Sierra vs Decagon

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: As AI has swept through customer support teams, reducing headcount and disrupting legacy helpdesks, Sierra has emerged as one of the foremost AI-native upstarts, launching as a productized BPO replacement with autonomous chat & voice. Sacra estimates Sierra grew to $100M ARR in October 2025, up 400% YoY from $20M, valued at $10B for a 100x revenue multiple. For more, check out our full report and dataset.

Key points via Sacra AI:

- The launch of ChatGPT in November 2022 marked the moment that AI chat passed the Turing test, immediately marking customer service as a core use case for AI disruption, with Sierra founded in 2023 by Bret Taylor (previously co-CEO of Salesforce and now Chairman of OpenAI) as an AI-powered BPO for customer support with AI chat & voice agents. Sierra costs a fraction of the cost of human agents (~10%) and enables brands to freeze or reduce support headcount with a pricing model pegged to outcomes at ~$1.50 per resolution—but it positions on customer experience (human-comparable CSAT scores) where AI agents can replace frustrating phone trees, resolving ~80% of commonly recurring questions and free up human agents to focus on revenue retention & upsell.

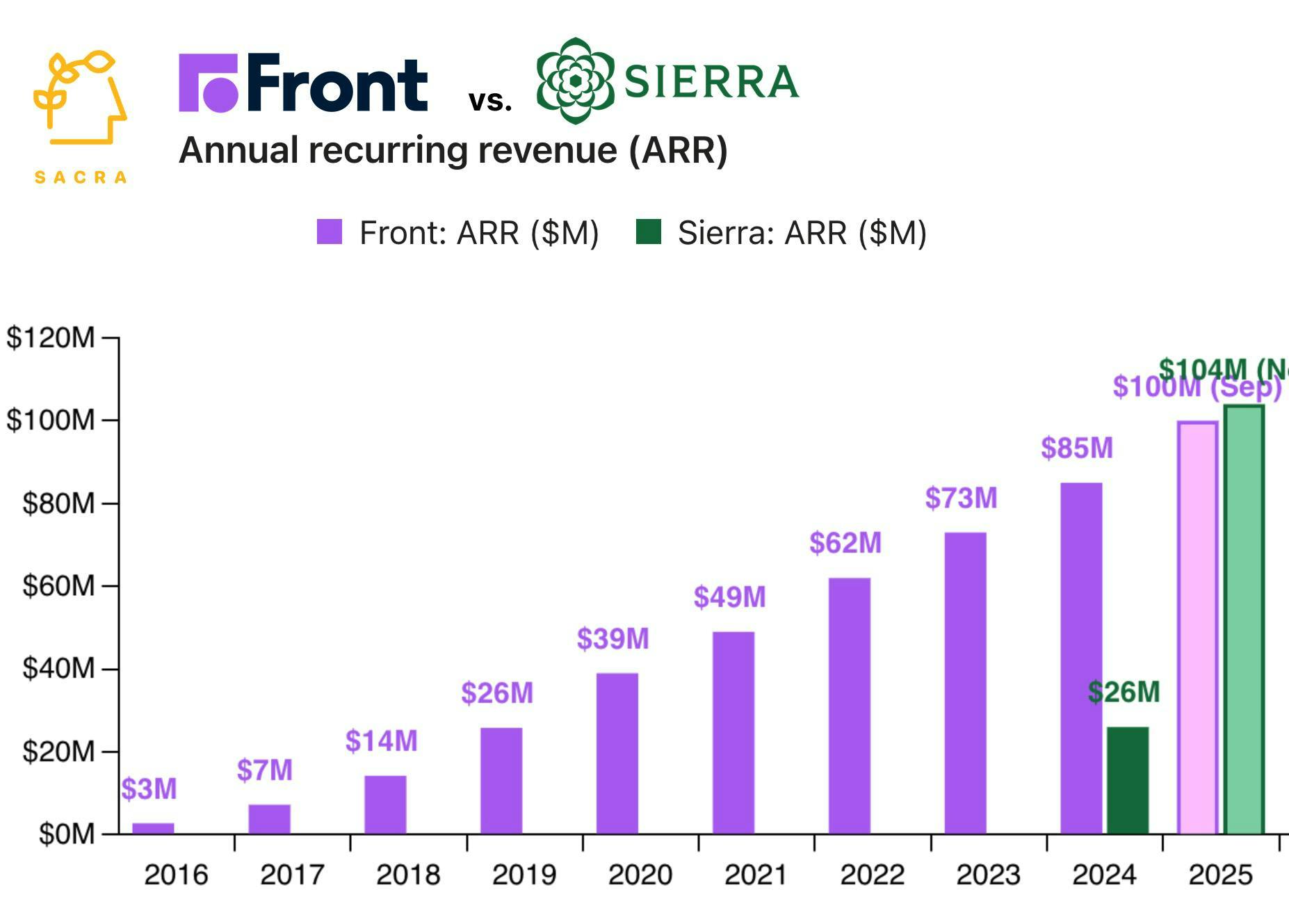

- Driving its initial customer deployments through a high-touch, forward-deployed model to manage the program and handle the coding & integrations on behalf of enterprise consumer brands (e.g., ADP, Weight Watchers & Redfin), Sacra estimates Sierra grew to $100M annual recurring revenue (ARR) in October 2025, up 400% year-over-year from $20M in October 2024, valued at $10B for a 100x revenue multiple after raising a $350M round (Greenoaks) in September 2025. Compare to Intercom at $343M revenue in 2024, up 25% YoY, valued at $1.3B in its 2018 Series D for a 14.4x multiple on $90M revenue at the time, and Decagon at $17M ARR in April 2025, up from $6M at the end of 2024 (up 900% YoY) valued at $650M for a 108x revenue multiple.

- Initially inbound support-focused, Sierra’s model generalizes into outbound sales (lead qualification, cold calling), collections, insurance claims follow up, supplier management and any workflow where enterprises currently pay humans to conduct external outreach, collect data from third parties, and manually input it into their CRMs & other systems of record. With AI agents trained in a brand’s tone & voice, able to query knowledge bases to retrieve key context and responsible for maintaining & updating the CRM, billing systems and the ERP, AI agent companies like Sierra & Decagon have the upside potential to first disintermediate and then displace previous-generation systems of record like Salesforce.

For more, check out this other research from our platform:

- Sierra (dataset)

- Decagon (dataset)

- Front: Inside the $1.3B Startup Slackifying Email [2020]

- Front (dataset)

- Intercom (dataset)

- Intercom's $250M/year AI bet

- Eoghan McCabe & Des Traynor, CEO and CSO of Intercom, on the AI transformation of customer service

- Gorgias at $69M ARR

- How AI is transforming B2B SaaS

- Colin Nederkoorn, founder & CEO at Customer.io, on the CDP layer in messaging

- Klaviyo: the $665M/year HubSpot for ecommerce

- Brian Whalley, Co-Founder of Wonderment, on Klaviyo's product-market fit Klaviyo (dataset)