TL;DR: Retool went from bottom-up PLG to enterprise elephant-hunting en route to $82M ARR. Now they’re building out a parallel, low-code version of the model-view-controller (MVC)-esque product that Airtable and Zapier are building for no-code. For more, check out our full coverage of Retool, including dataset, as well as our interviews with an anonymous ex-Retool employee on the company’s enterprise opportunity and a Retool customer on the fintech ops use case.

Check out our weekly email for more insights like this into private companies.

Success!

Something went wrong...

- In a world where engineering time is the scarcest resource in the org and the median SWE salary in the SF Bay Area has hit $224K, internal tools—which the customer never sees—represent about 50% of the software that businesses write. Roughly 80% of the internal tools that businesses write fit a simple set of primitives between the admin panel and the dashboard. (link)

- Retool found product-market fit saving developer time building admin panels, dashboards, and other simple internal CRUD tools (create-read-update-delete) in ~1 day instead of ~2 weeks by giving them pre-built components to wire up on top of their production database. Rather than write a full-fledged React app, developers can hook up their database and use Retool’s components to drag-and-drop to build their app, with minimal code required. (link)

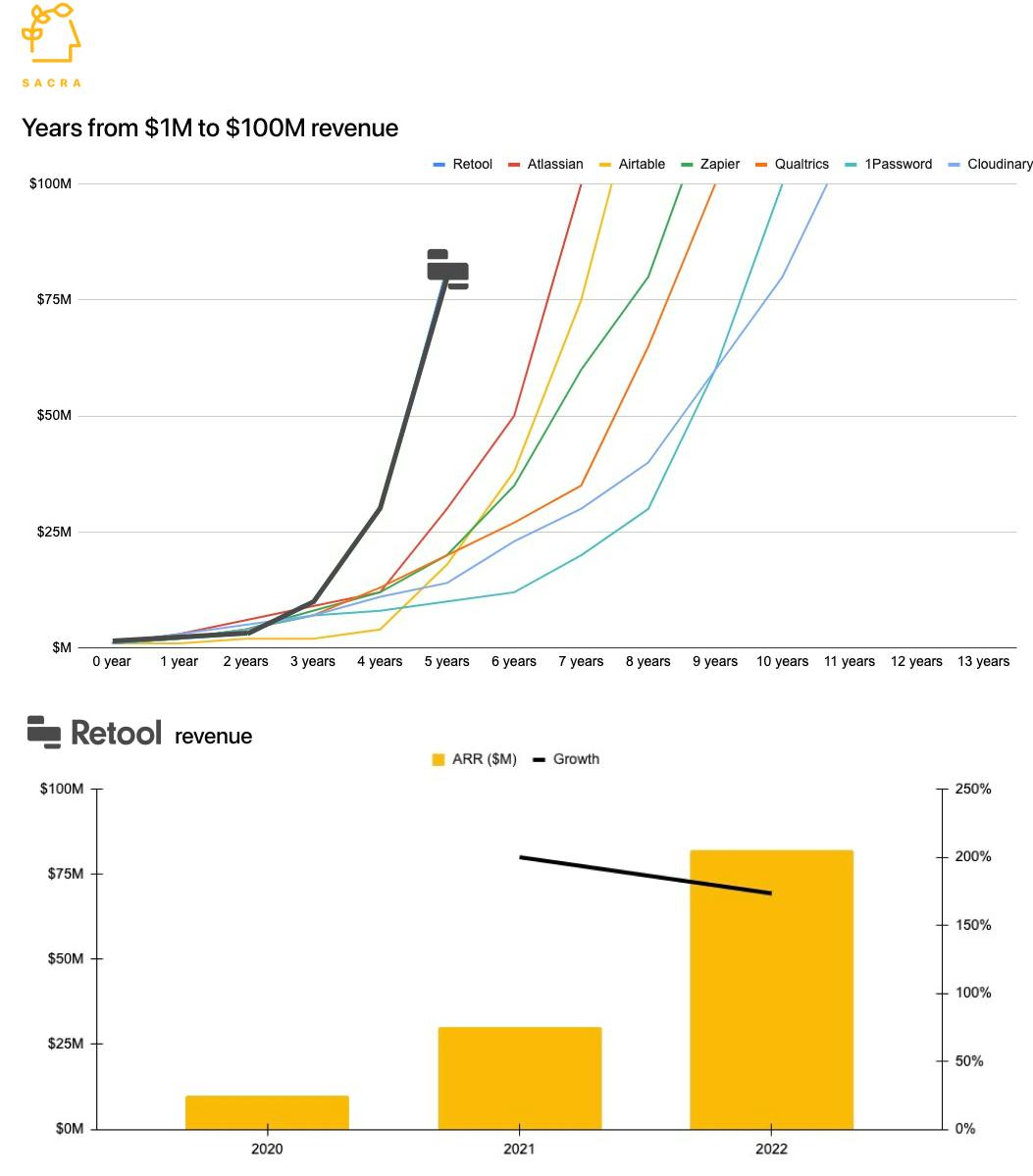

- Retool is per-seat subscription SaaS—they went from $10M ARR in 2020 to $30M ARR in 2021, and as of 2022, they’re at $82M ARR, growing 173% year-over-year. Like Airtable, Retool serves the whitespace between existing tools—and while teams might eventually build their own versions of Retool apps, other use cases tend to emerge. (link)

- The market for internal tools splits along the technical/non-technical line: engineers who write SQL and Javascript building on top of the production database versus non-engineers who point and click filters and conditional logic on top of SaaS apps and CSV exports. Retool saves engineers time by helping them build internal tools faster, while no-code tools save engineers time by empowering non-technical team members to build internal tools without asking for engineering time. (link)

