Customer.io's path to $100M

Jan-Erik Asplund

Jan-Erik Asplund

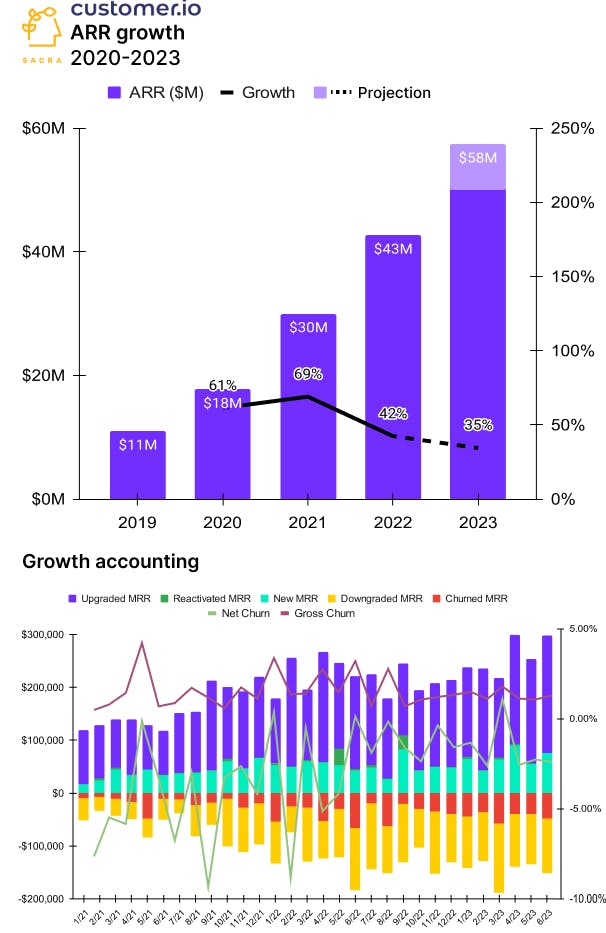

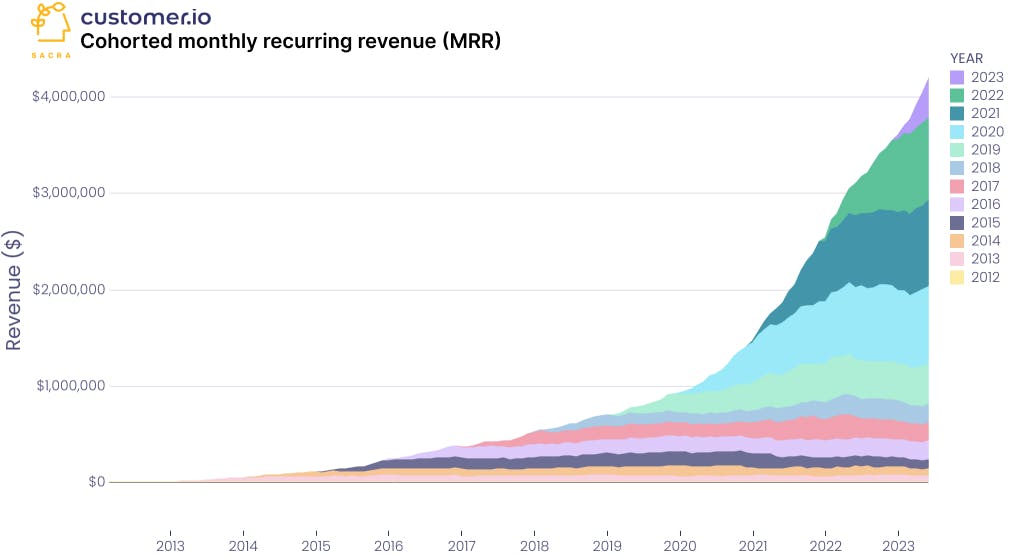

TL;DR: Customer.io has grown annual recurring revenue (ARR) to $50M, up 35% year-over-year, riding the rise of product-led growth. Now, they’re using this recession in tech to lay the foundation for a multi-product company, expanding into email coding and customer data platforms (CDPs). For more, check out our interview with Customer.io CEO Colin Nederkoorn, as well as our Customer.io report and dataset.

