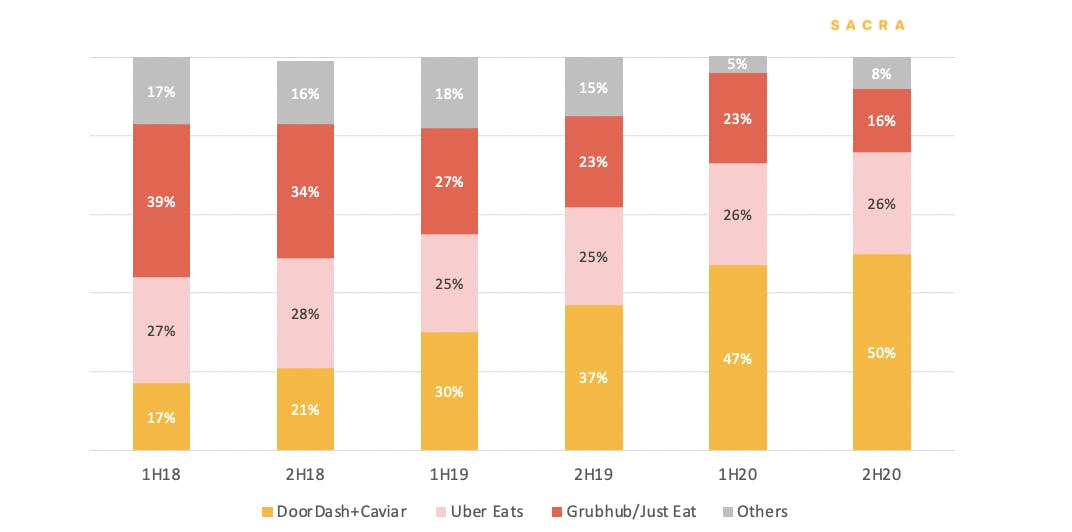

U.S. food delivery consolidated into an oligopoly market structure in the last three years. (Source: company disclosures)

There are early signs of this kind of competitive rationalization taking place in LatAm. Glovo exited Chile and Brazil in 2019. UberEats exited Argentina and Colombia in 2020. This rationalization marks the beginning of the third stage, where a handful of integrated logistic platforms start to emerge—and where you see the beginnings of improved unit economics.

The first stages of the on-demand economy are marked by the use of high marketing spend to gain traffic and attract more customers. Gradually, less well-funded companies cannot sustain this level of spending, exit, and the market structure becomes more concentrated at scale.

Once the competition rationalizes, AOV and frequency of purchase go up and the winning platforms will serve more active users with less pressure on customer acquisition costs. The market would reach equilibrium with better unit economics, more profitable and sustainable growth.

1. The unfair unit economic advantage behind Rappi’s 120% year-over-year growth

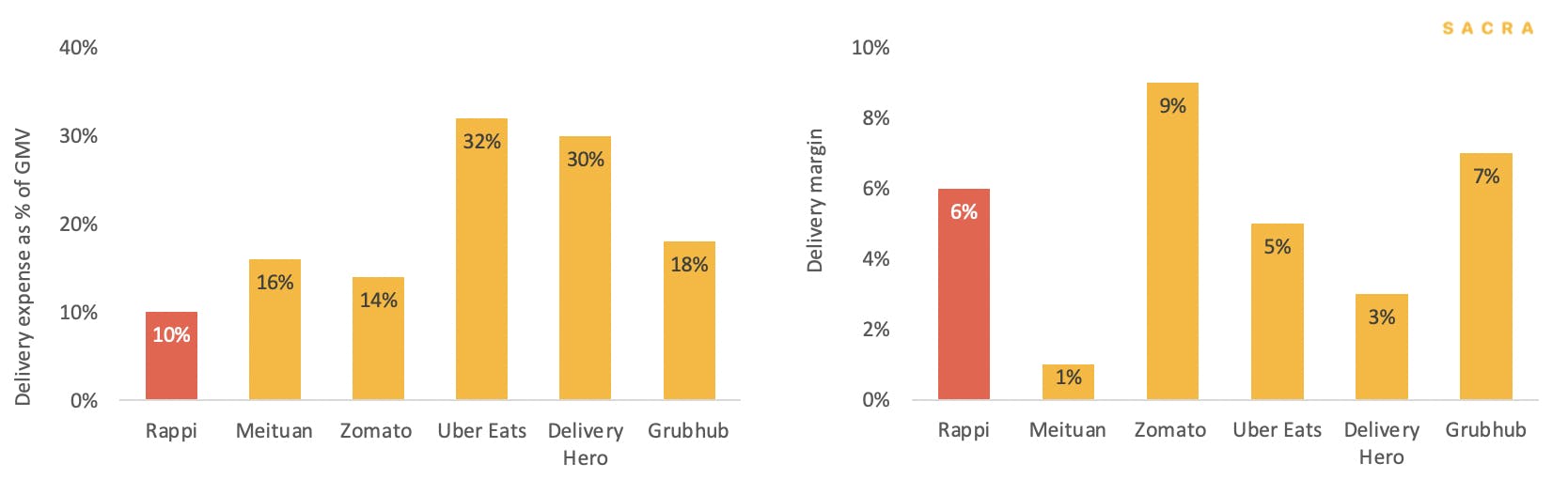

Few industries are as brutal and competitive as on-demand delivery, but Rappi has a powerful advantage on its hands. We estimate Rappi has one of the lowest delivery expenses of all on-demand apps as a percentage of GMV.

We estimate that Rappi generates an above-average delivery margin per order as a result of its low delivery expense and medium AOV, a structural advantage over its Western peers. As a result, Rappi can break even per order with just 2 drops per hour and hit profitability in a new zone just 3 and a half months after launch.

