Wiz passes $500M ARR

Jan-Erik Asplund

Jan-Erik Asplund

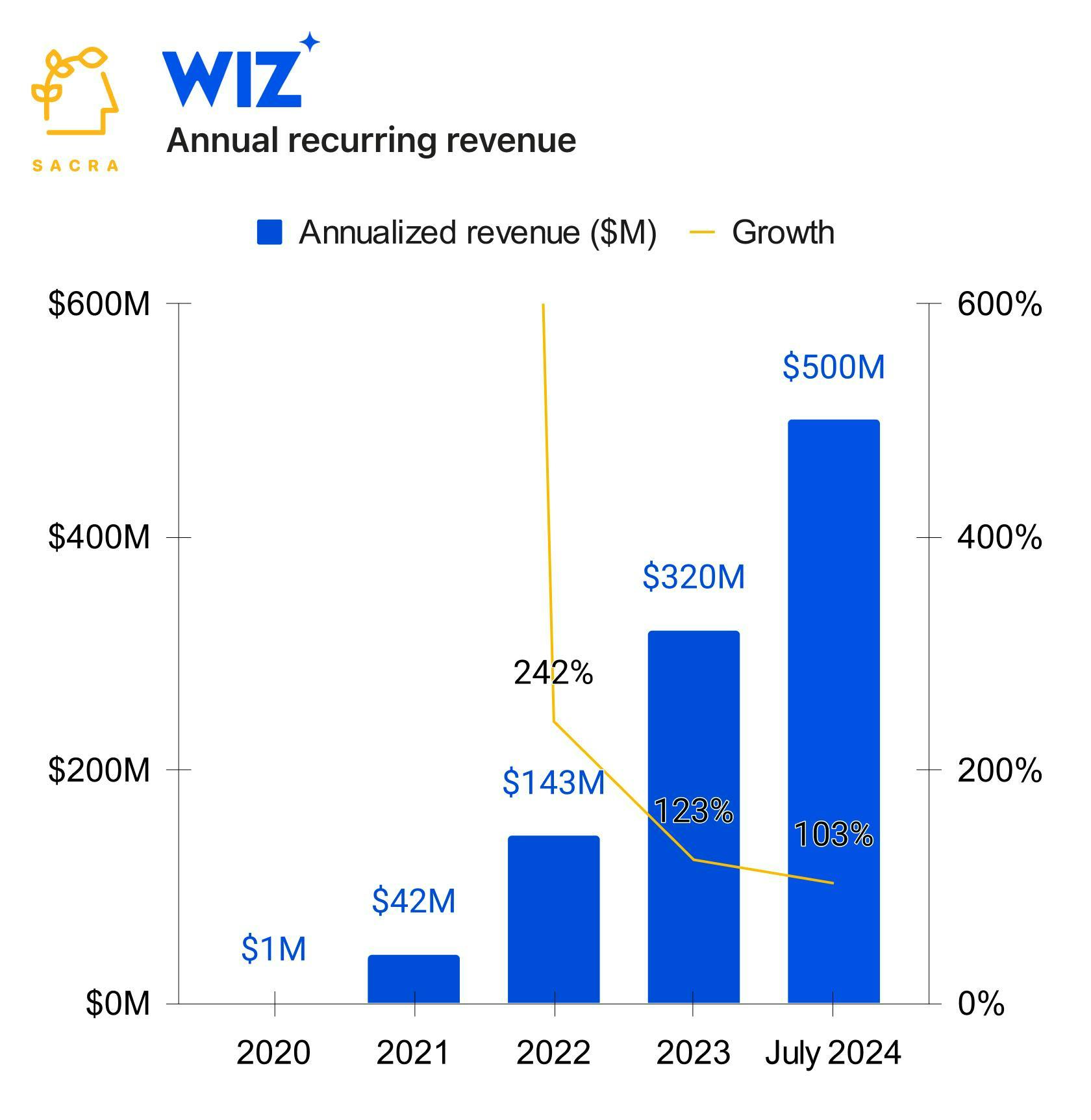

TL;DR: Sacra estimates that Wiz hit $500M annual recurring revenue (ARR) in July 2024, up 103% YoY. After declining a $23B acquisition offer from Google and repositioning its product to directly go after Snyk, Palo Alto Networks and CrowdStrike, Wiz is now projecting it will cross $1B ARR before going public in 2025. For more, check out ourfull Wiz report and dataset.

When we first covered Wiz, it had grown to $100M in annual recurring revenue (ARR) in 18 months on the back of its agentless scanner that plugs into your cloud (AWS, Azure, or Google) and monitors all potential attack surfaces.

As they approach $1B in ARR while growing 103% YoY, they’re now going multi-product with Wiz Cloud, Wiz Code, and Wiz Defend.

