ConvertKit vs. Beehiiv vs. Substack

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Beehiiv just announced a $12.5M Series A to go after Substack as they and ConvertKit all battle it out to build the best, most monetizable network for creators—now, it’s self-funded vs. venture-funded businesses in a race to become the Sulzbergers of the creator economy. For more, check out our interview with Nathan Barry, the CEO of ConvertKit, as well as our company reports on ConvertKit (dataset), Substack (dataset), and Beehiiv (dataset).

- Mailchimp launched in 2001 to give marketers what-you-see-is-what-you-get (WYSIWYG) drag and drop tools to make it easy for marketers to create and send rich, templated emails—at the time of their $12B Intuit acquisition in 2021, they generated $1B in annual recurring revenue (ARR). Similar to other startups that “democratized” the work of developers and designers like Canva with social media images, Mailchimp dramatically decreased the cost and friction to sending rich emails which hugely increased the transaction frequency and volume.

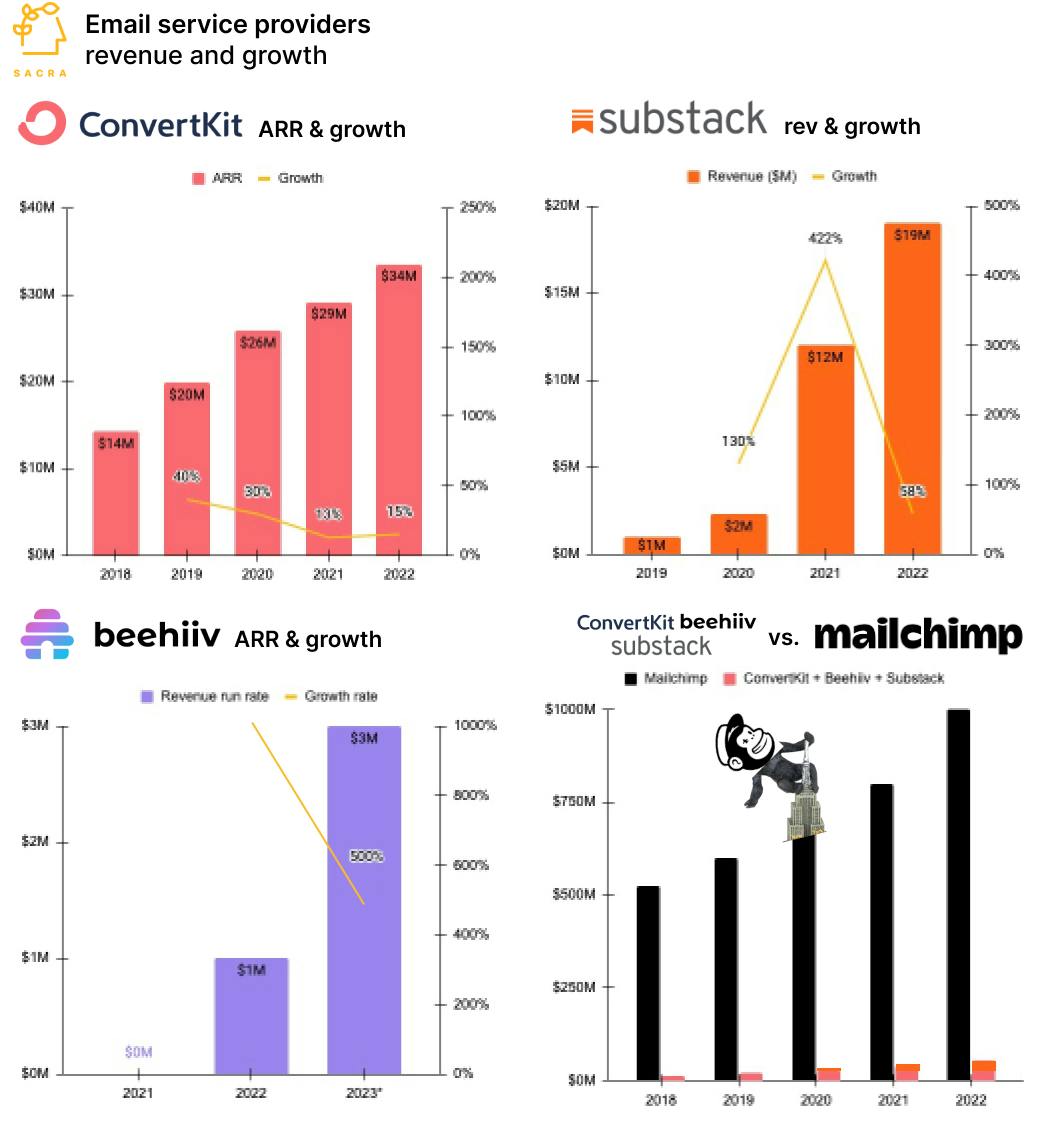

- Circa 2012, startups started breaking off specific customer segments of Mailchimp’s, from Klaviyo ($580M ARR in 2022) for ecommerce merchants in 2012 to ConvertKit ($33.5M ARR in 2022) for creators in 2013. The email service provider (ESP) market is large (~$9B per year), fragmented and non-winner take all with many large players, including HubSpot, Klaviyo, Intercom ($250M revenue in 2022), ActiveCampaign, Campaign Monitor, Customer.io, and others.

- Substack ($19M revenue in 2022) flipped the subscription SaaS model of ConvertKit on its head—instead of charging writers, they charged end-users and paid writers while taking a 10% cut of gross merchandise volume (GMV). Beehiiv, founded in 2021 by ex-Morning Brewers (acquired by Insider for $75M), fast-followed Substack with a go-to-market focused on newsletter "jocks"—compared to the eggheads at Substack and thespians at ConvertKit—undercutting its 10% take rate with a ConvertKit-esque subscription SaaS model.

- Today, the bootstrapped ConvertKit (valued at $200M) is at $33.5M in ARR growing 15% year-over-year, while the Lightspeed-backed Beehiiv has just hit $3M ARR growing 500% and the A16Z-funded Substack ($650M) is at $19M in revenue growing 59%. At 100% net dollar revenue retention, ConvertKit has been able to retain and expand its business in the context of high gross churn for businesses serving creators generally.

