Kapital at $184M/yr growing 156% YoY

Jan-Erik Asplund

Jan-Erik Asplund

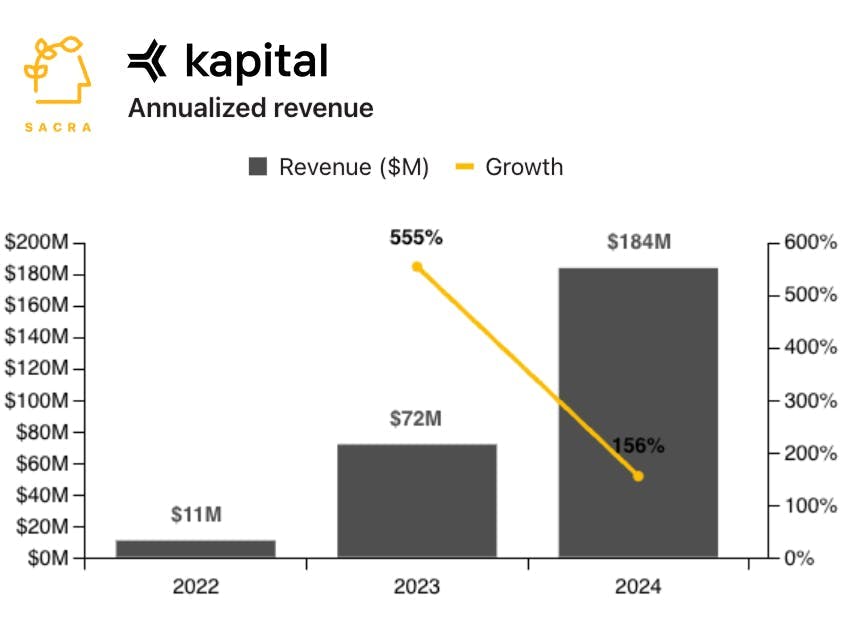

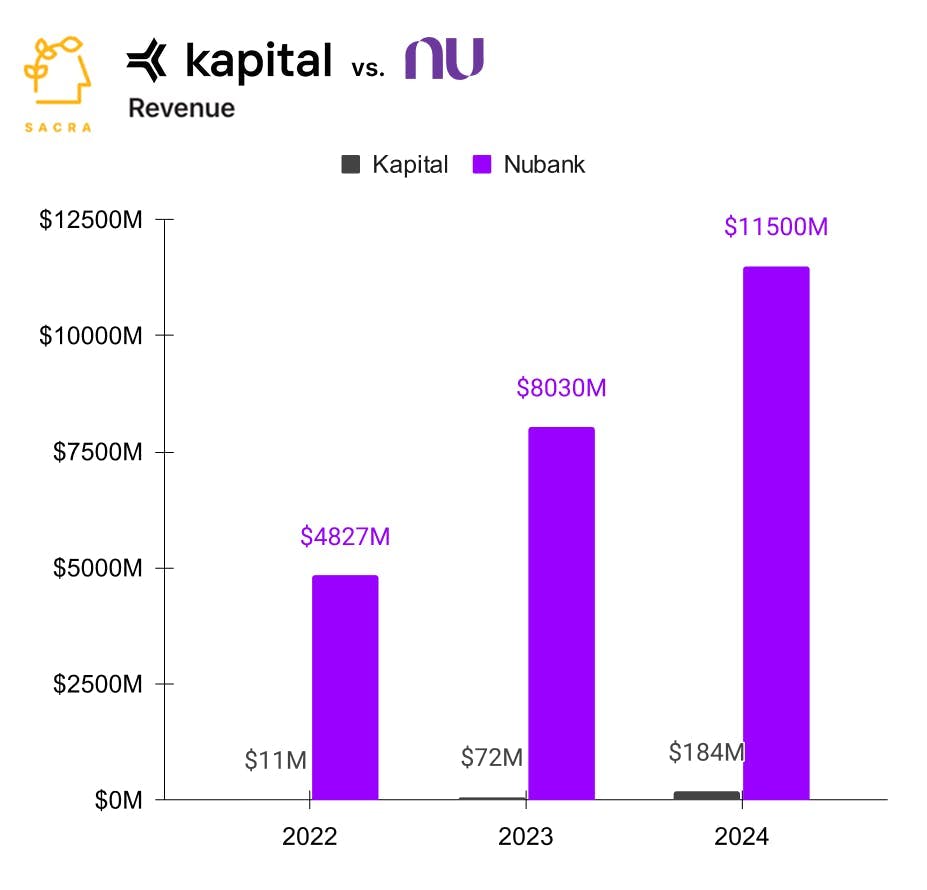

TL;DR: Over the past year, Kapital has layered lending, stablecoins, and treasury tools on top of its core banking platform to meet the cash flow and currency volatility challenges facing SMEs across Latin America. Sacra estimates that Kapital hit $184M in annualized revenue at the end of 2024, up 156% year-over-year from $72M in 2023. For more, check out our full Kapital report, dataset and our interview with co-founder Fernando Sandoval.

We first covered Kapital in January 2024 as a $72M/year B2B neobank rolling up cards, lending, and expense management in Mexico, interviewing co-founders René Saul and Fernando Sandoval about the fintech opportunity in LatAm.

We followed up in May 2024 with a report and interview with Fernando to talk about USD-denominated stablecoins as a treasury management tool for businesses in LatAm. Most recently, we caught up with Fernando again to talk about Kapital’s 2024, their geographic expansion plans, and the rising adoption of Kapital Flex loans.

Key points from our Kapital update:

- Sacra estimates that Kapital reached $184M in annualized revenue in 2024, up 156% from $72M in 2023 when Kapital’s acquisition of Banco Autofin added ~$45M of new ARR, with average revenue per user rising from $117 in Q1 to $153 in Q4 and 500,000 merchants on the platform (up from 80,000 as of 2023).

- While in the U.S., Ramp’s B2B buy now pay later lending product Flex is less a major monetization driver than a strategic product feature to help Ramp colonize all of a business’s spend, in LatAm, where 70% of SMBs fail due to lack of cash flow, Flex is Kapital’s “star product”, propelling total payment volume to $8.4B in 2024, up 298% from $2.1B in 2023.

- The lack of LatAm competition in SMB fintech SaaS and digital native banks has enabled Kapital’s all-in-one expansion from the bank account (with deposits growing from $241M in Q1’24 to $569M in Q4’24), bundling it with a lightweight FP&A dashboard (Runway), corporate card (Brex), expense management (Ramp), AP/AR (Bill.com), and treasury (Meow), with the company now eyeing HR, payroll & contractor payments (Deel) as the next frontier.

For more, check out this other research from our platform:

- Fernando Sandoval, co-founder of Kapital, on tropicalizing Brex for LatAm

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Art Levy, Chief Business Officer at Brex, on the strategy of Brex Embedded

- Fernando Sandoval, co-founder of Kapital, on stablecoins for cross-border payments

- Kapital: the $72M/year Nubank for SMBs

- Stablecoin diplomacy

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- The state of the LatAm startup ecosystem

- René Saul and Fernando Sandoval, co-founders at Kapital, on the fintech opportunity in LatAm

- Anthony Peculic, Head of Cards at Cross River Bank, on building a fintech one-stop shop

- Farooq Malik and Charles Naut, co-founders of Rain, on stablecoin-backed credit cards

- Arjun Sethi, co-CEO of Kraken, on building the Nasdaq of crypto

- Kraken at $1.5B up 128% YoY

- Bhanu Kohli, CEO of Layer2 Financial, on stablecoin-backed payments for platforms