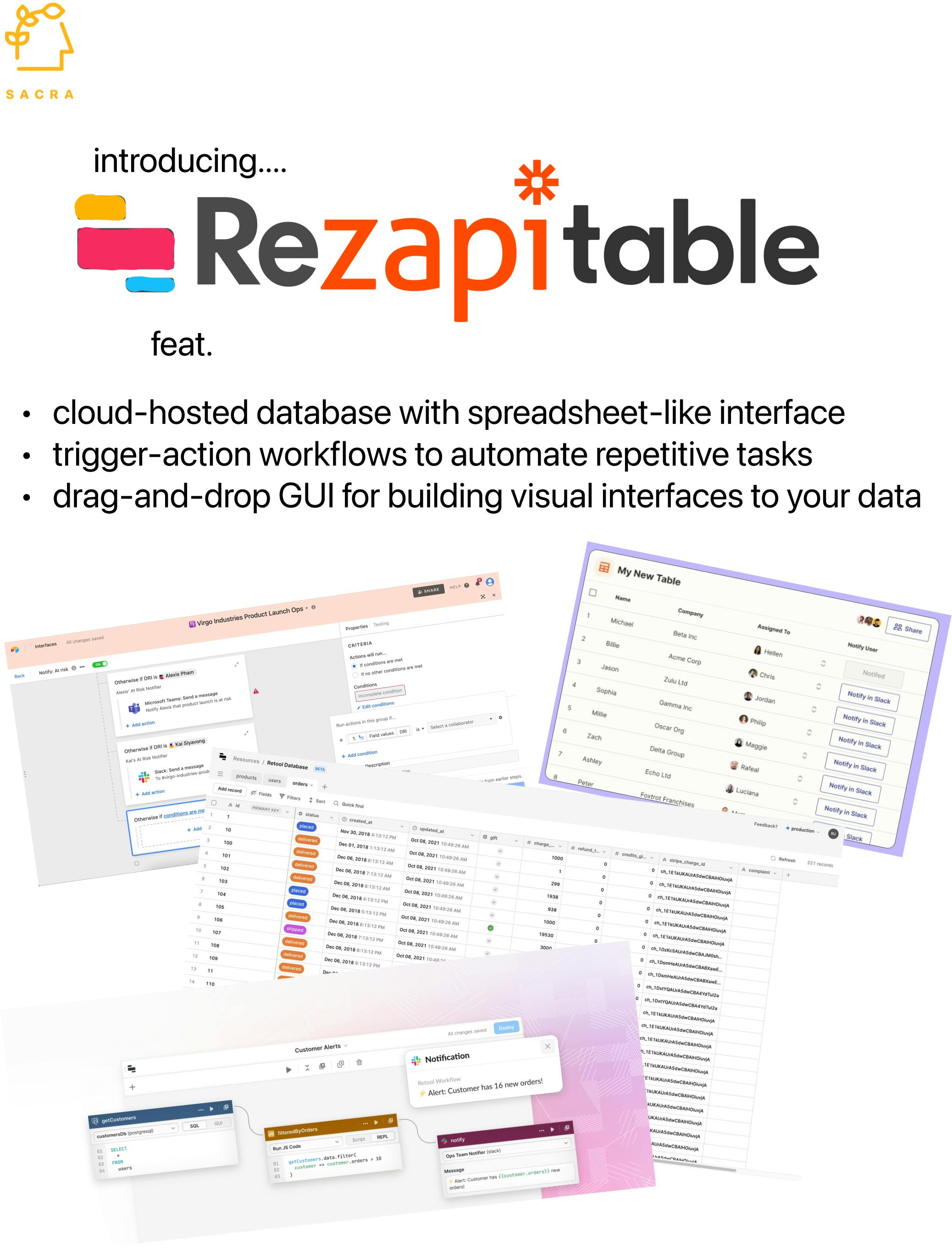

- All the major low-code and no-code platforms are converging on a similar model-view-controller (MVC)-esque line of products, like Retool with Workflows (Zapier) and Database (Airtable), Zapier with Tables (Airtable) and Interfaces (Retool), and Airtable with Interface Designer (Retool) and Automations (Zapier). Retool is looking to own app development centered on the production database, while Airtable and Zapier are competing to own app development for non-technical marketers and others. (link)

- Like Airtable, Retool faces headwinds on expansion in their product-led growth (PLG) motion because they charge a fixed price per seat for every seat—regardless of whether you’re a tool creator or only a user—disincentivizing sharing compared to a Figma or Zoom, which spread throughout the org with free seats and only monetize the seats of creators, editors or power users. We’re already seeing Retool’s pivot away from PLG and towards the enterprise as they heavily build their sales team, which went from ~6 in 2020 to ~30 in 2021 to ~80 in 2022. (link)

- A lack of expansion revenue biases companies like Retool towards de-emphasizing self-serve and focusing on locking down high ARPU enterprise deals—but they do that at the risk of leaving the bottom end of the market vulnerable to low-end disruption from fast followers like Budibase, Appsmith, Superblocks and others which compete on feature and positioning differentiation and on price. Consider Intercom, which went from startup-friendly to an opaque pricing model that charges the average team $731 per month—companies like Hubspot and Drift fast followed on features and ate up the conversational commerce market. (link)

- Retool’s strength in the enterprise comes from its engineering-centric paradigm that unlike no-code tools, allows teams to build secure tooling for ETL tasks ala Census ($80M raised), devops ala Sentry ($3B valuation) and metrics reporting ala Looker (acq. for $2.6B) with access management, data integrity and other safety guarantees around their mission-critical production data and business logic—without having to buy more enterprise SaaS. Where SaaS apps force companies to adapt to their data models and workflows, Retool allows them to build compliant and safe tools for their specific context. (link)