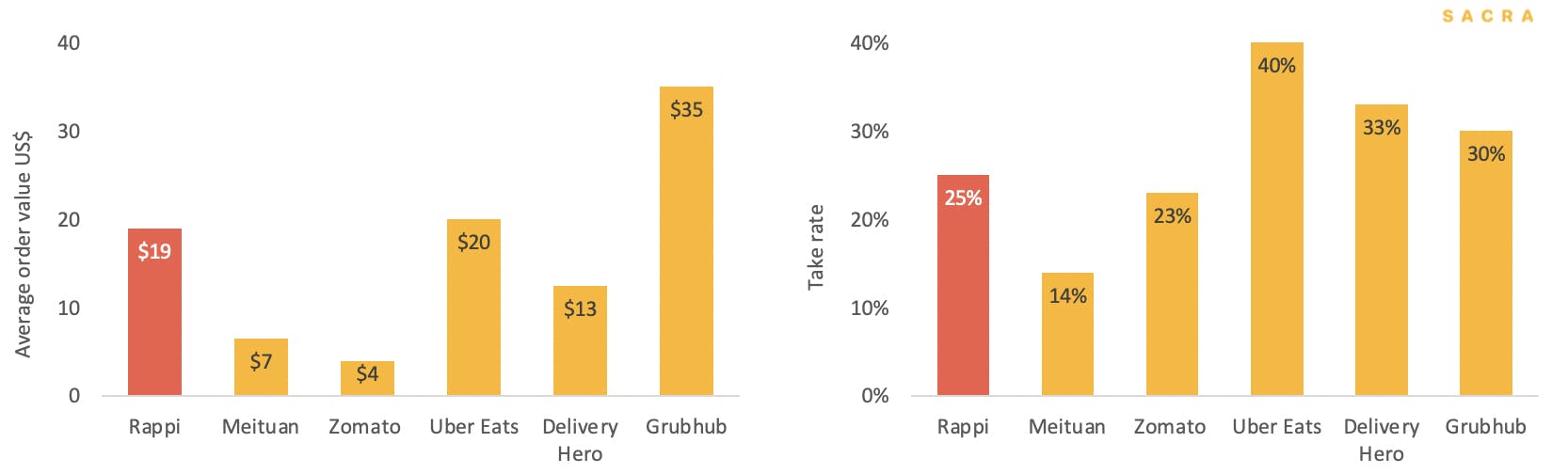

According to our primary research, Rappi also has a medium AOV and a below-average take rate (commission + delivery fee). (Source: company disclosures and Sacra estimates)

Rappi’s delivery expense as % of GMV is the lowest such that it can generate an above-average delivery margin. (Source: Company disclosures and Sacra estimates)

How does Rappi do this? There are three big factors:

- Incredibly dense markets: The LatAm markets where Rappi is active are 30% more dense than Asia and 3x the density of the USA.

- Cost advantage: We estimate Rappi’s delivery expense at 10% of GMV, compared to 14-16% in Asia and 30% in the USA.

- Low levels of online adoption: Food delivery is at 2% online adoption in LatAm, compared with 10% in India, 12% in the USA and 18% in China. CPG penetration is at 1% in LatAm, creating a long runway for Rappi.

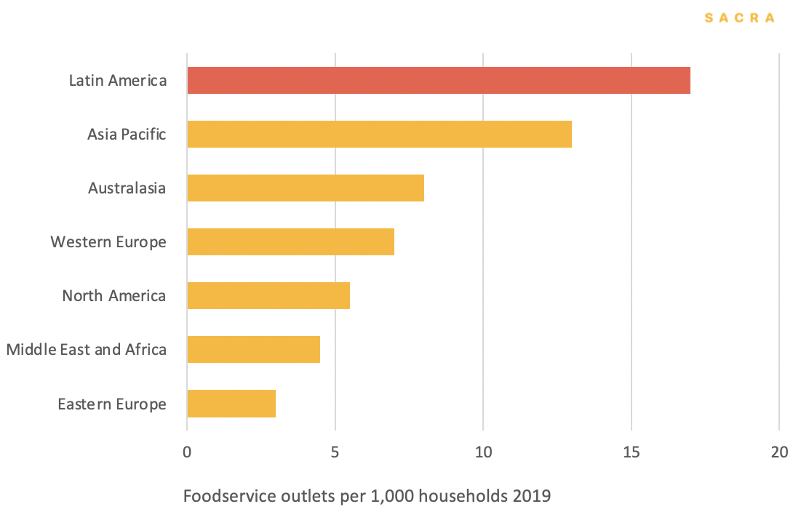

LatAm has the highest restaurant density in the world. (Source: Euromonitor 2019)

LatAm is one of the best markets for on-demand delivery in the world because of its high density of restaurants and merchants per household. According to Euromonitor, LatAm has 17 restaurants per 1,000 households, 30% higher than the density in Asia and three times higher than in the U.S.

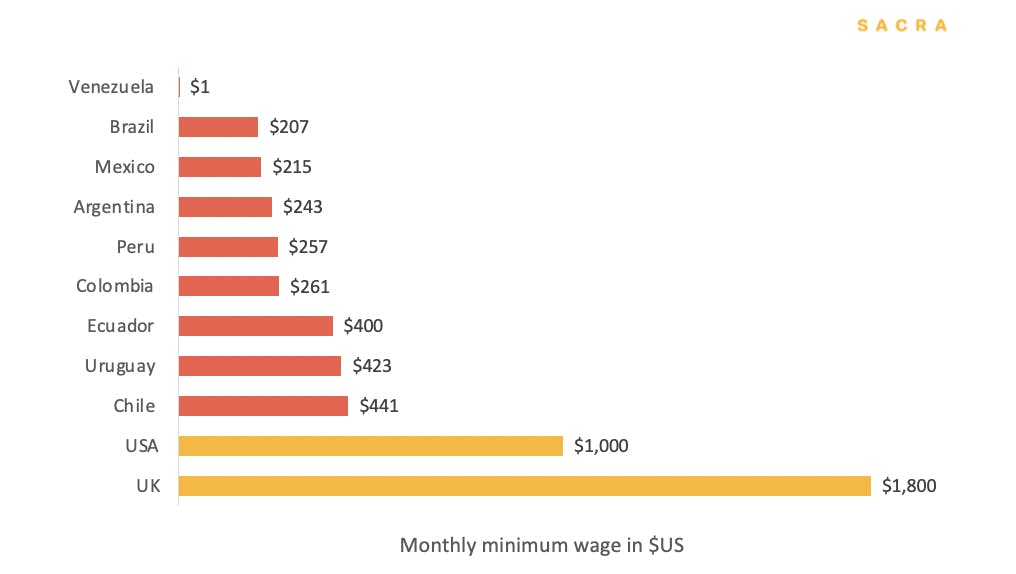

Latin America has among the lowest wages in the world. (Source: Eurostats 2021, Statista 2021)

Secondly, the difference in labor cost is significant between LatAm and the West. The average minimum wage in LatAm is $300 per month, compared with $1000 per month in the USA and $1800 per month in the UK. The company says its couriers receive two times the minimum wage, but this still provides Rappi a 20-40% cost advantage over its Western peers.