Key points via Sacra AI:

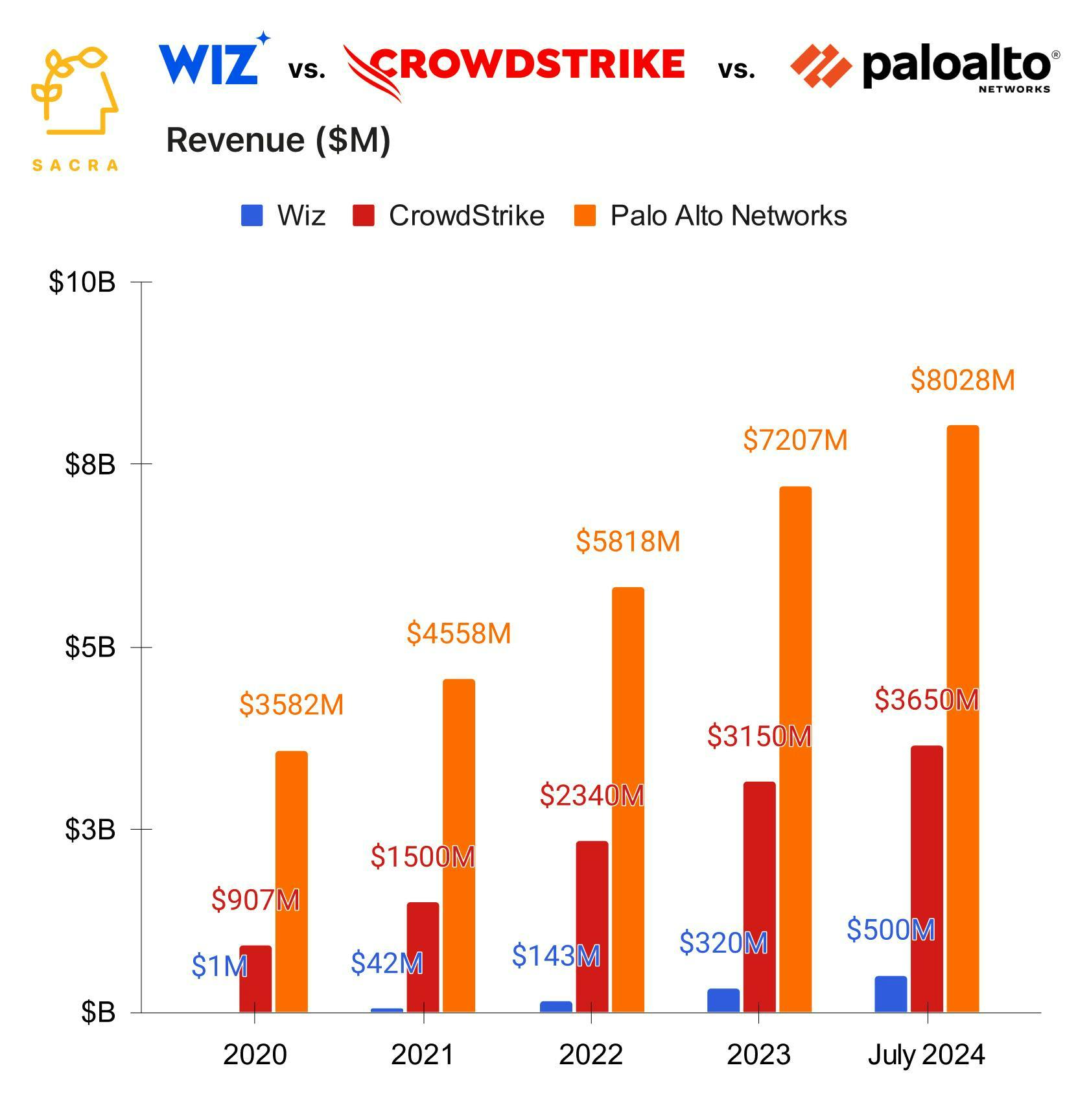

- Sacra estimates thatWiz reached $500M+ in annual recurring revenue (ARR) in July 2024, up 103% YoY, turning down an acquisition offer from Google at $23B, or about 46x forward revenue. Compare to threat detection platform CrowdStrike (NASDAQ: CRWD) at $4B ARR, up 30% YoY, valued at $85B for a 21x multiple, security rival Snyk at $300M ARR, up 25% YoY, valued at $7.4B at $200M ARR in 2022 for a 37x multiple, and cloud security incumbent Palo Alto Networks (NYSE: PANW) at $8.3B TTM revenue, up 16% YoY, valued at $127B for a 16x multiple.

- On the verge of passing CrowdStrike’s agentless scanner Falcon Horizon (launched October 2020) at $515M ARR (up 80% YoY) in August, Wiz’s sights are next set on Palo Alto Networks' Prisma Cloud (launched 2019) at ~$700M ARR (up 30% YoY). While agentless cloud security for CrowdStrike and Palo Alto Networks is powerful as a wedge into their customers’ Azure/AWS/GCP deployments, for Wiz, it’s the core product around which they’re rebundling the entire security stack.

- Going on the offensive across the cybersecurity stack, Wiz launched Wiz Code (September 2024) to go after Snyk in application security, Wiz Defend (December 2024) to go after CrowdStrike in threat detection and Wiz Cloud, an expanded agentless platform, to go after Palo Alto Networks in cloud-native application protection. At its stated goals of $1B ARR growing 100%+ YoY and IPO in 2025, Wiz looks to trade in excess of CrowdStrike’s 20x multiple at $25B+ in market cap.

For more, check out this other research from our platform:

- Wiz (dataset)

- Israel's YC of cybersecurity

- Snyk (dataset)

- Valimail (dataset)

- Rubrik: the Netflix of data backups

- Zachary Friedman, associate director of product management at Immuta, on security in the modern data stack

- Sam Li and Austin Ogilvie, co-CEOs of Laika, on the compliance-as-a-service business model

- Christina Cacioppo, CEO of Vanta, on the value of SOC 2 compliance for startups

- Shrav Mehta, CEO of Secureframe, on building a TurboTax for security compliance

- How Vanta, Secureframe and Laika are arming the rebels of B2B SaaS

- Rubrik (dataset)

- BigID (dataset)

- Lacework (dataset)

- Noname Security (dataset)

- Cribl (dataset)

- Netskope (dataset)