Israel's YC of cybersecurity

Jan-Erik Asplund

Jan-Erik Asplund

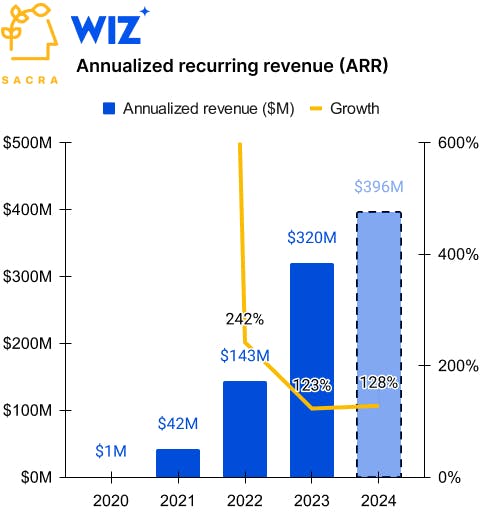

TL;DR: Wiz went from $1M to $100M ARR in 18 months, faster than any software company before—today, Sacra estimates Wiz is at $396M ARR, up 128% year-over-year. Their “suicide plan” for building a cybersecurity giant has them on a collision course with Palo Alto Networks: another of the many security startups incubated in the IDF’s legendary Unit 8200. For more, check out our full report, dataset, and sources for Wiz’s revenue growth, ACV, and ARR per FTE.

Key points from our research:

- In 1993, Check Point (NASDAQ: CHKP) produced the first successful commercialization of the firewall, selling an integrated hardware-and-software appliance security teams could use to protect their local area network (LAN) from external intrusion. As on-prem software gave way to SaaS, Check Point founding engineer Nir Zuk left and started Palo Alto Networks (NASDAQ: PANW) in 2005, finding product-market fit with a “firewall-as-a-service” designed for both application and network security.

- Wiz CEO Assaf Rappaport met his co-founders serving in Israel’s NSA, Unit 8200, which has incubated 80% of all Israeli cybersecurity companies including Check Point, Palo Alto Networks, Noname Security ($40M ARR in 2023), Snyk ($147M revenue in 2022), CyberArk (NASDAQ: CYBR), Guardicore (acquired for $600M), Imperva (acquired for $3.6B), and two dozen more. Another Israeli cybersecurity company incubated in Unit 8200, Orca Security ($50M ARR in 2023), has sued Wiz for IP theft, claiming that Wiz stole their core idea of agentless multi-cloud security from their founder, Avi Shua—the former Chief Technologist at Check Point.

- Wiz (founded January 2020) went from $1M ARR to $100M in 18 months, faster than any software company in history, with their agentless scanner that hooks into your AWS, Azure, and/or Google Cloud and prioritizes the most vulnerable attack surfaces. Wiz’s ascent came as COVID forced enterprises to migrate their infra to the cloud, creating budget for every Chief Information Security Officer (CISOs) to find a monitoring solution—Wiz was first-to-market, creating the cloud native application protection platform (CNAPP) category in their image.

- Sacra estimates that Wiz is at $396M ARR as of April 2024, up 128% year-over-year, with about 800 customers for an annual contract value of $495K. Compare to the agent-based incumbent Palo Alto Networks (NYSE: PANW) at $8B ARR, up 19% year-over-year with 85,000 customers ($94K ACV), and endpoint security platform CrowdStrike (NASDAQ: CRWD) at $3.4B ARR, up 34% with 23,000 customers ($148K ACV).

- In 2022-2023, we saw a wave of CNAPP startups acquired as incumbents fought back against Wiz, from PingSafe (acq. by SentinelOne, NYSE: S) to the Israel-based Bionic (acq. by CrowdStrike), Lightspin (acq. by Cisco, NASDAQ: CSCO), and Dig Security (acq. by Palo Alto Networks). Incumbents like Palo Alto Networks are bundling Wiz-like functionality into their existing platforms and leveraging their revenue scale in pricing, offering their CNAPP for free for two years to retain customers.

- Wiz is betting that their “suicide plan” for building a cybersecurity giant—raising $900M and hiring 750 employees—can get them into multi-year contracts in the enterprise before incumbents can get traction with their own CNAPPs. Wiz has won over companies like Morgan Stanley (NYSE: MS), Fox (NASDAQ: FOX), and LVMH, with some customers like Salesforce (NYSE: CRM) switching to Wiz from Palo Alto Networks for cloud security.

- Since 2023, Wiz has started rebundling horizontally through acquisition, buying Israeli companies like Gem Security (Rappaport met the founder in Unit 8200) for threat detection and response and Raftt for runtime security as they build an end-to-end cybersecurity platform, with a $200M Lacework acquisition reportedly in the works. The cybersecurity market is undergoing aggressive consolidation as CISOs look to reverse the trend of tool proliferation that started with the rise of the cloud, creating headwinds for the category, but $100B in upside for the company that can win the space.

For more, check out our Wiz report and full dataset, as well as this other research from our platform:

- Cribl (dataset)

- Rubrik (dataset)

- BigID (dataset)

- Snyk (dataset)

- Noname Security (dataset)

- Lacework (dataset)

- Anduril (dataset)

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Scott Sanders, chief growth officer at Forterra, on the defense tech startup playbook

- Zachary Friedman, associate director of product management at Immuta, on security in the modern data stack