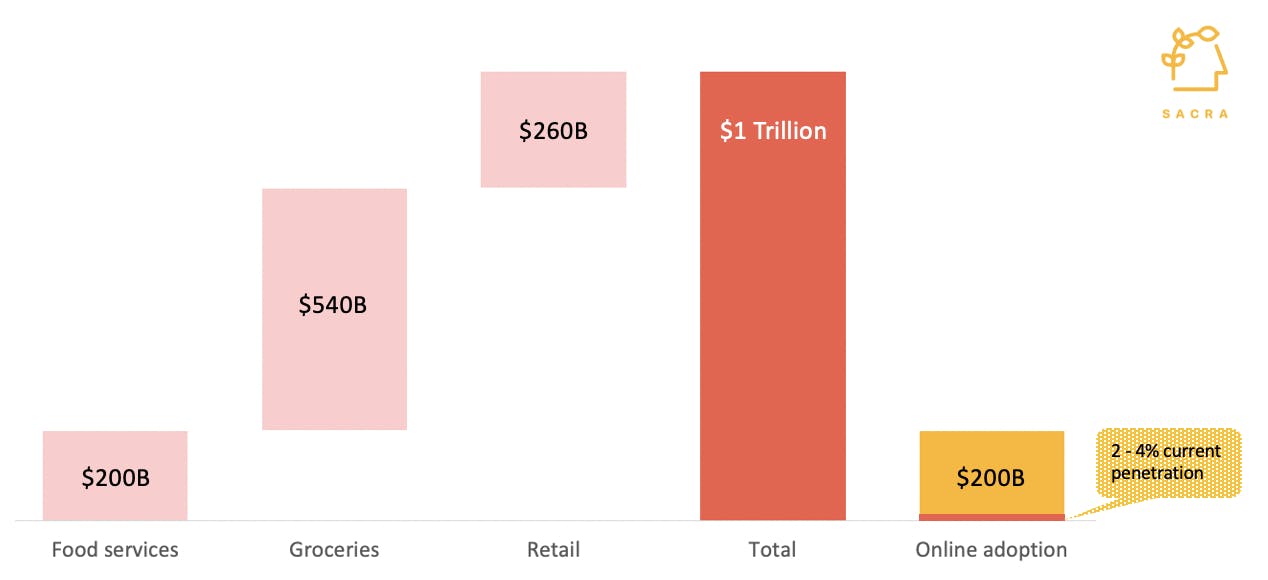

In 2019, CPG, food services and grocery amount to over $1 trillion markets in LatAm. (Source: Euromonitor 2019)

LatAm has a much lower online adoption in food delivery services compared with India, China and the U.S. (Source: iResearch and Sacra estimates)

Finally, there’s the size of the underlying food and CPG markets Rappi is addressing: over $1 trillion in total in LatAm. Future growth will come from both industry growth and from continued offline to online migration.

More broadly, LatAm represents 9% of the global population, with the continent’s GDP expected to reach $5 trillion by 2025. Per capita GDP is expected to double in the same period.

Both food delivery and e-commerce frequency are increasing across the region due to socio-economic factors such as rising urbanization, increase in working women and higher disposable incomes. 70%+ smartphone adoption and wireless data also accelerate growth.

Foodservice alone is a $200B market for Rappi. According to Euromonitor, LatAm’s total GMV from online food delivery was US$6B in 2020. This translates to just a 3% online adoption rate. Similarly, CPG and grocery account for more than half of total retail spend, but online adoption is still at a low single-digit. Given the relatively low levels of online adoption, we expect a long growth runway ahead.

