Customer.io passes $70M ARR

Jan-Erik Asplund

Jan-Erik Asplund

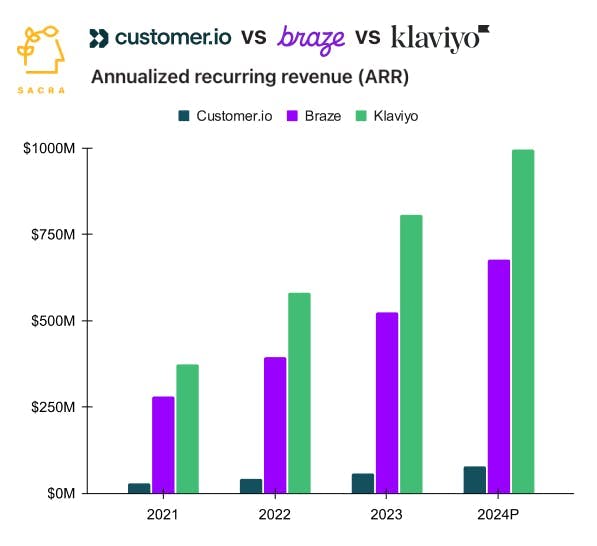

TL;DR: Sacra projects that Customer.io is on track to hit $78M annual recurring revenue (ARR) at the end of 2024, up 35% YoY. Since we first covered Customer.io in May 2021, the company has nearly 4x’d revenue while maintaining durable and capital efficient growth via its 110%+ net dollar retention. For more, check out our full report and dataset on Customer.io.

When we first covered Customer.io in May 2021, the company had crossed $20M ARR, growing 70% year-over-year, on less than $4M raised. In March of the following year, Customer.io raised its Series A backed by Spectrum Equity.

We followed up with Customer.io in August 2023, where we interviewed CEO Colin Nederkoorn and published an update on Customer.io passing the $50M ARR milestone.

Key points via Sacra AI:

- Sacra estimates that Customer.io has maintained 35% YoY growth over the last two years and into the upper 8-figures in revenue, on track to cross $78M in annual recurring revenue (ARR) at the end of 2024. Customer.io has historically been highly capital efficient, getting to $30M ARR in 2021 on less than $4M raised.

- The durability and efficiency of Customer.io’s growth comes from its strong net dollar retention (NDR)—111% in Q2 2023—on par with Klaviyo (NYSE: KVYO) at 110% and Braze at 114% (NASDAQ: BRZE). Since 2021, NDR has declined across these tools from ~130% to ~110% as budget constraints pushed customers to clean up inactive user profiles—a key pricing value metric—and downgrade pricing tiers to right size their plans.

- As Klaviyo has grown steadily through 2024 at ~35% YoY, hitting $940M in implied ARR, at the same time as it has improved net margin from -13% (Q4’23) to -0.57% (Q3’24), its ARR multiple has nearly doubled from 5.9x to 10.6x with its market cap on the verge of cracking $10B. In contrast, Braze’s ARR multiple has declined to 6.8x now, as growth has decelerated to 26% YoY ($582M ARR) with net margin at -16% given its model that hinges to a greater extent on closing big enterprise deals.

For more, check out this other research from our platform:

- Customer.io (dataset)

- Klaviyo (dataset)

- Iterable (dataset)

- Colin Nederkoorn, founder & CEO at Customer.io, on the CDP layer in messaging

- Customer.io: The $400M HubSpot of Product-Led Growth [2021]

- Eoghan McCabe & Des Traynor, CEO and CSO of Intercom, on the AI transformation of customer service

- Klaviyo: the $665M/year HubSpot for ecommerce

- Startup CMO on the data models underpinning CRMs

- Intercom (dataset)

- Attentive (dataset)

- Drift (dataset)

- Postscript (dataset)