- The growth of fintech and embedded finance serves as a tailwind for Retool, as fintechs like Lithic ($800M), Ramp ($8.1B) and Plaid ($250M revenue) rely on human-in-the-loop with software to power their ops teams’ compliance processes around loan underwriting, risk measurement, and fraud investigation. Fintechs need to build tools to get their engineers out of the weeds handling ops and free them up to move the product forward. (link)

- As software proliferates distributed workforces and blue-collar workers through marketplaces like Instacart ($1.8B in revenue) and vertical SaaS like ServiceTitan ($300M ARR), Retool’s mobile builder enables not-quite-internal tooling for non-employee contractor end-users that interact with production data and the customer experience. Retool is riding the blurring of internal and external apps that is tied to the blurring of employment boundaries between employees and contractors. (link)

- Because engineers trust Retool with writing to production databases, Retool has a strong position to move from an internal app builder into a builder of any app—internal or external—that the company needs. To expand beyond internal tools, Retool will have to solve for a higher degree of customizability and more unpredictable usage. (link)

For more, check out our coverage of Retool (dataset), our interviews with an ex-employee of Retool and a current Retool customer, and this other research from our platform:

- Zapier: The $7B Netflix of Productivity [2021]

- Former Zapier partner on Zapier's commoditization of SaaS [2021]

- Airtable: The $7.7B Roblox of the Enterprise [2021]

- David Peterson, early Airtable employee, on the future of product-led growth [2021]

Jan-Erik Asplund

Jan-Erik Asplund