Ramp's LLM workflow

Jan-Erik Asplund

Jan-Erik Asplund

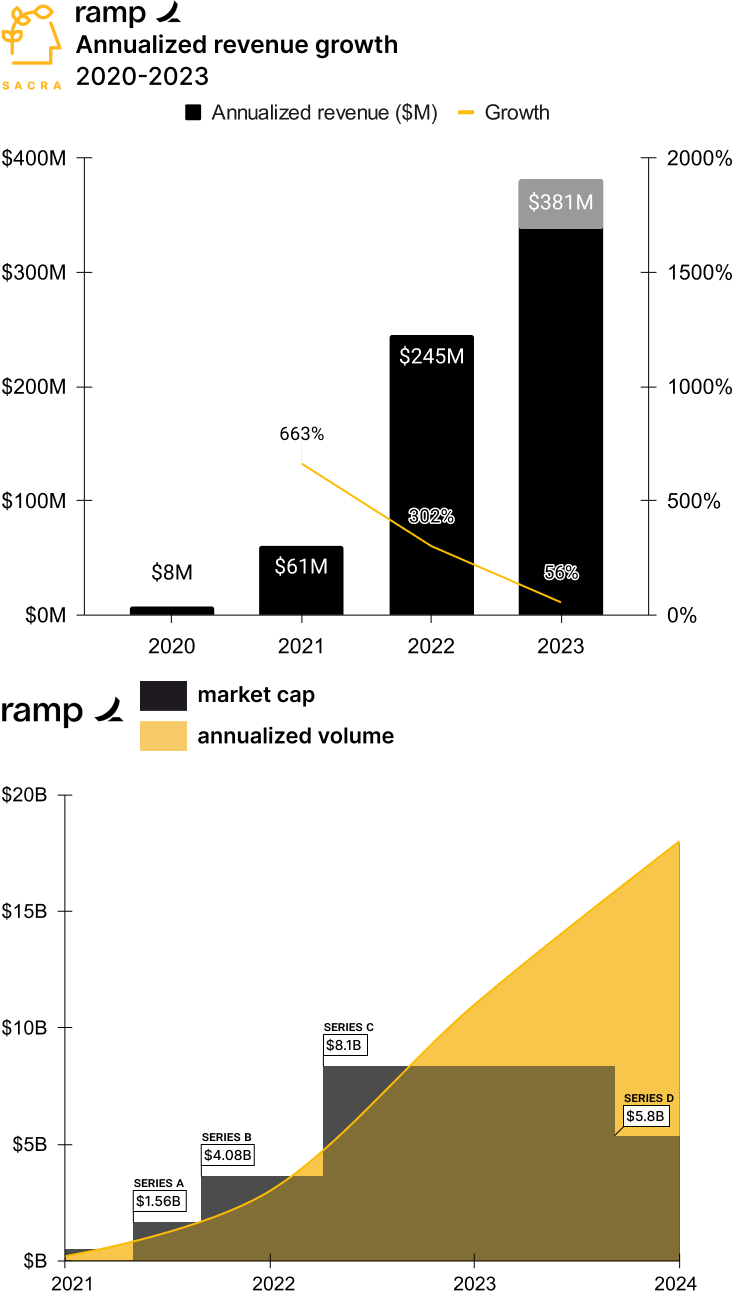

TL;DR: In August, Ramp raised $300M at a $5.8B valuation—down 28% from their last round, but with annualized payment volume rising to $16B. Using LLMs, Ramp is now going after Bill.com, SAP Concur, and Coupa. For more, check out our interview with Geoff Charles, VP of Product at Ramp, as well as our Ramp report and dataset.

In 2021, we talked with Karim Atiyeh, co-founder & CTO of Ramp, about how card issuing infrastructure created the opportunity to build Ramp. Given that financial events, whether they’re transactions, invoices, receipts or contracts, are all forms of language, we followed up with Geoff Charles, VP of Product at Ramp, to learn how Ramp leverages large language models (LLMs) to go after enterprise SaaS and consolidate the finance back office.

