Substack: the $19M/year content LVMH

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Substack grew revenue an estimated 10x during COVID and built a star-studded roster of writers. Now, it faces growing tensions between building for the mass market and building for its roots as a luxury, niche brand. For more, check out our Substack report (dataset) and our interview with Justin Gage, the founder of Technically, a 49,000 subscriber Substack.

Key points from our research:

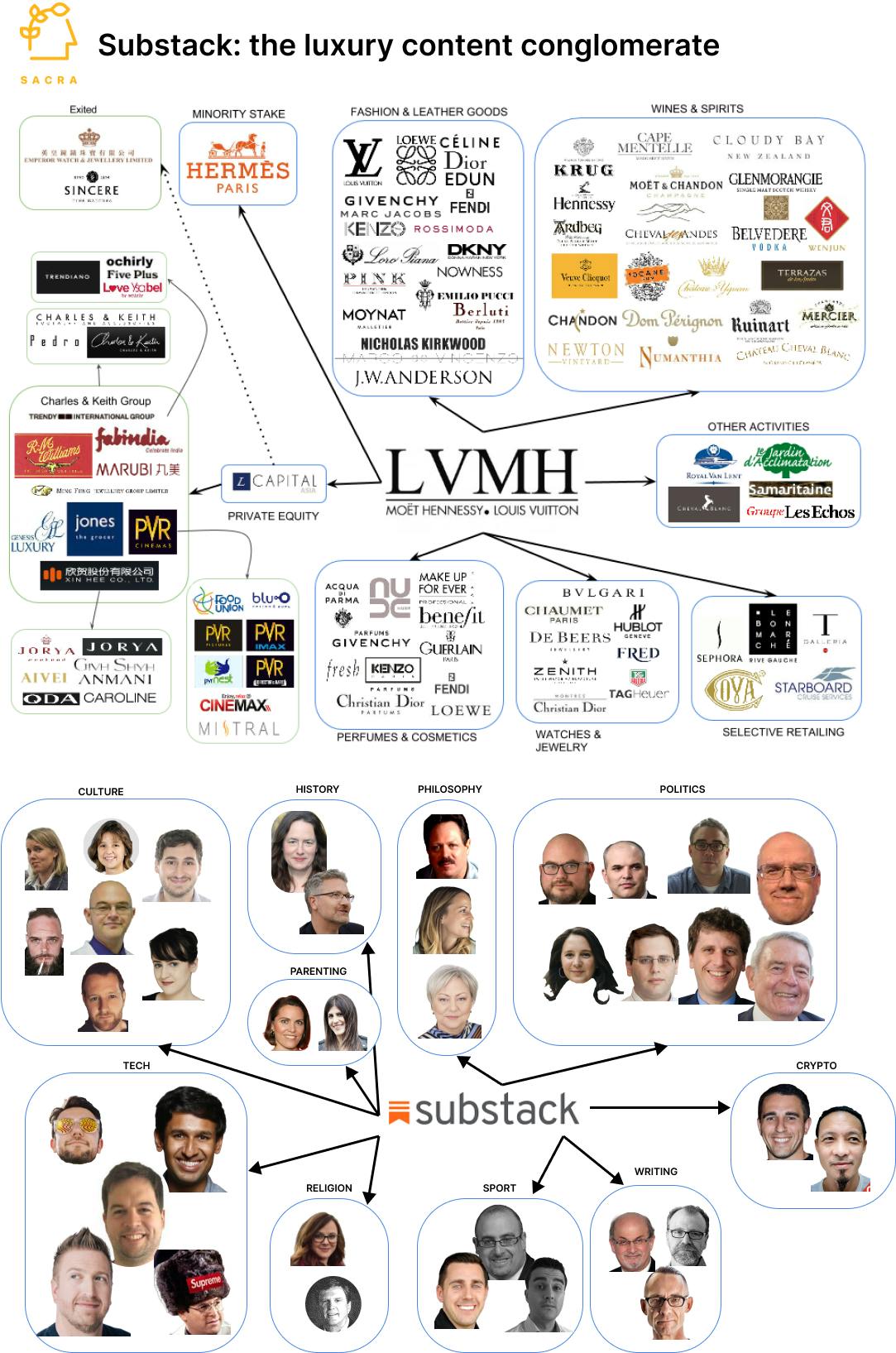

- In 2012, designer Dustin Curtis founded Svbtle (Y Combinator backed) as an exclusive, invitation-only blogging network seeded with an initial user base of prominent tech founders and investors like Kevin Rose (Milk), John Collison (Stripe) and MG Siegler (GV) to create a sense of prestige around a premium/luxury reading and writing experience. Svbtle’s decline came as they opened it up for everyone to join—alongside the initial rise of Evan Williams’ founding of Medium (roughly $35M in revenue in 2021). (link)

- Substack (2017) built “Svbtle with a paywall”, paying advances to prominent writers like Matthew Yglesias (ex-Vox) and Anne Helen Petersen (ex-Buzzfeed) to create a halo around its brand combined with a business model that enabled them to index on the upside of its big-name writers and focus on quality over mass market. Instead of charging writers via subscription SaaS for blog hosting (Wordpress), Substack flipped the business model on its head by paying writers and charging the end-user reader, giving the proceeds to the writer while taking a 10% cut of gross merchandise volume (GMV). (link)