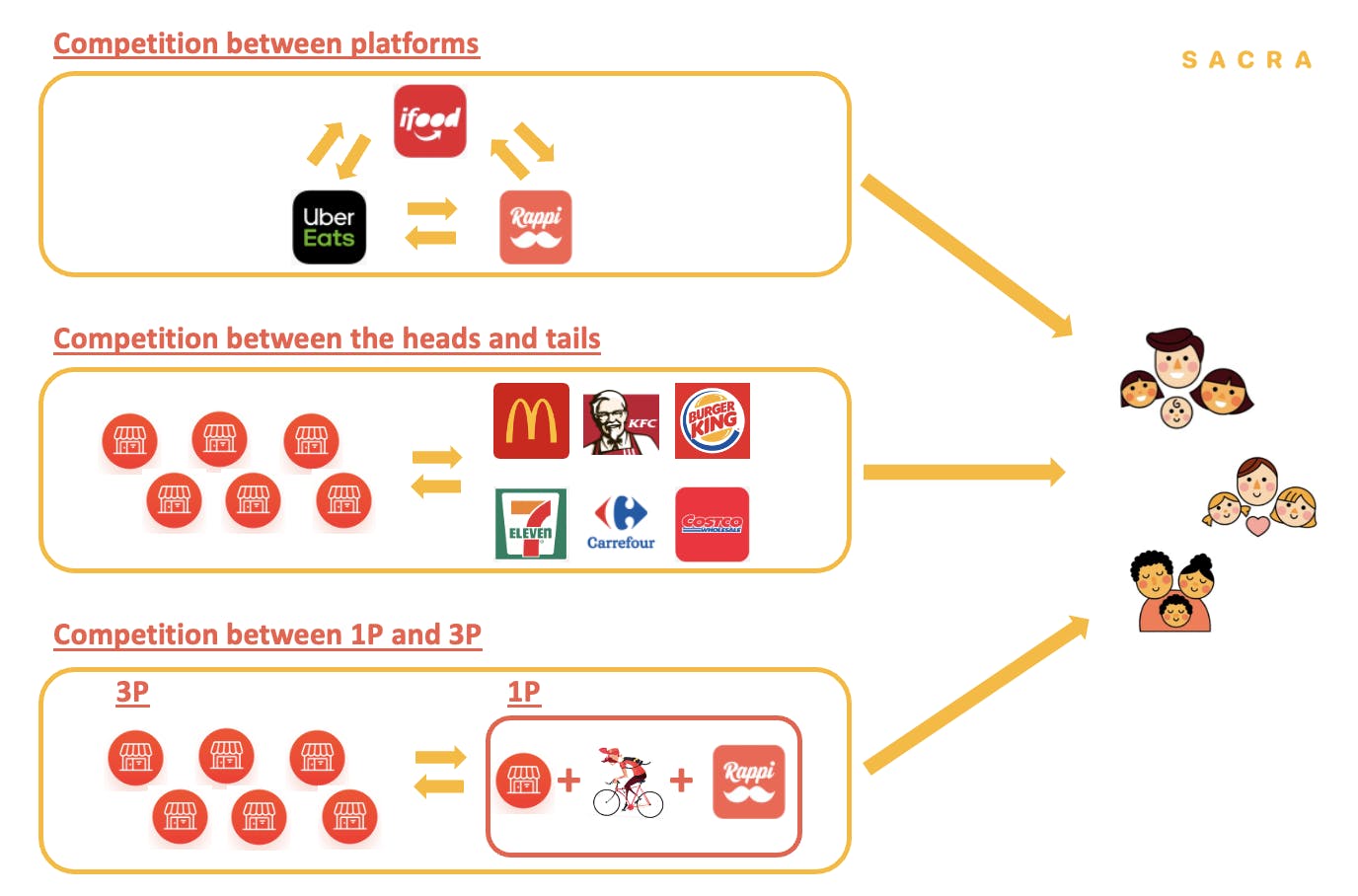

2. The 3 types of on-demand competition Rappi must overcome to win

On-demand delivery is one of the most complex and competitive industries. Companies can be burning cash for a long time. For Rappi to emerge as the Meituan of LatAm, it has to overcome three different types of competition.

Three types of competition for consumer wallet-share in the on-demand business.

First, there is competition between the platforms.

Rappi’s biggest competitors include iFood in Brazil, Uber Eats in Mexico and Pedidos Ya in Argentina. Platforms compete through supply-side exclusive contracts, discounts and promotions to incentivize spending.

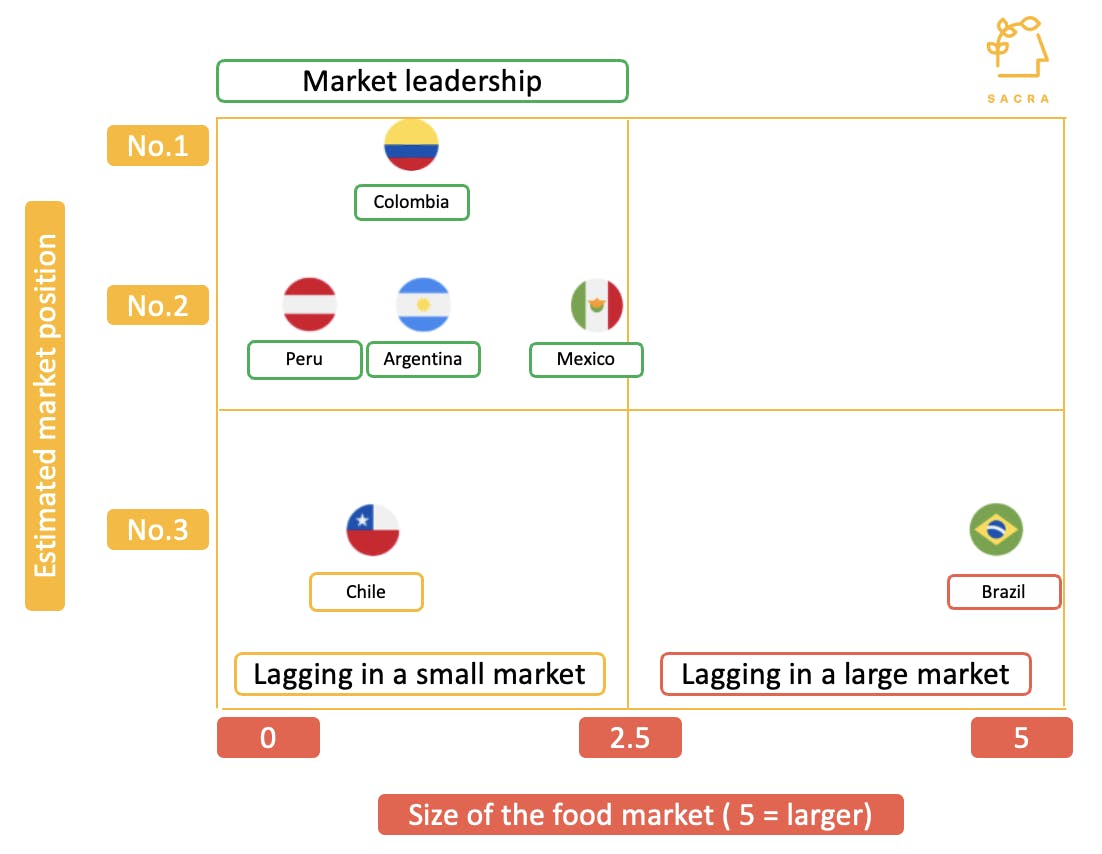

Rappi is among the top three players in all major countries it operates.

We estimate that Rappi is the top player in Colombia and #2 in Mexico, Argentina and Peru. Rappi is also fighting for #2 in Brazil, which is the biggest market in Latin America and contributes 40% of GDP.

Rappi’s battle in Brazil is particularly complicated because it is the home market of iFood. Uber Eats is another player aggressively leaning into Brazil for the #2 spot as well.

Because of local network effects and scale advantages, there is a meaningful difference in the competitiveness of the #2 and #3 players in these markets, and we believe it is likely that on-demand markets will eventually settle into a duopoly structure at maturity.

In the worst-case scenario, if Rappi loses in Brazil, as long as it can double its market share in Mexico, or triple its market share in Argentina, these gains can make up the loss of GMV in Brazil.