Key points from our report:

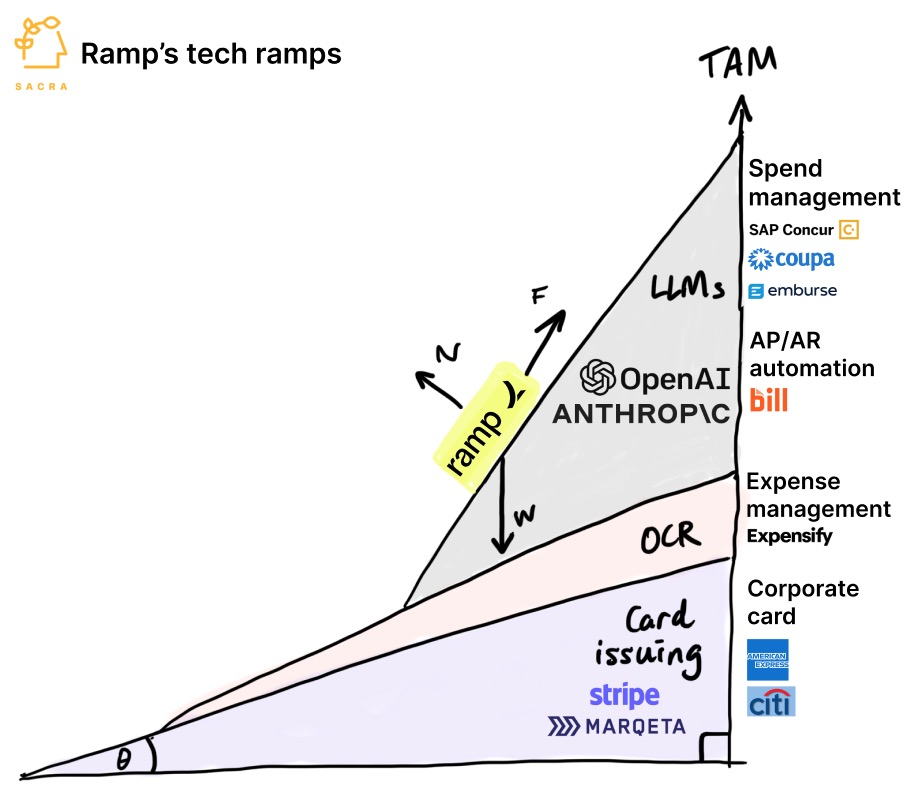

- Ramp (founded in 2019) launched a free corporate card with 1.5% cash back on the front end powered by real-time, programmatic expense management on the back end. Developer-first, API-based card issuing powered by Marqeta (NASDAQ: MQ) and Stripe allowed Ramp to distribute cards to everyone inside an organization while providing a smart automation layer on top to control and reconcile spend.

- By December 2020, ten months after launching, Ramp hit $200M in annualized gross payment volume (TPV) and $8M in annualized revenue—today, Sacra estimates that Ramp does about $16B in annualized TPV and $327M in annualized revenue, up 98% year-over-year, on track to hit $381M at the end of the year. Compare to Brex at about $500M in annualized revenue growing 50% year-over-year and doing about $20B in transaction volume.

