Beehiiv at $30M/year

Jan-Erik Asplund

Jan-Erik Asplund

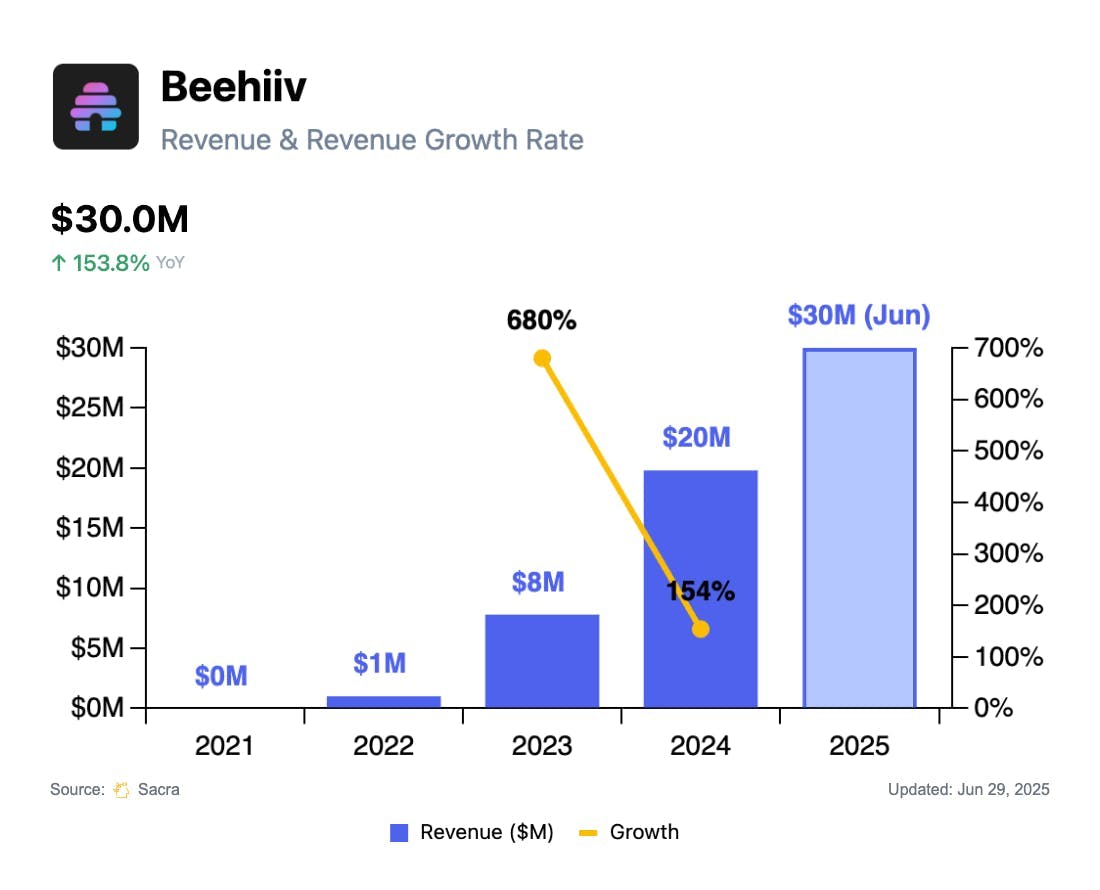

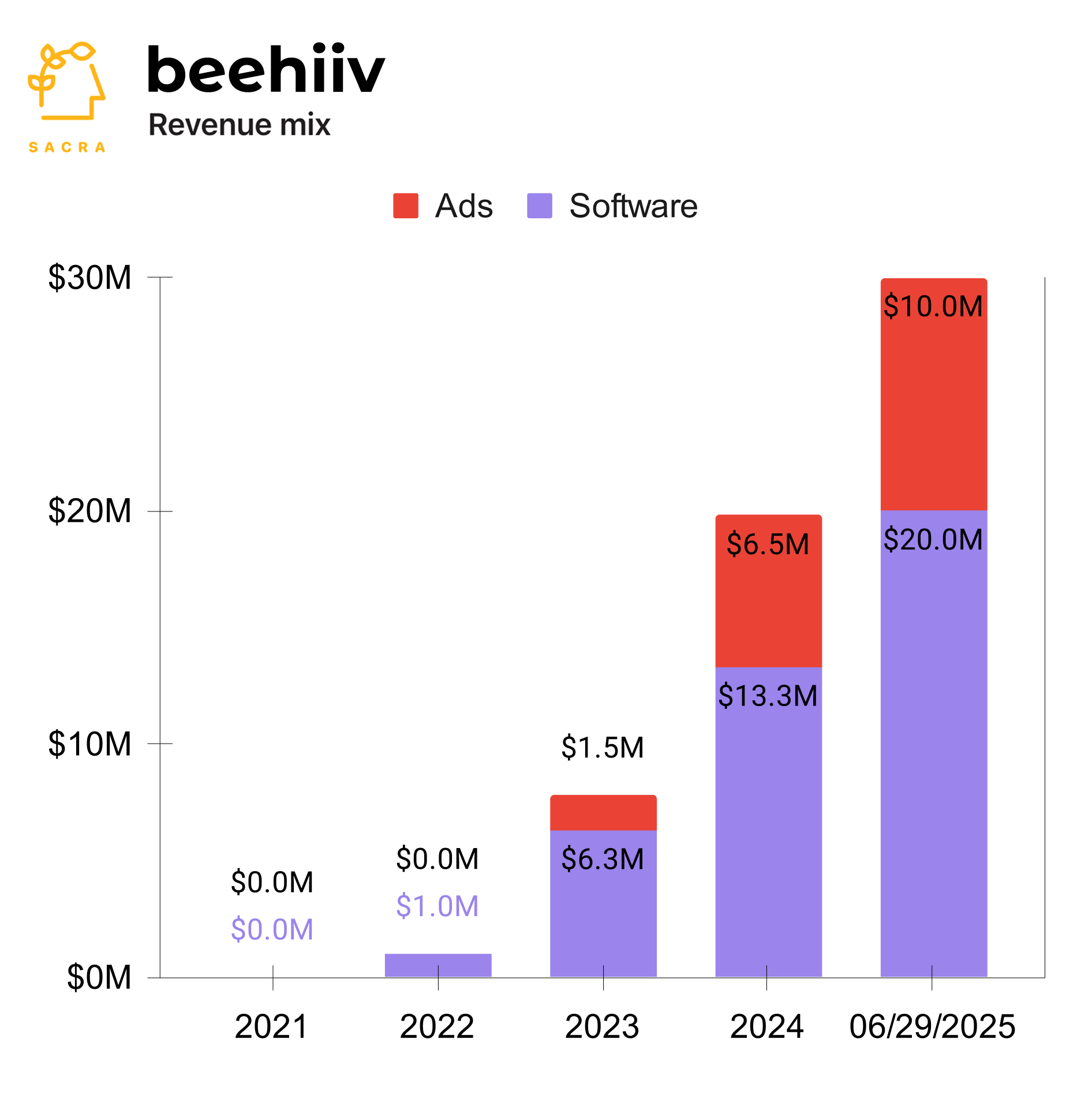

TL;DR: First launched as a subscription-based newsletter SaaS, Beehiiv now gets a third of its revenue from its performance ad network and creator-to-creator ad marketplace. Sacra estimates Beehiiv hit $30M in annualized revenue in June 2025, up from $19.8M in December 2024. For more, check out our full report and dataset on Beehiiv.

We last covered Beehiiv in May 2024, hitting $13M in annualized revenue and growing 450% YoY as a hybrid SaaS newsletter-builder with a nascent ads business model.

We first covered Beehiiv in June 2023, having just hit $3M ARR and growing 500% YoY after raising their $12.5M Series A (Lightspeed) as a better MailChimp focused on creators.

Key points from our research:

- Sacra estimates Beehiiv’s total annualized revenue hit $30M in June 2025, up from $19.8M at the end of 2024—compare to Kit (formerly ConvertKit) at $43.2M in SaaS ARR at the end of 2024, up 14% YoY from $38M in 2023, and Substack at $28.5M in revenue in 2023, up 50% YoY from $19M in 2022.