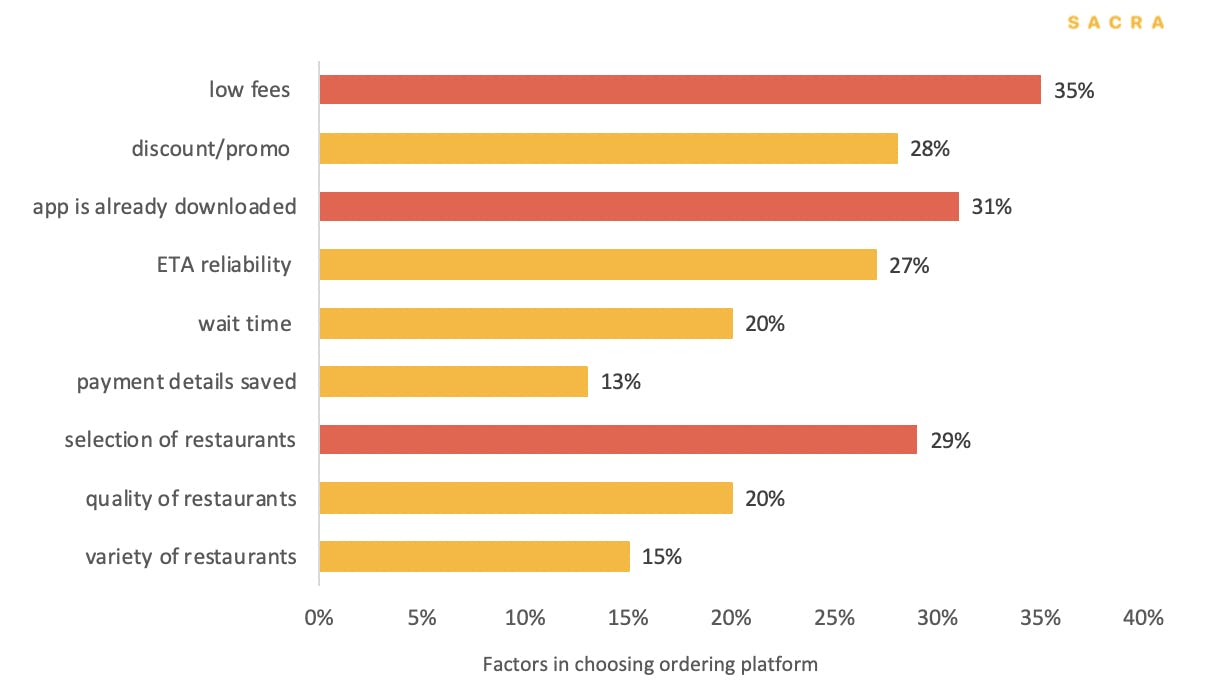

Customers are drawn towards the selection and availability of their favorite restaurants and merchants on the platform.

Meituan provides a valuable comparison here. There were a few critical reasons that Meituan won the war against 5,000 other on-demand companies in China. One was that their competitors ran out of money. Another was that Meituan was able to secure exclusive supply with merchants through a strategy that involved sending out 30,000 field sales reps to sell and onboard them.

Low fees, availability of preferred restaurants and immediate accessibility of the app are the key factors of which apps customers choose. (Source: Sense360)

Our primary research confirms that exclusive contracts are effective in defending market share in LatAm too. iFood attempted to expand in Argentina and Pedidos Ya attempted to expand in Brazil. However, neither company successfully took market share because restaurants in these countries had already signed exclusive contracts. To resolve the situation, iFood acquired Pedidos Ya's Brazilian assets and PedidoYa acquired iFood’s Argentine operation to consolidate the market.

However, iFood’s dominance in Brazil may be under threat. Rappi and Uber Eats have recently won the first round of dispute against iFood about restricting restaurants working with other platforms. CADE (the Administrative Council for Economic Defense) said it has forbidden delivery app iFood to sign new exclusivity deals with restaurants for delivery as a way to preserve competition.

From the merchants’ perspective, by signing exclusive contracts, restaurants can only list on one platform but enjoy a cheaper commission. For small merchants with less capacity to multi-home, it makes economic sense to be on one platform with the highest traffic and pay a lower commission. The platform would also prioritize these exclusive restaurants in their listings.

By becoming the one-stop service solution for merchants, Rappi can combine its platform with merchants’ distribution business, inventory management system and provide an integrated payment solution. As a result, Rappi can integrate more with the merchants’ operation.

The second type of competition is between big brands and the platforms.

Rappi serves as an online presence for merchants. However, by outsourcing lead gen and delivery to Rappi, restaurants not only risk losing their direct relationship with consumers but also orders transacted via the platform can be margin dilutive for the restaurants. This is because when delivery sales cannibalize in-store sales, without reducing labor costs or rents, the restaurants’ owners are taxed twice: fixed costs and platform commissions.

Similar to how Marriott and Hilton encourage direct booking and how Nike decides to delist from Amazon, merchants with bargaining power would force an outcome that’s more beneficial for themselves in the long term.

We believe the concentration of supply also weakens Rappi’s negotiation power. Our primary research suggests that the top 10-15% of restaurants generate the majority of GMV, with the most popular restaurants making on average 2,000-5,000 orders per month. In contrast, the other 85 - 90% of restaurants make less than 50 orders a month. Therefore, many SMBs are on the platform just to survive.

The third layer of competition is similar to how Amazon begins to compete with its merchants by selling lower-cost 1P products. Rappi runs their own 1P dark kitchens. Dark kitchens can provide additional production capacity dedicated to off-premise demand. Since the fixed costs are low, dark kitchens can be a more efficient use of capital.