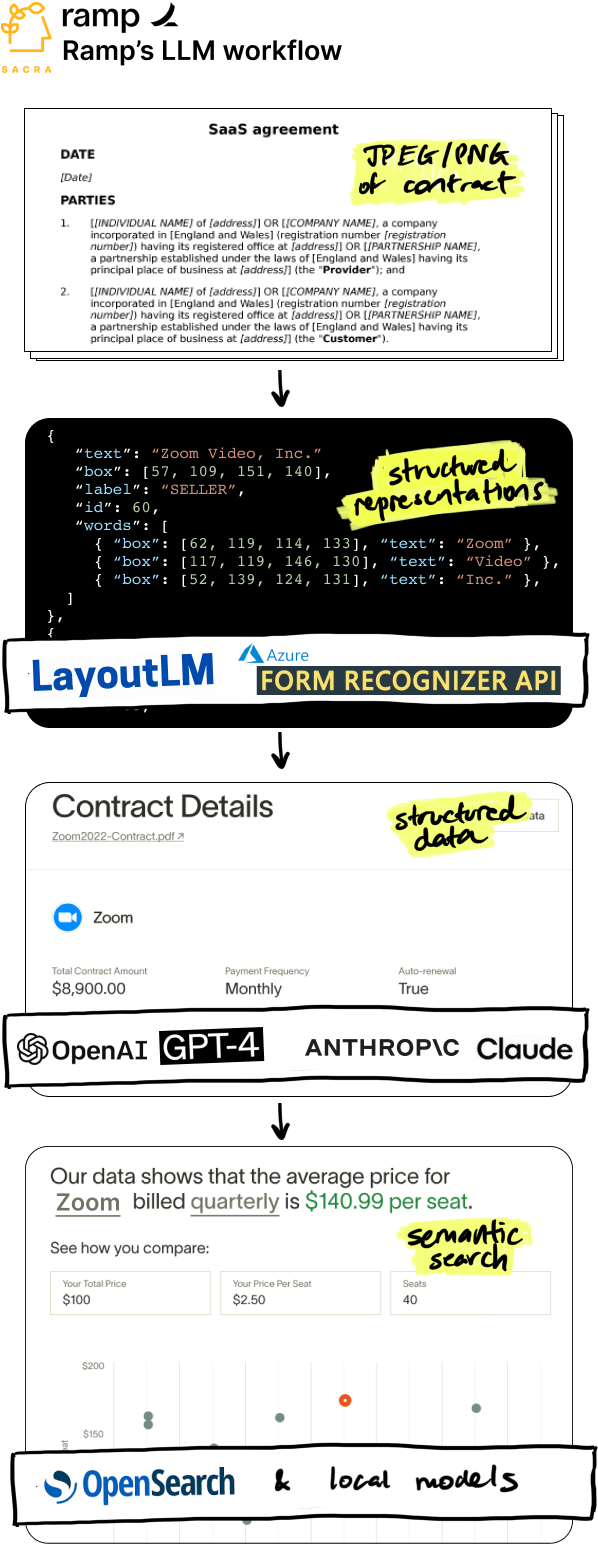

- With card issuing as its initial wedge, Ramp set out to colonize the entire finance back office, starting by layering on optical character recognition (OCR) to go after Expensify (NASDAQ: EXFY) and the $2B expense management market. OCR enables Ramp to ingest images and turn them into language around a financial event, which covers the range from short-form receipts and invoices to long-form contracts.

- LLMs supercharge OCR by “understanding” contract, invoice and receipt language and turn that understanding into structured metadata—giving Ramp a force multiplier in going after AP/AR automation ala Bill.com (NYSE: BILL) and enterprise spend management ala SAP Concur ($1.6B revenue in FY’21). Ramp’s multi-LLM approach uses OpenAI’s GPT-4 for quality output where speed is less important, Anthropic’s Claude for synchronous use cases that require speed, and local models for simple tasks where both speed and cost are important.

- Ramp both benefits from and is subject to the competitive dynamic arising from the dramatically declining cost of ingesting and understanding data—from $.06 per annotation with Amazon Mechanical Turk to $0.002 with GPT-3.5 Turbo, a 20x reduction—allowing virtually any company to tap into advanced data science techniques. Using LLMs, Ramp gets early to market with features like deeper auditability of expenses, proactive warnings about renewals and other important clauses hidden inside contracts, and quicker answers to questions about a company’s card usage and spending patterns.

- Whereas card issuing enabled new, digital workflows that form the basis of Ramp’s disruption of American Express (NYSE: AXP), the next wave of disruption built on LLMs will automate away the human labor and judgment built into those workflows. Rather than humans uploading receipts and filling out forms, AI will pre-classify transactions once they’re made and merely prompt a human to confirm—changing the finance manager’s role from pilot to auto-pilot monitor.

- Finance work moving from humans to autonomous AI agents portends a shift from seats in payroll in Rippling ($135M revenue in 2022) towards spend on tokens and SaaS in Ramp, blurring the boundaries to ownership over the full range of B2B spend. It’s still early for AI to replace high-cost services, but both dollars and margins will flow from services towards software and the finance team of the future will be strategic—not operational.

- By limiting their hiring and instead emphasizing the integration of AI into everyday workflows, Ramp itself has been highly human capital efficient, getting to $300M+ in annualized revenue with just ~500 employees vs. the ~1,000 of Brex and ~2,000 of Rippling. Ramp is building chatbots for support and customer research and deploying AI tools internally to help write code, the goal being to stay as small as possible and minimize the overhead of coordination.

- In the upside case, Ramp’s AI tools catalyze their colonization of the entire back office by offering customers better cost savings and insights in return for moving more of their B2B payments to Ramp, creating a flywheel where the more data they get on purchasing decisions, the more companies that will use Ramp. While generic model LLMs commoditize the data science portion, Ramp’s core advantage is their customer trust which gives them access to all the data on what companies are buying that normally lives in emails, Google Drives, or contract management systems like Icertis ($225M ARR in 2022).

For more, check out this other research from our platform:

- Ramp (dataset)

- Brex (dataset)

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Eoghan McCabe & Des Traynor, CEO and CSO of Intercom, on the AI transformation of customer service

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Banking-as-a-Service: The $1T Market to Build the Twilio of Embedded Finance

- Bo Jiang, co-founder and CEO of Lithic, on the key primitives in card issuing

- Charles Birnbaum, partner at Bessemer Venture Partners, on the five waves of fintech