Stan: the $14.7M/year store-in-bio

Jan-Erik Asplund

Jan-Erik Asplund

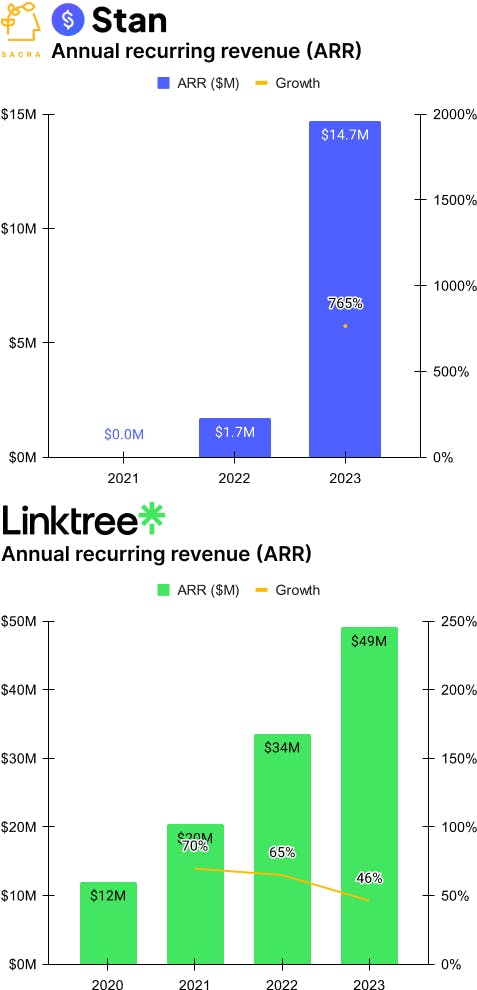

TL;DR: Stan hit $14.7M of annual recurring revenue (ARR) at the end of 2023, up 765% year-over-year, as store-in-bio replaced link-in-bio as the default home base of the online creator. Now, Stan is looking to overtake incumbent link-in-bio platform Linktree ($49M ARR, up 46% year-over-year) while getting on a trajectory to improve their 13% monthly gross churn. For more, check out our coverage of Stan (dataset) and Linktree (dataset).

Key points from our research:

- Link-in-bio is becoming the store-in-bio, with insurgent companies like Stan going up against incumbent link-in-bio Linktree and upstart link-in-bio Beacons as each of them builds flexible, mobile-native creator storefronts. Store-in-bio gives you ways to natively sell SKUs on the page rather than routing your traffic somewhere else, and bundles that with other merchant tools for email marketing (ConvertKit, $33.5M ARR), WYSIWYG website creation (Squarespace, NYSE: SQSP), scheduling (Calendly), digital downloads (Gumroad), and online course creation (Kajabi), on top of also allowing you to link out.

- Stan grew revenue a whopping 765% in 2023 by giving affiliates 20% of all revenue generated from their links into perpetuity, seeding a cottage industry of TikTok Stan influencers in an echo of Shopify's (NYSE: SHOP) 20% referral program, which short seller Andrew Left of Citron Research notoriously denounced as a multi-level marketing scheme in 2017. Citron went public with his Shopify bear thesis in October 2017 when the stock was at $10—the stock went on to grow steadily to $50 by February 2020 and hit $169 by the end of 2021 (it’s at $80 today and Citron has capitulated, with Left saying, "Stay away from category leaders with a cult following").

- At the end of 2023, Stan hit $14.7M of annual recurring revenue (ARR), up 765% year-over-year from $1.7M in 2022, with 300K customers for an average revenue per customer (ARPC) of $491—compare to Linktree at a Sacra-estimated $49M of ARR and ~340K customers for an ARPC of $144. Linktree has 1,500x as many overall users as Stan, but they monetize at only $144 of ARR per customer vs. Stan’s $490 per customer because while they enable creators to earn millions on OnlyFans (revenue and dataset) and other destination sites, they don’t capture much of that value.

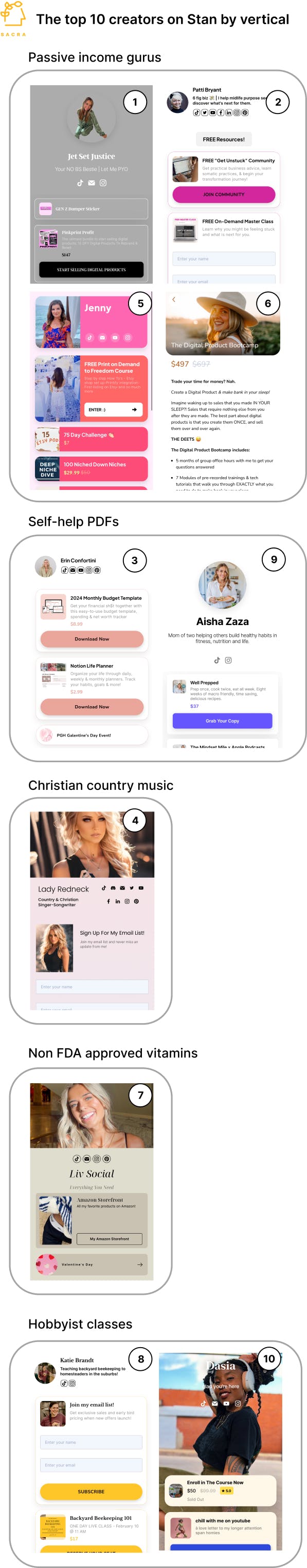

- Stan’s positioning as a neutral storefront allows them to capture traffic from platforms like TikTok—where e.g. OnlyFans links are banned for its vertical adult focus—while helping creators sell anything from supplements (physical goods) to live erotic calls (booking time), tarot classes (course creation), and white-labeled affiliate marketing PDFs (digital downloads). While other platforms are free to join but monetize on transaction volume, from Patreon’s 5% to OnlyFans’s 20%, Stan charges creators $30/month upfront but lets them sell anything and keep all their revenue.

- Gross churn is high at 13% monthly and Stan is living with the continued risk of being banned by TikTok, which recently sunset its integration with Shopify and will reportedly ban Amazon links-in-bio next. Investors overlooked Shopify considering its 5% monthly churn too high, but what’s important for increasing net dollar retention is expansion revenue whether that's through payments (Shopify) or usage (ConvertKit).

For more, check out this other research from our platform:

- Stan (dataset)

- Linktree (dataset)

- ConvertKit (dataset)

- Beehiiv (dataset)

- Substack (dataset)

- Neal Jean, CEO of Beacons, on building vertical SaaS for creators

- Nathan Barry, CEO and founder of ConvertKit, on ConvertKit’s path to $100M in revenue

- Justin Gage, founder of Technically, on how Substack earns its 10% take rate