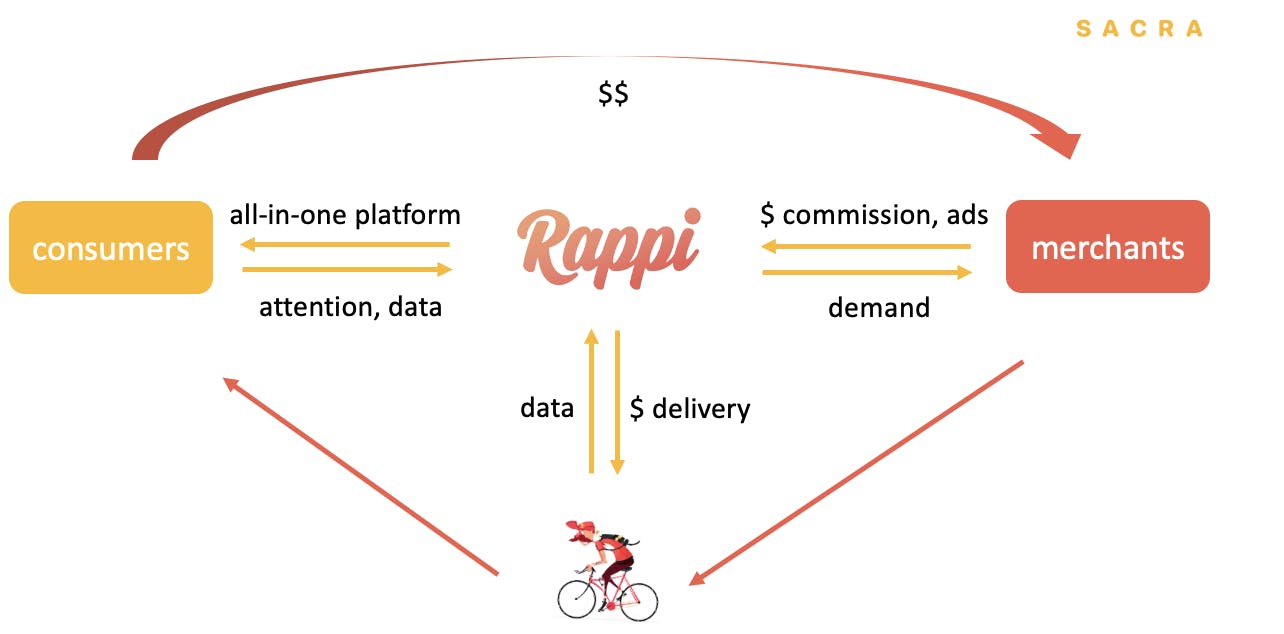

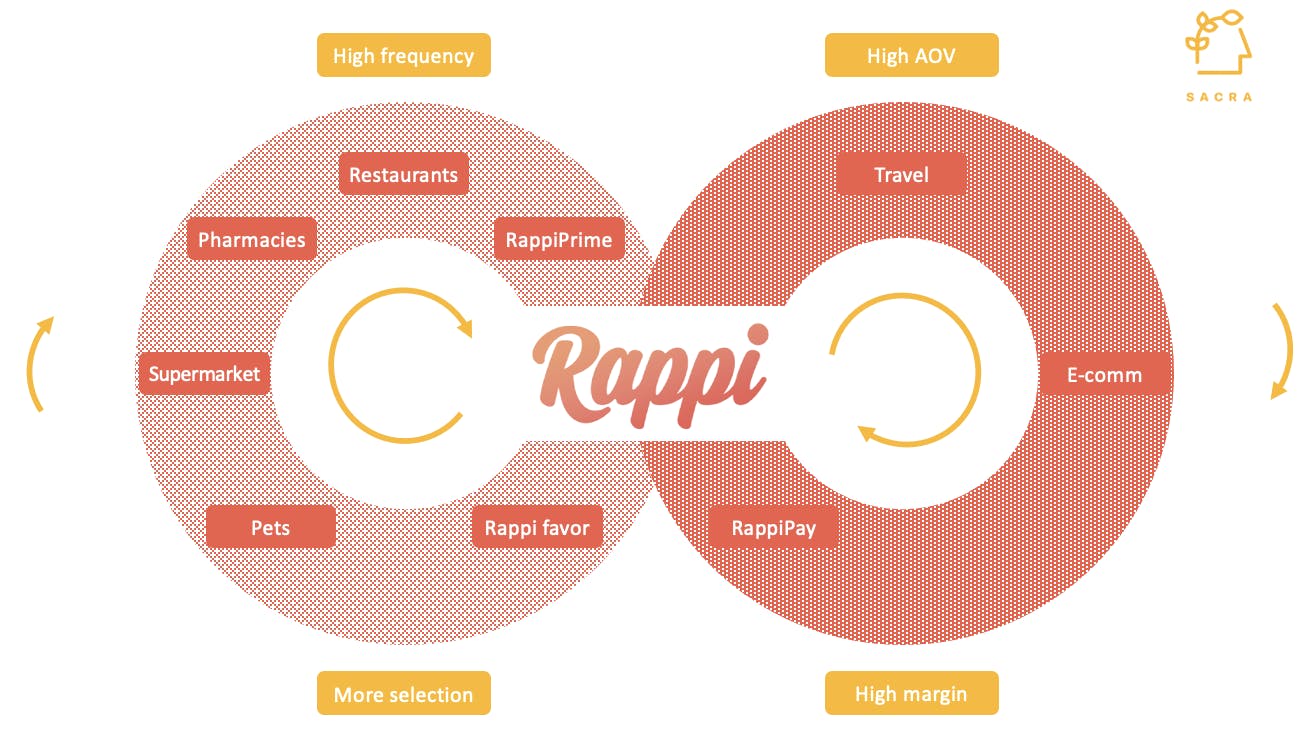

3. How Rappi can use multi-verticality to open new runways and accelerate ARPU growth

Over the last few years, Rappi has been expanding beyond food and CPG delivery into e-commerce, travel and merchant advertising: verticals that are complementary to Rappi’s existing services and can expand Rappi’s TAM in the long run through more user scenarios, larger cohorts and higher AOV.

This strategy of using high frequency, low margin verticals to gain mindshare and then cross-selling into low frequency but high margin verticals is similar to how Meituan became a one-stop platform in China:

- Expanded their customer base and transaction frequencies by introducing more services with strong cross-selling capabilities.

- Unlocking value for merchants through online marketing, payment systems and supply chain finance

- Investing in its intra-city on-demand delivery network and algorithm to improve operating efficiency

Cross-selling from high frequency, low margin verticals to low frequency but high margin verticals is an effective strategy to gain market share.

Through food delivery, Meituan captured users, and could then cross-sell the high margin hotel business to the same group of sticky users. As a result, 70%+ of its hotel booking customers came from its existing food delivery customers. Today, food delivery makes up 57% of Meituan's revenue but only 34% of its gross margin, whereas travel contributes 19% of revenue and 51% of its gross profit.

Meituan’s main advantage was its strong execution and ability to dominate new cities. The company used a team of 30,000 sales and business development representatives to establish relationships with merchants, on-board them, and provide them with SaaS solutions that helped them run their business while also bringing them into the Meituan ecoystem.

Rappi is still in the early days of building out this kind of ecosystem. The majority of Rappi’s current revenue—about 75%—comes from food and CPG delivery. Nevertheless, it is the only company in Latin America that has a super-app or multi-vertical DNA. In other words, it is a pure horizontal player, while all its competitors are vertical players with aspirations to go horizontal.

