Shein vs Trump

Jan-Erik Asplund

Jan-Erik Asplund

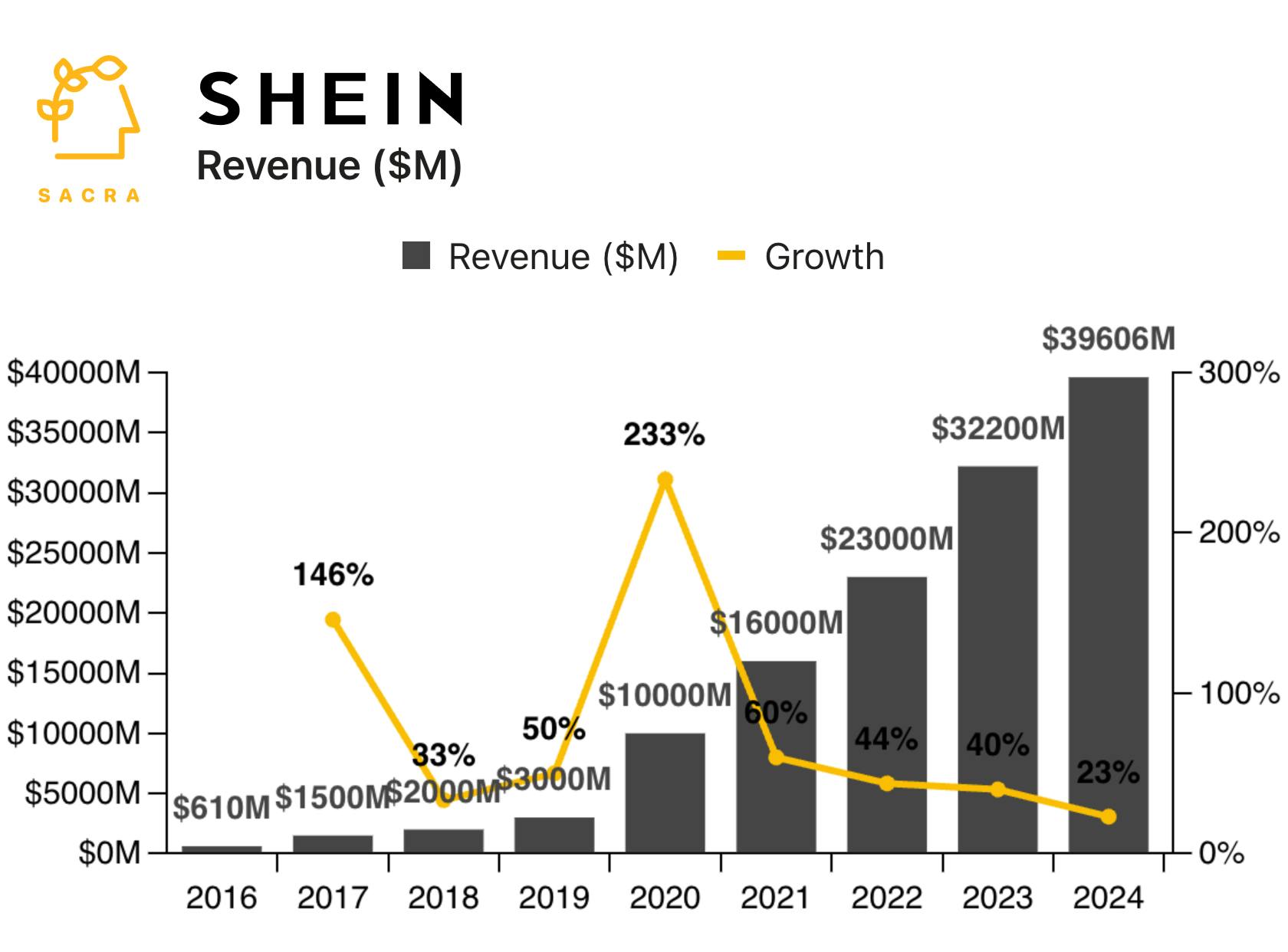

TL;DR: Trump’s closure of the “de minimis loophole” threatens Shein’s core business of selling Chinese bodysuits and designer dupes into the U.S. tax free. With revenue slowing to 23% YoY at a Sacra-estimated $39.6B for 2024, Shein’s bigger threat is Temu’s surging everything store. For more, check out our full report and dataset on Shein.

Last time we wrote about Shein, they’d generated $32.2B in revenue in 2023, up 40% YoY.

Now, with revenue growth slowing to 23% YoY (projected $39.6B revenue in 2024) amid increased competition with Temu (owned by Pinduoduo, NASDAQ: PDD) and President Trump promising to close the de minimis loophole that Shein has used to ship its products tax-free, the company is betting on its future as a global “everything store”.

Key points via Sacra AI:

- Operating on thin, 4-5% margins, Shein’s prices stand to rise 10-15% as a result of tariffs and President Trump’s closure of the “de minimis loophole” for tax-free imports—threatening Shein’s business model of undercutting Zara and H&M by 50-70% on price based on direct-from-China manufacturing & dropshipping. As part of President Trump’s war on trade, he’s alternatingly announced the closure (Saturday last week)—and the postponement of the closure (Friday)—of the de minimis loophole, allowing items under $800 per recipient per day to enter the U.S. tax free, which Shein exploits to the tune of $9B yearly in goods imported and sold in the U.S. and cumulatively makes up ~15% of all de minimis shipments from China.