- About 33% of Beehiiv’s revenue—~$10M annualized as of June 2025—now comes from (1) its Ad Network, where brands like Netflix, HubSpot and Roku pay to put ad spots in Beehiiv newsletters, and from (2) Boosts, where Beehiiv creators post bids for how much they’re willing to pay for each new subscriber, other newsletters can click to show ad units for those newsletters, and Beehiiv takes 20% of the GMV.

- With platforms like X cracking down on external linking, TikTok nearly getting shutdown in the U.S. and major platforms in general veering towards becoming more closed, Beehiiv, Kit, and Substack are diverging in how they help creators build owned audiences and diversify away from superplatforms—Beehiiv and Kit focus on direct list growth (recommendations, landing pages) and downstream monetization (ads, paid subscriptions), while Substack has gone middle-of-funnel and into competition with BlueSky and Threads, rebuilding Twitter’s discovery layer with Notes, a home feed, and video & audio live-streaming.

For more, check out this other research from our platform:

- Beehiiv (dataset)

- ConvertKit vs. Beehiiv vs. Substack

- Nathan Barry, CEO and founder of ConvertKit, on ConvertKit’s path to $100M in revenue

- ConvertKit (dataset)

- Substack (dataset)

- Stan (dataset)

- OnlyFans (dataset)

- Justin Gage, founder of Technically, on how Substack earns its 10% take rate

- ConvertKit at $38M ARR

- Substack: the $19M/year content LVMH