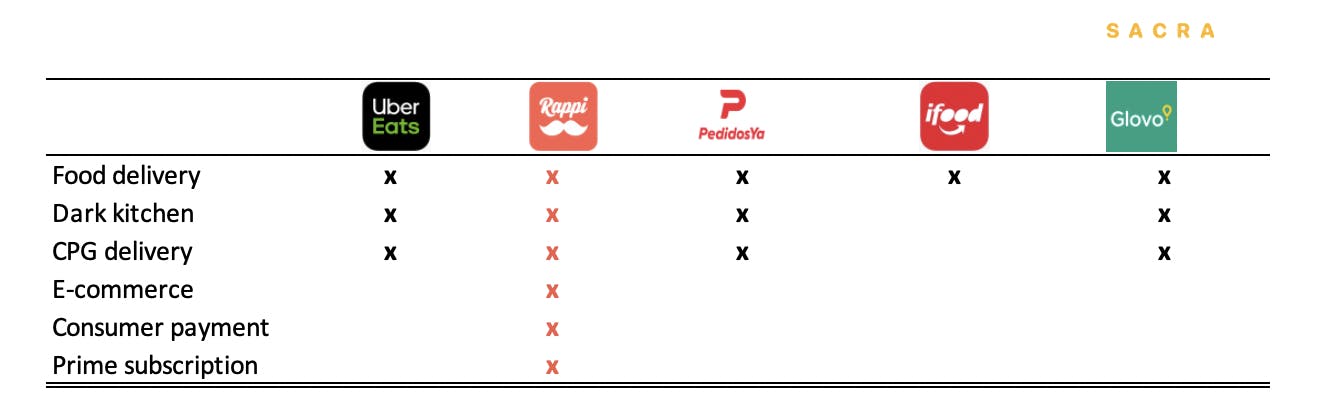

Rappi has by far the widest product offering of any on-demand app in Latin America.

We believe Rappi’s cross-selling strategy is bearing some fruits. Through our primary research, we learned that more than 90% of Rappi customers purchase from at least two categories. Average purchase frequency increases by 3x to 6 times per month after 3 years, and reaches 11 times per month after 5 years. Rappi's power users purchase as much as 20 to 30 times per month.

Rappi's unique geography and multi-vertical DNA give it an advantage in aiming to build something that hasn't yet happened in the West—a true super app:

- Super-apps are harder to build in countries with established internet economies, partly because super-apps are mobile-native experiences and most Western countries are not mobile-first.

- Super-apps need to own the user’s wallet to facilitate a high volume of transactions.

- In many cases, super-apps need to have strong positive relations with governments

The result is that countries with less established offline infrastructure can often leapfrog countries with legacy assets.

Rappi, for its part, is investing heavily in logistics. Food and CPG deliveries are the first steps. As consumers build habits to order more frequently, Rappi is expanding to adjacent verticals such as pets, e-commerce and travel. More categories can incentivize a higher frequency of purchase.

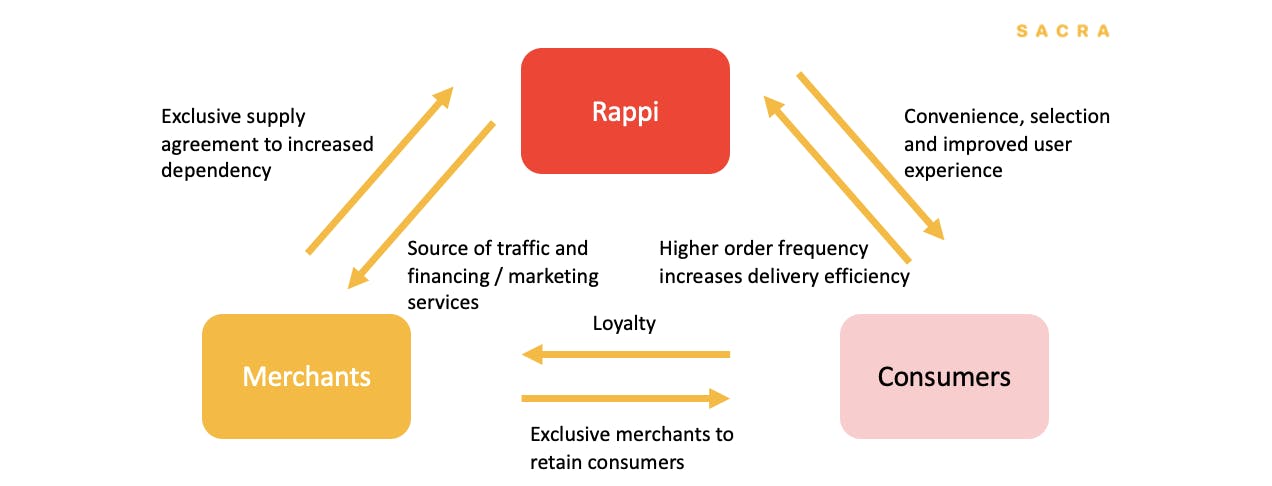

Once the platform reaches critical mass, it benefits from hyper-local network effects. Merchants want to list on platforms with the most traffic; customers want to order from platforms with the most selection and riders want to deliver for platforms with the most orders.

The network effect in delivery creates a positive feedback loop for merchants, consumers and the platform.

The local network effect also compounds with scale, increasing the platform’s ability to attract more merchants and leverage network density into better economics and user experience.

The virtuous cycle on-demand aggregators need to cultivate to reach profitability and market dominance.

The combination of competition rationalization and the emergence of super-apps increases the barriers to entry. Consequently, the market structure becomes more concentrated and new entrants are less likely to take market share. As Rappi accumulates more data on the customers, merchants and logistics, that infrastructure sets the foundation of a more profitable and sustainable business.

To improve efficiency, Rappi needs to match supply and demand at the right time. Otherwise, the biggest challenge for the marketplace is the lag between supply and demand, which will either increase ETA or reduce order volume. Rappi can optimize delivery time in the following stages:

- Collection: ensuring high liquidity of merchants and riders on the platform to reduce friction and time.

- Riders wait at pick-up stores: use a better algorithm to predict when orders will be ready to reduce waiting time.

- Delivery from store to customers: the distance between stores and customers impacts delivery time and cost. Rappi can determine which stores to display during a customer's initial search.

- Increasing drop density: in a dense network, Rappi can increase the average number of orders per delivery and per hour.