- Killing the loophole puts short-term pressure on margins & pricing, but Shein’s strength & advantage in fast fashion is speed—hourly drops of new product, 2-3 day delivery and rapid inventory turns of ~30 days with a negative cash conversion cycle—which has it building domestic U.S. warehouses & distribution infrastructure to get shipments to U.S. customers faster (~30% of GMV) in spite of having to pay import taxes on bulk shipments to its facilities. Starting in 2022 with a 659,000 sqft Indiana facility (soon to be 1M sqft) followed by a 1.8M sqft warehouse in Cherry Valley, CA and a 10K sqft office in Bellevue, WA, Shein has brought down delivery times from 10-15 days (shipping direct to U.S. consumers from China) to 2-3 days on select items with its U.S. warehousing & distribution infrastructure.

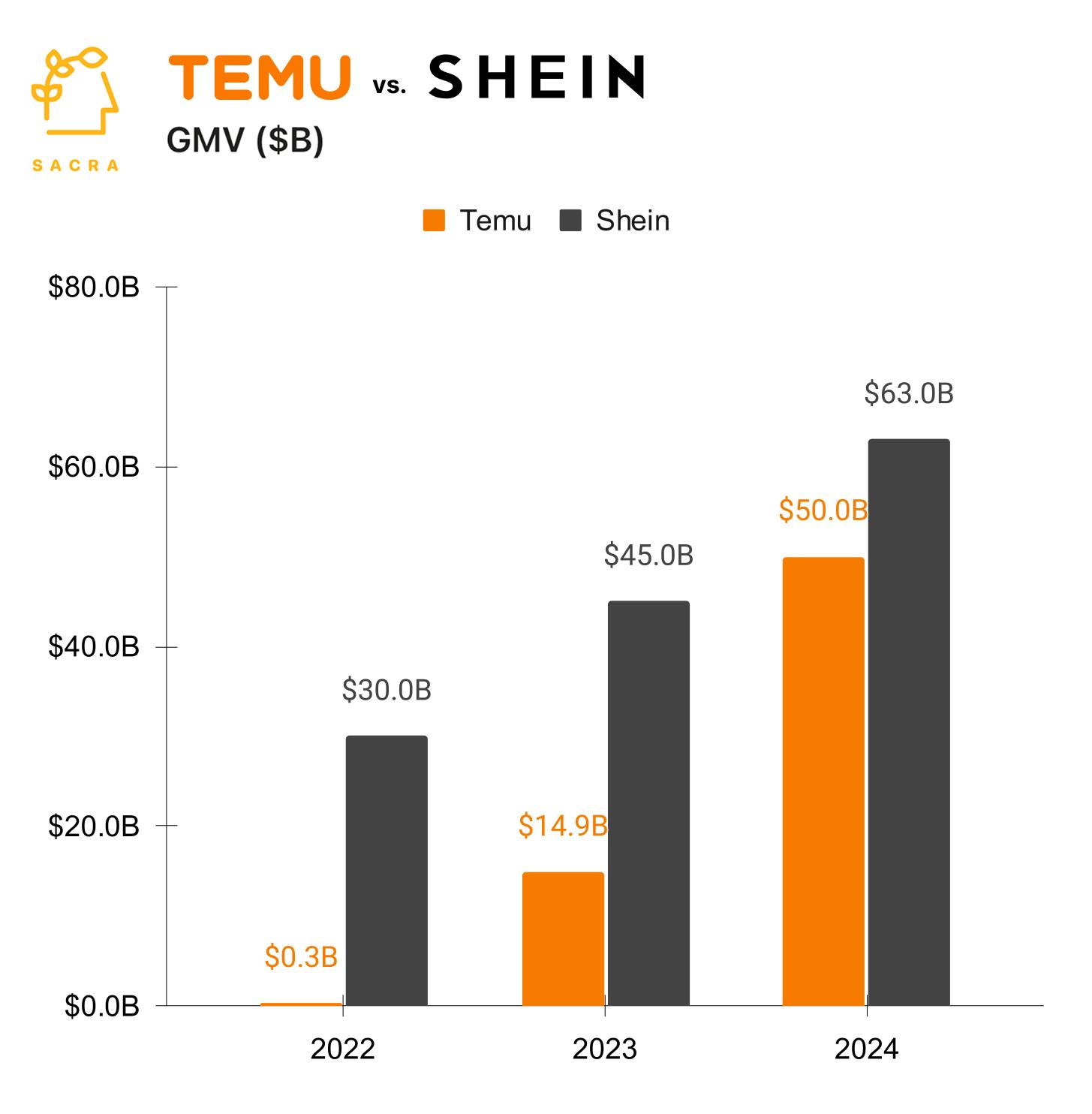

- While Shein has become the face of cheap goods flooding American markets tax-free, fast fashion was a wedge into Shein’s next stage—building a global everything store with a massive selection in direct competition with Temu (~$50B GMV in 2024, up 250%) for price-sensitive consumers across electronics, toys, furniture, and more. To help it expand outside fast fashion where Shein has its key advantage and supplier relationships, Shein launched a managed marketplace (35% of GMV in 2023), attracting independent retailers and top Amazon sellers from other product categories by offering low sales commissions (5-10% vs. Amazon’s 20-40%) and access to Shein’s global market of 90M consumers.

For more, check out this other research from our platform:

- Shein (dataset)

- Bytedance (dataset)

- Faire at $616M/year growing 74%

- Ameet Shah, partner at Golden Ventures, on the economics of vertical SaaS marketplaces

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- ShipBob: TikTok's $500M/year fulfillment arm

- Rokt: the $480M/year ad network behind Uber & Lyft

- Klaviyo: the $665M/year HubSpot for ecommerce

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Brian Whalley, Co-Founder of Wonderment, on Klaviyo's product-market fit

- Sampad Swain, CEO of Instamojo, on building ecommerce infrastructure for D2C 2.0