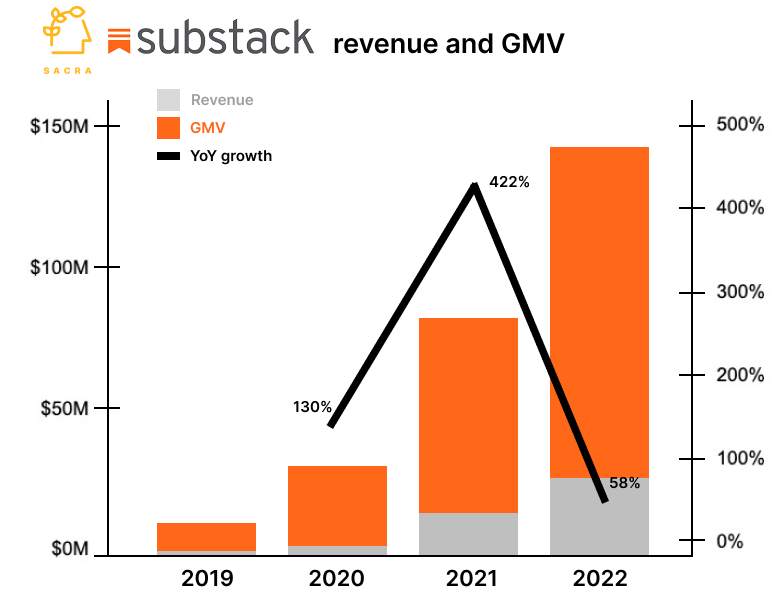

- Sacra estimates that revenue at Substack grew 58% year-over-year to $19M in 2022 off of 35 million subscribers, 2 million paid subscribers and $145M million in GMV with $82 million in funding raised. Writers charge roughly $8-10/mo on average and churn 50-60% of their revenue on an annual basis—compare to the New York Times which charges $17/mo and churns at 25% per year and The Athletic which charged $6/mo and churned at 20%. (link)

- In March 2023, Substack launched an equity crowdfunding campaign on WeFunder to raise $5M at a $585M pre-money valuation and estimated 30x multiple on $19M in TTM revenue, a flat round from their 2021 Series B led by Andreessen Horowitz where they raised $65M at a 102x multiple. Compare to the New York Times which is valued at $6.41B—about 2.8x on revenue of $2.31B, or The Athletic, which the Times acquired for $550M on $65M revenue in 2021 for an 8.5x multiple. (link)

- Even as growth has decelerated post-COVID, Substack has continued to attract highly differentiated writers on the supply side, “unbundling the New York Times” with journalists like Bari Weiss (ex-New York Times, 283K subs), Matt Taibbi (ex-Rolling Stone, 356K subs), and Noah Smith (ex-Bloomberg, 126K subs) leaving prestige publications to launch on Substack. In contrast to The New York Times or The Athletic, Substack’s lack of full time writers enables it to grow supply even in a downturn because it doesn’t come with high journalist headcount and fixed costs. (link)

- The core tension at Substack exists between building for the reader and network, which Substack owns in whole, versus building for the writer and the storefront, which the writer can replicate by piecing together commodity software. As a writer’s revenue grows, they’re financially incentivized to take the intellectual property and the audience they’ve built—which they own in whole—off of Substack and its 10% take rate to fixed price subscription SaaS solutions like Wordpress, Beehiiv or Ghost. (link)

- As a storefront—similar to other creator economy companies like Kajabi ($5B in cumulative GMV), Circle ($4M ARR in 2021) and Podia ($3.1M raised)—Substack has begun tilting from a single SKU (paid newsletter) to an all-in-one platform that helps writers monetize and retain subscribers across Chat (community), Notes (short form posts) and others with lower labor cost than long-form content production. Writing a 2,000+ word, 1x per week newsletter forever causes writer burnout—by giving writers ways to leverage their brand to drive engagement, Substack can grow GMV by driving expansion, ARPU and margin while staying focused on high-quality writers. (link)

- As a network, Substack’s launch of Reader and a mobile app integrates distinct Substack audiences into a unified reading experience, enabling discovery across all of its writers, similar to how Disney brought all of its franchises into a unified streaming experience with Plus. In addition to top of funnel, Substack also improves conversion to paid by powering 1-click checkout across Substack writers similar to how Shop Pay enables 1-click checkout across Shopify merchants and creates lock-in into the platform. (link)

- Substack’s upside case isn’t in going mass market—it lies in its brand halo and status as a luxury publishing conglomerate akin to LVMH that enables writers to build high-margin franchises across a growing number of niches. Substack’s ability to dominate culture and aggregate capital has given them the chance to build an asset-light cash flowing business that is able to build and acquire star writers from heritage brands. (link)

For more, check out our Substack report and dataset, our interview with Justin Gage, the founder of Technically, and this other research from our platform:

- OnlyFans (dataset)

- Linktree (dataset)

- Bolt (dataset)

- Neal Jean, CEO of Beacons, on building vertical SaaS for creators

- C-suite at creator economy company on the competitive dynamics of checkout

- Klarna: The $31B Snapchat of Personal Banking [2021]

- Beacons: The Storefront for the Multi-SKU Creator that's Growing 3X Monthly [2021]