We last covered Customer.io in May 2021 when they were at $20M in annual recurring revenue (ARR), growing 70% year-over-year. Read our report here.

Recently, we talked to CEO Colin Nederkoorn about Customer.io’s new CDP product (“Data Pipelines”), why they’re taking a platform approach to building out Customer.io, and the pitfalls of going multi-product.

Key points from our update:

- Across B2B SaaS, revenue growth has declined, with median growth in net new ARR falling 21% from Q1’22 to Q1’23, and in line with that trend, Customer.io’s net new ARR declined by 20.8% from Q1’22 to Q1’23, down from $3.5M to $2.8M. Buying slowed down with new signup ARR for Customer.io going flat—from $1.9M in Q1’22 to $2M in Q1’23—given tightened budgets and longer sales cycles.

- As customers re-evaluated their pricing plans and optimized usage, expansion revenue went flat, resulting in a net dollar retention decline for Customer.io from 133% in Q4 2021 to 111% as of Q2 2023. Net dollar retention for the median B2B SaaS company fell from 120% in Q4’22 to 112% in Q1’23.

- Meanwhile, gross churn has remained stable across B2B SaaS, particularly infrastructure like Customer.io where gross churn has held steady at roughly 3% quarterly every quarter since Q1’20. In the public markets, see CrowdStrike, where gross churn stayed at 2% from 2019 to 2022, even as net dollar retention plummeted from 147% to 124%.

- Today, Customer.io is doing $50M in ARR, growing at 35% year-over-year, with a quick ratio of 2x and more than 5,000 companies using their product to send 18B messages per year. Compare to Braze (NASDAQ: BRZE) at $407M in ARR growing at 31% year-over-year, but highly unprofitable with their net margin around -36%.

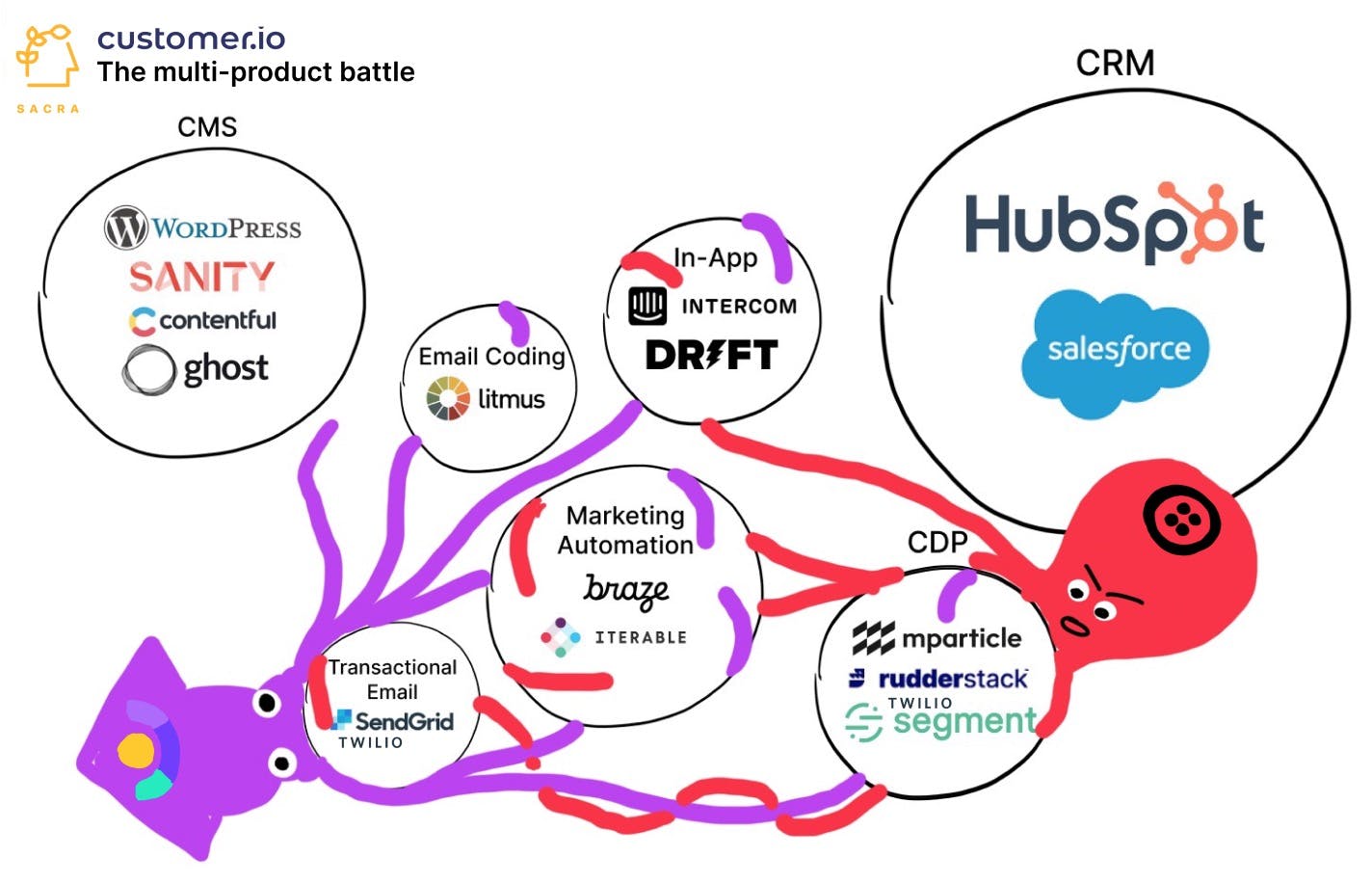

- While other SaaS companies have contracted and cut non-essential lines of business, Customer.io has gone multi-product and used bundle pricing offensively to undercut Segment’s increasingly expensive customer data platform. Launching a new low-end “Essentials” plan at $100/month lets Customer.io expand horizontally without leaving behind the land-and-expand SMB business that has been a hallmark of their growth to date.

- Customer.io’s strong balance sheet with $29M in the bank has enabled it to make strategic acquisitions of companies like Gist (in-app messaging) and Parcel (email coding)—products with strong brands run by small teams that solve specific problems around email. Folding Gist and Parcel into Customer.io consolidates the marketer/developer workflow and allows for the consolidation of spend from tools like Litmus and Dreamweaver.

- With its 2x quick ratio and highly efficient sales motion, Customer.io is growing by creating a platform that’s both interoperable with any 3rd-party product and is stand-alone, so a prospective customer can get started with any tool.Using Data Pipelines, a SaaS company can use Customer.io as their customer data platform while using any other tool—Braze, Iterable, etc.—to send messages to their customers.

- If Customer.io succeeds, it will look like a very different company on the other side of this downcycle—a multi-product platform company that is both infra for transactional email ($3B market) and eats up marketing automation ($10B), CDP ($5B) and in-app ($5B), bringing developers and marketers together from across the organization. By bringing marketers into the core product experience, Customer.io addresses the risk that companies “grow out” of Customer.io and move their customer data into tools like Klaviyo, ActiveCampaign, or Braze.

- Customer.io is on track to cross $100M in the next 2 years and challenge Twilio (NYSE: TWLO) across all these adjacent segments from the vantage point of building rich orchestration layers vs. Twilio’s approach built on API middleware. Building a revenue motion with strong retention and expansion dynamics like Twilio rests on capturing startups when they’re small and usage is low and scaling with them to IPO and beyond.