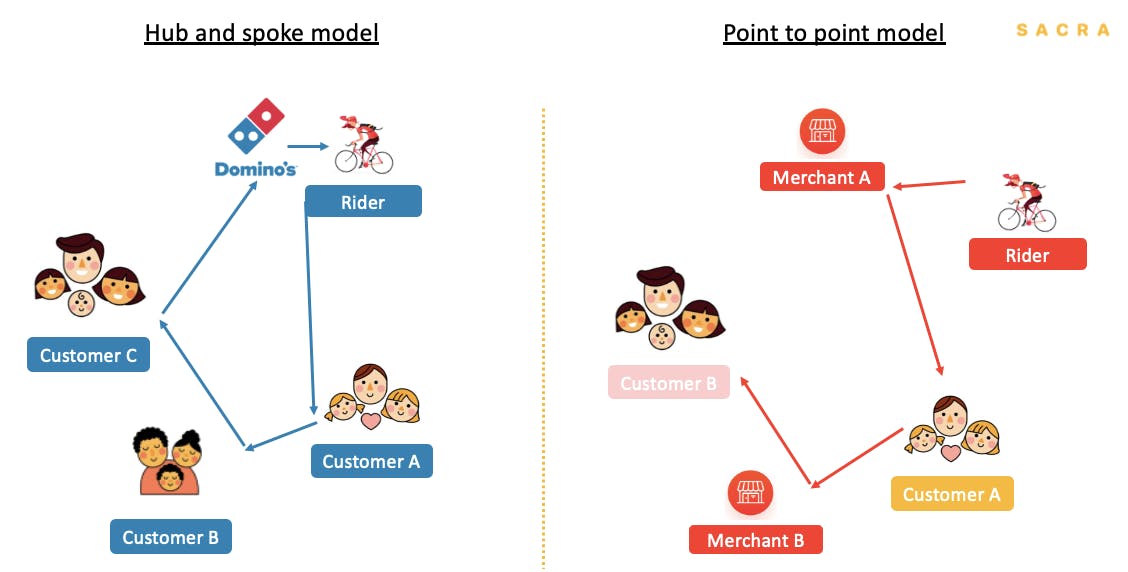

Rappi has an on-demand point-to-point delivery model. The typical challenge with this model is that since on-demand services are real-time systems, they require a highly liquid pool of riders and customers. A minimum level of riders needs to be at each location to fulfill delivery within a certain ETA.

Domino’s has a lower cost delivery model than aggregators’ point to point delivery model.

By being multi-vertical, Rappi has a higher chance to pick up and deliver multiple orders in one trip. This would improve delivery efficiency and make Rappi’s delivery model closer to Domino’s Pizza’s hub and spoke model. Domino’s Pizza has higher drops per trip because riders would stack orders and deliver to many households in one trip. This format reduces average delivery costs.

Rappi has committed a significant amount of capital to increase the scale of its delivery platform, expanding into new cities and building out dark kitchens. We believe, despite a higher initial capital expenditure, the full-stack model of combining leadgen, the delivery network and dark kitchens, is a superior business model. Dark kitchens can generate better economics for aggregators as they switch from a point-to-point delivery model to the hub and spoke model. By controlling the end-to-end value chain, the company has a higher chance to improve cost structure and benefit from operating leverage.

The upshot

The high cash burn in on-demand businesses raises eyebrows on the sustainability of the business model. However, the cost structure in LatAm is structurally different from the West. Examples from the East have shown that dominant on-demand aggregators and logistics networks can gain ecosystem control via a combination of operational excellence, scale advantage and local network effect.

At a $7B valuation, 7x EV/Sales, we believe there is an asymmetric risk-reward potential. The worst-case scenario is for Rappi to be derated to 3 - 4x EV/Sales, i.e., 50% downside risk, and get acquired by a bigger player. In the best-case scenario, Rappi would become a leading one-stop platform, rivaling the size of Mercado Libre. It would continue growing at a high double-digit while improving unit economics and reaching profitability.

Appendix

Rappi Funding History and Risks

Members

Unlock NowUnlock this report and others for just $50/month

Rappi Funding History and Risks

Members

Unlock NowUnlock this report and others for just $50/month

Disclaimers

- Sacra has not received compensation from the company that is the subject of the research report.

- Sacra generally does not take steps to independently verify the accuracy or completeness of this information, other than by speaking with representatives of the company when possible.

- This report contains forward-looking statements regarding the companies reviewed as part of this report that are based on beliefs and assumptions and on information currently available to us during the preparation of this report. In some cases, you can identify forward-looking statements by the following words: “will,” “expect,” “would,” “intend,” “believe,” or other comparable terminology. Forward-looking statements in this document include, but are not limited to, statements about future financial performance, business plans, market opportunities and beliefs and company objectives for future operations. These statements involve risks, uncertainties, assumptions and other factors that may cause actual results or performance to be materially different. We cannot assure you that any forward-looking statements contained in this report will prove to be accurate. These forward-looking statements speak only as of the date hereof. We disclaim any obligation to update these forward-looking statements.

- This report contains revenue and valuation models regarding the companies reviewed as part of this report that are based on beliefs and assumptions on information currently available to us during the preparation of this report. These models may take into account a number of factors including, but not limited to, any one or more of the following: (i) general interest rate and market conditions; (ii) macroeconomic and/or deal-specific credit fundamentals; (iii) valuations of other financial instruments which may be comparable in terms of rating, structure, maturity and/or covenant protection; (iv) investor opinions about the respective deal parties; (v) size of the transaction; (vi) cash flow projections, which in turn are based on assumptions about certain parameters that include, but are not limited to, default, recovery, prepayment and reinvestment rates; (vii) administrator reports, asset manager estimates, broker quotations and/or trustee reports, and (viii) comparable trades, where observable. Sacra’s view of these factors and assumptions may differ from other parties, and part of the valuation process may include the use of proprietary models. To the extent permitted by law, Sacra expressly disclaims any responsibility for or liability (including, without limitation liability for any direct, punitive, incidental or consequential loss or damage, any act of negligence or breach of any warranty) relating to (i) the accuracy of any models, market data input into such models or estimates used in deriving the report, (ii) any errors or omissions in computing or disseminating the report, (iii) any changes in market factors or conditions or any circumstances beyond Sacra’s control and (iv) any uses to which the report is put.

- This research report is not investment advice, and is not a recommendation or suggestion that any person or entity should buy the securities of the company that is the subject of the research report. Sacra does not provide investment, legal, tax or accounting advice, Sacra is not acting as your investment adviser, and does not express any opinion or recommendation whatsoever as to whether you should buy the securities that are the subject of the report. This research report reflects the views of Sacra, and the report is not tailored to the investment situation or needs of any particular investor or group of investors. Each investor considering an investment in the company that is the subject of this research report must make its own investment decision. Sacra is not an investment adviser, and has no fiduciary or other duty to any recipient of the report. Sacra’s sole business is to prepare and sell its research reports.

- Sacra is not registered as an investment adviser, as a broker-dealer, or in any similar capacity with any federal or state regulator.

...