Rokt at $600M/yr growing 43% YoY

Jan-Erik Asplund

Jan-Erik Asplund

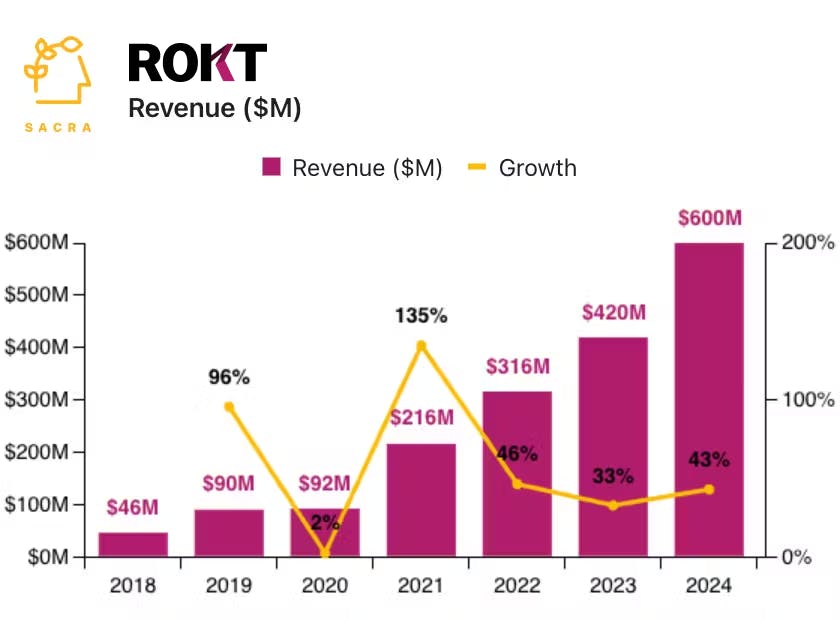

TL;DR: With its acquisition of customer data platform (CDP) mParticle at the beginning of 2025, Rokt is looking beyond the advertising business that makes up ~90% of revenue today. Sacra estimates that Rokt hit $600M in annual recurring revenue (ARR) in 2024, up 43% from $420M in 2023. For more, check out our full report and dataset on Rokt.

When we last covered Rokt in May, it had passed $480M in annual recurring revenue growing 52% year-over-year.

Founded in Australia in 2012, Rokt's core product is an SDK that big ecommerce retailers like Ticketmaster add to their checkout page to show offers for related products from 3rd-party brands, splitting the ad spend 50/50 with Rokt.

After ending the year at $600M in ARR and acquiring the customer data platform (CDP) mParticle, Rokt has its sights set on expanding outside advertising.

Key points via Sacra AI:

- At the beginning of 2025, Rokt spent $300M acquiring mParticle, a customer data platform (CDP) pioneer that enables enterprise retailers and brands to stream data from your storefront and customer analytics tools into mParticle to create unified customer profiles of purchase history and engagement—and then feed that data into tools like Braze and Iterable to target customers with personalized emails, in-app notifications, and upsells. At $300M, Rokt gets mParticle at a steep discount to its 2021 $800M valuation and at roughly the amount of total funding raised of $272M (from Bain Capital Ventures, Social Capital, Permira Growth), enabling its CDP to vertically integrate into a core use case a la Segment with Twilio rather than competing with the cloud data warehouse as a pure data router.

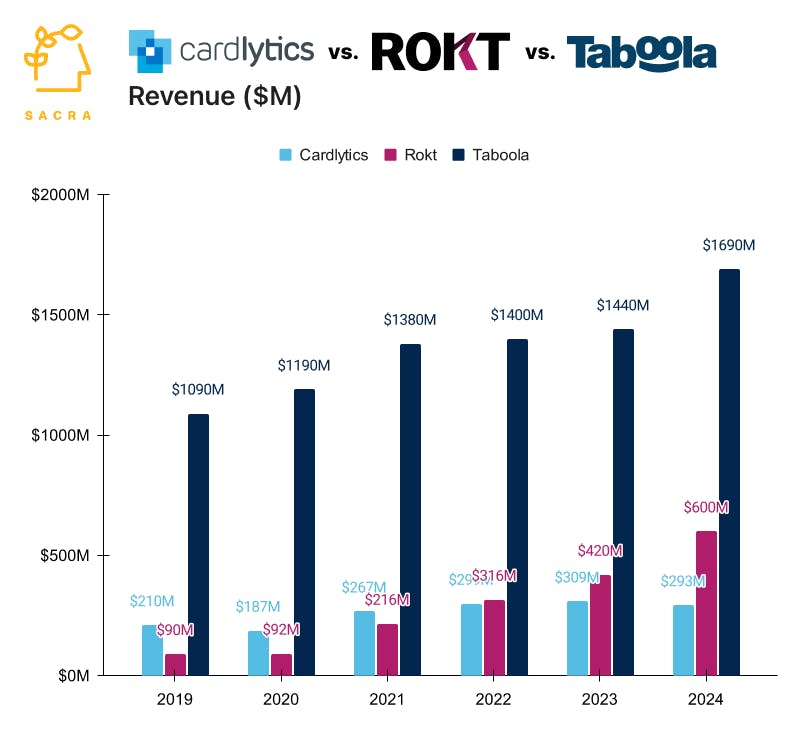

- Sacra estimates that Rokt hit $600M in annual recurring revenue (ARR) in 2024 (not including the addition of mParticle’s revenue), up 43% from $420M at the end of 2023, valued at $3.5B as of a January 2025 tender offer for a 5.83x forward revenue multiple. Compare to digital ad marketplace for banks Cardlytics (NASDAQ: CDLX) with $293M in trailing twelve months (TTM) revenue, declining 3% YoY, valued at $160M for a .54x revenue multiple, and content recommendation network Taboola (NASDAQ: TBLA) with $1.69B in TTM revenue, up 22% YoY, valued at $1.2B for a .71x revenue multiple.

- With its acquisitions of mParticle and Shopify upsell app AfterSell (2024), Rokt is expanding across platforms, accumulating first-party data and streaming it at low latency across all customer interactions to drive the most timely offers from first visit to checkout to post-purchase retention emails. While ~90% of Rokt’s revenue comes from advertising today, embedding their own unified customer profiles built on first-party data enables them to compete for a larger share of enterprise ecommerce budgets.

For more, check out this other research from our platform:

- Rokt (dataset)

- Rokt: the $480M/year ad network behind Uber & Lyft

- Stan: from $15M to $27M ARR in 3 months

- Brian Whalley, Co-Founder of Wonderment, on the post-purchase moment

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- ShipBob: TikTok's $500M/year fulfillment arm

- Bolt: the $11B Okta of ecommerce

- Jordan Gal, CEO of Rally, on building the Switzerland of checkout

- Maju Kuruvilla, CEO of Bolt, on the NASCARification of checkout

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Klaviyo: the $665M/year HubSpot for ecommerce

- Attentive (dataset)

- ShipBob (dataset)