- VC funding for creator startups fell to $123M in Q1’23, marking 7 straight quarters of decline since the peak at $1.7B in Q2’21, with no big IPOs—particularly among lighthouse companies like Patreon, where growth is flat and their valuation has fallen from $4.3B in April 2021 to about $1.6B today. Backed by $100M+ in VC, Clubhouse peaked during COVID, hitting a $4B valuation at the creator economy’s high-water mark—when the wave broke, downloads dropped off by 80%+ and the company was tasked with finding new product-market fit.

- During COVID, the creator economy peaked with companies like online course creator Thinkific (TSE: THNC) reaching $1.5B CAD in market cap off of $38.1M in revenue growing 81% year-over-year, before dropping to $161M CAD post-COVID with $51.5M revenue growing 35%. Operating expenses at Thinkific grew from $7.4M in 2019 to $70.1M for 2022, leading to losses of $36.4M for 2022 up from $1.3M of losses in 2019.

- Once the darling of the creator economy, Substack’s valuation has gone flat with its recent community round on WeFunder, with revenue decelerating to 58% YoY at $19M in revenue with reader churn at 50-60% per year. While Substack has the strongest brand halo, it achieved that through venture-style bets on heritage brand writers & thought leaders—which led to $5.2M in negative revenue for 2021, and the increasing likelihood that Substack will soon walk back its stance against ads and launch its own ad network.

- In the near term, the creator economy’s cultural influence has outpaced its GDP—in the long term, the networks that have begun to form at ConvertKit (connecting creators with Creator Network), Beehiiv (connecting creators to advertisers with Ad Network) and Substack (connecting readers and creators with Reader and Notes) are pulling adjacent, distribution-constrained SMBs into the ecosystem, whether they call themselves creators or not. While Substack takes a walled garden approach versus ConvertKit’s focus on integrations and interoperability, Beehiiv looks to take a hybrid approach that combines the brand-forward approach of Substack with ConvertKit’s focus on building for the customer rather than for an ideology.

- Creator companies with time optionality—either from bootstrapping or building asset-light, recurring subscription, cash flowing businesses—have the potential to win big in this space over the long-term with high ownership and high margins to become the Sulzbergers of the creator economy. Underneath the noise, the creator market is becoming increasingly outsized in terms of influence—ten years ago, 20,000 to 50,000 subscribers was a huge email newsletter for a solo creator, while today, the big solo creators have readerships of 2M to 3M, and they’re monetizing at 5 to 10x the same rate per subscriber.

For more, check out this other research from our platform: