Discord at $600M/year

Jan-Erik Asplund

Jan-Erik Asplund

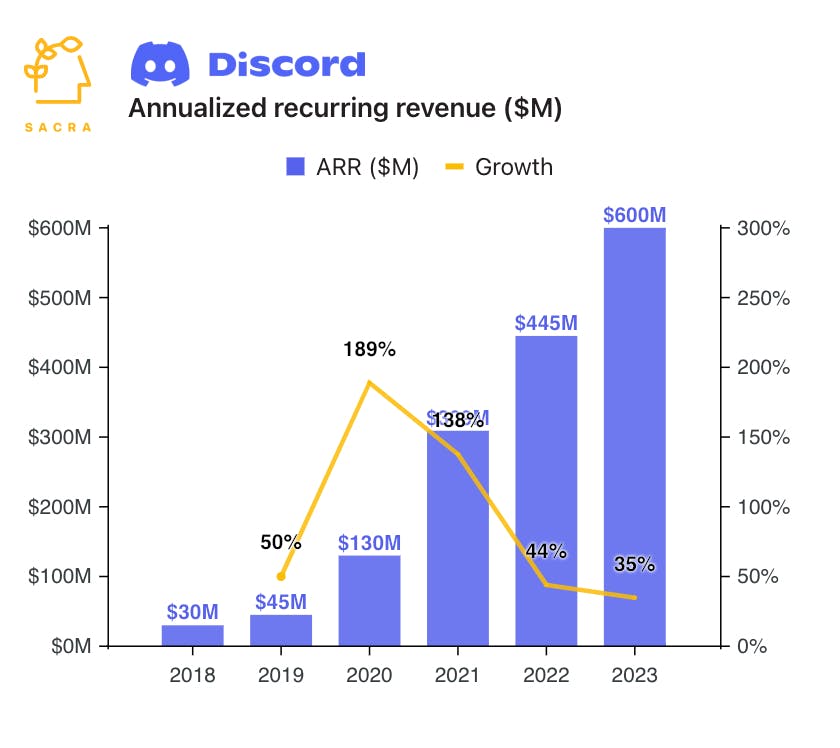

TL;DR: Sacra estimates that Discord hit $600M in annualized recurring revenue (ARR) at the end of 2023, up 35% year-over-year. After attempting to become the chat app for every community during COVID, Discord is moving away from NFTs and social audio and re-focusing on their core product-market fit around interactive experiences and games. For more, check out our full report and dataset on Discord.

When we wrote about Discord in 2023, revenue growth had recently slowed to 44% year-over-year with the decline of two trends—crypto and COVID-era social audio apps—that helped them triple in 2020 and double in 2021.

Generative AI was just emerging as Discord’s next big tailwind, with Midjourney projecting $200M in annual recurring revenue (ARR) from their AI art generation tool built into a Discord server.

This week, Discord announced that they’re moving away from their vision of building the chat app for every community, and leaning into the product-market fit they have for interactive, co-creative experiences.

Key points from our update:

- At the end of 2023, Discord hit $600M in annualized recurring revenue (ARR), up 35% year-over-year, valued at $15B as of their August 2021 raise (a 25x multiple on their 2023 revenue) with 200M monthly active users (MAUs) for ARPU of $3.00. Compare to Reddit (NYSE: RDDT) at $804M in revenue in 2023, growing 20% year-over-year, valued at $8.87B for a 11x multiple on revenue with 430M MAUs for ARPU of $1.87, and Snapchat (NYSE: SNAP, $14B) at $4.60B in revenue, growing 0.09% year-over-year, valued at $24.65B for a 5.4x multiple on revenue, with 800M MAUs for ARPU of $5.75.

- The first 2 years of COVID, Discord almost tripled their MAUs from 56M to 140M as they aggressively expanded to adjacent markets like crypto, NFTs, and social audio, launching features like Stage Channels (Clubhouse) with the aim of becoming the chat app for every community. Discord’s and Telegram’s “free-to-play” models enabled them to absorb the explosion in online communities during COVID, while Slack’s per-seat pricing limited its use case to B2B.

- Today, Discord is narrowing its focus on its highest engagement communities—gaming and surrounding metaverse (e.g., Midjourney)—where 90% of its 180M MAUs chat for 4+ hours per day on average, far more than they spend on TikTok (53 minutes), YouTube (48 minutes), or Twitter (34 minutes). Broadcast-reliant communities suffer from engagement decay, with participation skewing toward a handful of highly engaged users—a dynamic that works better on social graph-based networks like Instagram and Snapchat.

For more, check out this other research from our platform: