Clay vs Apollo

Jan-Erik Asplund

Jan-Erik Asplund

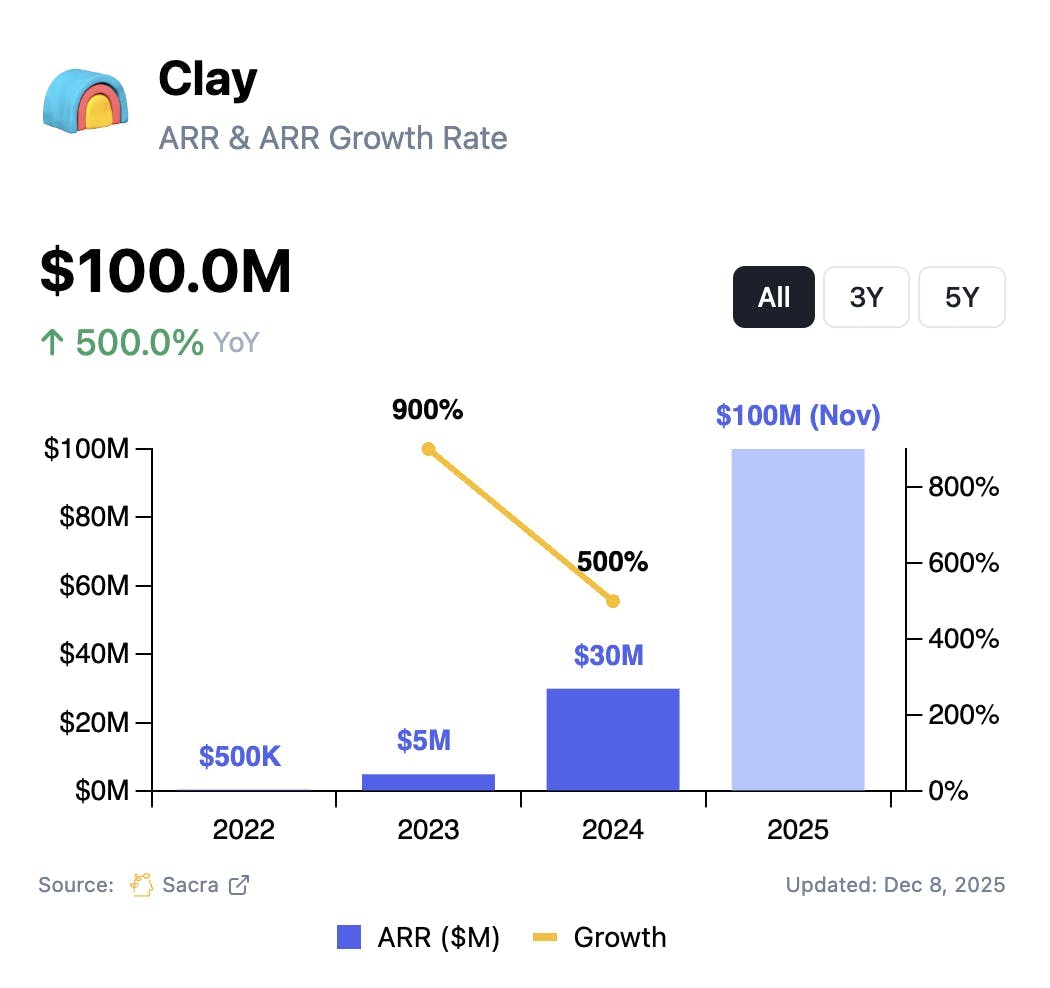

TL;DR: As AI has swept through sales and growth teams, Clay has emerged as one of the key systems of record for modern go-to-market teams. Sacra estimates Clay hit $100M ARR in November 2025, up 263% YoY, valued at $3.1B as of its June Series C led by CapitalG for a 31x forward revenue multiple. For more, check out our full report and dataset on Clay.

Key points via Sacra AI:

- Clay (founded in 2016) emerged out of the neo-spreadsheets trend pioneered by Airtable (founded in 2012) as a horizontal productivity tool before Equals (for finance), Rows (for BI) and Clay (for sales) launched for specific verticals, with Clay focusing on helping go-to-market teams build outreach lists by importing a list of prospects, enriching it with data from 100+ providers, and syncing it into a sequencer to power the outbound. Instead of charging per seat, Clay offers unlimited seats across all of its plans and monetizes based on credit-based subscriptions (from $149/month Starter with 2K credits/month to custom Enterprise) that meter each enrichment and AI action, with usage tending to cluster around single power-user "GTM Engineers" who function as internal product owners.

- Finding initial traction with cold email agencies managing many-vendor enrichment stacks before getting picked up by GTM teams at companies like OpenAI, Canva, and Anthropic, Sacra estimates Clay hit $100M ARR in November 2025, up 263% YoY, valued at $3.1B as of its June Series C led by CapitalG for a 31x forward revenue multiple. Compare Clay as a data-focused provider to all-in-one GTM platform Apollo.io at $150M ARR in May 2025, up from $134M at the end of 2024 and growing 34% YoY, last valued at $1.6B for a 10.7x multiple, and to ZoomInfo (NASDAQ: GTM) at $1.23B in TTM revenue, up 2% YoY, valued at $3.1B for a 2.5x multiple.

- While Apollo, ZoomInfo & HubSpot compete with Clay on data enrichment as all-in-one platforms, Clay positions as complementary with a bring-your-own-API-key model that lets teams run enrichments in Clay using their all-in-one’s API & credits without double counting against Clay credits, and still benefit from Clay for orchestration. On the back-end, Clay has built a marketplace model where 100+ 3rd-party data providers monetize enrichments through the platform via wholesale relationships such that Clay’s business model both makes margin on credits (via underuse and overages) and purely as workflow & orchestration SaaS.

For more, check out this other research from our platform:

- Airtable at $375M ARR

- Zoelle Egner, early Airtable employee, on customer success for product-led companies

- David Peterson, early Airtable employee, on the future of product-led growth

- Bobby Pinero, CEO of Equals, on bringing joy to finance teams

- Apollo at $100M ARR

- Apollo.io at $150M ARR

- Taimur Abdaal, CEO and co-founder of Causal, on the future of the "better spreadsheet"

- Austin Hughes, CEO and co-founder of Unify, on the death of the SDR

- Matt Sornson, ex-CEO of Clearbit, on going from data to workflow company

- Nico Ferreyra, CEO of Default, on building an end-to-end inbound sales platform

- Apollo (dataset)

- Clay (dataset)

- Gong (dataset)

- Calendly (dataset)

- Zapier (dataset)

- Outreach (dataset)

- 6sense (dataset)

- Otter (dataset)