For more, check out this other research from our platform:

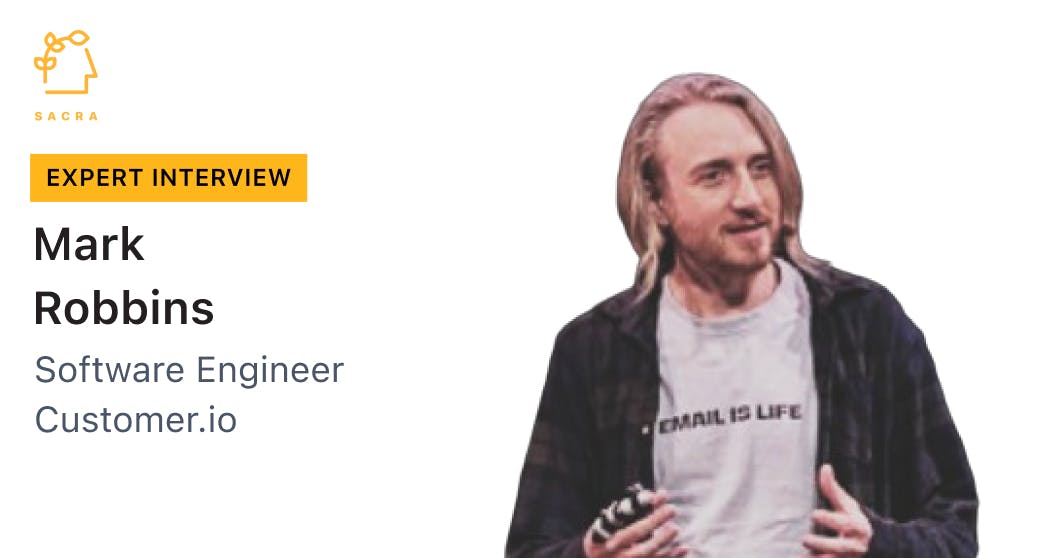

- Colin Nederkoorn, founder & CEO at Customer.io, on the CDP layer in messaging

- Customer.io: The $400M HubSpot of Product-Led Growth [2021]

- Eoghan McCabe & Des Traynor, CEO and CSO of Intercom, on the AI transformation of customer service

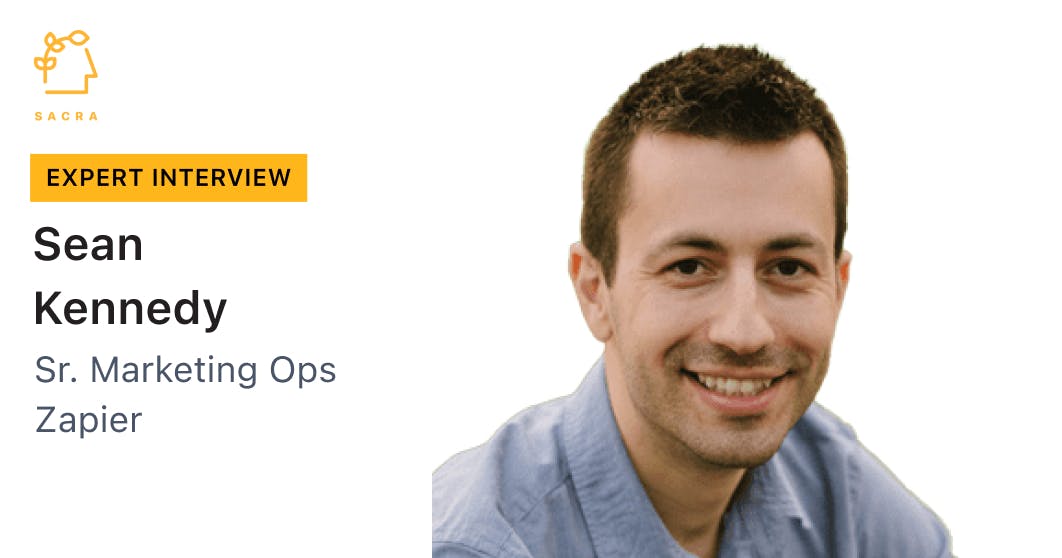

- Startup co-founder on building a customer communication workflow

- Startup marketer on the process of choosing a customer communications platform

- Startup CMO on the data models underpinning CRMs

- Intercom (dataset)

- Attentive (dataset)

- Drift (dataset)

- Postscript (dataset)